Have you considered going the responsible investing route?

I know when it comes to investing, most people are more focused on growing their wealth and reaching their financial goals (i.e. being able to retire comfortably at 65). And there’s absolutely nothing wrong with that. The point of investing is to grow your wealth and reach your financial goals after all. But there’s another component to investing we all need to take a deeper look at.

What are we saying about our values with our investing dollars?

Be honest with me (and no judgment here, I’m guilty of this too), do you know what companies you’re actually investing in? Are they companies that match your personal values, or companies you would never give your money to otherwise? Or maybe you have no idea what companies you’re investing in because it’s no easy task to go through each investment fund and sift through the lengthy list of companies buried in there.

No matter how you answer, I think we can all agree that in the world we live in today, it has never been more important to start being more intentional with our money and mindful of how our dollars are impacting our society and environment.

What Is Responsible Investing?

There are a few terms people like to use, such as impact investing or sustainable investing, but you can also just call it responsible investing. I personally prefer the term responsible investing because to me it signifies that you are taking responsibility for how your investments are making an impact on the world and what they are saying about you as a person.

But maybe I’m getting ahead of myself. In case you’re not familiar with the term responsible investing, first I have a few podcast episodes you might like to check out: episode 182 and episode 129. But to break it down a bit, when it comes to investing there is standard investing and responsible investing.

Standard investing, as you may guess, is probably how you’re investing now if you’re not currently investing in portfolios deemed “responsible”, “sustainable” or “green”. Responsible investing “refers to the incorporation of environmental, social and governance factors (ESG) into the selection and management of investments,” as described by the Responsible Investment Association. In other words, the funds, stocks, and bonds you’re buying are making a positive impact on the environment and society, and operate in an ethical way.

What Is the ESG Approach?

Talking about how companies are evaluated (what makes a company, and thus it is a stock or bond, “responsible”), let’s dive more into the ESG Approach. The ESG Approach is simply a way to measure a company’s environmental, social, and governance risks.

For instance, how well does the company manage its environmental impacts, such as waste disposal, water management, and carbon emissions? How well does the company manage its societal impacts, such as labour management, privacy/data security, and workplace health? How well does the company govern itself as a business, such as are they transparent with their taxes, how is their board composed and who really owns the company?

For a company to be deemed responsible, it needs to have the highest ESG factors.

How Can You Invest Responsibly?

If you’re a DIY investor, of course, you can do your own research and build a portfolio yourself of funds, stocks, or bonds of companies that pass the ESG risk test.

But if you’re like me and do the bulk of your investing using robo-advisors, there are a few robo-advisors with responsible portfolios you can invest in. And by a few, I mean only 3 in all of Canada. At least that’s what I found from my research of the 10 robo-advisors listed on my recommendations page.

The good news is that until now there were actually only 2! Luckily, RBC InvestEase has recently announced that they now offer responsible portfolios and I am so happy that they’ve expanded their portfolio offering!

Also, if you’re not familiar with RBC InvestEase, read my two posts about it below (one even includes a full video tutorial). Essentially, RBC InvestEase is a robo-advisor by RBC but works the same as other robo-advisors in that it offers a low management fee of 0.50% (standard for all robo-advisors) and offers portfolios of low-cost ETFs that track the broad market index.

What’s the Performance & Cost Like?

Two questions people always have when thinking of switching their standard investment portfolio to a responsible one: “Am I sacrificing performance and is it the same cost?”

Investment Performance

A lot of people I talk to worry that investing responsibly, means they may give up the same returns standard investing can give them. There is an extra cost to investing responsibly, but that cost is not performance. Over the long term, there is no data to show that responsible investments perform worse than standard investments. This was actually a topic I talked about at length with Tim Nash from The Sustainable Economist in episode 129 of my podcast, so make sure to check that out.

Cost of Investing Responsibly

Since I mentioned there is a cost for investing responsibly, that cost is the actual MER of the ETFs.

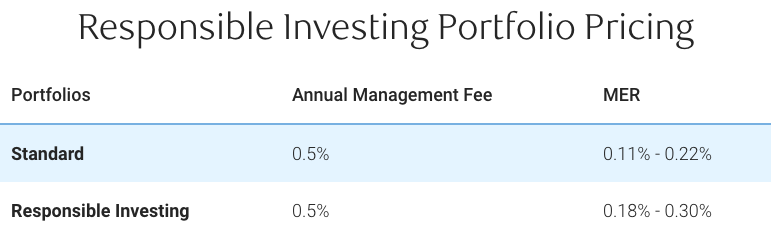

Comparing the costs of RBC InvestEase’s standard and responsible portfolios, you can see that although the management fee is the same (0.50%), the cost of the actual funds (their MER) is more expensive. Here’s what that looks like.

Standard Portfolio

0.50% + 0.11%-0.22% = 0.61-0.72% in total costs

Responsible Portfolio

0.50% + 0.18%-0.30% = 0.68%-0.80% in total costs

Still, in my view, it’s worth the extra cost if it means investing in companies you can feel good about.

How Does RBC InvestEase Build Its Responsible Portfolios?

The last thing I want to share is specifically how RBC InvestEase builds its responsible portfolios. They use the ESG Approach and build their portfolios with companies that have the highest ESG factors. Their process for doing so includes removing any company that is involved in the tobacco business, controversial weapons, and civilian firearms, as well as omitting any companies that are involved in severe controversies.

To learn more about their approach and how it all works, check out their Responsible Investing page.

There are also 3 articles by RBC InvestEase that go very in-depth on how they build their portfolios and more about responsible investing in general:

- How We Construct Your Responsible Investing Portfolio

- Socially Responsible Investing vs. Responsible Investing

- Responsible Investing or Standard Portfolio – What’s Best for Me?

What are your thoughts on responsible investing? Share in the comments below.

+ show Comments

- Hide Comments

add a comment