With so many digital apps available that let you add coupons at checkout or reward you for shopping online, it sometimes feels like the latest Fintech is just pushing you to spend more, instead of spending more responsibly. Luckily, banks like Tangerine are coming up with solutions to help you spend less, budget better, and save more when you use their platform.

If you’ve been a long-time reader, then you may already know that I’ve been a Tangerine customer for a while. I banked with them back in my early 20s, left them to try out a few other credit unions and banks, then ended up right back where I started in my late 20s because I honestly couldn’t find a bank that offered all the benefits they did. I’m talking no fees on chequing accounts, high interest on savings accounts, a cashback credit card, stellar customer service and an easy-to-use online banking platform.

They have come a long way since when I first banked with them and now have a few new features that I’ve just started to use to help me budget better and reach my financial goals sooner. But before diving into all that, let me share how my husband and I bank with Tangerine.

My Banking Set Up at Tangerine

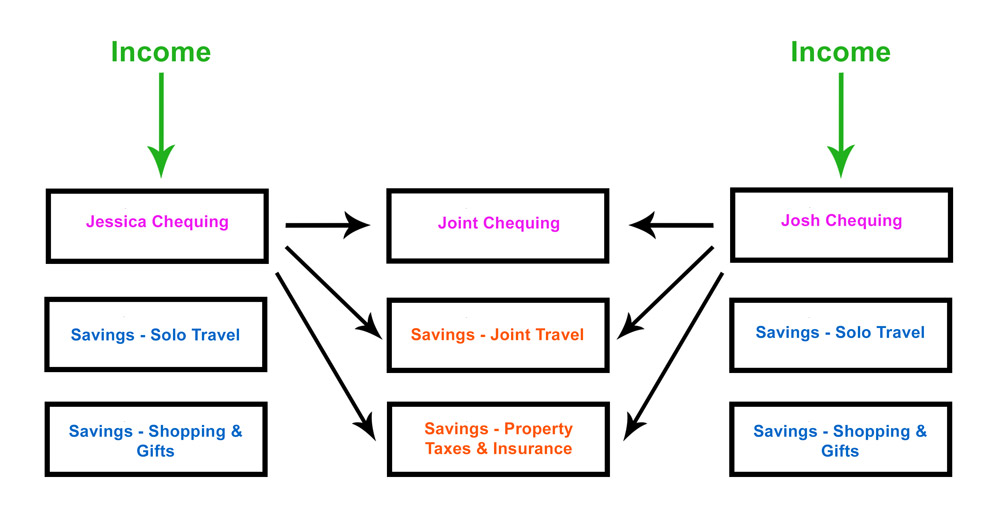

Tangerine has been the main bank for my husband and I for the past 4 years. We share a joint chequing account for our joint bills (i.e. mortgage, property taxes, utilities, groceries), and we share two joint savings accounts to save up for trips together and pay our annual property taxes and home/auto insurance.

Aside from that, we keep everything separate by each having individual chequing accounts and savings accounts. To learn why we don’t combine our finances even though we’re married, check out this video we did together.

To give you a visual of what our banking setup with Tangerine looks like, here’s how money flows in and out of all of our accounts.

As you can see, income flows into our individual chequing accounts, then we have regular automatic transfers set up so money flows out of our individual chequing accounts and into our joint chequing accounts, joint savings accounts, and individual savings accounts.

We’ve had this setup for years and we’ve never had an issue because it pretty much runs on auto-pilot. That being said, there are a few improvements I’ve just made to utilize Tangerine’s latest features.

Goals Feature (New)

The first improvement is to use Tangerine’s new Goals feature. We obviously already have savings accounts for some of our financial goals, however, the only way for us to track our progress towards those goals is to compare what’s in our accounts to what’s noted down in our budget spreadsheet.

Luckily, Tangerine just introduced its Goals feature that helps you set up a savings goal and track your progress. Not only does it give you real-time updates on your progress, but you can also adjust your goals anytime in just a few clicks.

To give you an example of how it works, here’s how I set up my Solo Travel savings goal.

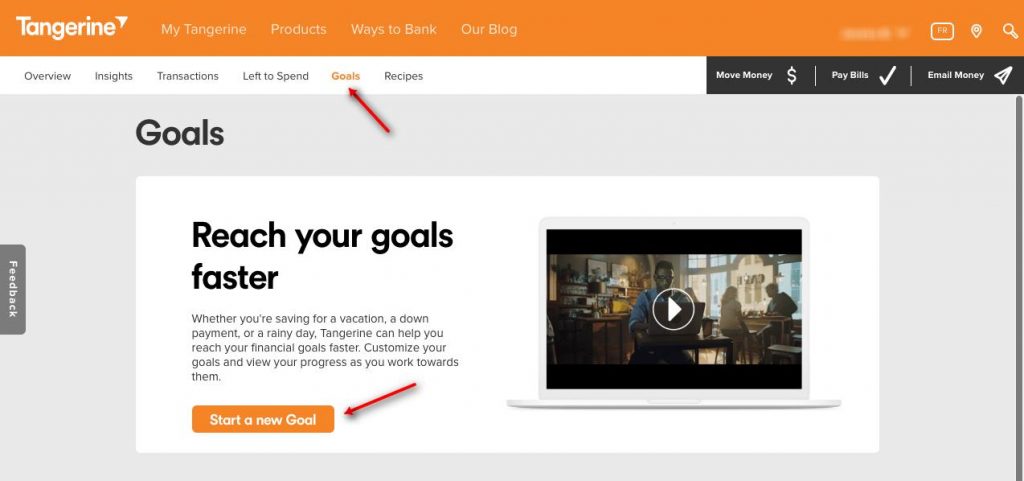

Step 1 – Start

Log into your account, then click on the Goals link at the top of your dashboard. Once you’re on the Goals page, click the Start a New Goal button.

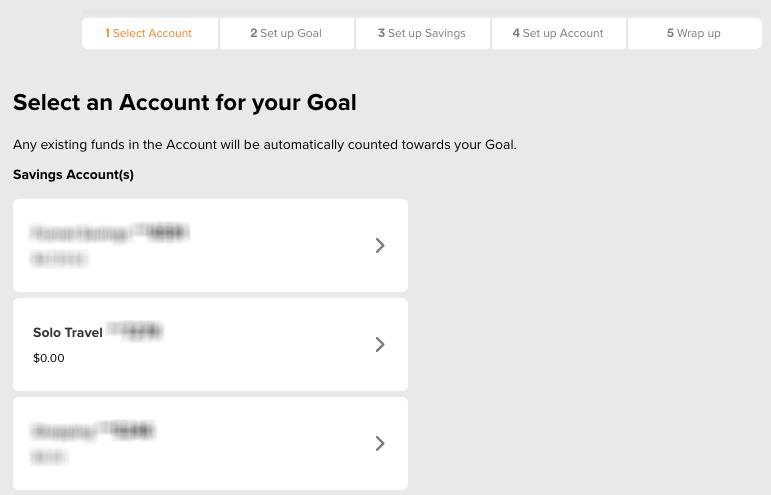

Step 2 – Select Goal Account

Step 2 – Select Goal Account

Choose what savings account you want those funds to be put into.

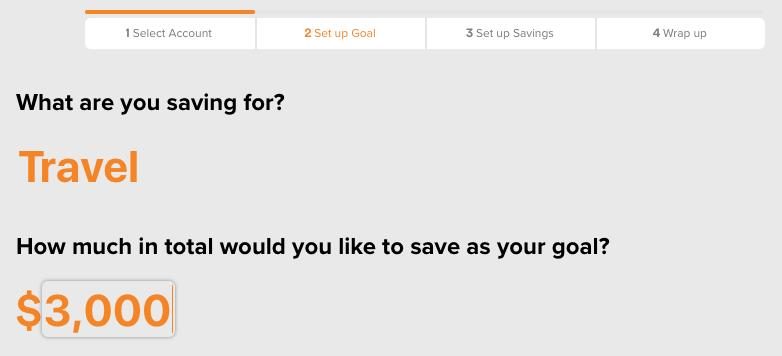

Step 3 – Select Goal Category & Amount

Step 3 – Select Goal Category & Amount

Type in what your savings goal is and how much you want to save up to reach it.

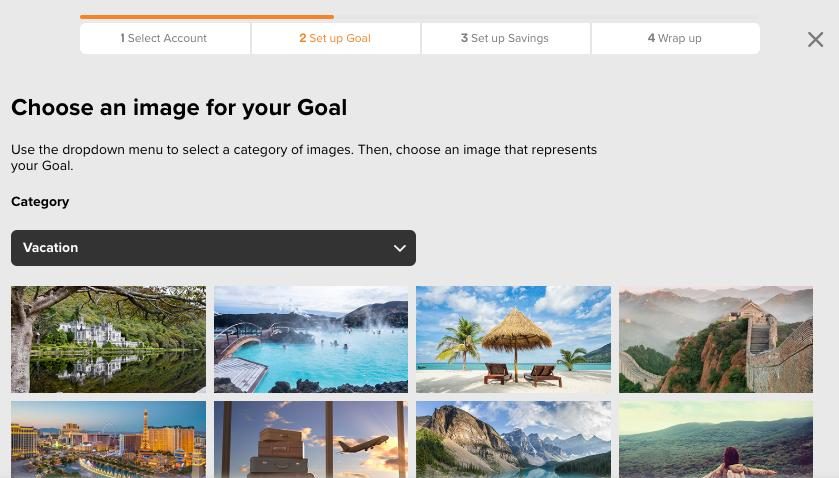

Step 4 – Select Goal Motivational Image

To give you some visual inspiration, choose an image for your goal.

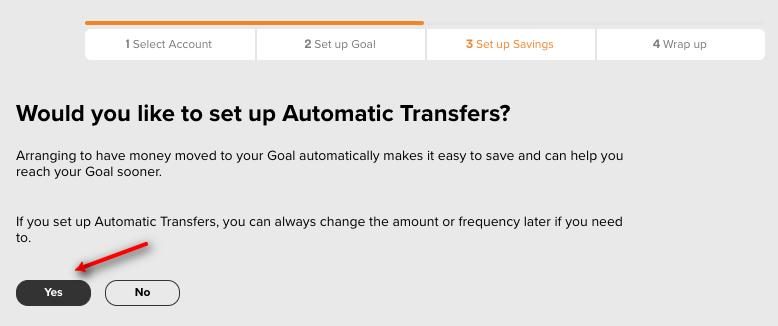

Step 5 – Say “Yes” to Automatic Transfers

Choose “Yes” to confirm that you want to set up regular automatic transfers for your goal.

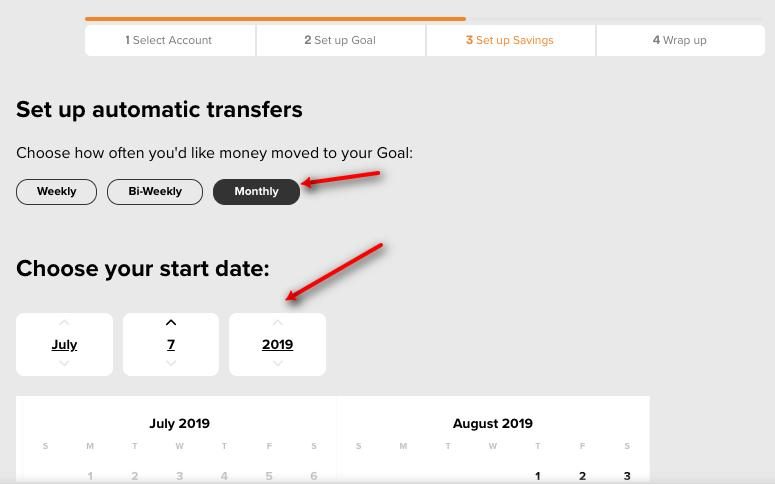

Step 6 – Select Automatic Transfer Frequency & Start Date

Choose the frequency of your transfers (weekly, bi-weekly or monthly), then pick a start date for them to occur.

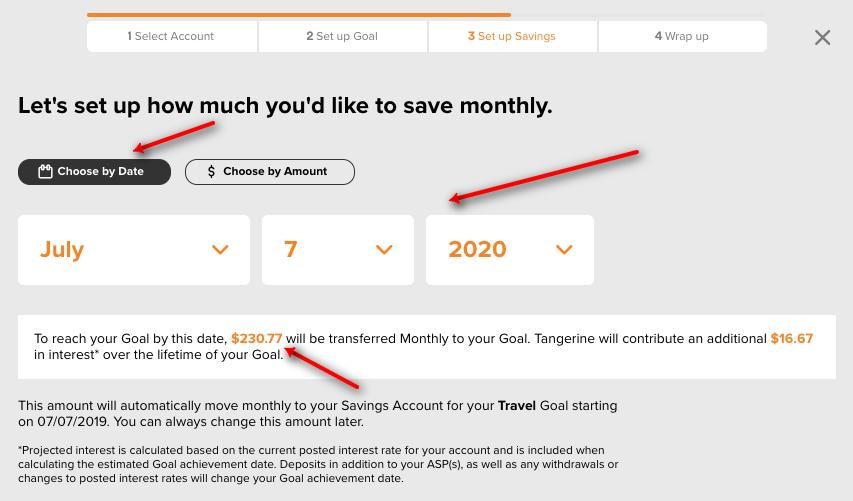

Step 7 – Choose Frequency Amount or Goal Achievement Date

Decide how much you’d like to save within your set frequency. You can choose a specific amount of money per transfer, or you can choose what date you’d like to reach your goal. If you do the latter, it will calculate how much you need to save for you.

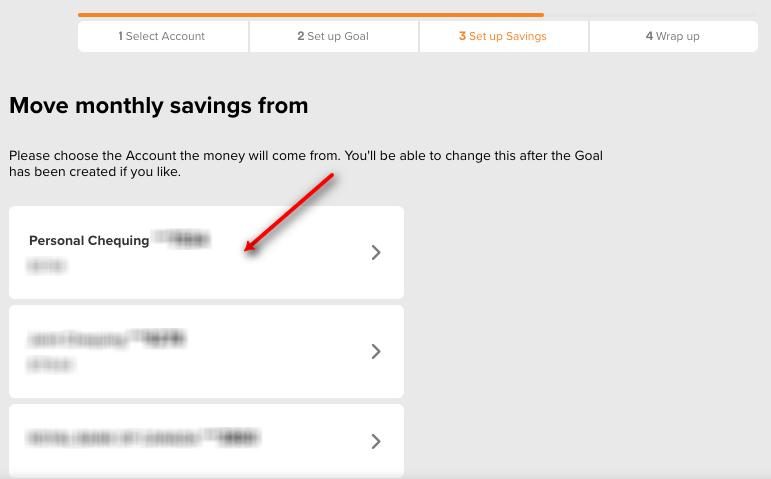

Step 8 – Select Auto-Withdrawal Account

The last step before moving forward is to choose from which account you want funds to be taken out of to go into your goal savings account. You can choose any Tangerine chequing account you have set up or you can even pick a chequing account at another bank that is connected to your Tangerine account.

Important Things to Know

While going through this process, there are a few things I noticed that I want you to know about.

Joint Accounts Not Part of the Goals Feature

The Goals feature isn’t currently available for joint accounts. I really wanted to set up a goal for my husband and I’s travel fund, but none of our joint accounts were an option using this feature. I’m hoping this will change in the near future, but for right now you can only use the Goals feature with an individual account.

The “From” Account Can Only Be a Chequing Account

This may not be an issue for you, but it was something I was a bit surprised by. If you wanted to set up a goal in which money moved from one savings account to another, that’s not possible. The only way you can set up a goal is if funds are transferred from a chequing account to a savings account. That being said, you can however set up automatic transfers between savings accounts or from a savings to a chequing account, just not through the Goals feature.

Video Tutorial

If you’d like to watch a quick video tutorial on how the Goals feature works, here’s one you can check out from Tangerine.

Left to Spend Feature (New)

Aside from the Goals feature, Tangerine also has its Left to Spend feature which is basically a way for you to build a budget within Tangerine itself. It also works very similarly to how I teach my clients to set up a budget (just check out my budget video tutorial to see what I mean).

First, you determine your monthly income, then you set aside a portion of that income for your savings goals and fixed expenses. After that, whatever money is left over is how much you can afford to spend on your variable expenses.

In other words, the Left to Spend feature is a way for you to always reach your savings goals and pay your bills, and have enough left to spend on whatever else you want or need in your daily life.

Here’s how it works.

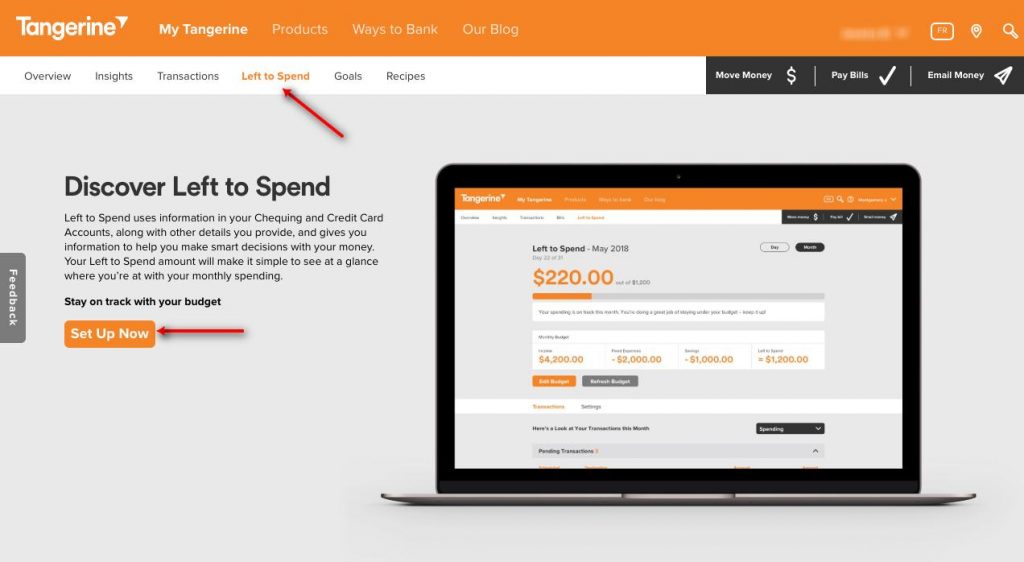

Step 1 – Start

Log into your account, then click on the Left to Spend link at the top of your dashboard. Once you’re on the Left to Spend page, click the Set Up Now button.

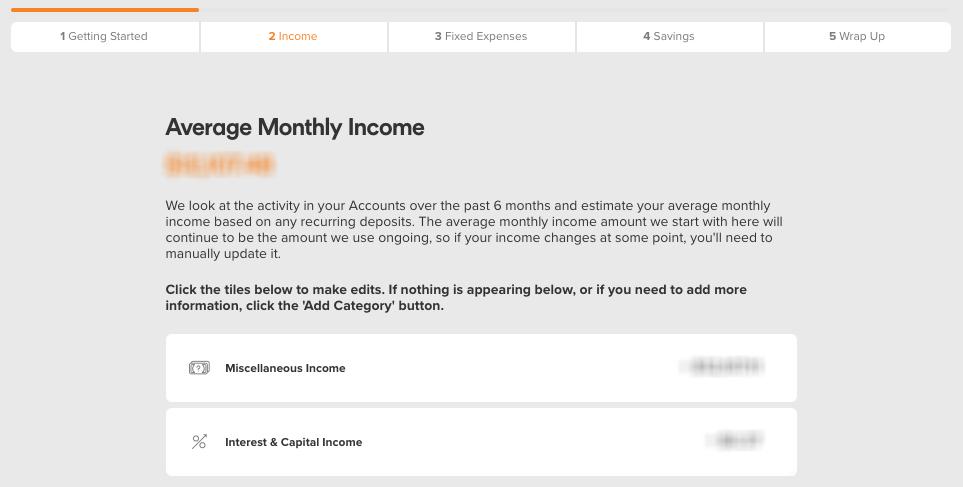

Step 2 – Determine Average Monthly Income

Determine what your average monthly income is. Tangerine automatically calculates what it believes your average income is based on the past 6 months of deposit activity in your account, however, you can set your own number in case it’s not an accurate reflection of your real income.

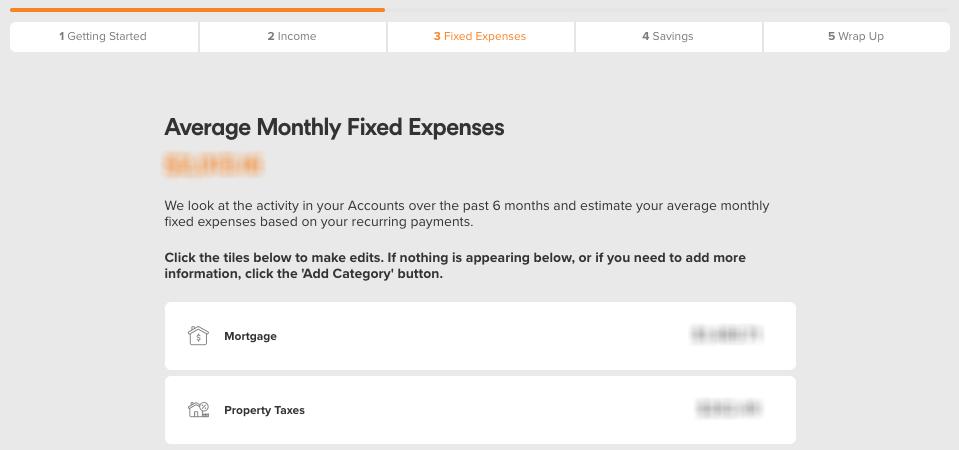

Step 3 – Determine Average Monthly Fixed Expenses

Note down your fixed expenses. Tangerine will automatically estimate your fixed expenses, but if the numbers don’t match your real numbers, you can edit them and add more categories.

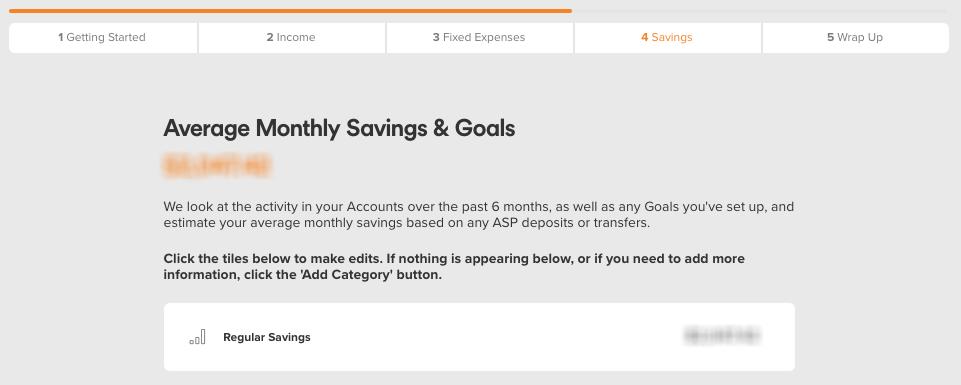

Step 4 – Note Down Average Monthly Savings Goals

Note down your savings goals. Tangerine will include any savings goals or automatic transfers for this section, but you can edit, add or delete any of them to make the numbers more accurate if you need to.

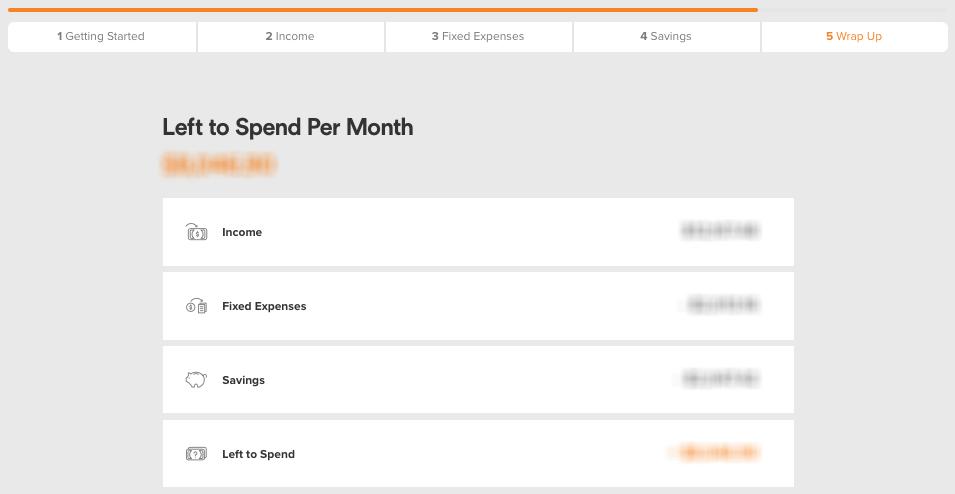

Step 5 – See What’s Left to Spend Per Month

Now that you know your net income and how much you have to spend on fixed expenses and your savings goals, it will tell you how much money you’ve got left to spend on your variable spending. Once you’ve confirmed everything, you’ll be able to track how much you have left to spend easily whenever you log into your account. You can also set up alerts to notify you if you’re getting close to going over budget.

Important Things to Know

Having tried out the Left to Spend feature myself, I don’t actually have anything to complain about. It works very similarly to the budget spreadsheet I’ve been using for years, and in my opinion is a great feature to use if you want to set up a budget but hate spreadsheets. Not only that, it’s pretty great that it gives you real-time updates on how much you have left to spend in the month, helping you to not go over budget.

With that said, I don’t think I could actually use this feature myself. Although Tangerine is my main bank, what I didn’t include in my diagram at the top are the other credit cards, chequing accounts and savings accounts I have at other financial institutions. Because not all my spending transactions are with my Tangerine credit card or debit card, the Left to Spend feature wouldn’t be able to track transactions at other banks or use different credit cards. That’s why for me, I’ll have to still use my budget spreadsheet.

But, if all of your transactions take place in Tangerine, you should definitely use this feature to help you stay on budget. It’s free, easy to use, and basically a no-brainer.

Video Tutorial

If you’d like to watch a quick video tutorial on how the Left to Spend feature works, here’s one you can check out from Tangerine.

Do you bank with Tangerine? If so, have you tried out any of their new features? Let me know what you think in the comments!

Hi Jessica! I would like to know if these saving goals allow you to adjust it to different interest rates for each savings goal? That’s something i like with scotiabank, i can set these mini saving goals with higher interest rates on some… so wondering if Tangerine allows the same? Thank you for providing these visuals!

No, from what I can see there’s no way to adjust goals based on interest rates, most likely because there’s one interest rate for chequing accounts, and one for savings accounts, so it’s fairly straight-forward.

Do you happen to know what happens if you take money out of a goal? Does it automatically adjust the withdrawals to a new higher amount to keep you back on track by xx date?

A great question, but unfortunately I don’t know! You’d have to ask Tangerine’s support team about this.

Hi there! I was excited to find your page and was curious to watch the YouTube video you linked to about how you and your husband combine parts of your finances, but it says the video isn’t available anymore.

Yeah, I took it down a few years back unfortunately.