It’s yet another tax season, but for many Canadians, it will be very different this year. That’s because a whopping 60% of them started a side hustle in 2021, which means a lot of people are searching for answers on how to file self-employed taxes in Canada for the first time. Good thing I’m here with all the answers!

You see, not only have I been through it all myself (I started my first side hustle about 8 years ago and went fully self-employed 5 years ago), but because I’ve made a number of blog posts and videos about self-employed income tax and sales tax, I get questions every single day on this topic.

The good news is it’s not that complicated. It may feel like that at the beginning because this is your first time filing self-employed taxes, but I promise you it can be very straightforward. I mean, how do you think I was able to help my sister Sarah file her first self-employed tax return with TurboTax in just over an hour?

What I’ll be covering in this blog post:

- Common Self-Employed Tax Questions

- 5 Step Guide to Filing Your Self-Employed Taxes

- How to Stay Organized Throughout the Year

- ???? Giveaway!!! (Read to the Bottom for Details)

Common Self-Employed Tax Questions

Before we get going, I want to clear a few things up because I get these questions ALL THE TIME!

What’s the Difference Between Having a Side Hustle and Being Self-Employed?

Having a side hustle simply means you’re an employee working for a company, but you also have some work on the side in which you earn self-employed income.

For example, before I started running my own company, I worked full-time as a marketing coordinator at a law firm during the day, but at night and on the weekends I ran a blog and podcast as my side hustle and earned income from both by selling ads to brands.

Being self-employed means you are not an employee for any other company and you only earn income through your own business (i.e. small business owner, freelancer, a subcontractor). Back in 2017, I quit my full-time marketing job and since then all of the income I earn has been through my business, making me 100% self-employed.

How Do I File Taxes as a Ride-Sharing Driver (i.e. Uber, Lyft, Skip the Dishes)?

So many Canadians have taken on extra work as ride-share drivers, whether it be through Uber, Uber Eats, Lyft, or Skip the Dishes. But what many of these people don’t realize is the income they earn through these apps is self-employed income. Luckily, TurboTax has this detailed blog post on Ride-Sharing Income Taxes that walks you through how to file your income taxes if you fall into this category in 5 easy steps.

If My Business Didn’t Earn that Much Money, Do I Still Need to Report It On My Tax Return?

I get this question a lot because I think a lot of people are under the impression that if you only earn a few hundred dollars from your business or side hustle, then it doesn’t really count in the eyes of the Canada Revenue Agency (CRA).

Unfortunately, that’s not how it works. If you earn any amount of self-employment income, you need to report it on your tax return. If you don’t, that’s actually considered tax evasion which is illegal. So as soon as you start earning any amount of self-employed income, make sure to keep track of it and report it on your taxes.

What Kind of Business Expenses Can I Claim?

Besides being your own boss, the biggest perk that comes with being self-employed is the business expenses you can claim on your tax return to lower your taxable income.

With that said, a lot of people get confused as to what expenses they can claim. That’s a big reason why I like using TurboTax and I recommended my sister use it this year. As you go through the software, it provides suggestions for business expenses you can claim. However, you’ll also want to keep track of your business expenses throughout the year, so make sure to get familiar with the CRA’s list of business expenses.

What’s the Tax Filing Deadline?

If you’re an employee, or you’re an employee with a side hustle, then the deadline to file your individual tax return is always on April 30 or the next business day if it lands on a weekend. Since April 30, 2022 lands on a Saturday, that means the tax filing deadline for your 2021 income taxes is on May 2, 2022.

If you’re self-employed, you have until June 15, 2022, to submit your self-employed tax return. With that said, you still have to pay your tax bill by May 2, 2022. If you don’t pay before this date, interest will start to accrue on your balance owing. That’s why personally I’d recommend filing your taxes by the May 2 date to avoid paying any interest.

5 Step Guide to Filing Your Self-Employed Taxes

Ok, so hopefully I’ve answered a few of your questions already, but now let me break down the process of filing your self-employed taxes for the first time so you can start taking action (and feel good about it).

Step 1 – Gather All of Your Documents

The first thing you’ll want to do is gather all of your necessary documents for tax time. And ideally, you’ll have already kept them in one place to make it easier for you to sort through.

In my early years of earning self-employed income, I kept all of my paper documents and business expense receipts in a shoebox. For all of my digital documents and receipts, I kept them in a special folder on an external hard drive. Now, I still use a shoebox for anything paper-based, but for anything digital I actually keep them organized by month and year on my Google Drive (so I won’t be hooped if my external hard drive decides to stop working, which has happened to me in the past).

If you’re curious about what documents you may need to gather, check out TurboTax’s 2022 Canada Tax Checklist as your personal helper.

Step 2 – Decide How You’d Like to Do Your Taxes

The next step would be to decide how you’d like to file your taxes. You can file manually, through an accountant, or using tax software. For most of my time being self-employed, I’ve used TurboTax. And the reason is that the software is super easy-to-use, inexpensive, and can accommodate whatever your income situation is.

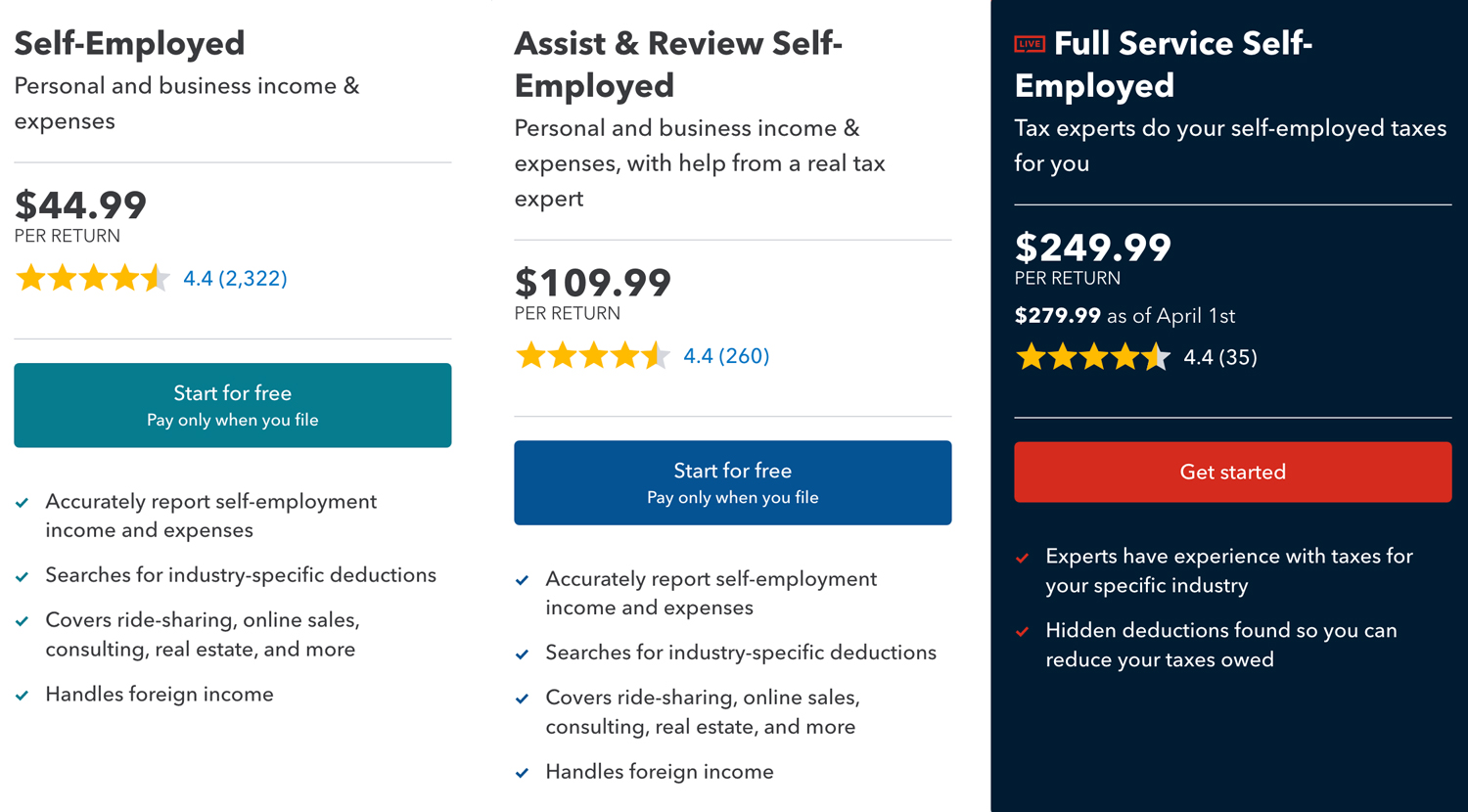

You can use them if you’re an employee, an employee with a side hustle, or fully self-employed. Not only that, they offer different versions of their software depending on how much support you need, such as do-it-yourself, Assist & Review, or Full Service. If this is your first time filing self-employed taxes, I’d recommend trying out Assist & Review or Full Service if you feel like you’ll need some extra support and advice with your tax return.

With Assist & Review, it’s pretty self-explanatory. You go through the do-it-yourself software, but you get the added benefit of getting live help from a tax expert. Not only can you ask unlimited questions along the way, the expert will also review your return before you file.

With Full Service, that’s also pretty self-explanatory. You get a tax expert to do your taxes for you from start to finish. This is for anyone who has no desire to do their taxes on their own but instead wants to hand everything over to a tax expert to do it for them. I actually tested out TurboTax’s Full Service for myself last year, make sure to check out my review.

Another thing to keep in mind when deciding which option is best for you is that you can claim TurboTax as a tax deduction if you’re self-employed.

Another thing to keep in mind when deciding which option is best for you is that you can claim TurboTax as a tax deduction if you’re self-employed.

Step 3 – Update Your CRA My Account

Before filing your tax return, make sure that all of your personal information is up-to-date in your CRA My Account. That includes your marital status, name, mailing address and province/territory of residence, and banking details. And if you don’t already have a CRA My Account, this should be the first thing you do before starting your tax return as it may take some time to set up.

To sign in or register for a CRA My Account, click here.

Step 4 – File Your Tax Return & Pay Your Tax Bill

Assuming you decide to use TurboTax, actually doing your taxes is super simple. As I mentioned earlier, I walked my sister through TurboTax’s software in just over an hour and she’s now confident she can do it on her own next year.

And that’s sort of the point. TurboTax is meant to guide you through each step so you know exactly what you’re supposed to be doing. Your biggest job is just making sure you have all your documents at the ready.

Then, once you’ve input all of your information into TurboTax, all you have to do is file your return through the software and pay your tax bill through your My CRA Account. Here’s some important information about the different ways you can pay your tax bill, but for me, I’ve always just set up a pre-authorized debit to pay my tax bills.

Step 5 – Be Smart with Your Tax Refund

Step 5 – Be Smart with Your Tax Refund

If you receive a tax refund, instead of a tax bill, please make sure you do something smart with it! Too often I see people spend it mindlessly thinking that it’s free money from the government they can treat themselves with. It’s not. It’s actually your money that’s just being returned to you.

You see, if you get a tax refund it’s because you overpaid on your taxes. This is most common for individuals who are employees or employees with a side hustle since their employers take a portion of their pay and remit it to the CRA on their behalf. In other words, if you’re an employee, you’re prepaying your income taxes throughout the year via your employer.

The amount that’s taken off is based on an assumption of what your average tax rate will be, but oftentimes employers will overestimate this amount to be safe. If this is the case and you’ve paid more taxes than you owe after filing your taxes, you’ll receive a tax refund. You could, however, also get a tax refund if you’re low income and/or use enough refundable tax credits to constitute a refund.

This is all to say that it’s not free money, it’s your money just being returned to you. So wouldn’t you want to make the best use of it once you get it back? In my opinion, your tax refund should go towards the following in sequence of importance:

- Your emergency fund

- Paying down high-interest debt

- Your investments (i.e. RRSP or TFSA)

With that said, I know it’s been a rough few years for all of us, so if you did want to treat yourself, then just make sure you only spend a portion of it (i.e. 20%).

How to Stay Organized Throughout the Year

To finish off this blog post, I want to share how to stay organized throughout the year. Tax time can be stressful, but the best way to alleviate some of that stress is to stay organized with your business income, expenses, and tax deductions/credits year-round.

If you have a very simple setup, like a side hustle or you’re self-employed but only have one or two clients, then you can easily get away with using a simple spreadsheet to stay on top of things. For example, I set up my sister with my Budget Spreadsheet for Self-Employed Individuals so she could keep track of her business income and expenses as she only started her business 8 months ago and has just a few virtual assistant clients.

But if your business has multiple streams of income and/or clients, and you need something a bit more comprehensive, that’s when I’d recommend investing in accounting software like Quickbooks (which is the software I currently use).

Moreover, if you feel like doing your own bookkeeping is keeping you away from doing other tasks that could make your business more profitable, you may also want to consider hiring a bookkeeper to do all of that for you. This is actually what I did last year. Although I genuinely love doing my own bookkeeping, I realized that with my business continuing to grow, it was taking me more and more time to do it myself. So, over the summer I hired a bookkeeper to help keep everything up-to-date in my Quickbooks account and it was one of the best things I’ve ever done.

Giveaway!!!

To make this tax season extra special, I’m giving away special codes to 8 lucky winners so they can use whatever TurboTax they like for absolutely free!

To enter for your chance to win, do the following:

- Comment what you’d like to do with a tax refund in the comment section of this blog post.

- Subscribe to my email list using this form.

For full sweepstakes rules, terms and conditions, click here.

*This contest is now closed.

Got Any More Tax Questions?

Since after reading this, I know you may have some more tax questions left unanswered, drop them in the comments and I’d be happy to answer them. Happy tax filing!

I will be investing my tax refund. I would love to take a trip but it’s not always the best use of my tax refund.

If I get a tax refund this year, I will be putting that into savings so I can be one step closer to getting my kitchen reno’ed!

What would I like to do with a tax refund or what should I do?

Should : Invest it and put it away for my retirement.

Want : Get on a plane! I’m getting itchy travel bug feels.

I’m a PhD student who has managed to save and invest up to low 6-figures by following blogs and podcasts like yours! Having maxed out my RRSP contribution limit last year, I expect a significant tax refund that I would put into my next level in te financial journey: start my way into real estate with rental properties! This is only my second time filings taxes in Canada (first by myself) so I’ll need all the help I can get!

If I get a tax return this year, I hope to contribute to my savings account and pay off some debt

Thank you for this blog post! Been coming upon many road blocks as I do my taxes this year – but have been learning SO much.

With my tax return (if I get one!) I’ll be spending it on tuition for my last master’s course! Which means I’ll have gotten through my master’s debt free!

Even if you don’t make the April tax deadline .

Be sure to at least claim and make the April deadline to submit other forms eg. foreign property ownership. The late penalty is high.

Id like to pay off credit card debt with my refund.

Ahh!! Thanks for this post! It will be my first year filing as a self-employed person and I’m pretty confident I’ll do it wrong (though, maybe not if I use turbo tax). If I get a refund I’ll be adding part of it to my France vacation fund and part of it to my retirement fund 😀

This year would be my first year that I start filing side hustle income taxes. Hopefully I can still get some sort of refund and re-invest into my portfolio!

My husband and I are saving up to have a baby (in-vitro), so any amount of extra income goes toward that.

Refund will be split between RRSP and RESP contributions. And hopefully it won’t be stolen by needing to replace an old set of wheels for our teen drivers.

I’ll be loading up my RRSP and TFSA to take advantage of the recent dip in stocks! Also probably going to take a trip when things open up!

Tax refund will 100% be going towards my student loan. All extra money will be going to knock that bad boy down!

I would use a tax refund to travel – can’t wait to be on the road again!

I’d top up my emergency fund with my tax refund 🙂 (already subscribed to your newsletter!)

I will take my tax refund and put it my back into my side-hustle business

I will be adding any tax refund to my energency savings.

I’d like to invest a tax refund or maybe just put it in a savings account to cover gas and grocery expenses! I feel for families trying to make ends meet.

I’m due for a large refund, so thanks for the ideas! I’m planning to invest part of it, and possibly make a principal payment on our mortgage. Some will go to savings and some has been “spent already”.

Thanks!

I will split my refund up between my emergency fund, savings, and my investment account.

With a tax refund, I’d most likely use half to pump up my business more (advertising, website, new equipment), and the rest would be divided between my rainy day fund and perhaps start investing!

Unfortunately I’m self-employed so won’t be getting a refund but if I were to get one, I’d like to think I’d invest half with my TFSA and put the rest towards my next trip abroad!

I’d dump my refund into my RRSP.

If I receive a refund, I will use it to help pay for biz supplies, new equiptment, After this snowy winter I Definitely need NEW WIPERS on my car that I use everyday for my House call grooming business! (I can’t wait for a tax refund for wipers of course! lol 🙂 thank you for your helpful tax information.

I used Turbotax assisted last year and will do so this year!

I’ll be loading up my RRSP and TFSA to take advantage of the recent dip in stocks! Also probably going to take a trip when things open up!

If I had a tax refund, I’d put it into savings to later invest in my business.

Reno’s and investments! A little bit for different things on our list

I’ll be investing my tax refund in ETF’s or index funds to save for our first home! It’s a long process but every bit counts and I’m new to index fund investing.

I would save my tax refund

I will hopefully be planning a staycation for thé family

I will purchase some winter tires

I plan to invest mine, in my TFSA!

Hoping to put my refund towards replacing some damaged flooring in my home.

With a tax return, I’d invest in a new mountain bike! Not a necessity, but great for overall well-being. 🙂

If I receive a tax refund this year I will put it in my savings! We just bought a new home so the savings account took a bit of a hit

Re-invest!!!

I would invest it! Working towards FIRE ????

Our tax refund will go towards donations, our mortgage, RESPs and a date night!

When searching for how to file self-employment taxes in Canada, your blog popped up. This was very helpful, and reassuring that I’m not going to be overwhelmed by my first time filing.

As for any tax returns, it’ll probably go towards getting a personal assistant!

Amazing!