Make Sure to Also Read:

So…I wrote this blog post about self-employed taxes in Canada over two years ago, mainly because I couldn’t find a resource quite like it when I first became self-employed in 2017. Fast-forward to 2021 and it’s still my most popular blog post! I still get emails and comments all the time about it, so I thought it was time for a bit of an update.

My Experience with Self-Employed Taxes in Canada

When I first wrote this blog post, I had just finished my first year of self-employment. For some backstory, I quit my corporate job in marketing in November 2016 and officially started working for myself in January 2017. It’s now March 2021, which means I’ve been successfully working for myself for over 4 years.

It’s crazy to see how fast time has flown by since that first year of self-employment. Looking back, in all honesty, I had no idea what I was getting myself into. Although I saved up about a year’s worth of living expenses into my Emergency Fund and had earned just over $30,000 from my side hustle in 2016 (which proved to myself I could earn a full-time living if I dedicated full-time hours to my business), I really didn’t have much of a plan. I don’t have a formal business background, I’ve never even taken a business class, and I’m completely self-taught when it comes to running a business. Luckily, you don’t need a business degree to be a successful business owner! I’m sure it helps, but it’s not essential.

You see, there are so many great free and reasonably priced courses and resources out there, anyone can learn this stuff if you have the self-discipline to do so! In retrospect, I probably knew more than I gave myself credit for. But what I will say is experience helps. The longer you run your business and continue to educate yourself, the easier it gets. I’m so much more organized and efficient now compared to that first year. Not to mention, I’ve tripled my business revenue!

And if you’re curious about what the heck my business actually consists of, I made a video that goes in-depth about it. But for the quick version, my business includes:

- Content creation (blog, podcast, videos, social media)

- Freelance writing

- Public speaking

- Selling digital products and courses

- Providing financial counseling services to individual/couple clients

- Running my Millennial Money Meetup® event series

So, what’s the big difference between being an employee earning a paycheque at a company compared to being self-employed? Well, when you’re self-employed, that means that you become fully responsible for setting aside money to pay your income taxes and contribute to the Canada Pension Plan (CPP). It also means you have to pay that money directly to the government via your CRA My Account. When you’re an employee, your employer deals with all that for you by taking a percentage off your gross pay and submitting it to the government on your behalf.

That’s why when you’re an employee, you shouldn’t have a tax bill to pay after you file your taxes. If your employer took off the right amount of money from your pay, your tax bill should $0. Or, in most cases, they’ll have taken off too much, and/or you’ll be eligible for some tax deductions and credits, thus providing you with a tax refund. A tax refund simply means you’ve overpaid on your taxes, so the government is paying you back. That’s right, a tax refund is not free money! It’s literally the government giving you back your own money.

When you’re self-employed, you’ll always have a tax bill to pay because you won’t have an employer doing all that work for you. Instead, when you become your own boss, you also become your own bookkeeper and accountant (unless you choose to hire someone to do that for you). Luckily, it’s not that complicated or much work to do on your own. Believe me, I’ve been doing my own bookkeeping for almost 4 years. The only thing I get help with is I hire a tax accountant to help me file my taxes every year (and she’s worth every penny!).

How to Know If You’re Self-Employed

There are a ton of different terms for being self-employed, so I want to start with clearing some things up. If you’re a freelancer, if you’re a small business owner, or even if you have a side hustle, all of those would fall under the umbrella of self-employed. Self-employed simply means you are earning income by yourself, outside of an employer.

That being said, there are a few exceptions in which you aren’t self-employed but still need to set aside money for income taxes. For instance, if you earn cash tips from your job, that is considered taxable income. Not only do you need to claim that cash as income when filing your taxes, but you also need to pay tax on it. The same goes for if you do any cash gigs. For instance, if you’re a musician and get paid for your performance in cash, that cash is considered taxable income that you need to claim and pay taxes on. If you do not claim any cash you earn as income on your taxes, that is considered tax evasion and is illegal.

Another example would be if you are a hired contract worker for a company. In some instances, the company will pay you regularly as if you are a normal employee, but they won’t take any tax or CPP off your paycheque. In this case, you may not be self-employed in the traditional sense, but you would be in the sense that you have to save a percentage of your pay for tax time.

And since I mentioned side hustles, if you work a full-time job for a company, but in your spare time you have a side hustle, it’s on you to save a percentage of your side hustle income for tax time as well. I remember the first year I earned money from my blog, I had no idea I had to do this! When I filed my taxes, I was hit with a bill of a few hundred dollars and I felt like such an idiot. So no matter what your side hustle is (running an Etsy store, consulting, freelance writing, Uber driving), remember that you need to save some money for income taxes and CPP contributions.

For more info, check out this article on the government’s website about tax obligations for self-employed individuals.

What You’re Required to Pay as a Self-Employed Individual

Okay, with all of that knowledge in your head now, let’s talk about what you’re on the hook to pay to the government come tax time. When you’re self-employed, and you’re operating your business as a sole proprietorship, you must pay:

- Personal income tax on your business’ earnings minus business expenses

- Contributions to the Canada Pension Plan (CPP)

- Contributions to Employment Insurance (EI) voluntary

How to Calculate How Much You’ll Owe If You’re Self-Employed

Let’s talk specifics here. You may think that you have to pay tax on every dollar your business earns, but that’s actually not the case. You’re only required to pay income tax on your business’ earnings after business expenses. Moreover, you can lower your average tax rate and thus your tax bill even more by taking advantage of other personal tax deductions and tax credits, such as claiming some of your RRSP contributions as deductions.

For example:

Let’s say you’re a self-employed web designer in Ontario and you earned $100,000 in business revenue. Business revenue is the total amount of income your business generated by selling goods and/or services. Business revenue does not include any sales tax collected (that’s completely separate).

You spent $30,000 on business expenses and operating costs.

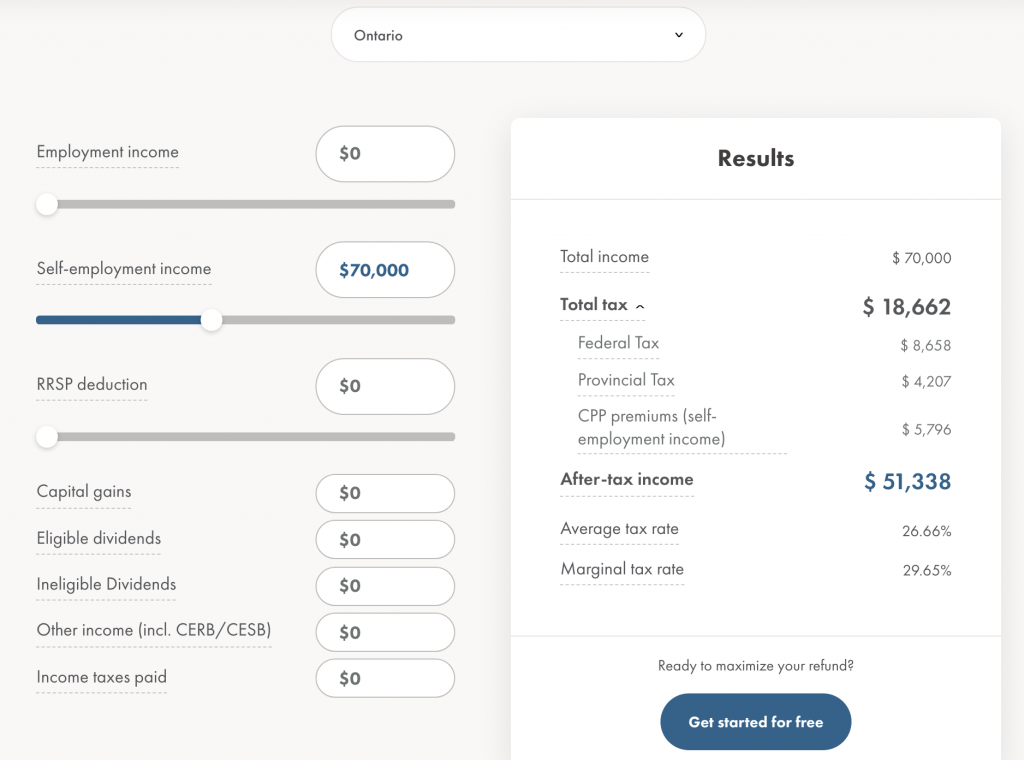

That leaves you with $70,000 in business earnings after expenses. Using this free tax calculator, you’ll find that your average tax rate would be 26.66%, and you should set aside $18,662 to pay your federal and provincial taxes and your CPP premiums.

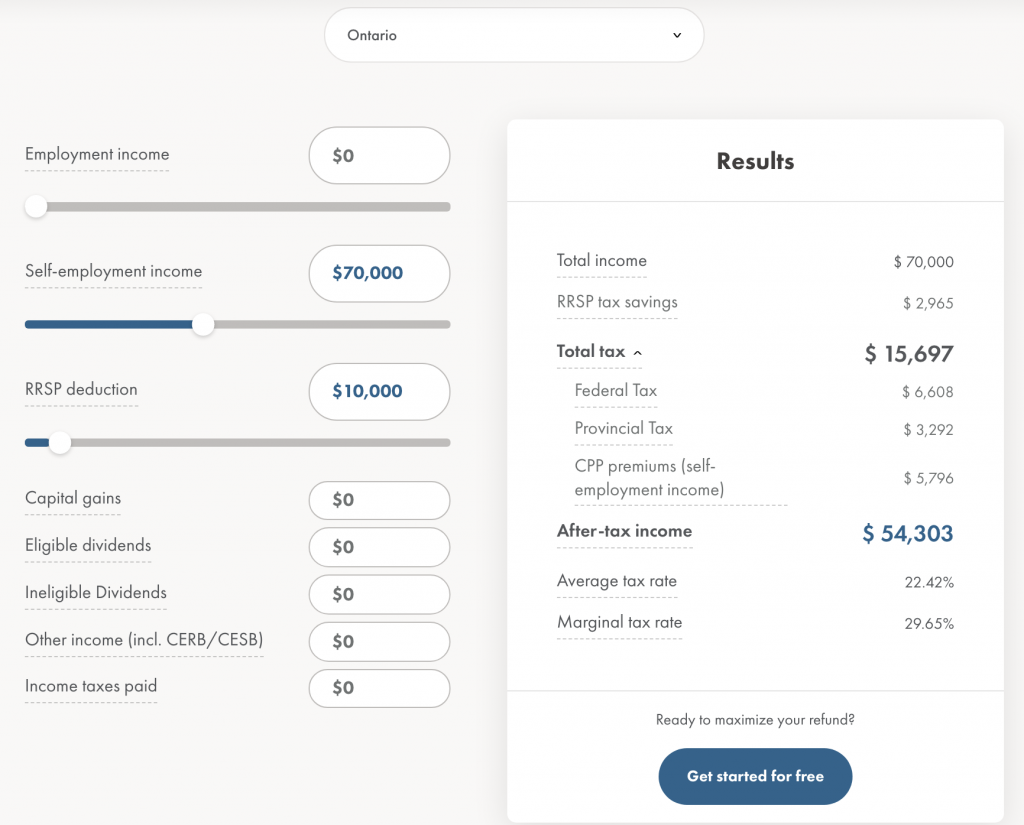

Now, let’s say you also contributed $10,000 to your RRSP which you claim as a tax deduction.

As you can see, your RRSP deduction lowered your average tax rate to 22.42%, thus decreasing your tax bill to only $15,697.

Although this calculator is great, I would suggest just using it as a reference point to determine a percentage you should be putting aside for income taxes and CPP. You may owe less, you may owe more. But it’s important that throughout the year you keep track of your business revenue and expenses, and adjust your tax savings if necessary.

Moreover, having been doing this for several years now, I personally always aim to save more than I need to. I never want to find myself in a situation where I owe more than I have saved, and am forced to dip into my personal Emergency Fund to pay part of my tax bill. So, if I was in the example above, I’d probably round up those average tax rates to 28% or 25% just to be safe.

In my experience, I’ve found it better to be safe than sorry. Plus, if you over save, there’s your “tax refund” (sort of). If you save more than you need to for taxes, then you have extra money to play with. Or, you can be boring like me and just put that extra money into the following year’s tax savings account or my investments.

How to Calculate Your CPP Contributions

Personally, I just use this tax calculator to ensure I’m saving enough for income taxes and my Canada Pension Plan contributions, but if you’re curious how the math works, here goes!

For your CPP premiums, you are required to pay these if you are 18 or older and earn more than $3,500/year. It’s also interesting to note that if you are an employee, you only pay half of your CPP premiums (5.45% as of 2021) and your employer pays the other half. When you’re self-employed, you aren’t so lucky and have to pay the full 10.9%. You are required to pay 10.9% on your gross income (business revenue – business expenses), minus the $3,500 basic exemption amount. Here’s an example:

You earned $100,000 in business revenue

You spent $30,000 on business expenses and operating costs

You’re left with $70,000 in business earnings after expenses

Subtract the $3,500 basic exemption amount to equal $66,500

Multiply $66,500 by 10.9% to equal $7,248.50

$100,000 (business revenue) – $30,000 (business expenses) = $70,000 – $3,500 (basic exemption amount) = $66,500 x 10.9% = $7,248.50

But that’s not all! There is actually a ceiling for CPP premiums. The maximum amount a self-employed individual can contribute to CPP is $6,332.90/year as of 2021. Which means instead of paying $7,248.50 in CPP, you would actually only owe the maximum contribution amount which is $6,332.90.

Since CPP contribution amounts change every year, to keep up to date check out this CPP contribution rates, maximums and exemptions page on the government’s website.

How to Calculate Your EI Contributions

I want to make it clear that contributing to the EI program is not mandatory when you’re self-employed. It is 100% voluntary. However, by not contributing to EI, that means you are ineligible to take advantage of all the benefits EI has to offer, such as maternity/parental leave or being a caregiver to a family member who is ill or injured. Then again, it may not be worth it to you and instead you may prefer to just have a very cushy Emergency Fund.

But if you are interested in it, here’s how much it costs. As of 2021, the EI rate is 1.58% for self-employed individuals. This means that for every $100 you earn, you need to pay $1.58, to a maximum of $889.54/year (on maximum insurable earnings of $56,300). And for insurable earnings, this refers to your gross salary, or your business revenue after you’ve deducted business expenses but before you’ve paid income tax and CPP.

Using my earlier example:

You earned $100,000 in business revenue

You spent $30,000 on business expenses and operating costs

You’re left with $70,000 in business earnings after expenses

$70,000 x 1.58% = $1,106

Since $1,106 exceeds the maximum EI contribution amount, you would then just pay the maximum amount of $889.54 for EI. To play around with different scenarios, you can check out this free EI calculator.

To learn more, visit this page about EI special benefits for self-employed individuals on the government’s website.

Final Thoughts

This has been a major post, so if you actually read it all, word for word, you are a rock star! Not only that, now you’re way more informed than most self-employed people. High-fives all around for that!

But again, if you’ve got to do your self-employed taxes in Canada and are still confused about things, feel free to email me or leave your question in the comments and I’ll try my best to help you find an answer or solution.

I will be coming out with more blog posts and videos on other self-employed finance topics, so to keep in the loop make sure to subscribe to my email newsletter.

Is it your first time filing self-employed taxes in Canada? What are your concerns or questions? Let me know if you can’t find the answers here and I can write a follow-up blog post!

THANK YOU!!!! This was so helpful! Book marking this for tax time.

So glad you found it helpful!

Say I own 6 rental properties, 3 of them are paid off the other 3 are mortgaged the 3 I own pay for the mortgage in the other three. So let’s just say the 6 rental properties $200,000/year but all of that was reinvested into the mortgages of the rental properties. How much would I owe in income taxes?

That’s something you should discuss with a tax accountant.

Okay, so I’m viewing this years later.

I Googled and this came up.

Even though it has some information I already knew, it does make me feel relieved that I’m doing at least some if not all of it right? Thanks for this!! Helps calm my nerves about tax time. I have money saved away, which also makes me nervous, hahaha. I always look at my account thinking “Is it enough?!”.

Nice! So glad this post helped calm your nerves and confirmed some things for you that you already knew so you can be confident doing what you’re doing already. 🙂

Wonderful and simplified post. Thank you

Can you pay as you go? For example, paying CPP, EI, & tax amounts whenever you receive a cheque/payment, which could be biweekly or monthly, instead of waiting for tax season?

Thank you

Great question and the answer is no, you can’t set your own income tax instalment payment schedule. It’s annually or quarterly. More info here: https://turbotax.intuit.ca/tips/do-i-have-to-pay-tax-by-installments-124

Hi I am Mudasir from India ,if somebody will be hired labourer/workerof company,and is earning 35000 dollars annually .Has he/she pay tax also…plz explain how much will be his saving.

Not quite sure what you mean, but if you earn $35,000 and are hired on as a contractor (not employee) by a company, yes of course you need to pay income taxes on that income in Canada.

Question! If I have a side gig and have a full time job with an employer, do I need to pay into cpp and ei again or because i have an employer would I have already reached my max?? Thanks for any help ! Your blog was so insanely helpful!

You could owe more CPP and EI. When you claim that self-employed income with your employment income on your tax return, your tax accountant or the tax software you’re using will tell you if you owe anything more.

Hi Jessica! Thanks for the blog post, very helpful. To follow-up on this question, would we claim self-employed and employment income on the same tax form? When you had both jobs, did you file a T2125? Thank you!

Yes, you only do one tax return when you’re an employee but also run a self-employed business. The easiest way to do it is either hire an accountant to help you or use tax software (most years I used TurboTax).

Hiya Jessica!

This awesome. Thank you for writing it! Certainly makes things easier to understand.

Potential idea for another blog post – what to claim as expenses.

I know this varies depending on profession (I technically have three jobs I am self employed in – actor, online reseller, and an independent contractor).

Could you cover how to break down the biggies (like percentage of rent for home office, phone and internet bills, car and travel expenses) and how to create a list of expenses to run with throughout the year?

Great idea!

Hi, sorry if this is a stupid question, because maybe you said it here before, but where I have to register and report my income? By CRA?

I am from Germany and came to Canada for work and travel and it is really hard to understand all the rules, but this article is so helpful, thank you so much!!!

When you file your tax return, that’s when you would report your income. A tax accountant can walk you through the entire process 🙂

Thanks, I have a follow up question. If you make under $30000 and do not have a HST number and have high expenses particularly in the first few years to get set up. Is it possible to get a self employment tax return?

So you’re asking if you earn under $30,000, can you still claim business expenses as tax deductions? Absolutely. If you are running a business, be it a full-time business or a side hustle on top of your corporate day job, yes you can claim business expenses for that self-employed income. It has nothing to do with HST. A great calculator to play with is https://simpletax.ca/calculator

Thanks! This has broadened my understanding of self-employed taxes

Glad I could help!

Thank you!!! Your wonderful and I understand you more than anyone else. I am doing home care for seniors, I want to pay all taxes, especially CPP. I only have a few clients and it’s not tons of money, should I open a business account so I can claim gas and uniforms? Or skip that and just pay my taxes annually. As I said it isnt alot but really need to pay into CPP.

What do you mean by business account? Like a business bank account? If you’re a sole proprietor operating your business under your personal name you don’t need to do that. You can just use your personal bank accounts and credit cards. And if you are earning self-employed income, then you are required to pay tax and CPP. If you’re a sole proprietor, you don’t have to set up anything to do this. Just make sure you claim that income on your personal income taxes, and save receipts for any business expenses to use as deductions. Here’s a list of business expenses you can claim: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/business-expenses.html

Yes, you can get a tax refund if you make under $30,00/year!

So instead of owing, you’ll most likely get a refund (even if your self-employed)

I believe that’s what you were asking? 🙂

Really helpful thanks just took the leap from employee to entrepreneur and this broke it down really well

So glad I could help!

Hi Jessica,

This is a super helpful article – thank you!

So, just to clarify, you should put aside 25% of your net income for income tax, and an additional 9.9% (think it has now gone up to 10.2%) for CPP?

I was assuming the CPP would be included in the 25% I put aside, but it would appear I am wrong. My first year doing taxes as a freelancer – it’s a steep learning curve! 🙂

Nope you’re right, include CPP in the amount you’re saving for income tax. But honestly, 25% is just a general number. What I would suggest instead is estimate what your gross income is (minus business deductions), then use a tax calculator like simpletax.ca/calculator to get a more accurate percentage of what to put aside for income tax and CPP.

Great! Thanks so much!

Most helpful and easy to understand info I have found so far! Thank you!

Thanks so much! Glad you found it helpful!

Hi Jessica,

If I have a full-time salaried job where they automatically deduct EI, does that mean I have to pay EI on my side hustle? Or can I choose not to pay EI on that amount? I don’t expect to make a ton of money and am just doing it for some extra spending money so I’d like to keep as much of it as possible. Thanks!

Great question! You would only need to pay additional income tax and CPP on your side hustle money, not extra EI. You can play around with numbers to see what I mean: https://simpletax.ca/calculator

I’m a student and looking into getting into transcriptionist for over the summer and during a full time work load. I don’t except to make that much money so I am just wondering if you know anything about it and if you think it would be worth it after taxes? I couldn’t afford to have a huge tax bill while in school so would it be accurate if I were to make 6,000$ in a year that if I saved 25% that that would be enough to cover the taxes on it?

Just wondering if you have any advice on getting into self income options.

It’s always worth it to make money! And 25% is just a general number, that’s why I suggest plugging in your actual numbers into a tax calculator like this: https://simpletax.ca/calculator. If you were to earn $6,000 in self-employed income in a year, your average tax rate would be 4.25%, meaning you’d have to pay $255 in taxes leaving you with $5,745 in after-tax income. Definitely worth it!

Hi Jessica. Glad I found this blog. Question – if I am freelancing/self-employed, do I need to register a business, or just file taxes as ‘self- employed?

If you’re a sole proprietor running a business under your personal name, no you do not need to register your business. And when filing your taxes as a self-employed person, or even if you just have a side hustle, it’s fairly straight-forward if you use tax software or work with an accountant.

A very good article Jessica. Came in handy as I recently lost my job after being employed full-time for the last 15 years. There is an offer for me to start a 6 month contract position in a financial institution. I was told to incorporate to get paid. I have been reading a lot if I should incorporate or be self-employed. The CRA website has loads of information for sole prop, partnerships and self-employed but it assumes you are one or the other. It does not assist you in deciding on selecting if you should incorporate or not.

I live in AB, the job offer is 6 months contract position, I invoice them bi-weekly for the hours worked + GST. My question is should I be Incorporated or Self-Employed? Maybe its just terminologies but am I right to assume Self-Employed is the same as Sole prop?

A follow-up on your response to Paula that we do not need to register a Sole Prop. How about the GST then? I thought I need a business number to remit the GST. Any assistance is much appreciated.

Being self-employed simply means you work for yourself and run your own business (you are not an employee working for a company). In which case, you could be self-employed and run your business as either a sole proprietorship or incorporation. In terms of which one should you do, there are many differences between a sole proprietorship and incorporation. I would suggest connecting with a tax specialist who helps small businesses (the Wellth Company is one suggestion), or you can also check out more resources on Ownr.co, a website that helps you register your business.

As to your second question, you only need to register your sole proprietorship if you wish to use a name other than your personal name for your business. Registering your business and registering for GST/HST are separate things. And as mentioned on the government website, if you want to register for GST/HST and do not already have a business number, they will give you one when you register for GST/HST.

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/account-register.html

Good luck!

Great blog, Thanks! My question is, the 9 digit business no. that I had set up online through CRA website (no accounts under that number yet – according to CRA phone rep.); so it that the same no. as my GST no.? I had read that the term Business No. and GST No. we’re same and are often referred to either way. Can you confirm or clarify this?

Thanks, appreciate it!

Shannon

Your business number and HST/GST number are sort of the same. Your business number would be like this 9-digit number: 123456789. Your HST/GST number would be that number plus RT 0001. So it would look like: 123456789 RT 0001. You can find more info about this specifically in this helpful article by TurboTax https://turbotax.intuit.ca/tips/a-guide-to-business-numbers-6211

Hi Jessica,

Very helpful and well-written blog post, thanks for that!

I am from Ontario and have begun doing freelance work for a design company in Ontario while working remotely (abroad). If the company I do design work for actually uses those designs to sell to a client and they already charge sales tax on that item to the client, do I need to also be including HST in my invoices to the company for said design?

Thanks!

Hi Amanda, great question. Yes, you still need to charge your client HST, even if they sell your designs and charge their customers HST.

Thank you! So helpful!

So glad you found it helpful!

Hi Jessica, great post! Will the CPP amount be automatically calculated in my refund owing if I am using an online tax program like ufile or do I have to do something separately to make sure it’s paid? thanks! F

Yes, that’s right. CPP won’t be separate from your income tax owed (or refund), and if you’re using online tax software if it will automatically calculate everything for you.

Great, thanks so much!

Hi Jessica, I just received a job offer and they want me to be incorporated?

I have no idea how to do any of this lol. I live in AB and will be providing my services in BC, I will be receiving $300 per day sub pay (non taxable) on top of $35 per hour (10 hr days) and also 4% vacation paid out weekly. What would my obligations be for CPP, EI, Income tax and GST? Am I required to pay WCB also? And how do I track everything? Am I able to write off my vehicle, mortgage, fuel etc? Please help

For your situation, I would get in contact with an accountant to help and guide you.

Hi Jessica, I’m on Ontario Disability Support Program, but I also just became self employed. They didn’t kick me off disability, but they did lower my check.

I just filed taxes in March. I wasn’t self employed till April 2. Do I have to file again by June for my self employment taxes? And how do you pay them if you owe money back?

If you weren’t self-employed until April 2, 2020, then no you don’t need to refile your 2019 taxes. You’ll just have to file as a self-employed person for your 2020 taxes (which you’ll file in the 2021 tax season).

Thanks for replying. Great information.

Hi Jessica, great article. I recently started a business from home after losing my job and incorporated on a lawyer’s advice. I don’t plan to take a salary for at least 6 months, possibly longer and will reinvest what I make. Do I still have to contribute to CPP if I am not taking anything out of the business? Could I take a dividend at the end of my first year and claim that on my taxes?

I’d suggest working with a CPA to help you with all of your questions.

So no matter how much you made you still have to file taxes, but if you make under a certain amount, are you not required to pay taxes on it? And if so, how much would that be?

Thank you

Even if you don’t earn any income, you should still file your tax return. And if you earn any amount of income, you are legally required to pay income taxes on that money. However, if you do not earn an income or earn very little income, you can claim the Basic Personal Amount non-refundable tax credit when filing your taxes. This is the amount you can earn without paying any income tax. For your 2020 taxes, the federal Basic Personal Amount is $13,229 (meaning if you make this amount or less, you do not have to pay federal income tax). The provincial Basic Personal Amount varies per province.

Jessica thank you so so much, I really appreciate you for responding to my comment, and answering my question!

Happy to help! 🙂

Lets say I work for myself and contract myself to different jobs. I make 450k a year. Imagine I had zero deductions (obviously I will have some, but pretend I dont). How much is the MAXIMUM possible amount of income tqx I would pay on 450k without any deductions (in NS if that matters). Thinking ahead. Thanks

Using SimpleTax’s free calculator it looks like your average tax rate would be 47.54%, so that would mean you’d owe $213,942 in taxes. I’d play around with the calculator to get a better sense for different scenarios. https://simpletax.ca/calculator

Hi Jessica. Great article. Very helpful. Navigating the waters as a new small business owner is super confusing.

I have a question regarding quarterly taxes — I’m a freelancer and I’m wondering if I have to start paying quarterly taxes in my first year or if I just claim/pay taxes at the regular tax time in one lump sum in my first year?

Thanks

First year you’ll just be doing annual, and then most likely your second year will be quarterly if the government sees your income increase. You can find more info here: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/making-payments-individuals/paying-your-income-tax-instalments/you-have-pay-tax-instalments.html

Hi, I have heard that people register a business and then write a pay cheque from that business to themselves. Do you think that is a better way to do things? Also did you resister a business yourself or did you just transition to working by yourself using your name. I work for a company in the US as a consultant and I work from home. Apparently I am self employed. So I am wondering if I should register a small business.

I’m a sole proprietor, but I did register my business under the name Jessica Moorhouse (that’s my maiden name, I use my married name for my personal life and accounts). I think what you’re referring to in terms of writing yourself a paycheque is if your business is incorporated. If you’re a sole proprietor, your business money is your personal money so there would be no difference there. If you choose to work under your personal name, you don’t need to register a business name. You can just start working under your name.

SUPER helpful! Thank you so much!

Happy to help!

Hi Jessica. This blog is great! Thank you so much. My question is, my business is under my name so I don’t need to register, but then how to I contribute to CPP in order to have that benefit? I am currently setting up my self-employed EI contributions but not sure if I need to set up CPP?

There’s nothing extra to set up. It will be calculated how much you owe when you file your taxes.

Hi Jessica, this is my first year claiming for self employed income. Is it possible to owe NO money to taxes because you’ve written off so much in business expenses or do you always owe something?

Yes, if you don’t earn a profit from your business (your business expenses equal the same amount as your revenue), or you end up with a net loss (your business expenses exceed your revenue), then you effectively you wouldn’t have any income to claim and thus wouldn’t owe any taxes.

Hi Jessica! This article is SO helpful. I have a quick question. I am going to be launching my gifting company in October 2020. I don’t plan on making more than 30K this year (or maybe not even any year as this is my side business). Would I have to charge taxes on all of my products? I do have an HST account through CRA. Thank you, Mercedes.

So you’ve already registered for a GST/HST account through the CRA for your business? If that’s the case, then you do have to charge your customers GST/HST because you’ve registered. It doesn’t matter how much you earn. Once you register, you must collect and remit sales tax. If you hadn’t registered, then the $30,000 threshold would have applied.

Hi Jessica,

Thanks for all the information. Can you explain when I might have to start paying in instalments? Is it in my first year? I started in Feb 2020, and have already made close to 30000. I am offering educational services so from what I read no HsT needs to be charged but I did see that it is my responsibility to pay in instalments or risk paying the interest on late payments. Or is this only after the first year is filed and they send me a letter telling me to do so. Can you confirm this?

So for your income taxes, you wouldn’t be required to do instalments in your first year, but most likely your second. It was actually my accountant who told me I needed to do instalments, I never got a message from the CRA telling me to do it. However they did send a reminder via my CRA My Account mail dashboard halfway through the year that I needed to do it. I would simply follow the rules stipulated here or talk to an accountant: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/making-payments-individuals/paying-your-income-tax-instalments/you-have-pay-tax-instalments.html

For GST/HST instalments, I also never got a message from the CRA telling me it was time for me to do it. My accountant told me I needed to start paying in instalments. So I’d similarly suggest talking to an accountant or you can find more info here: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/pay-instalment.html

Hi Jessica,

Thank you so much for this informative post.

I registered my business, as to avoid anyone from taking my name. I definitely won’t be making more than 30k, I’m thinking 10k-15k however I do work for a company with an annual salary of $42 500. With that said, since I’m operating my business as a sole proprietorship, when doing my taxes I will need to combine both incomes together correct? How much taxes would I need to pay on that amount? I currently only pay about ~1000/year since I contribute to my RRSP, and I am located in Quebec.

Thank you!

I’d suggest using a tax calculator like https://simpletax.ca/calculator to determine how much you should save from your self-employed income. Your employer should automatically deduct taxes from your pay, so you just need to set aside money to pay your self-employed taxes. With that calculator, you can plug in your employment income and your estimation of self-employed income, it will give you an estimate of your average tax rate (i.e. 25%) and then that should be the percentage you set aside from your self-employed income.

Greetings and thank you for making this informative blog ! I currently have a few concerns regarding my situation. I’m a young artist in Canada, Quebec who is looking to start working as a freelancer. I was aware of previous employers deducting the government tax from my pay slip for me. However, now that i am going to be working for myself, i was wondering if i had to pay my taxes in installments or in one bulk at the end of the year since i won’t have an employer to pay the tax money for me. Keep in mind that i am starting this off slowly and i am likely to make less than 400$ by the end of the year with this artistic work. Thank you for taking time to read this and i hope that you’d be able to clarify this. 🙂

For your first year of self-employment, you wouldn’t have to pay in instalments. You simply need to save up money in advance to pay your tax bill (ideally in a high-interest savings account), then file your taxes during tax season like you normally would and pay your taxes owed. As you continue with your business though, you may have to pay in instalments. You can find more info about that here: https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/making-payments-individuals/paying-your-income-tax-instalments/you-have-pay-tax-instalments.html

Many thanks for such an informative post. I have a question. I am self-employed, if I earned income in 2019 for work completed in 2019 but only received the payment in January 2020, should I be reporting that income for my 2019 taxes or 2020 taxes?

Great question! It doesn’t matter when you receive payment, it matters when you did the work and invoiced/billed for payment. So if you did work and invoiced in 2019, that revenue is for the 2019 tax year, not 2020. As an example, if I did work for a client in December 2019 and then sent them an invoice right after, if they didn’t pay their invoice until January 2020, I would still report that revenue for the 2019 tax year, not for 2020.

Hello Jessica,

I have incorporated account and I worked for a company on contract between Feb’2020 to Mid Sept’2020 after which I got a full time job with another company. Can I take salary for the whole month from my incorporated account if I have worked for more than half a month in Sept’2020 ? Also can I take bonus in year end for my incorporated account ?

For corporate tax questions, I’d suggest connecting with a CPA to help you with your situation. As an example, I use Lisa Zamparo from The Wellth Company for my sole proprietor taxes but she also helps small incorporated businesses as well.

Hi Jessica. Thank you for the blog. I just started a side hustle, receiving payments mostly in cash or e-transfers will Likely not meet the 30k threshold annually on HST. I was just wondering though when it’s time to prepare this year’s tax return whether I will be able to continue using tax software like Ufile to report my side hustle income. The CRA website refers to certain forms to be filed. Also, how much would a tax accountant cost?

For several years when I worked full-time and had a side hustle, I just filed my taxes with tax software. But if you want specific help or advice with your taxes, you may prefer using a tax accountant. As my taxes have become more complex and I’m now fully self=employed I really like using a tax accountant to file my taxes and provide expertise. But technically yes you can use tax software. One thing you can actually do in advance of tax season is test out a few different software to see how they work. The great thing about the paid ones like UFile and Turbotax is you only pay if you actually want to move forward and file your taxes. But you can open an account for free and check it out beforehand. This way, you can determine if software is fine or if you’d prefer using a tax accountant.

What bank account do you use for the money you set aside for taxes? Just a regular savings account?

Yup! So for me, since my business is registered under a different name than my legal personal name, I have to have a business chequing account with a bank in order to cash cheques from clients. However, once those funds are deposited into my business chequing account, I then transfer those funds to a personal savings account at EQ Bank that I nickname “Taxes” to keep separate from any other savings accounts.

Thanks! Was wondering about whether it would make sense to have it in an investment account in the meantime, but perhaps it’s too short term, so regular savings account makes sense.

I wouldn’t invest money that you’d need to withdraw in less than a year to pay taxes, unless it’s some sort of guaranteed investment like a short-term GIC.

Which Tax program do you prefer. Is Simple tax better than Turbo Tax? I have used several and have always preferred Turbo Tax. Which do you prefer? Thank you

I’ve never used SimpleTax but know tons of people who’ve used it. In the past I’ve used UFile and TurboTax, but that’s going back maybe 4 years since I became self-employed and have used an accountant since I need the help. I like both between the two if I’m honest, though I do remember really liking Turbotax’s interface.

Hi,

Actually I am an employer who has to pay wages to employees on payroll.And for that I want to know their contribution that I need to pay to CRA .

Could you pls guide me on how to determine that by myself.

I’d suggest hiring an accountant to help you with this.

Hi Jessica,

Thank you so much for your time and efforts for creating such wonderful blog to educate the person like me on managing small business in Canada. I have a quick question here.

I recently incorporated an IT business (actually in July, 2020) and have been working for it as a self-employed. So far I receive my income either cash or etransfer into my personal bank account as I do not have bank account for my business. Does it work that way?

I would suggest working with an accountant if you’re incorporated. Being a sole proprietor is very different than incorporation.

Thank you so much. That was so great. You really explained everything I should do in my first year about tax reserve.

Glad you found it helpful!

Hello Jessica,

I was wondering what the consequenses would be of not paying your cpp for the last 3 years on self employed earnings. I am very close to applying for my cpp so I was wondering if they just adjust your monthly amount or do you have to pay back the 10.5%. The tax software i used never added it to my tax owing.

CPP is included in your income tax bill, so not sure how you weren’t paying it for the past 3 years. You don’t apply to contribute, you’d only apply to receive payments when you retire. I would suggest checking your CRA My Account and looking at your tax returns, you’ll be able to see how much CPP you’ve contributed in the past.

Thank you for this post! This was my first year as a self employed small supplier and the thought of calculating everything is so daunting to me, but at least I can understand it a bit more. So for my business I design, produce, and sell custom merchandise made in China, and I also have clients who pay me to produce their own custom merch through my services. From reading your post, when I put down my personal income tax, I do not include the manufacturing costs that I earned from my clients to produce the merchandise, because that would be considered expenses, correct? Also, would paying custom fees also be considered as expenses or no? Thank you so much.

I’d suggest talking to an accountant to help you since I can’t speculate on what to do with your business and what is and isn’t a business expense. But the good thing is the fee you pay your accountant is considered a business expense.

Yes, I did check. Nothing was contributed to CPP in the last 3 years. Yet my notice of assessment is up to date with all taxes paid. Nothing owing. I will call them. I am going to blame the tax software for not raising that red flag.

What software did you use?

I better not say. I went back and reviewed my return. Most of my income was from rental properties which for some reason did not fall under the self employed category. The rest of my income came from odd cash jobs which I claimed and Interest Income.

I see. So property income is not subject to CPP premiums and is not considered self-employed income (more info here: https://www.taxtips.ca/realestate/rentalorbusiness.htm). But for cash jobs, which sound like self-employed work in which you were simply paid in the form of cash, if you claimed that income on your tax return as self-employed income, you would be subject to CPP premiums, unless you earned less than $3,500, the basic exemption amount (more info here https://turbotax.intuit.ca/tips/cpp-ei-considerations-self-employed-canadians-8648#:~:text=Everyone%20between%20the%20ages%20of,employer%20contributes%20an%20equal%20amount.).

This was SO helpful! Thank you!!

So glad you think so! 🙂

I am a VERY small business.

I made just under $500. LOL.

Would I still have to report even $200?

This post is very helpful, thank you for your insights and time to write this.

Yup, you must report every dollar you earn, doesn’t matter how much it is.

I am just starting on this self-employment journey, and wanted to say thank you. This post has been so much more informative and straight forward than weeding through all the various government websites! Appreciate your help!

So glad you found it helpful!

Hi Jessica,

Thanks for your videos and posts, they are very helpful! From your post, it sounds like CPP contribution is paid as a lump sum to CRA during tax time, but I have seen info on signing up for a payroll program account with the CRA where you have to remit source deductions on a quarterly basis (for new sole proprietors). Are you able to clarify this?

Appreciate the help!

When you file your income taxes, either if you’re using tax software or when using an accountant, your CPP contributions should be included (it’s line 421 of your T1 tax return. So when you pay your tax bill you’re also paying your CPP.

Ahh ok that makes sense. So any idea what the Payroll program account is for then?

It’s for if you need to set up payroll to pay employees in your business. More info here https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll.html

Ahh I see. Ok, thanks so much for clearing this up. Appreciate your help ????

No worries, happy to help!

Hi Jessica,

I’m looking to gain at bit more information and knowledge on this

I am an artist and also a student in University. Over the past few years I have sold some artwork but overall have made under $8000.00 a year. I do not have a business number and have never claimed this income and I do not charge taxes.

How much do can you make as a small business before you have to start claiming taxes and giving my income numbers on my taxes?

This is important because I am going to court for a family matter and the opposing party is claiming that I am not stating all of my income and “hiding” my finances. From my point of view, I have never claimed this money because I havent made enough to justify it

You have to claim every single dollar of self-employed income on your income taxes. There is no threshold. In other words, you should have claimed that $8,000 on your income taxes. If there is a paper trail, such as deposits into your account from artwork sales, then the CRA may eventually discover this and audit you. If you want to fix this error because you should have claimed that income (not doing so is considered tax evasion), then you can make an adjustment to past tax returns by filing a T1 adjustment. More info here https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/about-your-tax-return/change-your-return.html

You don’t need to have a business number to earn self-employed income. For instance, for years I earn tiny bits of advertising revenue from running my blog under my personal name. I didn’t have a personal number, but when I filed my taxes I made sure to claim that self-employed income and paid taxes on it. More info about business numbers can be found here https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/registering-your-business/you-need-a-business-number-a-program-account.html

For your court situation, you may want to consult with a CPA to get some advice on this.

I started a small business selling a handmade board game in Oct ’20. I have received payments mostly in cash or e-transfers and most likely not meet the 30K threshold annually on HST.

I haven’t registered a business yet and haven’t charged customers HST either.

I am planning to use my brother’s inactive incorporation to provide invoices without claiming HST. Should that be the best solution to my business or should I start my own incorporation?

How do I file tax on this small business income?

I would definitely consult a CPA to see what makes the most sense for your business.

Hi Jessica! If I work full time plus have a side hustle as a health coach, would it be better to have a separate tax filing for my side hustle as it’s own business or just add it to my income tax form I do normally?

If you’re a sole proprietor, no matter if you have a registered business name (i.e. Hannah’s Health Coaching) or just use your legal name (i.e. Hannah Smith), your side hustle income will simply be added to your personal income taxes. The only way it would be separate is if your business were incorporated, then you would have a corporate tax return and a personal tax return.

Hi Jessica.

Came across this blog post via Google and what a wealth of information! I am just beginning the self-employment journey and this has a lot of food for thought for me to consider.

Thanks for putting it out there!

So glad you found it helpful!

Hi Jessica,

Thank you so much for sharing the information in helping people starting their own business or being their own boss! I found your post gave me the confidence of what I need to do.

My husband decided to work for himself starting this March. I will be the one who will help him with the paperwork including book keeping and pay HST for him.

He is in construction so he has expenses like car mileage, materials, gas, etc… My question is do you know of a software which I can track the income and expenses?

Thank you very much!

Tuyet

Freshbooks or Quickbooks would be two great options to check out.

Hi Jessica,

Thanks for this great article.

I’m in IT sector with a major bank and I got a job offer from a third party company that is asking me to get incorporated and they would pay me 90 dollars an hour for a new role(1 year contract ) that totals upto 175k a year. In case of an employee, it would be around 80 to 90k. I want you to choose either of these two options. A. This is usual range in IT. You should get yourself incorporated considering this compensation gap as one reason. OR B. this is something fishy and not practical and in line with current IT market.

I would suggest contacting a CPA to help you determine what makes the most sense for your situation and if incorporating makes sense for you.

I have a short question I couldn’t find an answer: Does all self-employed income needs to be reported, or is there a minimum threshold below which it isn’t needed? My partner worked last year beside her employment a few hours for her professional order and invoiced them about $300. This is a tiny amount compared to her other income, but wondering if it falls under a threshold or if we would need to report it?

There’s no threshold, you have to report every dollar of self-employment income.

Hi Jessica, Thank you for the wonderful Post

I am a full time employed and I Do have a sole proprietorship but my client are based in UK, so I don’t have to collect HST.

What I am required to Pay (TaxWise)?

Correct, if they are outside of Canada you do not charge them GST/HST or provincial sales tax. You do of course have to claim that income on your tax return and pay income tax on it.

Wow you’re great! Love your simplified, clear, clean and simple approach, it makes it easy to follow. You set a benchmark with your color coded examples, if only the cra would follow suit… not holding my breath.

Was confused about one thing, in your post your wrote the following:

“But that’s not all! There is actually a ceiling for CPP premiums. The maximum amount a self-employed individual can contribute to CPP is $5,796/year as of 2021. Which means instead of $6,982.50, you would actually only owe the maximum contribution amount which is $6,332.90.”

In the last sentence, is the figure: $6,332.90 simply a typo and should have been $5,796 (CPP Contribution ceiling)?

Many thanks, the world needs more people like you lol.

Good catch, I must have updated only part of that section for 2021. It’s fixed now. The CPP maximum amount for 2021 is $6,332.90

Great post, love your clarity!

Had a question about RRSP contribution room (aka “deduction limit” according to CRA) and the effect “deductions” and “contributions” have on it.

If you have “UNDEDUCTED contributions” made in a given year – so you don’t deduct it against your income but carry it forward for the following year – does it still decrease your deduction limit (aka contribution room) for the tax year?

“Deduction limit” implies the max amount you can deduct your RRSP contributions against your income in a given year (correct?) where as “Contribution Room” suggests how much you’re allowed to contribute to your RRSP in a given year. However CRA doesn’t seem to make any distinction between the two and opts for the phrase “Deduction limit” while acknowledging the term “Contribution Room” as if it were the same.

reference:

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/contributing-a-rrsp-prpp/contributions-affect-your-rrsp-prpp-deduction-limit.html

Seems like a poor choice of words since “deduction” and “contribution” can almost be seen as an oxymoron – it’s contradictory when used interchangeably. Shouldn’t the CRA have thought to differentiate between the two?

I’ve scoured the net and haven’t received any clear indicator about how it’s handled. I suppose I could ask the question in one of two formats to gain a better understanding on how it’s handled:

1) Do undeducted contributions decrease your deduction limit for the same year? Since you’re actually not deducting it against your income and carrying it over to the following years (indefinitely) until it gets claimed.

2) Do undeducted contributions decrease your contribution room for the same year? Since you’re making a contribution to your RRSP your contribution room (aka deduction limit) naturally decreases, regardless if you didn’t deduct it against your income for that year.

I’m assuming the latter (question format #2) and I assume a lot of the issue has to do with the semantics and implications of using the word: “deduction limit”. If you will recall, the CRA has opted to use the term: “deduction limit”

Assuming it is the latter, how do your undeducted contributions get handled in the following years? Does it become a straight deductible against your income once claimed, without having any impact to your deduction limit (aka contribution room)? So in addition to claiming your UNDEDUCTED contributions you can also claim the FULL amount of your deduction limit (aka contribution room) as a deductible against your income in the same year if you wanted?

Many thanks, if you can help me cut through the fog you’re amazing!

Hi David, if you contribute to your RRSP, those contributions will take up some of your contribution room even if you choose not to use those contributions as tax deductions for the current tax year (and carry those deductions forward to a future year). Contribution room and when you choose to use the tax deduction they provide are not correlated. You can effectively make contributions to your RRSP every year and choose to carry forward the deductions indefinitely if you want to, but those contributions will still count towards your overall available contribution room. And totally agree how the CRA words things is confusing. I’ll definitely be making a video on it in the near future!

Hi again, great thanks for clearing it up! That makes a lot of sense, everything you wrote.

After posting the comment earlier I was running a little short on time and decided to go ahead and file the remainder of my taxes. When I got to the RRSP’s, there was a very short tidbit offered by TurboTax which sort of touches on the subject of unused deductible contributions, as follows:

“RRSP Contributions to your own, or your spouse or common-law partner’s RRSP/PRPP after 1990, but did NOT deduct on line 20800 of any previous return, or designate as an HBP (Home Buyers’ Plan) or LLP (Lifelong Learning Plan) payment. You can carry forward this amount and use it as a deduction in a future year up to your RRSP deduction limit for that year. The CRA keeps track of the unused amount and increases your yearly RRSP deduction limit accordingly .”

However they don’t seem to expand any further than that. So the “what” is answered, but not quite the “how”… how do they track and increase the deduction limit accordingly? And how do they know I’m using up to my deduction limit? Thankfully I was in a position where I had to file both 2019, 2020 tax year returns for a family member so I was able to in some degree get an idea how TurboTax (therefore CRA?) calculates it moving forward:

All contributions eat away at your contribution room regardless if deducted or not, as you already stated, and get tallied up as “total contributions” for that year. The unused (undeducted) contributions you declare for that year roll into your next years filing and get tallied up along with all your other contributions for that year, lumped up once again as “total contributions” for that year, and so on and so fourth, cyclical.

Earlier this didn’t make any sense to me since that would imply the unused contributions from last year would once again eat away at your contribution room (deduction limit) for the following year, since they get lumped in again and count as your sum “total contributions”. However, based on that short tidbit I pulled earlier:

“The CRA keeps track of the unused amount and increases your yearly RRSP deduction limit accordingly .”

they do in fact raise the bar to compensate for it.

After filing both years taxes I was able to put the two together and indeed my unused (undeducted) contributions did carry over to next years filing and get counted as part of the “total contributions” made for that year. And the deduction limit remained the same from last year carried forward to the following year (plus the following year’s new limit added.). So they keep track, but they don’t really explain how.

I suppose in many ways it could make sense to do it this way, it’s systemic and tracks the flow of funds relative to the deduction limit (contribution room.) Also, it allows for the continued use of the word “deduction limit”. Calculating it this way allows them to accurately track that you deduct only up to the deduction limit while making sure the contribution room doesn’t erode each year. It’s a simple but genius way to account for both the contributions and deductions at the same time.

To my surprise none of this is included, or even mentioned, in the calculation CRA provided on their website. understandably, it’s difficult to determine, but maybe a (“we add “X” here”) to represent the previous year’s “unused contributions” when determining the deduction limit for a given year. If they don’t want us messing with it ourselves, a mere mention would have been nice to avoid unnecessary confusion lol.

Anyway, there it is, as far as I can tell. You may need to verify – and please DO let me know if I”m wrong on any of this lol. And yea a video would be great, unbelievable how fragmented all this is. I know you help a lot of people on here so I took the time to spell it out. Based on you’re comments, you’re very responsive and helpful so thought I would return the courtesy. People probably don’t care much for the complexity of it all, but it’s nice to know for those who are strategically mapping out their finances/investments.

All the power, love your work!

oh my… I didn’t realize how carried away i got, had no idea it would be so long (above).

all the best lol.

Hi Jessica,

Starting my own business and my question is do I pay my taxes in a lump sum at the end of the year or do I pay a percentage every paycheque? If it is every paycheque, do I have the option of paying as a lump sum at the end of the year?

For your first year you’ll do a lump sum (so it’s important to set aside money for taxes throughout the year). But your second year, most likely you’ll have to pay instalments. For example, I pay quarterly. More info here: https://turbotax.intuit.ca/tips/do-i-have-to-pay-tax-by-installments-124

Great article Jessica!

I’m full-time self-employed. My earning after expenses is $24,100.00

Using the https://www.wealthsimple.com/en-ca/tool/tax-calculator/ :

Federal Tax = $1,306 (5.41%)

Provincial Tax (Ontario)= $741 (3.07%)

CPP premiums (self-employment income) = $2,163 (they got it right)

I didn’t understand those values, since Federal tax we have to pay 15% of the total, and provincial 5.05%. Is that right?

What am I missing here Jessica?

Thank you!

As the calculator says, it’s giving an approximate and also it’s taking into consideration the basic personal tax amount as well.

Hi Jessica,

Thank you for the post, indeed very helpful. I just arrived Canada and just got a job through an agency – the thing is, I have to get incorporated.

Would you kindly share your thoughts on this, pros and cons, and also is getting incorporated the same as being self employed?. What is the best way to go about it- can I do it myself or do I have to get professionals involved?

Lastly, what are the downsides to getting jobs through agencies?

Looking forward to your response.

Thank you!

If you want to learn more about incorporation or want to do it (something I’m actually in the process of doing) I would highly recommend going through a lawyer so you can also get advice. There’s a lot to know and they can guide you through it and answer your questions. That being said, I find it odd that an agency who wants to hire you as a contractor requires you to be incorporated? Typicaly it’s fine if you’re just a sole proprietor. Moreover, incorporation is most beneficial if you’re earning over $100,000+ as a rule of thumb.

Do you have to submit taxes for your sole proprietorship if you make under 30k, and more specifically in BC? I thought I read this somewhere.

I made only 3k this year as I was just starting out. I also have a full time job.

Totally new to the business world and hoping for some guidance.

You’re probably thinking of GST/HST (sales tax). For income tax, you need to report every single dollar of self-employed income to the CRA when filing your taxes. For info on sales tax read this https://jessicamoorhouse.com/sales-tax-in-canada-hst-gst-pst-self-employed/

Hello Jessica. If I have a full time job and I am starting a little side job while continuing to work for my employer. I will be making leather products. Not sure how much it will bring in. Do I have to register my business name even if you dont make much money from it? And will I have to file my taxes together with my employment income and my little business income together as one? Thanks so much for all of your advice.

Hi Kim! So if you’re just running your business under your personal legal name, you are automatically considered a sole proprietor and do not need to register your business. If you wish to run it under a differet name (i.e. Kim’s Leather Goods) then you will need to register your name. And correct, no matter how much you earn from your side business you do need to report all business revenue and expenses in your personal tax return.

Hi,

This was an interesting read. I have a question I am also a self employed. I want to know, I have to pay income tax at the end of the year or is there any concept of advance tax where we have to pay tax regularly ?

Regards

Bhanu Gupta

Hi Bhanu, for your first year of being self-employed you’ll file and pay your income taxes during tax season like you normally would as an employee. But once you hit a certain threshold of income, you may have to pay your income taxes in instalments throughout the year (but still file once annually). I share more info about this here: https://www.youtube.com/watch?v=0NcimhbbwQg

Thank you so much for the information, you made it really easy to understand! I have a few questions, when you are talking about self employed taxes are these the taxes your company owes or are these your personal taxes? Also my husband is planning on paying himself a salary so would he need to take the deductions of his cheques every month or would that be included in your SE taxes and would we then need to also file personal taxes if we are taking a salary?

If you’re self-employed, when you file your taxes you would just file one personal tax return. You would only file a different type of return for your business if you’re incorporated (a corporate tax return). In other words, when you’re a sole proprietor, your business income and your personal income are one in the same. And if you want to pay yourself a salary, when you’re a sole proprietor that really just means giving yourself an allowance for personal expenses and savings, and setting aside a portion of your income for taxes in a separate bank account so you have it ready to pay come tax time. You don’t have to set up a special payroll system to do this, you’d just do it by setting up separate personal bank accounts to separate the money for your own knowledge.

Thank you, my husband’s business is incorporated so I guess I’m asking if we would still set aside money for self employment taxes how you mentioned in this article, and if we do then does that mean we wouldn’t have to take taxes off of his salary cheques each month? Also would we have to file personal and corporate taxes every year? Thank you for listening I really appreciate it!

If he’s incorporated, I’d highly recommend discussing the best way to set things up with a CPA.

Thank you for this very informative article! Earlier this year, I left my office job where I was an employee for the last 16 years to become a Realtor. My salary as an employee for 2021 will still be about 85k. I expect that the self-employed Realtor income will be zero or less for 2021 due to the timing. (I will only be licensed in November). I also expect my 2022 salary as a self-employed Realtor will be less than I’ve made this year as an employed worker.

I will have many expenses as a new Realtor. I’m trying to determine the best time to buy them, 2021 or 2022.

With more business expenses than business income as a Realtor in 2021 can I use the expenses (essentially losses) against my other income from 2021 (the 85k income earned as an employee)?

If not, I suppose that I would be better off holding off most expenses until 2022 if possible

To be clear, I’m talking about expenses such as professional headshots, marketing materials, yard signs, a printer, some inexpensive video equipment etc.

Any advice on timing these purchases would be greatly appreciated.

Thanks!

Great question! I’d first recommend discussing things with a tax accountant (I have a few listed on my recommendations page), but also this article shares how if your sole proprietor business operates at a loss (business expenses are more than your revenue) you could apply to past personal income. https://taxpage.com/articles-and-tips/business-expenses/

Thank you so much for your reply! I’ll check out the article that you linked!

Also, can you tell me when business related expenses actually become eligible business expenses that can be used on income taxes in terms of the actual start date?

To be more clear, I am referring to the fact that I am not in fact a licensed Realtor yet… I’ll only be licensed in November. I’d love to get a head start on getting set-up but do I need to become licensed before being able to consider business related expenses to really be business expenses? For example, can I get my professional headshot photos done in August and use them as a business expense even if I am not licensed yet or do I have to wait until I am licensed in order for anything to be considered a business expense?

Any info would be great! Thanks in advance!

You can start claiming eligible business expenses after your business’ start date. In your case, even though you’re not licensed yet, you have intent to start a business once you’re licensed in November, so your business start date could be before you get your license. But again, I’d suggest talking with a tax accountant. https://turbotax.intuit.ca/tips/need-know-claiming-start-costs-new-business-canada-8828

Great! Thank you for sharing your knowledge! It’s so nice of you to take the time to reply to all your comments. Really appreciate it!

Happy to help!

WOW!!!!

I’m sooo happy to have found THIS/YOU!!!!! Canadian Girl as well…. BRAVO as I have been looking for someone who can give me some insight from Canada.

Finding YOU/THIS was a like finding a diamond NOT in the rough!!!

Thank you from the bottom of my toes!!

Yay, so glad you found this helpful! 🙂

Hi Jessica. Super resourceful blog. Thank you. Question: income tax time, would I have to pay income tax on self employment income and HST collected separately or would it get lumped together?

They are completely separate. You file and pay your personal income taxes through your CRA My Account, and you file and pay your GST/HST through your CRA My Business Account.

Thank you!

Hi Jessica,

Super helpful information, thank you! There is one question I would appreciate some clarity on, if possible:

I am a sole proprietor paying taxes by instalments, and the reminder for the Sep and Dec instalments just arrived in the mail. However, my workload/income has greatly decreased since June (compared to the usual norm), resulting for the first time ever in me not having enough funds to pay the next instalments unless I dip into long-term savings.

I have trouble understanding how to proceed – is it correct that I can simply pay less than the requested amounts (or even nothing at all) for the two next instalments, and any interest/penalties on potential amounts owed would ONLY materialize if I indeed end up still owing taxes for 2021 when I submit my return early next year? Meaning that if my already paid Mar and Jun instalments end up covering my taxes for this year, there will be no interest/penalties to pay? Is this what the “current-year” payment option is about?

Thank you!!

Hi John, great question. As shared in this article, yes if the instalment amounts you are required to pay are actually more than what your tax bill will be for the current year, you can pay less than those amounts and not be charged interest. You can find a good example for what I mean here https://www.personaltaxadvisors.ca/paying-income-tax-instalments-in-canada/

Super helpful! Thank you! I am a contracted service provider in the community, so essentially my car is my office, plus I have a home office. Do you have or can you recommend any resources for keeping track of vehicle related expenses? And other claimable expenses?

Keeping track of your mileage is key and I know many accounting software programs like Quickbooks Self-Employed have integrations for that. Or you can just have a notepad in your car to keep track. But also found this resource that may be helpful https://quickbooks.intuit.com/ca/resources/expenses/how-to-write-off-vehicle-expenses/#:~:text=You%20can%20deduct%20%243%2C500%20for,documents%20to%20prove%20your%20deductions.

Thank you!

This was a very helpful article.

Glad it was helpful!

Hey Jessica,

I really appreciate your videos they help a lot. I two questions. One for an individual who is self-employed to Pay CPP is there a separate form you are suppose to fill out?

The reason I ask this question because I am self-employed and wanted to try doing my taxes next year I purchased Turbo tax and put in rough estimates of what I think my total self employed income and expenses will be. After completing it I was able to see my Federal and Provincial tax totals but did not see the CPP amount anywhere.

Do we just do a straight calculation of 10.9 of our total income minus 3500?

You pay CPP with your income taxes, it’s bundled into one total tax bill (it’s not separate). If you’re looking for a good calculator I like this one to do estimates for tax/CPP https://www.wealthsimple.com/en-ca/tool/tax-calculator/

Hi Jessica,

I read your blog but still unsure where to start. I live in Québec and I’m a tarot reader. I recently decided to start doing personals (3 months ago) on a website called Wisio. I am unsure where I should start and wether or not it is considered self-employed, freelancer or something else. I would simply like to know what should I do first!

Thank you in advance!

Yes it’s considered self-employed income and you need to report it on your personal tax return.

Hi Jessica,

This is a very great post and a very helpful one indeed.

I just have some clarifications, though.

I am currently in the Philippines and will be migrating this year to Canada. I will be continuing my job there in Canada starting September 2022 with my current employer which is based in France.

I received an advice that it is better to register as a self-employed there and declare the monthly income and expenses. Is it right that I can be considered as self-employed since I will be working for the French company just like a consultant?

Also, I am trying to learn the CRA site just in case I already need to register an account as a self-employed. It’s indicated there that, in order to register an account, I need to be able to file my income tax and benefit return for the current tax year or the previous year. Does this mean that I can only register in CRA in January 2023 when I already filed my income tax for 2022?

Thank you so much in advance!

Honestly since your situation sounds complex, find yourself a CPA who can help you.

Hey Jessica, how are you? Really nice article…I have a question about self-employment, if my company/myself have a contract with an international company, does it change anything? Like, with a contract can I receive the payment on my regular account and do my tax returns in the same way? Thank you so much!

Hi Jessica,

Thanks for this post. I recently had to pay a lump sum in taxes. But last year I messed up and wasn’t prepared to pay it and ended up having to borrow money from family in order to just pay it and then had to pay them back over time. This year I was prepared and did a pre-calculation so it was all ready to go. Unfortunately it still hurts seeing that much going out of the account and straight to the government. Guess it’s the same though as it getting taken from each monthly pay check.

I feel you, being self-employed for so long I always have a tax bill to pay.

Hi Jessia thank you so much for the thorough info on self employment.

Now im working fulltime at this one company but want to get a second job that requires me to work once weekly (lets call thus company B). If i get a job as self employee at the company B, wouldnt i techincally be paying about 5% more than if I were a regular employee because of the CPP? I am just trying to figure out how much more of a wage i should get from the company as a self employee. I dont need a benefit or vacation pay since I get that from the full time job I already have. Could you advise me on this? Thanks!

If for your second job you are considered self-employed (i.e. hired on as a contractor), then correct, for that income you earn you would have to pay the full CPP amount. You can get a sense of how much using this calculator https://www.wealthsimple.com/en-ca/tool/tax-calculator/ontario

Hi Jessica,

Super resourceful blog. Thank you.

I am a sole proprietor and I am importing goods from Europe under my business name and whole-selling in Ontario. I have registered GST/HST program and I am collecting HST (%13) from my customers. When I import the goods, I pay %5 GST to Canada Border Services Agency through my customs broker. My question: Am I eligible to claim Input tax credit (ITC). ? and what is the process and when can I claim it? Thanks

Honestly, I’d suggest talking to an accountant about this.

Thank you for this article. I found it really helpful!

Thanks!

Thank you for this! I’m starting a side hustle and I’m trying to figure out whether it’s better to remain a sole proprietorship or incorporate. What do these numbers look like if one incorporates (as in assuming 100K in business revenue)?

I’d highly recommend speaking with an accountant who works with business clients (I have a few listed on my Favourite Things page). They’ll be able to look at your numbers and project some scenarios and ultimately advise on whether it makes financial sense to incorporate now or wait. I also have a video that goes through the pros and cons https://www.youtube.com/watch?v=WvLyt6r3HT8

Hi,

I am self-employed as well as working part-time as an employee. My employer deducts CPP and EI from my bi-weekly paycheques. Am I also required to remit CPP and EI from my self-employed pay? At the end of the year I will hit the max through my employer, so I don’t want to overcontribute by adding from my self-employement pay.

You can’t over-contribute to CPP or EI so you’ll be fine. Since your employer already collected CPP and EI from your pay, when you file your taxes and declare your employment and self-employment income, if you already hit the CPP and EI maximums, you won’t owe any more.

Thank you so much for this! Do you have anything to share on the GST/HST front? I’ve been hired as a contractor so am responsible for my own taxes, but I’m earning a set salary per year so am really unclear on whether or not I need to register for a GST account and pay into that

If you’re an independent contractor then that makes your a sole proprietor. On the good side, that means you can take advantage of some business expense tax deductions, but it also means you’ll be paying both the employer and employee portions of CPP, will need to keep track of your income and expenses more closely, and if you earn more than $30K yes you should be charging your employer GST/HST. Because they aren’t really your employer. They are your client who you were hired to do work for independently. https://fbc.ca/blog/things-you-should-know-self-employed-contractor-canada/