Inflation hit 6.8% in Canada (as of this past April), so if it feels like everything has gotten way more expensive compared to a year ago, you’re absolutely right! From groceries to gas prices, there’s nowhere you can look without getting slapped with some sticker shock. So what’s there to do? How can we combat rising prices while still trying to save for our future goals and continue to live our normal lives?

I’ve been in the game of sharing money tips on this blog and on national news for over 10 years, so this topic is one of my specialties. Read my full post to learn what you can actionably do right now to get a better handle on your spending and save more, including how I’ve been able to save more money and earn cash back using Rakuten since 2016!

1. Track Your Spending

The honest truth is that most people who want to save money and are feeling the pinch with rising costs have no idea what’s going on with their money. And that’s because most people rarely check their bank or credit card statements regularly or track their spending every month.

Which I get because I’m sure there are a million things you’d rather do before spending an hour analyzing your spending from the past month. But I promise you, it’s not that bad and much less painful than a root canal.

Moreover, how are you supposed to make changes to your spending habits without knowing what your spending habits are? Tracking your spending and making it your monthly ritual is the best way to get your finances in control. It’s something my husband and I have done for over 5 years (it takes us 30 minutes per month tops!) and no exaggeration it has been a major game-changer in terms of keeping us more accountable with our spending.

Not sure where to start with this? You can of course use one of the many apps out there, such as Mint or YNAB, but personally, I think apps are too passive. You need something that will force you to take a good hard look at every expense line by line and really think about it. That’s how you can find the categories you’re regularly overspending in and discover what you can cut out to free up more cash flow. That’s why I suggest using a spreadsheet to keep track of everything, like one of my budget spreadsheets (they also come with video tutorials to show you how to do it).

2. Change Your Mindset About Cutting Your Spending

When I tell people they need to cut their spending, typically their first reaction is to get defensive. And hey, I get it! Who wouldn’t react this way when someone tells them they need to make a big change in their day-to-day life. But I also think it’s because the act of cutting something out sounds like you’re losing something or giving something up. But that doesn’t have to be the case.

Instead, I encourage people to change their mindset with their spending. It’s not about going without, it’s about becoming more intentional with what you have and being more mindful about where your money goes.

For example, one money-saving tip I’ve seen forever is to cancel all your subscriptions. If you have 5 TV streaming subscriptions, 2 music stream subscriptions, and 1 newspaper subscription, cancel them all! Well that doesn’t sound fun, does it? Because what that means is you cutting out most of your entertainment.

So instead of blindly following some cliché savings tip, do this instead. Take a look at your spending and cut out anything that doesn’t align with your personal values or doesn’t bring you joy. I promise, just by doing this, you’ll be able to find quite a few things to get rid of that you won’t miss anyway.

Next, start thinking about how certain expenses you have now, that aren’t absolute needs, are actually preventing you from achieving some of your savings goals. In other words, do you want to spend that $200 on takeout this month to enjoy now? Because if you do, that means it will take you an extra month to save up enough for that trip to Mexico. Are you ok with this expense delaying one of your very important savings goals? If not, then maybe it’s time to delete the delivery apps on your phone and make a meal plan for more home-cooked meals.

I’d even go a step further and suggest making a vision board for your savings goals so you can focus more on what you’re working towards and less on what you have to give up.

3. Make a Shopping List & Save Up in Advance

Shopping lists aren’t just for grocery store runs. They work for everything! For example, I just bought a new house and there are a lot of things I need to make it a home. But instead of buying things blindly, I make a list in a shared Googe Doc with my husband of all the things that we need.

In conjunction with this shopping list, we also make special savings account for these purchases (i.e. label it “New Home Expenses”). Then, with our budget, we figure out how much we can afford to contribute every month to that savings account. Over time, money will accrue and when there’s enough in there, we can refer to our list and see which items have the highest priority. Not only will this help you stay organized and motivated, but it also eliminates that feeling of guilty many people have (myself included) when you have to spend money on something new.

I do the exact same thing when it comes to buying clothes and pampering myself. Every month, I set aside a certain amount of money into my “Personal Shopping” savings account, and then when I want to update my wardrobe or treat myself to a pedicure, I’ve already got the money saved up so there’s no need to feel guilty about spending money on myself since I know I earned it and did the hard work of saving up for it in advance.

4. Shop Online & Earn Cash Back with Rakuten.ca

My last tip is to actually shop online and make sure to use a cash-back program like Rakuten. I know most of us have had to move most of our shopping online because of the pandemic, but over the past two years, I’ve actually noticed that it’s helped my spending. This may not be the case for everyone but hear me out.

First off, whenever I shop at the mall or a store in person, I typically spend more money than I budgeted and buy things that I didn’t intend to. I think a big reason is that I’ve got time to browse and will perhaps wander into other sections of the store that have nothing to do with what I came in for. Moreover, I sometimes think that even if what I came to buy isn’t available, because I took time out of my day to make the trip to the store, I should at least buy something otherwise it was a waste of a trip. I know, it’s not logical, but this is what goes through my mind.

When I shop online, it’s a different story. Typically I shop online because there is something specific I need that I’m looking for. I rarely go to an online store just to browse. But even if I do, I do what I call “virtual window shopping”. I have some fun looking, but then close my browser or close the app with the exact same amount in my bank account. I also find that I spend a lot more time considering a purchase when I’m online. There’s less of a sense of urgency. So I can put things in my cart and close my computer. Or put things in my cart, then take them out. No one knows and no one cares but me. It’s wonderful.

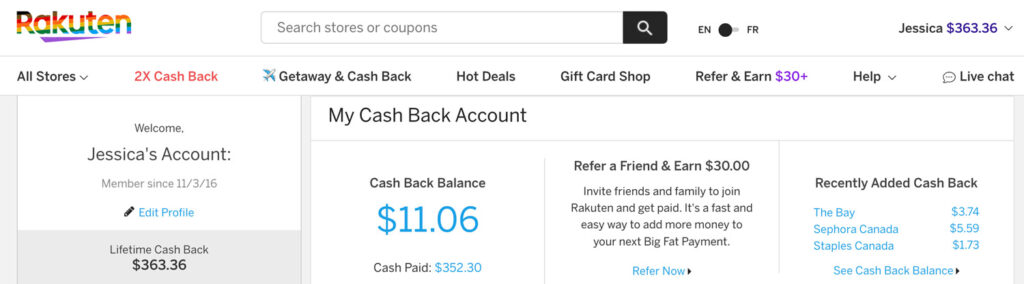

That being said, when I do purchase something online, I always use Rakuten. Seriously, I’ve been using them since 2016.

Why do I use it? It’s free, it helps me earn cash back on my purchases (and if I earn cash back from my credit card, that’s double the cash back!), and my favourite part is helps me find discounts on things when I get to the checkout. To me, it’s the easiest way to save money when you’re already shopping online.

Not only that, you can use Rakuten to purchase gift cards for gas or groceries too and earn cash back. This way you can buy the things you need, and maybe that bit of cash back can help offset the rising costs we’ve all been experiencing due to inflation.

What Is Rakuten?

In case you’ve never heard of Rakuten before, here’s the low-down. Rakuten.ca launched in 2012 and has since become the leading Cash Back shopping program in Canada. They are essentially an affiliate platform in which the 750 retailers that Rakuten has partnered with that pay them a commission each time one of Rakuten’s members makes a purchase. Rakuten then shares these commissions with its members in the form of Cash Back.

And the best part about all this is it’s free to be a member. So, there’s literally nothing to lose by using Rakuten (which is why I’ve been using them for 6 years).

What’s also really cool to hear since Rakuten has just celebrated its 10-year anniversary is that it’s not only welcomed 6.5 million members to its platform, but it has also helped them earn $70 million in Cash Back.

How Does Rakuten Work?

As I’ve mentioned, when you use Rakuten, you earn Cash Back when you shop at one of their partner retailers and it also provides you with coupon codes, so you take advantage of any sales or discounts at check out.

To use Rakuten, there are three different ways you can do it:

- Through Rakuten.ca

- Through the Rakuten app on iOS or Android

- Using the Rakuten browser extension

Through Rakuten.ca

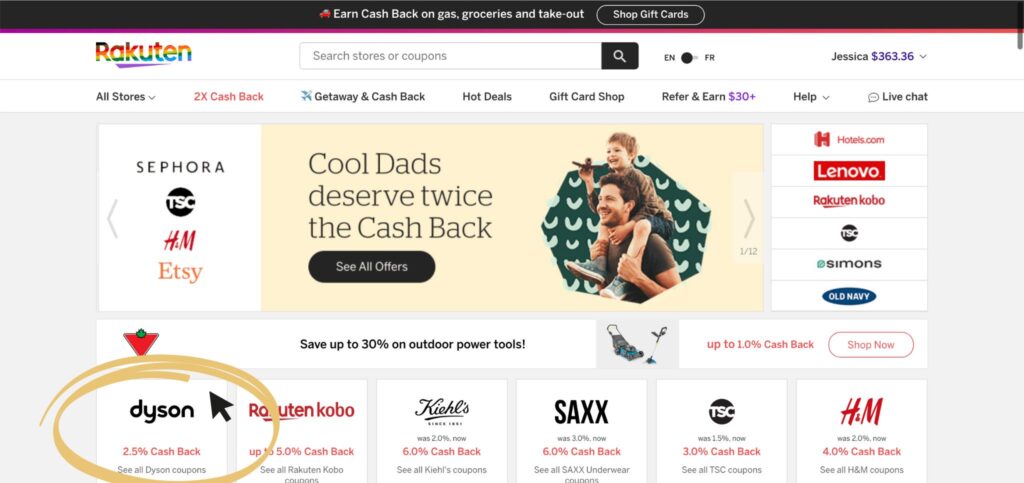

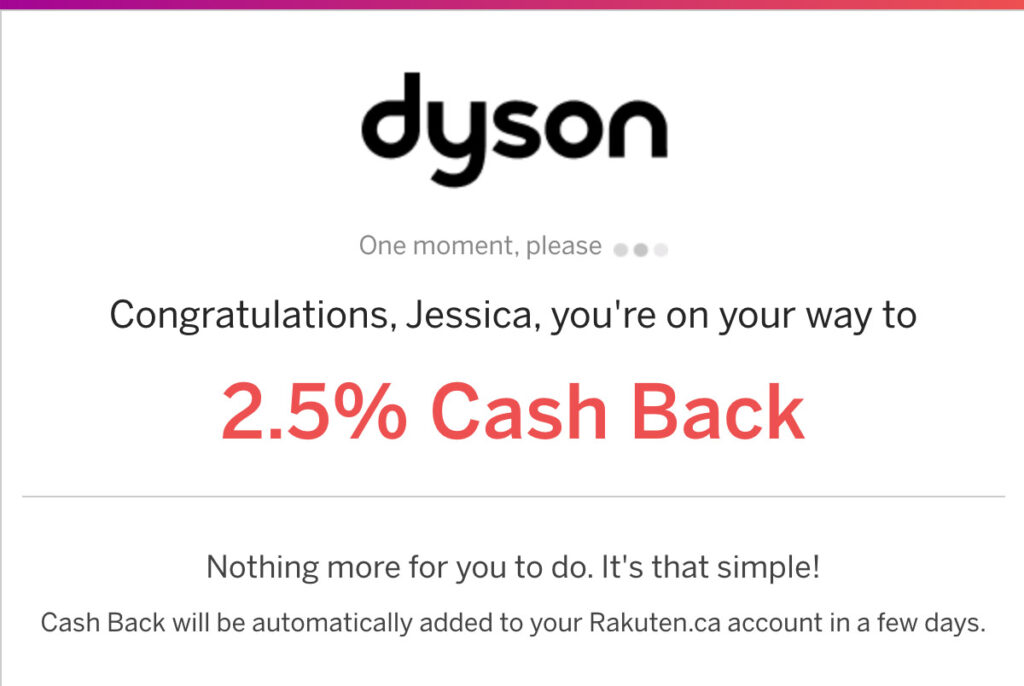

The first way is pretty straightforward. Just visit Rakuten.ca, log into your account, then search for the store you wish to shop. Once you find the store, click on it and it will redirect you to that store’s website where you can start shopping. Rakuten will automatically track your purchases and Cash Back earned.

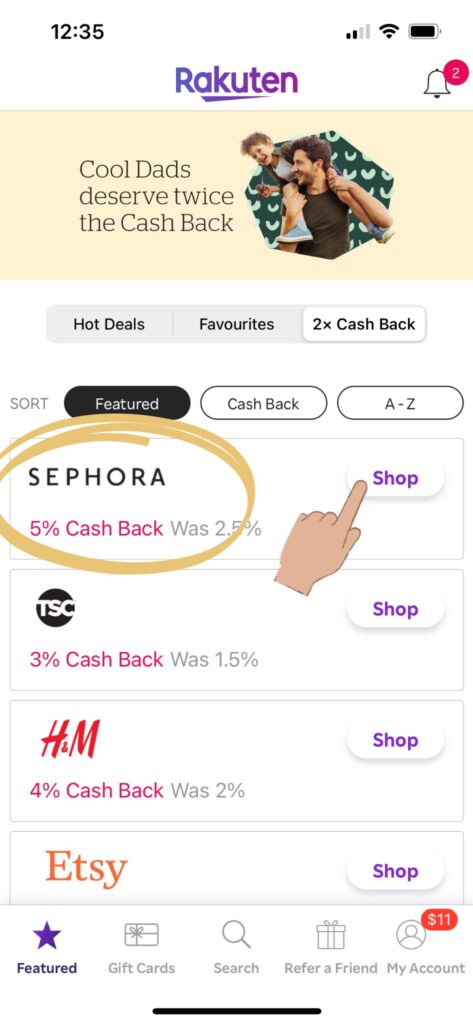

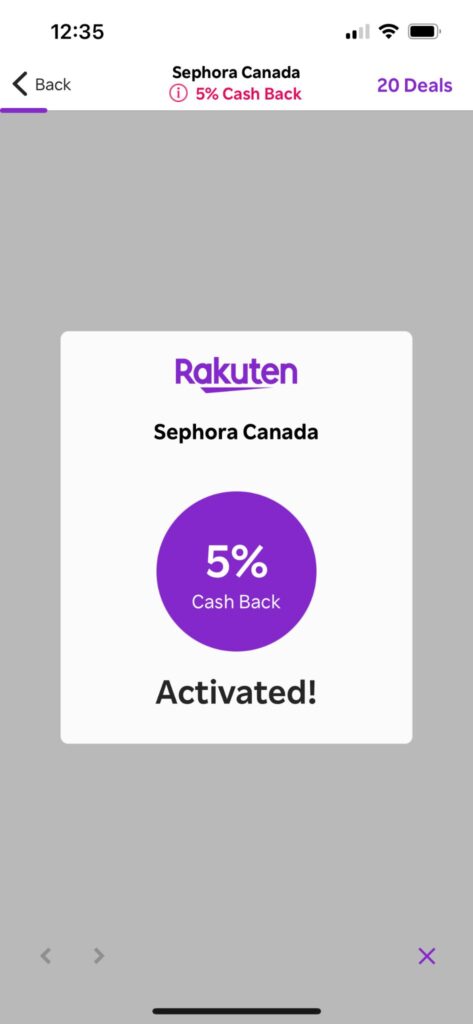

Through the Rakuten app on iOs or Android

Similarly, you can download the Rakuten app on your iOS or Android device and do the exact same thing. Log into your account, find the store you want to shop, then click “Shop” to be redirected to the store while Rakuten tracks the Cash Back you earn.

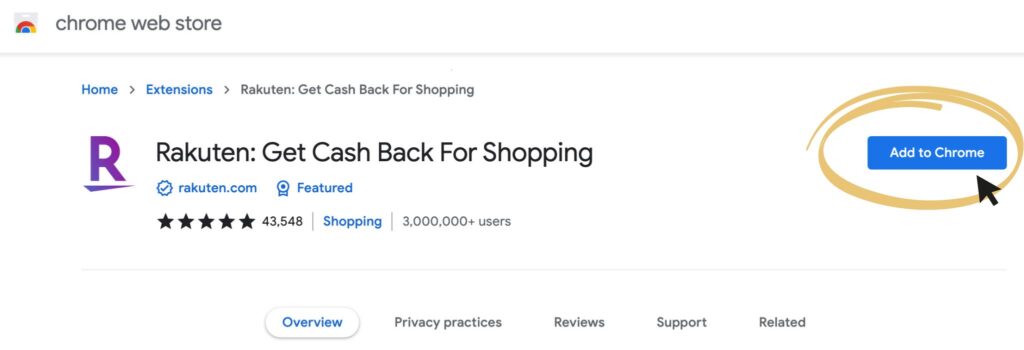

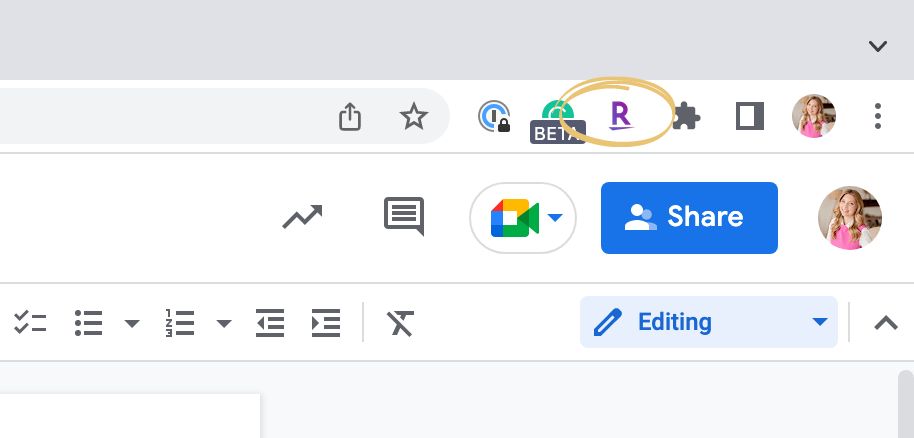

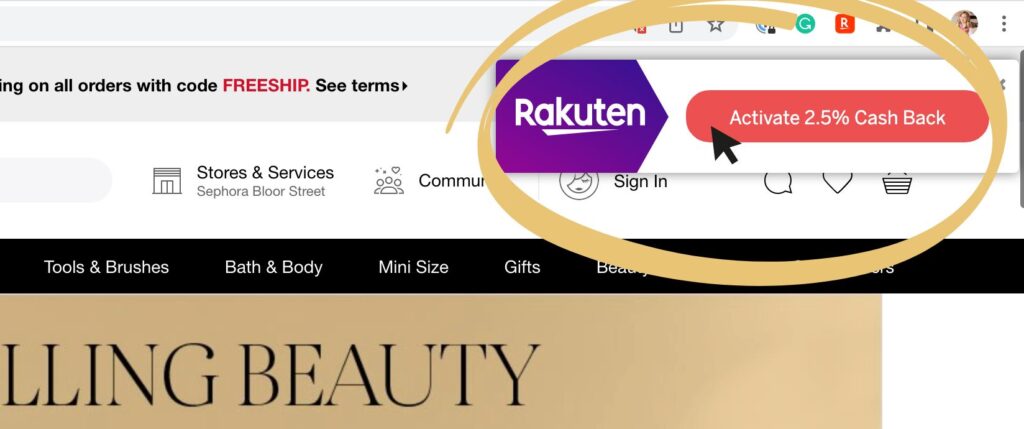

Using the Rakuten Browser Extension

Using the Rakuten browser extension is the method I use the most because I can benefit from Rakuten even if I forget to go through the website or use the app. All you have to do is download the browser extension for Chrome, Safari, Firefox, or Edge, and install it. Then, whenever you’re surfing the internet and land on one of Rakuten’s partner retailer websites, a popup will appear asking you if you’d like to activate Cash Back.

How Do You Sign Up?

To sign up, you of course can just do it through Rakuten.ca, but I’d also like to point you to my referral link because it will give you $30 when you sign up (it will also give me $30). The best part about this is once you’ve signed up, you can get your own referral link to share with friends and family and continue earning $30 each time someone new signs up. So not only can you earn Cash Back but you can also earn money through referring others as well!

Use this link to get $30 on sign-up: https://www.rakuten.ca/r/jessicamoorhouse

Have you ever used Rakuten before? Let me know in the comments!

+ show Comments

- Hide Comments

add a comment