Whenever I’m asked what finance apps I use or recommend, in all honesty, I’m very reluctant to share any. I’m what you would call a non-early adopter. I’m usually late to the party in terms of trying out new apps, and the reason is that I don’t like integrating an app into my personal money management setup only for it to be de-listed from the app store 6 months later.

Because of that, when it comes to working with financial counseling clients or managing my own personal finances, all I use is my budget, spending, and net worth spreadsheets to organize my finances, no-fee banks for my day-to-day banking needs, credit cards for my fixed expenses of business spending, and robo-advisors and discount brokerages for investing. That’s it.

So, you may be wondering “Why are you reviewing KOHO then?”

Well, they’ve actually asked me to work with them several times over the past few years but I resisted. I talk with new fintech companies all the time, so I figured if KOHO was going to disrupt the financial services industry, it would still be around in a few years for me to review. They’re still here and have grown exponentially since their launch in 2017, so I’m finally ready to try them out.

But that’s not the only reason. The big reason I’m reviewing them is because of a message I got from my cousin. She was thinking of trying out KOHO and wanted an honest review from someone in finance that she could trust. Well, I told her I’d get back to her with my findings and personal experience using KOHO, and that’s what I’m now going to share with you in this post.

And spoiler alert, since this is a sponsored post, my review is going to be a positive one. As you know if you’ve been a long-time reader, I only partner with brands that I believe in, use myself, or would confidently recommend to a friend or family member.

How to Integrate It Into Your Cash Flow System

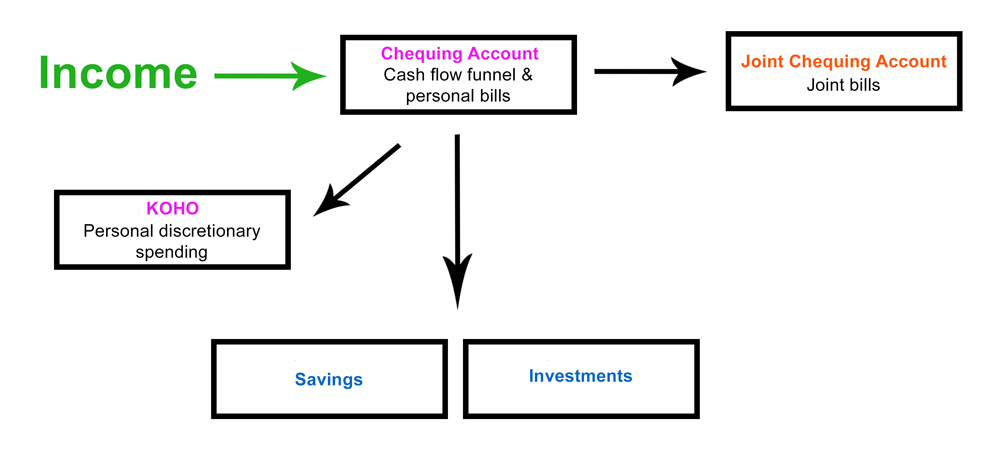

First, I want to show you how I’ve integrated KOHO into my cash flow system.

As previously mentioned, for my day-to-day banking I use a no-fee bank. It’s great because I don’t pay any fees, but there are some restrictions. Namely that I can only have two chequing accounts with this bank. I use one as a personal chequing account to deposit cheques into, make e-transfers with, and pay personal bills, and the other one is a joint chequing account I use with my husband for our joint bills.

In an ideal world, I would have a third chequing account as my personal discretionary spending account. An account in which I would give myself a set allowance every month and I could use those funds to buy whatever I want (like takeout, coffee, or clothes). But, I’m at my limit for chequing accounts at my current bank…which is where KOHO comes in.

You may be wondering why don’t I just use my credit card for my variable spending, and the answer is I do and I overspend EVERY. SINGLE. MONTH. Credit cards are great for paying fixed expenses, but I find it almost impossible to stay on budget when I use them.

You may be wondering why don’t I just use my credit card for my variable spending, and the answer is I do and I overspend EVERY. SINGLE. MONTH. Credit cards are great for paying fixed expenses, but I find it almost impossible to stay on budget when I use them.

Moving forward, I’m going to use KOHO for my discretionary spending. I kind of think of it like doing the cash envelope system. I get a set amount of money to play with every month, but I can’t spend more than that because nothing will be in the account and you can’t go into overdraft or borrow funds like a regular credit card. I’ll also be able to track what I spend easily and get real-time updates on what my balance is so I can either reel in my spending or buy that scented candle because I want it and can afford it.

What Is KOHO?

To get a better sense of what KOHO actually is, I want to clear some things up first.

KOHO is not a bank. KOHO is a prepaid and reloadable VISA card available in Canada. In other words, it’s similar to a VISA Debit card since you’re loading your own money onto it (not borrowing funds), with the added benefits of earning cashback like a regular credit card. A better way to describe it would be it’s a digital spending account that comes with a physical card and app.

What Are KOHO’s Benefits & Features?

I read a ton of forums and reviewed blog posts to see what questions people had about KOHO, and I’m hoping the following should answer all of your pressing questions:

Fees

- There is no activation fee or any other fees to open or maintain a KOHO account.

- You will be charged a 1.5% foreign transaction fee on purchases outside of Canada, which is actually quite low compared to the typical 2.5-3.5% your credit card would charge you.

- KOHO does not charge you a fee to e-transfer funds from your bank into your KOHO account, or vice versa.

- If you are charged a fee from your bank to do an e-transfer, KOHO will reimburse you if you e-transfer more than $20.

Security

- KOHO cards are issued by People’s Trust, a federally regulated trust company.

- KOHO doesn’t actually hold your funds, People’s Trust does and they are CDIC insured. More info here.

- If KOHO becomes insolvent, People’s Trust will guarantee your funds so you won’t lose any money you put into the app.

- KOHO is a chip and pin card for extra security.

- You can either insert and use your pin or simply tap your card at payment terminals to use it.

- You can lock your card through the app if you’ve lost it or it’s stolen to prevent someone else from using it.

Referrals & Cashbacks

- If you sign up using my promo code MOMONEYPROMO you’ll earn 1.50% cashback for 3 months after you make your first purchase.

- When you sign up, you’ll get your own referral code to use with friends and family.

- After the 3-month cashback promo ends, you’ll automatically earn 0.50% cashback on all your purchases, called PowerUps.

Other

- There is a RoundUp saving feature that automatically puts money into a savings section of the app each time you make a purchase.

- KOHO tracks all of your transactions so you can clearly see where your money went.

- KOHO is accepted wherever VISA is accepted.

- You can connect Apple Pay to your KOHO account.

- You can create a joint account for yourself and someone else.

- You can have up to $20,000 in your account.

Does KOHO Affect Your Credit Score?

This is a common question I see about KOHO, and the answer is simple — NO. Because KOHO is simply a prepaid reloadable VISA card, they do not perform a hard pull on your credit like a bank or credit card company would if you were trying to open a new bank account or apply for a new credit card. A hard pull on your credit would ding your credit score (make your score drop temporarily). A soft pull on your credit, however, doesn’t ding your credit score, and that’s what KOHO does do in order to verify your identity and confirm you have a Canadian credit file.

Does KOHO Build Credit?

Continuing with what I was talking about above, because KOHO is not a bank or credit card, it cannot help you build or improve your credit score.

How Does the Goal Function Work?

Although I am personally using the app as simply a spending account, KOHO also offers functionality to help you save for your financial goals. To set this up, all you have to do is:

- Go to Savings > Create Savings Goal

- Name your Goal (i.e. Trip to Mexico)

- Enter the amount you want to save (i.e. $1,500)

- Pick the date you need the money by (i.e. June 2020)

- Add funds to your goal (optional)

- Review your Savings Plan. You can edit your goal and adjust the savings frequency and contribution amount at any time.

You may be wondering, if I don’t manually add funds to my Savings Goal, then how does it work? Well, you set up a daily contribution amount (i.e. $2) that will automatically move from your Spendable section into your Goal Savings. I think the logic behind this is it’s making your savings automatic and you probably won’t even notice those little amounts that have been relocated from Spendable into Savings. My cousin told me this is her favourite function of the app, so if you are having a hard time putting money into savings, it’s worth a try.

Before I move on, there are two important things to take note of:

- You do not earn interest on the money you put into Goal Savings. So, in my opinion, once you have a substantial amount of cash in there, move it into high-interest savings account at a bank to earn interest.

- If you only have $20 in your Spendable and have $30 in Savings, if you use your KOHO card to buy something that’s $40, it will use $20 from Spendable and take the remaining $20 from your Savings. That’s why you still need to keep an eye on your Spendable balance before making a purchase if you don’t want to accidentally spend your Savings Goal money on a purchase.

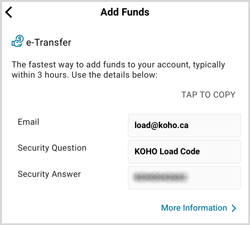

How Do You Load Funds into Your KOHO Account?

The easiest way to load funds into your KOHO account is via Interac e-transfer. At first, it sort of feels like you’re sending an Interac e-transfer to KOHO and you’ll never see your money again, but for my first load onto the app, I e-transferred $50 and within a few minutes I got notified that the transfer was successful.

The easiest way to load funds into your KOHO account is via Interac e-transfer. At first, it sort of feels like you’re sending an Interac e-transfer to KOHO and you’ll never see your money again, but for my first load onto the app, I e-transferred $50 and within a few minutes I got notified that the transfer was successful.

I honestly had to read the instructions a few times, but it’s fairly simple:

- Log into your bank account.

- Set up a new e-transfer contact with the email load@koho.ca.

- If you have to set up a first and last name, use something like KOHO Load (that’s what I did).

- For the Security Question for that contact, put KOHO Load Code.

- For the Security Answer, put your code that is noted in the app in the “Add Funds” section.

- Choose an amount to e-transfer and hit send.

- And if you’re like me and have to pay $1 for Interac e-transfers with your bank, in the “Message” section of your e-transfer you can let KOHO know you are being charged a transfer fee and they will reimburse you if your e-transfer is over $20.

- Your funds will appear in your account within 24 hours.

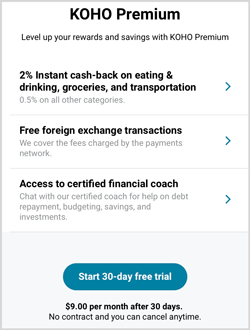

What Is KOHO Premium?

The regular version of KOHO, it’s free to use and there are no fees whatsoever. But, if you want some added benefits and features you can choose to upgrade to KOHO Premium for $9/month (or $84/year). To test it out, you can do a 30-day free trial and can cancel anytime.

The regular version of KOHO, it’s free to use and there are no fees whatsoever. But, if you want some added benefits and features you can choose to upgrade to KOHO Premium for $9/month (or $84/year). To test it out, you can do a 30-day free trial and can cancel anytime.

What KOHO Premium will get you is:

- 2% cashback on eating and drinking (restaurants, bars, coffee shops, fast-food, and food delivery services), groceries (all larger chains and smaller stores), and transportation (Uber, Lyft, gas, 407 tolls, transit tickets, and passes, parking, and car rentals). You’ll also still get 0.50% cashback on all other spending categories.

- Free foreign exchange transactions. They’ll cover the 1.5% fee that is normally charged by the payments network on any purchases made at merchants outside of Canada.

- Free access to a financial coach. Coach has a CFA and FPSC L1 designation and can give you advice on budgeting, financial planning, and debt, and answer questions about taxes, credit scores, and investing.

- Price-matching, whereby you can send in recent past receipts made online with KOHO and they’ll search to see if they could have gotten you a better deal. If so, they’ll credit the difference in price to your account.

- Higher “velocity” limits, meaning you can take out $400 at an ATM per transaction, for a maximum of $800 per day. Your account balance can also be $40,000 instead of $20,000.

Final Thoughts

Hello, when you sign up with KOHO. It says, “”Funds are not insured by CDIC”?

That’s right, KOHO the company is not CDIC insured. But KOHO does not actually hold your funds, People’s Trust does and they are CDIC insured. That’s to say, if KOHO goes bankrupt, you won’t lose your money because People’s Trust has it, not KOHO. Here’s an answer to this from KOHO on their site as well. https://help.koho.ca/general-information/is-koho-cdic-insured

But, if you’re still worried about it, I would say just don’t put that much money in your KOHO account. For me, I’m using it as a spending account so won’t have more than a few hundred dollars in my account at a time. Moreover, you’re not earning interest on your account balance so if you want to hold a few thousand dollars in there, personally I think you’d be better off putting that into a high-interest savings account so it could earn interest.

I have been using YNAB, YouNeedABudget.com since July and it has changed my life. I’m in my 40’s and am finally in control of my money for the first time in my life. It’s a budget based on 4 rules and you learn to trust your categories. It is available online, iPad, and iPhone (Android) so I can check out my category before I make a purchase on my credit card. Way simpler. You don’t need a lot of different savings accounts, just categories with purposes. Check it out.

Very cool, glad YNAB works for you and thanks for sharing!

Can I use KOHO to pay income tax and property tax? Will I still send cash back on these big ticket expenses?

Great question! So here’s info on receiving direct deposits from the CRA: https://help.koho.ca/en/articles/3854053-how-to-set-up-cra-direct-deposit#:~:text=Through%20the%20CRA%20My%20Account%20site%2C%20you%20can%20direct%20your,for%20your%20KOHO%20personal%20account

So if you set it up you’d be able to receive for example your tax refund into your KOHO account.

However, in terms of sending money from KOHO to the CRA to pay income taxes, that’s less clear. From my research, I don’t believe you can. I think what you’d have to do is transfer funds from KOHO to your bank account and pay it through your bank. Here are your payment options to the CRA: https://www.canada.ca/en/revenue-agency/services/make-a-payment-canada-revenue-agency/make-payment/general-payment.html

And in terms of property taxes, I don’t think so either. Typically you are required to pay by cheque or direct deposit through your bank. But I’d suggest looking at your municipality’s property tax info to see what payment options they accept.

Interested if you are still using koho? I’ve been interested in trying it for discretionary spending but wondering if i would just use my credit card if i go over.

Yup I still use it! It helps me not overspend on things like eating out for lunches and other non-essentials.