Launched in September 2020, RBC Remote Account Open is a new way to open an RBC bank account from anywhere, anytime. For all the important info, keep reading!

I don’t know about you, but since this pandemic started I’ve had to adjust my life a lot.

It’s so weird looking back at some of the stuff I was posting in March. I’ll hold my hands up guilty and say that I was an optimist (or maybe just naïve) and thought everything would go back to normal in just a few months. I even had the audacity to joke on Instagram on March 12 (before things got scary) that going into lockdown wouldn’t be much different than my normal routine of working from home self-employed.

Well, after experiencing lockdown, I can now say that it is different. Very different. Apparently, I do actually like to leave my house from time to time! But even now that many restrictions have been lifted and things are improving, I’m not taking any chances. As someone who has asthma (though fairly mild), I’m taking the threat of COVID-19 very seriously.

What this means is I limit going out to public places and try to do all my chores online if I can. And I know I’m not the only one who’s had to adjust their life so dramatically because of the pandemic either.

On the upside, it’s nice to see that the financial industry is noticing and doing something about it to better serve customers.

RBC’s Remote Account Open Experience

One of the major players in the financial industry responding to this new world we now live in is RBC. This September, they launched their RBC Remote Account Open experience through their RBC mobile app.

This new RBC Remote Account Open experience means that anyone can set up a new bank account in minutes via their mobile app. Not feeling up to a trip to the branch or even a call on the phone? No worries — you can now open an account using your phone from the safety of your own home.

Who Is This For?

RBC’s Remote Account Open benefits everyone, however, it’s particularly useful in providing banking access for people who aren’t able to or aren’t comfortable opening a bank account via the traditional route.

You see, in the first few months of the pandemic, RBC noticed a 60% increase in average daily digital enrollments amongst clients who have been with RBC for more than 5 years. Add that to the growing demand for online banking services over the past few years, and it became very clear, very quickly that many customers were seeking new digital options for banking.

But in terms of who will benefit the most from this, it’s people like me who just aren’t comfortable going to a bank branch anymore for fear of putting themselves at risk during this pandemic. It will also benefit anyone who lives in a remote area where traveling to a bank branch may be inconvenient, and newcomers to Canada who currently have to self-isolate.

Is RBC’s Remote Account Open Safe & Secure?

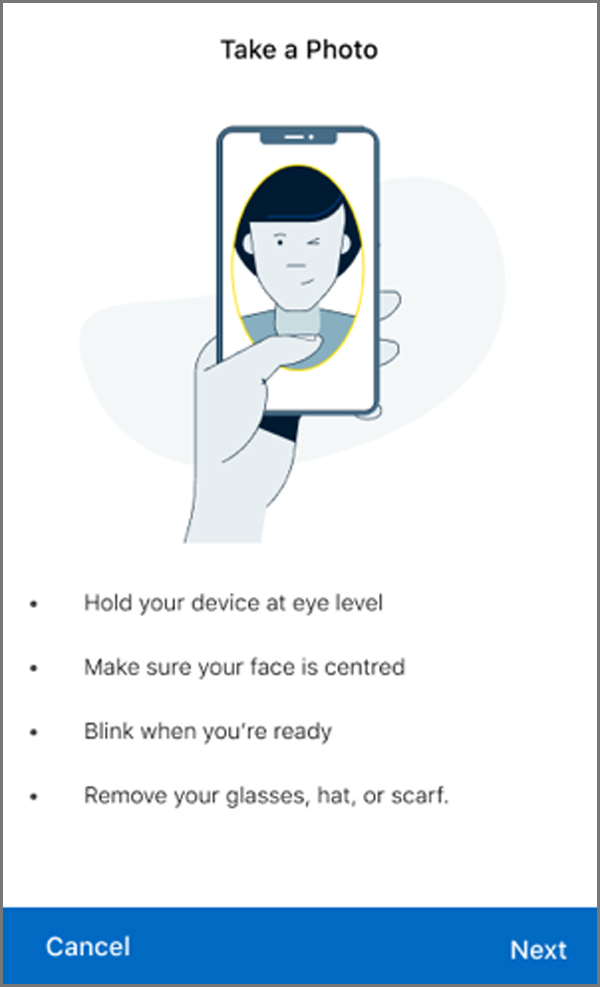

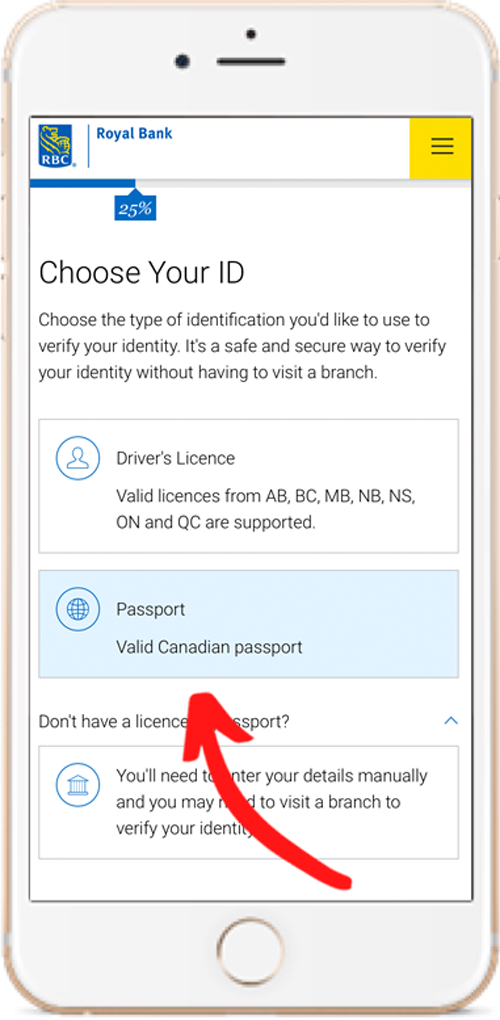

With new technological innovation, there’s always the question “But is it safe?” RBC Remote Account Open uses industry-leading security to ensure safety for its customers and uses ID verification technology (IDV) to verify customers’ government-issued identification against the security features and characteristics of their driver’s license or passport. What this means is in addition to providing your license or passport for ID, you also need to provide a live photo as proof that you are who you claim to be.

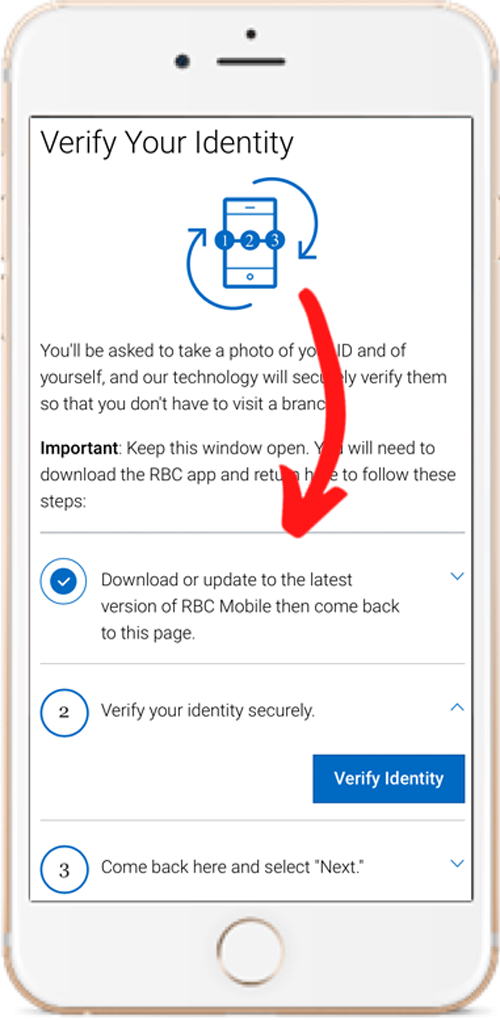

Here’s what the process looks like so you can see what I mean.

First, you have to take a photo of your government-issued ID, front and back.And then you have to take a live photo of yourself so the app and its security software can confirm your identity.

How to Open an Account Using RBC Remote Account Open

So, how do you open an account using RBC’s Remote Account Open experience? Follow these steps:

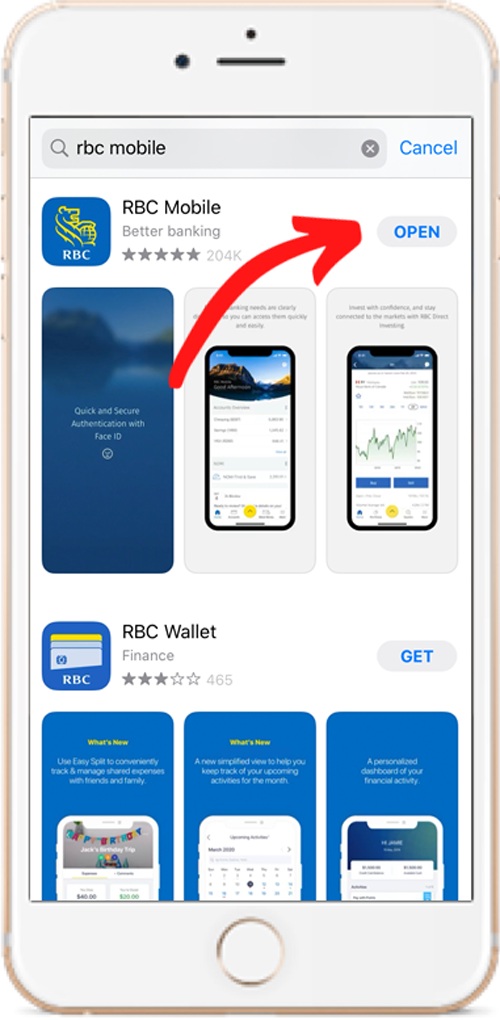

1. Download the RBC Mobile app on iOS or Android

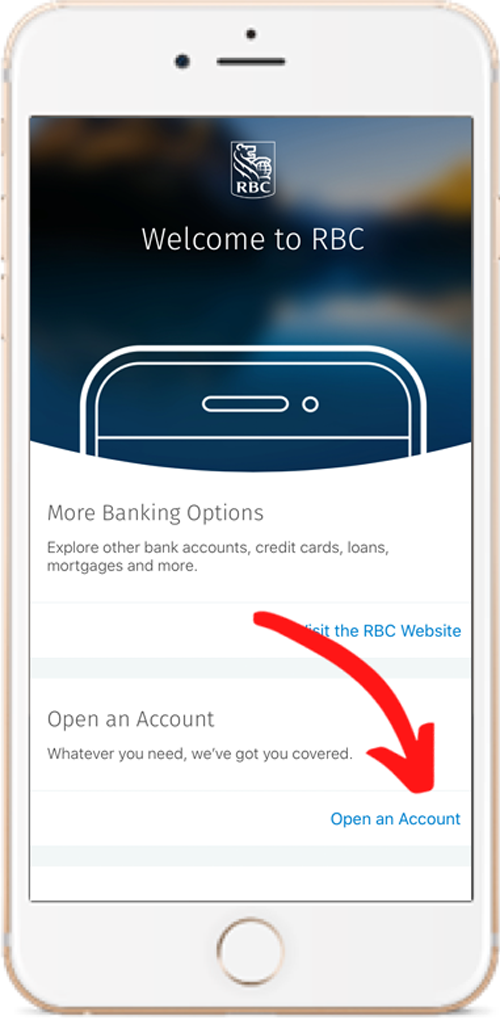

2. Click “Open an Account”

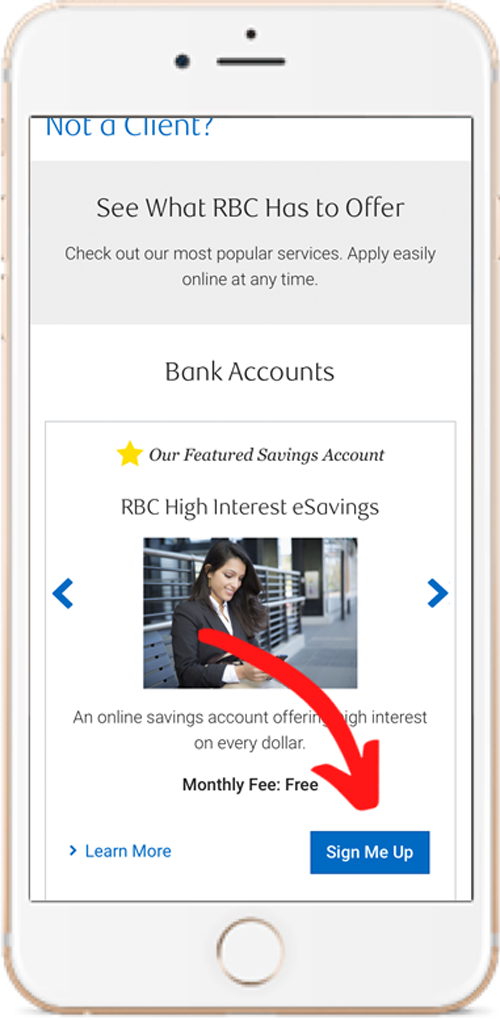

3. Choose an Account to Open

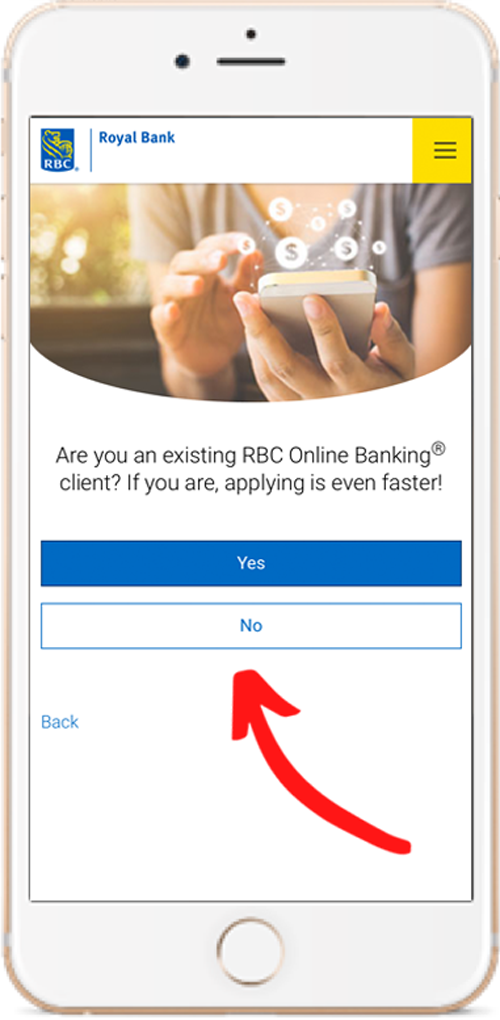

4. Answer Questions About Your Customer Status, Residing in Canada, and Age of Majority

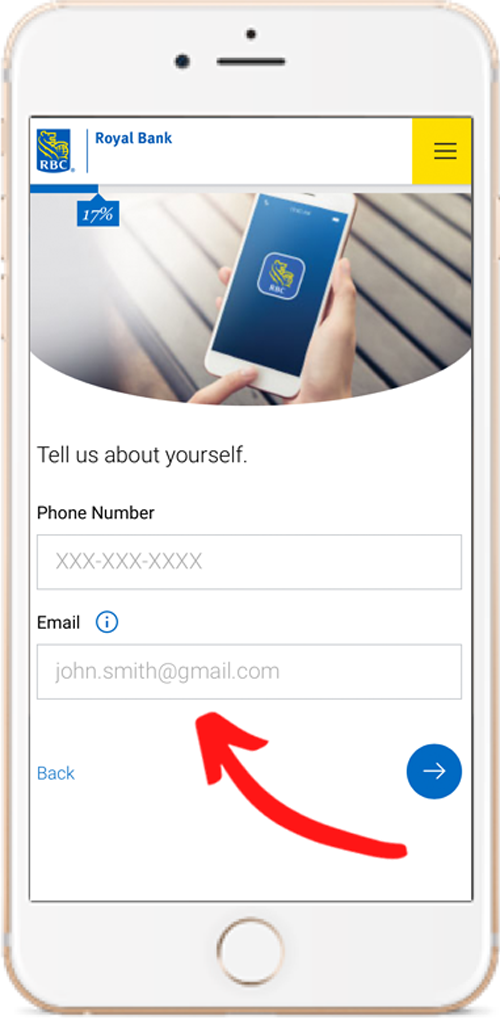

5. Provide Your Phone Number and Email

6. Choose a Government-Issued ID to Verify Your Identity

7. Verify Your Identity

Follow the steps (seen earlier) to complete the ID verification process. The last steps after verifying your identity will involve being sent the necessary client agreements through secure email, and setting up your PIN so you can start making transactions.

Follow the steps (seen earlier) to complete the ID verification process. The last steps after verifying your identity will involve being sent the necessary client agreements through secure email, and setting up your PIN so you can start making transactions.

Final Thoughts

As a personal finance blogger who’s been writing online for almost 9 years (December 2020 will be my 9th blogiversary!), I’ve gotta say that one of the coolest things about being around for so long is that I’ve been able to witness the evolution of the financial services industry in Canada over the past decade. And guess what typically sparks innovative new products and features like RBC Remote Account Open? Times of crisis and times of social change.

Just like you, I can’t wait for this pandemic to be over. But if there’s one silver lining, I’m really excited to see what other innovations the financial industry has in store for all of us.

I’m tryna got my son to open an account, he needs one for his payroll, I’m gonna let him know about how to open one with RBC

Glad you found this helpful then!

I am a retiree living in Latin America. Can I open an account at RBC from Mexico? I am a US person.

Likely no, but I’d suggest contacting RBC to discuss your situation with them.

I am a Canadian live overseas for many years, i am attending to retire in Canada at the age of 70. I try to open an account, online banking before I’m heading back to canada. I prefer to go with RBC, Nova Scotia Bank Canada or some other Canada banks. I have hard time to unload the RBC Mobil app.

Regards.

I’d suggest getting in touch with the financial institution directly.

This is a great post! I just applied for an account online and it was so easy.

Great!