Make Sure to Also Read:

In my previous blog post about self-employed taxes in Canada, one thing I didn’t discuss was sales tax in Canada (GST, HST, PST, RST, and QST).

And that’s because income tax and sales tax are completely different beasts and deserve their own stand-alone blog posts. So here we go, let’s dive into the exciting world of sales tax. Since this is a very long blog post, here’s a helpful legend to help you.

In this Blog Post You’ll Learn:

- GST/HST

- Who Needs to Register, Collect & Remit GST/HST

- Registration Threshold – Single Calendar Quarter

- Registration Threshold – Last 4 Calendar Quarters

- Register Any Time You Want (But Beware)

- Who Do You Charge GST/HST To?

- Who Not to Charge GST/HST

- Who to Charge GST/HST

- What About Digital Goods & Online Services?

- How to File & Pay Your GST/HST

- PST, RST, QST

- Who Needs to Register, Collect & Remit PST, RST, QST

- Who to Charge British Columbia PST

- How to File & Pay Your British Columbia PST

- Who to Charge Manitoba RST

- How to File & Pay Your Manitoba RST

- Who to Charge Quebec QST

- How to File & Pay Your Quebec QST

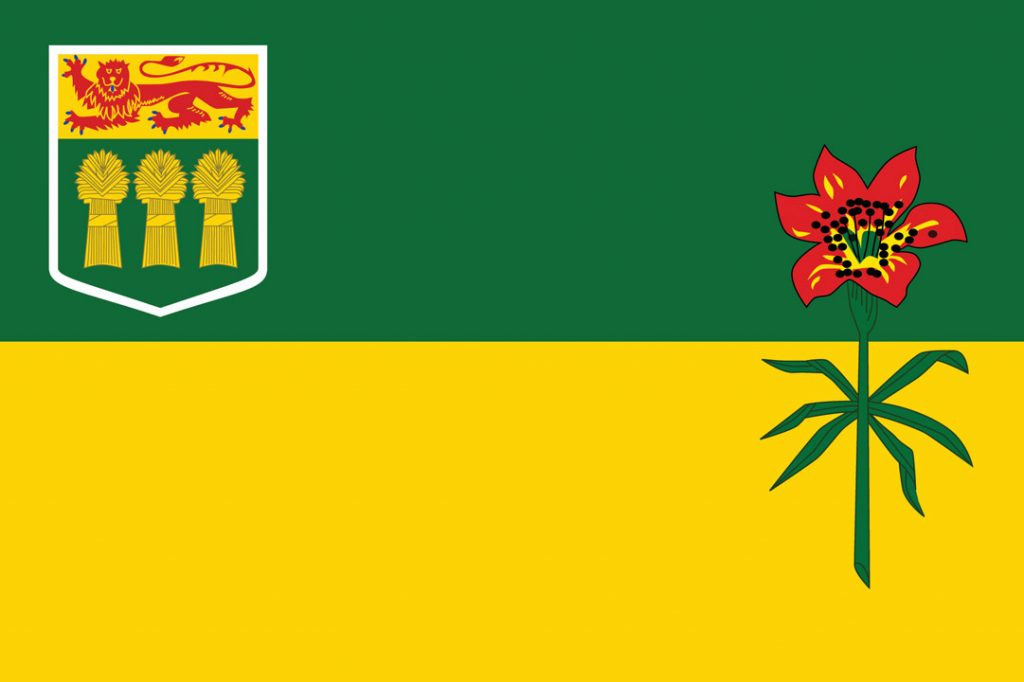

- Who to Charge Saskatchewan PST

- How to File & Pay Your Saskatchewan PST

I also made a video that goes through much of what’s in the blog post. So feel free to watch it first, then read on for more in-depth info.

**As a disclaimer, I am NOT an accountant. I am simply a small business owner who has had to navigate the ins-and-outs of sales tax for my business. For advice on your specific business, please consult with an accountant and/or contact the CRA or the provincial government about their sales tax registration requirements.

GST/HST

Who Needs to Register, Collect & Remit GST/HST

Let’s start by discussing which businesses actually need to collect and remit GST/HST. You need to register for a GST/HST account and start collecting and remitting sales tax to the CRA if your total business revenue (the amount your business earns before expenses) from your worldwide sales is $30,000 or more in any single calendar quarter or in the last four consecutive calendar quarters. If you earn less than $30,000 in business revenue, then you are considered a small supplier and do not need to register for, collect or remit GST/HST until you exceed that threshold.

Now you may be wondering, once I exceed that threshold, what’s the deadline to register for GST/HST? Well, it depends on when you exceeded that $30,000 threshold.

Registration Threshold – Single Calendar Quarter

If you managed to exceed that $30,000 threshold in a single calendar quarter, on the day you surpassed that threshold is your effective date of registration. You must start charging GST/HST on your date of registration, and unfortunately, that includes collecting GST/HST on the sale that pushed you over the $30,000 threshold. I know, that sucks because it may mean you have to go back to the customer and charge them sales tax (or to save face, just eat it out of your own profits), but it’s because technically that sale is one that took place above that $30,000 threshold.

So, we know when you have to start collecting sales tax, but what’s the deadline to officially register for GST/HST with the CRA? You have to register within 29 days of your effective date of registration.

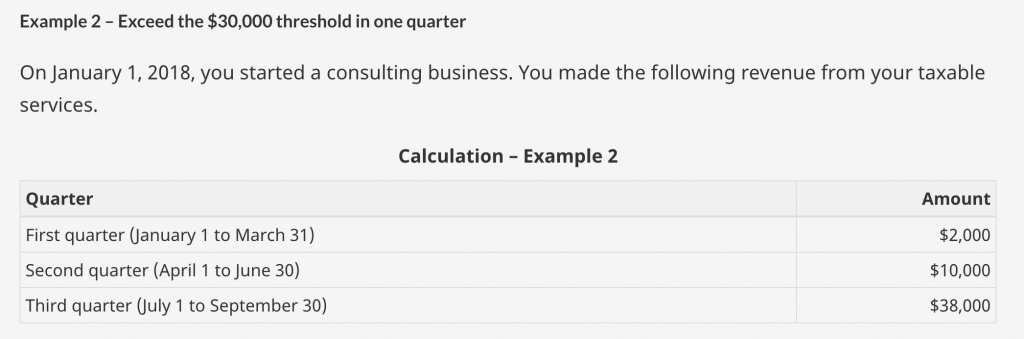

As an example found on the CRA’s website, here’s what exceeding that threshold in one calendar quarter looks like. As you can see, in the first and second quarters, you earned less than $30,000 in business revenue. But in the third quarter, BAM! You must have had a good sales month because you earned $8,000 over the $30,000 threshold.

Let’s say you surpassed that threshold on Sept. 12 in that third quarter. That means that Sept. 12 would be your effective date of registration, and starting Sept. 13 you’d have to start collecting GST/HST (not including the amount you’d need to collect from the sale on Sept. 12 that pushed you over that threshold). Moreover, you’d have 29 days from that effective date to register for GST/HST, which means you’d have to register no later than Oct. 9.

Registration Threshold – Last 4 Calendar Quarters

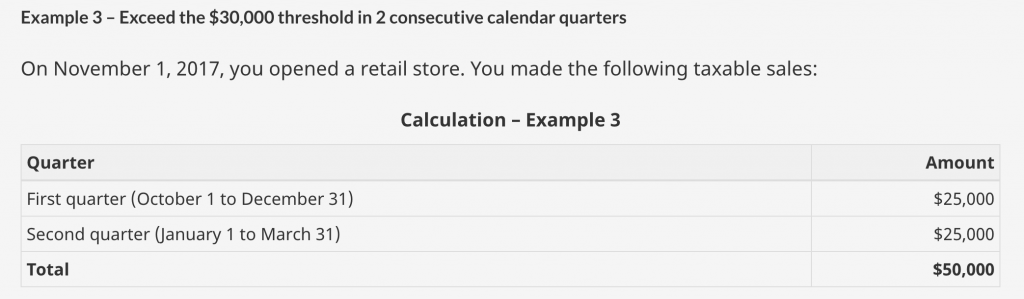

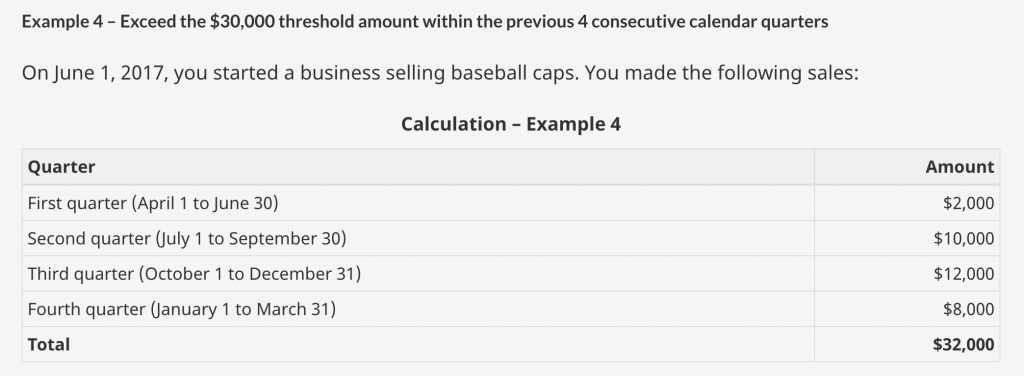

Now, depending on your business, it may be unlikely that you can make $30,000+ in a single calendar quarter, so very well you may not exceed that threshold unless you combine revenues from 2, 3 or 4 calendar quarters, as shown below.

In these cases, you exceeded the $30,000 threshold in the 2nd calendar quarter and the 4th calendar quarter respectively — March 31. Your effective date of registration is no later than 1 month after you exceed that threshold — April 30. That means that starting April 30, but no later than May 1, you need start collecting GST/HST and you have to register for GST/HST within 29 days of your effective date of registration.

Register Any Time You Want (But Beware)

That being said, you don’t have to wait until you make $30,000 in business revenue to register for GST/HST. If you want to start collecting and remitting GST/HST before then, you can voluntarily register for an account whenever you choose (even before you’ve earned your first dollar!). Why you may want to do this is so you can take advantage of input tax credits from your business expenses. That being said, you may not want to deal with the hassle when you’re just starting your business, so waiting until you exceed that threshold may be a better idea for you.

Moreover, if you are selling a product in which you are embedding the sales tax into the price, registering for GST/HST before you need to may actually eat into your profits. This was my experience when I had a business partnership with a friend a few years ago (now defunct). We sold an online course through the platform Thinkific, and their checkout cart wouldn’t allow us to charge sales tax to our customers. Since I registered our business for GST/HST when we launched our business, this meant that every time we made a sale, I had to manually deduct sales tax from the purchase price and remit it to the government.

For example, if we sold a course priced at $399, and a customer from Ontario bought it, we’d have to deduct 13% ($45.90) from that purchase, reducing our actual earned revenue to $353.10.

Who Do You Charge GST/HST To?

A common question I get is “Once I register for GST/HST, who do I charge it to? Are their special rules or exceptions?” Yes there are!

First, let’s discuss who not to charge GST/HST to.

Who Not to Charge GST/HST

If you sell goods that are categorized as zero-rated, then you do not need to collect any GST/HST from customers who buy those goods. These supplies would include things like agricultural products, most farm livestock, feminine hygiene products, and certain medical devices. For a broader list, check out this list of other zero-rated supplies.

Certain groups of people are also exempt from being charged GST/HST, such as Indigenous peoples and provincial and territorial governments.

There are also some exempt supplies from GST/HST, meaning you do not charge the GST/HST on these types of property or services. They range from child care services, music lessons, tutoring services and more. For a full list, read the Exempt Supplies section of the CRA’s webpage.

Lastly, if you provide goods and services to customers outside of Canada, you do not charge them any GST/HST.

Who to Charge GST/HST

So those are the types of customers or circumstances in which you would not charge GST/HST. Let’s now talk about who you would charge GST/HST to. And the key term to remember as we discuss this is place of supply. In other words, where are you supplying your goods and services to? Are you supplying them to customers in the same province as your business is located? Or are you supplying them to customers outside of your business’ province? Because it actually doesn’t matter if your business is located in Ontario or Alberta. What’s important is where your customer is.

Let’s look at an example. Pretend you run an online business based in Toronto, Ontario in which you sell and ship T-shirts to customers. If a customer located in Ottawa, Ontario bought one of your T-shirts and got it shipped to their home, you would charge them 13% HST. Because they are an Ontario-based customer, and the place of supply of your goods (T-shirts) was Ontario, you would charge that customer Ontario’s 13% HST.

But what if that customer lived in Calgary, Alberta? If you have to ship their T-shirt to Calgary, making the place of supply of your goods Alberta, then you would charge that customer Alberta’s 5% GST. In Alberta, like the territories, they do not have HST or a provincial sales tax, they just have GST.

Lastly, if your customer was based out of Vancouver, BC, making the place of supply British Columbia, then you would charge them 5% GST plus 7% PST. Because British Columbia doesn’t have HST, but instead has GST and a provincial sales tax, you would need to charge that Vancouver customer both taxes for a combined 12% tax. You would then collect that 12% tax, and remit the 5% GST to the CRA (federal government) and the 7% PST to the British Columbia provincial government.

One last example, let’s pretend you don’t sell anything online but instead have a physical storefront in Ontario to sell your T-shirts. It’s obvious that you would charge Ontario-resident customers 13% HST, but what about non-resident customers like out-of-town tourists?

Well, since the place of supply of your T-shirts is Ontario, not the customer’s place of residence, they would be required to pay 13% HST. That’s why when you’re a tourist in another province, you are automatically charged that region’s sales tax since that is the place of supply and where sales tax is attributed. That being said, depending on what goods and/or services you’re selling, customers may be able to apply for a GST/HST rebate.

What About Digital Goods & Online Services?

And since I get this question a lot, if you sell a digital product in which there’s no shipping required (like an e-course) or provide an online service (like online coaching), then I would still go by these rules.

However, full disclosure, I’m not a CPA so feel free to discuss your particular situation with a tax professional. But from everything I’ve read from different government and tax accounting websites, to me it looks like the place of supply for digital goods and online services would be the place of residence of the customer, not the location in which you are conducting business.

So, if you are based in Ontario but you are selling an e-course to a customer in Alberta, you would charge them 5% GST (not 13% HST).

For a full breakdown of provinces/territories with GST or HST, here’s a handy table for you to memorize.

Province |

Tax |

|---|---|

| Alberta | 5% GST |

| New Brunswick | 15% HST |

| Newfoundland & Labrador | 15% HST |

| Northwest Territories | 5% GST |

| Nova Scotia | 15% HST |

| Nunavut | 5% GST |

| Ontario | 13% HST |

| Prince Edward Island | 15% HST |

| Yukon | 5% GST |

How to File & Pay Your GST/HST

Once you’ve registered for GST/HST, then all you have to do is charge that sales tax to your customers, collect it, then hand it over to the government. A good idea to ensure you stay on top of things is every time you make a sale and collect payment from your customer, put the revenue you earned from the sale in one bank account, and the sales tax you collected on top of that revenue into a separate bank account. This way you won’t accidentally spend the sales tax you collected or think you’ve earned more business revenue than you actually did.

Then, when it’s time to file and pay your GST/HST to the CRA, you can follow along this video to see how you’re supposed to do it.

PST, RST, QST

Who Needs to Register, Collect & Remit PST, RST, QST

So that was GST/HST but what about all those provinces who don’t have HST, or don’t solely have GST like Alberta and the territories? They have what’s called a provincial sales tax in addition to the federal goods and services tax. British Columbia and Saskatchewan have PST, Manitoba has RST (Retail Sales Tax), and Quebec has QST (Quebec Sales Tax). Below is a chart of their various sales tax rates.

So…do you need to charge PST, RST, or QST? Again, it depends. It depends on if you operate your business in one of these provinces and/or if the place of supply of your goods and services takes place in one of these provinces. It also depends on if your business revenue surpasses a certain threshold, however you of course can voluntarily register for any of these provinces’ sales taxes whenever you like, just like you can with GST/HST.

Province |

Tax |

|---|---|

| British Columbia | 5% GST + 7% PST |

| Saskatchewan | 5% GST + 6% PST |

| Manitoba | 5% GST + 7% RST |

| Quebec | 5% GST + 9.975% QST |

Who to Charge British Columbia PST

Who to Charge British Columbia PST

I think it’s easiest to go province-by-province, so let’s start with British Columbia. BC has a 7% PST.

For some helpful resources to learn more about BC PST:

- British Columbia PST Registration

- British Columbia PST exemptions

- Bulletin PST 001 – Registering to Collect PST

- eTaxBC Services

If your business is located in BC, you are required to register, collect, and remit BC PST if you meet the following criteria:

- Sell taxable goods in BC

- Lease taxable goods in BC

- Provide related services in BC

- Provide legal services in BC

- Provide telecommunication services in BC

- Provide software in BC

- Act as a liquidator, receiver, receiver-manager, or trustee and dispose of assets as part of your business

- Have $10,000 or more in gross business revenue from all retail sales of eligible goods, software, and services in the previous 12 months, and your estimated gross revenue from all retail sales of eligible goods, software, and services in the next 12 months is $10,000 or more.

If your business is earning less than $10,000 in a 12-month period, then you would be considered a small seller and would not be required to register for BC PST until you surpass that threshold. You may also not be required to register for BC PST if you do not sell taxable goods, software, or accommodation, do not make taxable leases of goods, and do not provide taxable services (i.e. related services, telecommunication services, and legal services).

If your business is located OUTSIDE of BC, you are required to register, collect, and remit BC PST if you meet the following criteria:

- Sell taxable goods to customers in BC

- Accept orders from customers located in BC (including by telephone, mail, email or Internet) to purchase goods

- Deliver the goods you sell to your BC customers to locations in BC (this includes goods you deliver through a third party, such as a courier)

- Solicit people in BC (through advertising or other means, including mail, email, fax, newspaper or the Internet) for orders to purchase goods

- Meet the minimum BC revenue threshold:

- Your gross business revenue in the previous 12 months from all retail sales and leases of goods and all sales and provisions of software and telecommunication services to BC customers is more than $10,000, or

- Your estimated gross revenue in the next 12 months from all sales and provisions of software and telecommunication services to BC customers is more than $10,000

There are of course some exceptions and special circumstances, so please read Bulletin PST 001 – Registering to Collect PST for more information.

You can also opt into voluntarily registering for BC PST anytime.

Registering for BC PST is super easy, and all the instructions can be found here. But when it comes time to file and pay your BC PST, watch my video below for a full walk-through.

How to File & Pay Your British Columbia PST

Who to Charge Manitoba RST

Who to Charge Manitoba RST

Next, we’ve got Manitoba. Their provincial sales tax is called RST, which stands for retail sales tax and is a 7% tax on taxable goods and services.

For some helpful resources to learn more about Manitoba RST:

- Manitoba RST Registration

- Manitoba RST exemptions

- Bulletin RST 004 – Retail Sales Act & Registration

- Manitoba Taxcess

If your business is located in Manitoba, you are required to register, collect, and remit Manitoba RST if you meet the following criteria:

- Sell taxable goods in Manitoba

- Lease taxable goods in Manitoba

- Provide related services in Manitoba

- Have $10,000 or more in annual gross business revenue

If your business is earning less than $10,000 annually, you are considered a small business and would not be required to register for Manitoba RST until you surpass that threshold. Once you surpass that threshold, you have one month to register for RST.

If your business is located OUTSIDE of Manitoba, you are required to register, collect, and remit Manitoba RST if you meet the following criteria:

- Sell taxable goods to customers in Manitoba

- Accept orders from customers located in Manitoba (including by telephone, mail, email or Internet) to purchase goods

- Cause goods to be delivered in Manitoba, (i.e. delivered by the seller, or shipped by arrangement of the seller by common carrier, whether or not the goods are shipped at a specified cost to the customer)

- Solicit sales from customers in Manitoba, directly or through an agent, by advertising or any other means

- Hold inventory of taxable goods in Manitoba, available for sale to Manitoba customers

- Meet the minimum Manitoba revenue threshold of $10,000 in annual business revenue

There are of course some exceptions and special circumstances, so please read Bulletin RST 004 – Retail Sales Act & Registration for more information.

You can also opt into voluntarily registering for Manitoba RST anytime.

Registering for Manitoba RST is super easy, and all the instructions can be found here. But when it comes time to file and pay your Manitoba RST, watch my video below for a full walk-through.

How to File & Pay Your Manitoba RST

Who to Charge Quebec QST

Who to Charge Quebec QST

Next, we’ve got Quebec. Their provincial sales tax is called QST, which stands for Quebec sales tax and is a 9.975% tax on taxable goods and services.

For some helpful resources to learn more about Quebec QST:

If your business is located in Quebec, you are required to register, collect, and remit Quebec QST and GST (you’ll have to register for them at the same time through Revenu Quebec) if you meet the following criteria:

- Sell taxable goods in Quebec

- Lease taxable goods in Quebec

- Provide related services in Quebec

- Your total worldwide taxable supplies (including sales, rentals, exchanges, transfers, barter, etc.) and those made by your associates exceed $30,000 in a given calendar quarter or in the four preceding calendar quarters.

If your business is earning less than $30,000 in a given calendar quarter or in the four preceding calendar quarters, then you are considered a small supplier and would not be required to register for Quebec QST until you surpass that threshold. Once you surpass that threshold, you have one month to register for RST.

If your business is located OUTSIDE of Quebec, then you may be considered a Supplier Outside Quebec. Instead of giving you a list of criteria, Revenu Quebec actually made it very easy to determine if you need to register for QST by way of an interactive quiz. So all you have to do is take the quiz, and it will tell you whether or not you have to register. Why can’t all provinces do this?

Click here to take the QST Supplier Outside Quebec Quiz

That being said, you can of course opt into voluntarily registering for Quebec QST anytime.

Registering for Quebec QST is super easy, and all the instructions can be found here. But when it comes time to file and pay your Quebec QST, watch my video below for a full walk-through.

How to File & Pay Your Quebec QST

Who to Charge Saskatchewan PST

Who to Charge Saskatchewan PST

And last but not least, we’ve got Saskatchewan. Their provincial sales tax is called PST (just like BC), it’s currently a 6% tax.

For some helpful resources to learn more about Quebec QST:

If your business is located in Saskatchewan, you are required to register, collect, and remit Saskatchewan PST if you meet the following criteria:

- Sell taxable goods in Saskatchewan

- Lease taxable goods in Saskatchewan

- Provide related services in Saskatchewan

- Operate your business outside of your home

- Have $10,000 or more in annual gross business revenue

If your business operates from within your home (i.e. make and sell craft items) and is earning less than $10,000 in annual gross business revenue, then you are considered a small trader and would not be required to register for Saskatchewan PST. However, if you earn less than $10,000 in annual revenue but operate outside of your home or make sales to commercial customers, then you would be required to register for PST. Moreover, if you offer products or services for sale through online platforms, no matter your revenue, you would not be considered a small trade and would also need to register for PST.

If your business is located OUTSIDE of Saskatchewan, you are required to register, collect, and remit Saskatchewan PST if you meet the following criteria:

- Make tangible personal property available for purchase in Saskatchewan

- Accept orders to purchase tangible personal property that originate in Saskatchewan

- Cause the tangible personal property to be delivered in Saskatchewan

Unlike the other provinces, there was no mention of a business revenue threshold. In other words, if you are a supplier outside of Saskatchewan and meet the above criteria, you are required to register for Saskatchewan PST.

There are of course some exceptions and special circumstances, so please read Bulletin PST-5 – General Information for more information.

And of course, you can opt into voluntarily registering for Saskatchewan PST anytime.

Registering for Saskatchewan PST is super easy, and all the instructions can be found here. But when it comes time to file and pay your Saskatchewan PST, watch my video below for a full walk-through.

How to File & Pay Your Saskatchewan PST

What to start getting your self-employed finances organized? Download one of my budget spreadsheets.

Thanks for sharing the timely article, Jessica! It is helpful for me because I have to file taxes for blog income earned through display ads. I don’t sell any products and plan to file as a sole proprietor.

So glad you found this helpful! If you have any other questions, as someone who had a side hustle then became full-time self-employed, I’ve been through it all. Happy to help or answer any other questions you may have.

Hi,

In example 3 at the top of this page, you said that the threshold was passed in the second quarter…to 50K, and that the date of registration is 1 month later than the end of the quarter which is April 1? Isn’t the date of registration no later than 1 month after the date that the 30K threshold is reached? So that wouldn’t be the end of that quarter (March 1) but whatever earlier date the threshold was met. So the date of registration is actually earlier than April 1. Do I understand this correctly?

This section on the CRA website may help to clarify things https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/when-register-charge.html

Hi Jessica.

I’m in the process of setting myself up for self-employment (sole proprietor under my legal name) based in BC. I plan to offer my services in food photography, stop motion animation and related areas like recipe development so all digital services.

Am I correct in understanding that if I have Canadian clients I would have to register for the GST/HST program in line with the $30K threshold and then the BC PST program being based in BC if I have BC clients and meet the 10K threshold? I don’t believe QC, SK and MB programs would apply in my situation.

Any advice you can offer would be greatly appreciated. Thank you in advance

That’s correct. If you don’t plan on having clients in QC, SK, or MB and don’t meet their requirements, you don’t need to register. But you will need to register for BC PST and GST/HST once you meet those requirements. For instance, if you have a client in BC, you’ll need to charge them PST and GST and then remit the PST to the BC government, and then the GST to the federal government. That being said, I’d also recommend chatting with the BC PST contact centre. I called them to find out more about their requirements and it wasn’t a long wait to call and they were super helpful. https://www2.gov.bc.ca/gov/content/taxes/sales-taxes/pst

Thanks for replying Jessica. I am not sure where exactly my clients will end up being. Sounds like it might be better to have them all outside of Canada to make it easiest. I will reach out to the BC PST centre, thanks again for the information and replying so quickly. Your blog posts are super helpful!

It’s really not that bad having clients throughout Canada. And until you reach their thresholds/requirements for PST for Manitoba, Saskatchewan, Quebec, you just have to charge those clients GST. Otherwise, you just charge clients in BC PST+GST, and all other clients either GST or HST.

Hi Jessica thank you for helping me understand this so much. Love your videos you have a great personality that makes it simpler and fun haha!

My question is I live in BC, and have no registered for PST as I’ve never gone over the $10K threshold for goods yet. What happens if I accidentally do go over $10K? From that point do I need to register and begin collecting? Just curious if it matter that this may happen at a weird time of year like August.

That’s why it’s important to track your business revenue to know when you go over that threshold. Once you do, you’ll no longer be considered a small seller and will have to register to collect PST, no matter at what point in the year that happens.

Hi Jessica. Great article!

We have customers across the country. Can you help me understand when we need to start collecting?- is it only as per the threshold in each jurisdiction or when we hit $30k as a whole Nationally? For example, BC is only at $8k, Manitoba is at $3k. The majority of sales are Quebec and Ontario then Alberta.

Thanks for your help

For provinces that have GST only or HST, then the $30,000 worldwide business revenue rule applies (i.e. Ontario). For other provinces with their own provincial sales tax like Quebec, Manitoba, and BC, I’d definitely look at all the criteria in the bulletins I’ve linked to to see if you are required or meet their threshold, but I’d also suggest calling each of their departments to get clarification for your situation. I was able to get a hold of someone for BC PST pretty quickly and they were super helpful.

This was so great, thanks for the info! So if I registered for a GST number but made less than 30,000 do I still have to pay the GST? We did charge GST to some businesses so… there’s that 🙂

Yes, as soon as you register for GST/HST you must start collecting and remitting it.

Great article, can you help me clarify this scenario, I have a full time job making say 50,000/tr, I want to sell on Ebay /Amazon, so basically if i make less than 30,000 with the sales I dont worry about taxes because I’m small supplier. On income tax I add the sales to my regular income, now my income is say 75000/year. My question is are they considered separate incomes or one income, my worry is I would no longer be a small supplier, therefore having to charge taxes, I hope this makes sense..

Thank You.

It’s based on your business revenue, not your employment income.

I am a blogger and I don’t actually sell products to people. I make my income from site ads, and affiliate links. I have no way of tracking who buys what, from what country and those people would be paying whatever taxes they need to from the actual company that the affiliate links go to when they make their purchases. I made way over $30,000 this year (I’m in Ontario) and my accountant talked about charging HST, but I just can’t see how that is possible in this situation. Is this a grey area? or do I have to remit HST on every sale I make even though 99% of my sales are linked to US companies and the majority of my blog traffic is US-based?

For the affiliate links and site ads, you’re not paid by the customer, you’re paid by the affiliate or site ads company. So you’d need to determine where that company is based and if they are based out of Canada, then you would have to collect/remit GST/HST if you are over that $30,000 threshold. That being said, I’d suggest discussing this further with your accountant, or if they aren’t providing you with clear guidance…find a better accountant.

Hi Jessica. Great article…so much important information. I have a question – what would be the purpose or value in voluntarily registering/remitting taxes prior to reaching any of the different thresholds?

Thanks in advance!

Input tax credits. You can get back some of the sales tax your business pays on business expenses. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/complete-file-input-tax-credit.html

What about this set of circumstances. I have a small business (graphic design) and do collect and remit HST. My sales for that business exceed the $30,000 threshold.

If I were to earn income outside of that business in my own name this year (by selling pottery for example) am I obligated to charge HST on those sales? And in the future, if that venture does well and I were to register a second business with income under $30,000/year, is that 2nd business considered a completely separate identity meaning I wouldn’t have to charge HST because my sales are under $30,000?

If you also run your graphic design business under your personal name then it’s the same business as your pottery business (just a different service/product you offer but they would both be considered to be under the same sole proprietorship). In which case, yes you would need to charge/remit HST on your pottery products. In order for it to qualify as a different business, you would need to register one of the businesses under a different name and get a different business number (i.e. Heather Designs).

Hi Jessica, im just confused. what is the “Actual annual worldwide and domestic gst/hst taxable sales ” and ” Acutal annual domestic gst/hst taxable sales ” what do they mean? is that just my income for both? im self employed contractor and work in only manitoba

Actual annual worldwide and domestic gst/hst taxable sales simply means what is the total amount of sales you’ve made within Canada and outside of Canada. This includes zero-rated sales (i.e. if you have a customer in the U.S., you would not charge them sales tax, they would be zero-rated). Actual annual domestic gst/hst taxable sales means the total of sales you’ve made within Canada. If you don’t make any sales internationally, then the numbers should be the same.

Hi Jessica, great blog and videos. You are providing very useful information for people just getting started with a small business such as myself. Last year I retired and started doing some consulting work as a contractor with my former employer. I set up a business as a sole proprietorship. I had a few small contracts which were administered by separate agency. The agency that setup my billing to collect GST from the company that employed me, with the idea that I might pass the $30k for the year. Last year I only made about $10k through this consulting work, but did collect GST on this amount. My question is am I now required to register to remit the GST I have collected? Is there any way around this registration process, such as a one time payment though the tax system. My reluctance to register is that I may be consistently making less than 30k a year. If I did register, how regularly would I need to remit GST? Thanks in advance.

The agency shouldn’t have been collecting GST before you were registered to do so, especially since you aren’t required to register until you hit $30K. I’d suggest either talking to an accountant or the CRA to see how to move forward.

Hi Jessica,

Thanks for taking the time to quickly answer my question.

Calvin

This is such an awesome post, bookmarking it for future reference!

If you could, I’m still quite confused on PST/RST/QST. Say I make one sale a year (if that!) to the provinces which charge those sales taxes, am I required to register with the province? Am I better off not selling to those provinces? Thanks!

No, all of those provinces have their own requirements and thresholds, so unless you meet them you aren’t required to collect/remit those provincial sales taxes. For more information about your particular business and if you meet their requirements, I’d suggest contacting those provinces business sales tax departments.

Hi Jessica – I have a question in relation to selling an online course. I saw the following in your blog post (great post) and am also using the Thinkific platform:

We sold an online course through the platform Thinkific, and their checkout cart wouldn’t allow us to charge sales tax to our customers. Since I registered our business for GST/HST when we launched our business, this meant that every time we made a sale, I had to manually deduct sales tax from the purchase price and remit it to the government.

This all makes sense in relation to my sales tax obligation. My question is, am I required to provide an additional receipt to the person on top of what they would automatically get at time of purchase (if they also are in Canada) separating out the tax for their tax purposes? Hope that makes sense!

Thanks in advance

Honestly, that’s why I stopped using Thinkific’s payment platform and switched to taking manual paymenys via Quaderno. In terms if the receipt, I don’t believe so. I simply made sure the registrants knew tax was inclusive.

Thanks for the quick reply and additional info Jessica.

You’re welcome!

I’m an online business selling zero rated products so no gst charged to customer . But do i charge gst on the cost I charge to my customer foe shipping that product to the customer in canada?

Hello, thanks for the awesome article. I was wondering for the PST, RST, and QST if the threshold was nationwide or for just the specific province? For example, if I only sold $500 annually in British Columbia, but $12000 annually in other provinces, would I still need to collect for BC? Thanks!

This is really useful info, Jessica! I have a question I can’t seem to find an answer to online: I registered for an HST/GST number because it was a requirement from a supplier. That supplier ended up telling me they’re not taking on new clients so now I am stuck with an HST/GST number. Even though I’ll make under 30k, do I NEED to charge sales tax? Is there any way for me to get out of this situation? Thanks!

Yes, once you’ve registered for GST/HST you will need to collect it and remit it to the CRA. The only way to get out of it is if you closed your business and closed your GST/HST account. But there are lots of positives for having GST/HST remember such as taking advantage of input tax credits.

Hi Jessica,

I just started a consulting business in New Brunswick and I will not hit 30k sales.

I am a sole proprietor. When I record my expenses to determine my taxable income – I am only entering the net figure right? Exclude/ignore the tax as I am not charging tax on my services?

thanks for your time

This page on the CRA website should answer your question: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/sole-proprietorships-partnerships/report-business-income-expenses/completing-form-t2125/expenses-section-form-t2125.html

Hi Jessica!

I love your blog and videos. I’m having a hard time understanding the government sites’ lingo, and I hope you can help. I’m in BC and would like to get into selling digital products (such as Canva templates, spreadsheets, online courses etc.). I’m assuming I need to collect GST/HST but is PST required for digital products?

Thank you 🙂

Hi Jessica!

Your site is very useful. Thank you so much.

May I ask a question? I am a freelancer in Alberta. Trying to figure out how to calculate GST. On Upwork.com I’ve got a job. The client from Ontario.

Total billed – 166.65, Upwork fees – 33.33, taxes paid – 1.67. My earning – 131.65. Which amount should I use for GST? 166.65 or 131.65? Thank you inadvance

You just need to charge 5% GST on the amount you billed the client. Upwork fees would count as tax write-offs. With that said, this article may help too https://support.upwork.com/hc/en-us/articles/4401838411283-Canada-Indirect-Taxes-for-Freelancers

Hi Jessica,

I am new to the Canadian self-employment world and absolutely love your blogs and videos. A question, I have started working as a contractor for a US based company that pays me a regular monthly salary (but doesn’t take any tax or benefit off my paycheque). Do I need to register for GST/HST? Also can I treat this as “self-employed” and claim business deduction?

No, you only charge GST/HST within Canada. You don’t charge it to foreign clients/customers. With that said, make sure you’re putting a percentage of your income away for income taxes. And if you are in fact self-employed, then yes you can claim eligible business expenses as tax deductions. I’d definitely suggest connecting with an accountant to make sure you’re prepared for filing your income taxes.

Hi Jessica!

I am confused with the Manitoba tax! Businesses need to start collecting PST in Manitoba when they hit the 10000$ threshold of sales in Manitoba or in all Canada?

This article explains more specifics about Manitoba RST https://jeremyscott.ca/manitoba-pst-registration-rules/