The one thing I keep getting asked by podcast listeners, Instagram followers, my course students, and even journalists is “How do you save money during such uncertain times? Is it even possible?!” So when BMO approached me to partner in providing financial advice, I thought it was the perfect time to finally tackle this subject.

Yes, it absolutely is possible to save money right now! And when you think about it, uncertain times may actually be the perfect wake-up call for many of us who’ve been putting off taking our finances seriously.

Just take my own introduction to the world of personal finance. Graduating from university in 2009 with a very much not-in-demand film degree was terrifying. At school, I had dreams of becoming a famous editor, working in Vancouver’s film industry. After school, I just wanted a job. Any job! Something that would help me afford to finally move out of my parent’s basement.

Through the course of being unemployed and working odd jobs until I finally found full-time employment in 2010, I realized that although there is much in the world that I couldn’t control, there still were things that I could. Like improving my financial literacy, participating in online personal finance communities so I didn’t feel alone, and discovering new, unique ways to save money and grow my wealth.

That’s what I did to feel more in control of my future back in 2010…and it worked! I may have gone a step further than most by turning it into my full-time career, but what I did back then has never been more relevant than right now.

So, is 2020 the year you take your finances a bit more seriously? Is this the year you try things a bit differently, prioritize saving money above spending, and start to make some real change you’ll thank yourself later for? Awesome! Here are 6 ways you can save money that you can implement right now!

1. Pay Yourself First

If you’ve ever picked up a personal finance book, chances are it will mention paying yourself first. Why? Because it’s good advice and it works (it’s also first on BMO’s list here!). I’ve been integrating this concept into my finances ever since I got my first full-time job a decade ago, and I’ve been able to grow my savings more than I ever thought possible because of it.

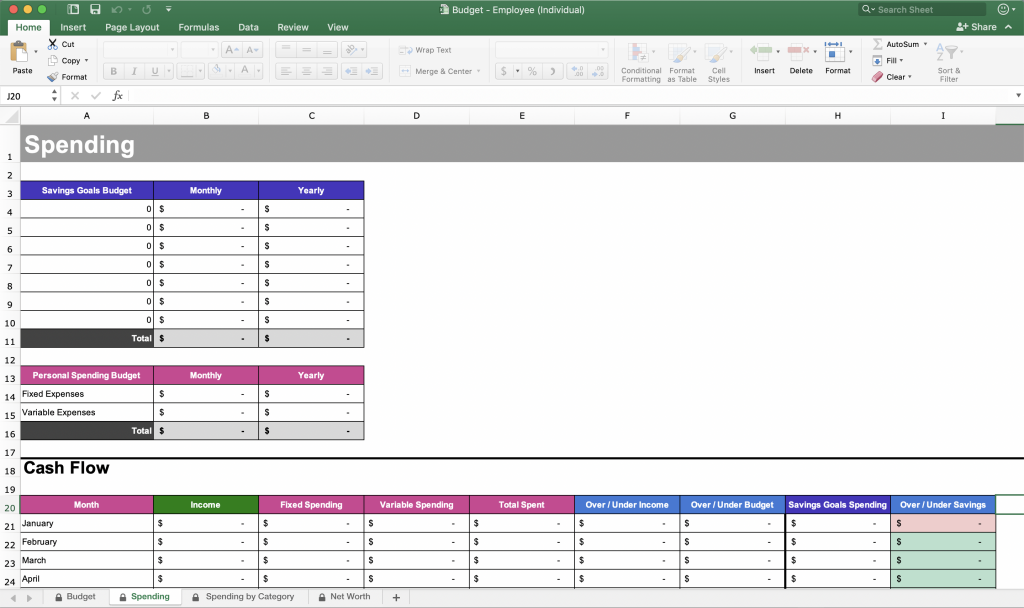

What paying yourself first means is putting the focus on saving first, spending second. That’s exactly why I’ve set up my budget spreadsheets so you have to allocate a portion of your income to savings before expenses.

You see, because you are forced to think about savings first, you are more inclined to cut expenses in order to afford your ideal savings goal amounts. The opposite is true too. If you start with your expenses first and find out there may not be enough money left over for savings, you’ll find it more difficult to cut expenses to afford savings.

2. Save Money Automatically

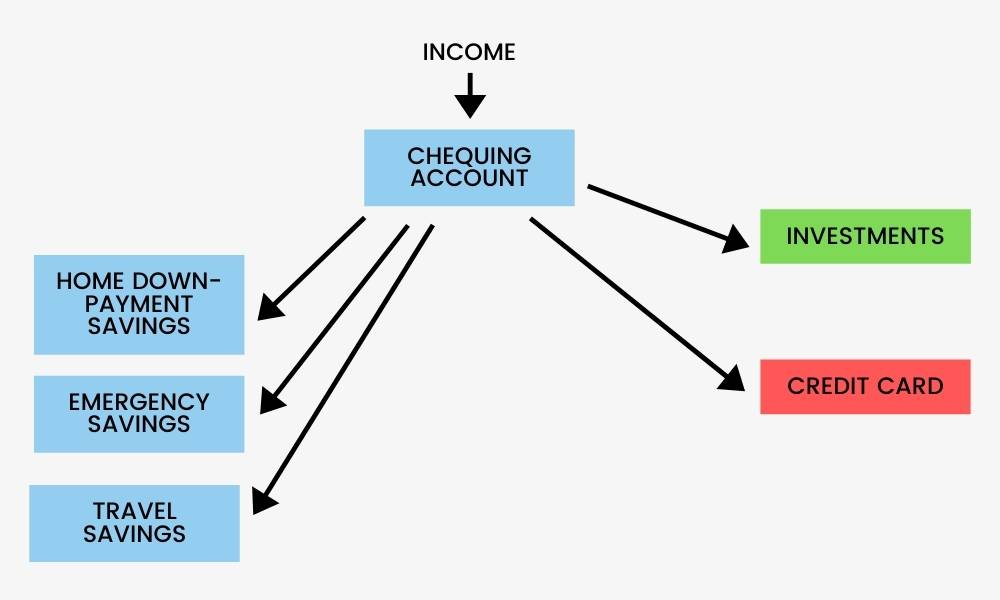

Once you’ve set up your budget to pay yourself first, make it automatic! This was another concept I learned in my 20s after reading The Automatic Millionaire, and there are countless surveys and studies that have proven this to be the most effective way to save as well.

The idea is that if you set up automatic savings deposits, say from your chequing account to your savings or investment accounts after you’ve received your direct deposit from your pay, you are more likely to grow your savings without much effort or thought on your part. In other words, out of sight, out of mind, while your savings grow in the background.

Alternately, if you don’t set up automatic savings deposits and rely on your own effort to manually transfer income to your savings or investment accounts, you are less likely to follow through and more likely to just spend that money instead.

So, take a look at your bank account set up and create automation so that every payday or every month, money is moved into your savings and investment accounts. Do it for a year, and I promise you’ll be pleasantly surprised by the results.

3. Track Your Spending

I know, I know, no one likes to do this! And I get it. It’s uncomfortable sifting through your spending and coming face-to-face with your past spending choices.

But tracking your spending isn’t meant to make you feel bad. It will actually make you feel good once you do it on the regular. You see, tracking your spending will help provide you with some much-needed clarity about your money by answering the age-old question “Where did all my money go?”

Moreover, it will be able to clearly answer another important question “Is my current spending helping or hindering me from achieving my savings goals?”

As a personal example, I’ve been tracking my own spending for 4 years now. Before that, I thought I had a good handle on my finances. But since I didn’t track my spending, I didn’t actually have any proof if that was true or that’s just the truth I was telling myself.

What I inevitably found out by looking at my past bank and credit card statements was that in 2016, the year before I started tracking my spending, I was spending money on the craziest things and not saving nearly as much as I could have. What crazy things? Bagels with cream cheese. Wine. Coffee. New clothes. Makeup. Expensive skincare. Stuff I know now I was buying to fill an emotional void because I was unhappy with my life at the time.

Well, since then, I’ve been tracking my spending every month and I even look forward to doing it. It makes me feel more in control of my money, and provides me with that helpful data that tells me to either “Slow down with your spending, things got a bit out of hand this month” or “Good job, you were able to spend within your budget!”

4. Cut Back on Expenses Outside of Your Value System

When you get into the habit of tracking your spending, you’ll be able to more easily identify areas you’d like to cut back on to free up more money for savings. Cutting back isn’t something that should feel like a punishment or restriction. Instead, think of it as a way to get you focused on your savings goals again, and to more mindfully consider whether your current spending aligns with your personal values.

I’m sure we’ve all read a headline bashing millennials for wasting money on avocado toast, implying that’s the reason we can’t afford things like a home of our own. Obviously, this is ridiculous. Avocado toast is not the bad guy (it’s too delicious to be a villain)!

What I think those articles were trying to say is that if you want to become a homeowner, then you need to decide what you value more? Expensive brunches every weekend, or saving up for a home down-payment?

By reviewing your spending and cutting out anything that doesn’t align with your values, it will make it so much easier to free up cash for savings, while still maintaining a life that makes you happy and a future that gets you excited.

5. Have a Wallet Reminder

You may have never heard of this little trick before, but it’s so simple and so effective. Put a card-sized piece of paper in your wallet, in the windowed space where you’d normally put your driver’s license. On that piece of paper, write down:

- Your top savings goals to keep you accountable, or

- A piece of advice that will help you close up that wallet and walk away from the checkout counter or close your Internet browser.

And to make sure you read that piece of paper before every online purchase, get rid of any bank or credit cards saved with any online retailers. They say it’s for your convenience to have it saved, but it’s really to incentivize you to make a purchase without taking that extra minute to reconsider.

6. Avoid Lifestyle Inflation

Last but not least, avoid lifestyle inflation. This was another piece of advice I’ve abided by for years, and I’m so glad for it.

Lifestyle inflation refers to you increasing your spending as your income increases. In other words, if you were to get a raise at work, instead of saving that extra money, you’d spend it on going out more, clothes, or finding a more expensive place to live.

Why this isn’t a good thing to do is because it pretty much keeps you in the same place you were financially before you got that raise. Even though your income increased, your expenses did too, meaning you still have the exact same amount leftover for savings.

A better strategy is to continue the same lifestyle you had before you got that raise, and divert the additional income you’re now earning into your savings or investment accounts. This way, you’re effectively accelerating how long it will take you to achieve your different savings goals, which will in turn help build your wealth quicker.

This strategy should also be used whenever you get an unexpected windfall like a bonus, raise, Christmas money, birthday money, a tax refund, or an inheritance. Instead of spending that money, put it into your savings or investments. Or, if you want to treat yourself a little bit (and there’s nothing wrong with that), give yourself a specific amount to spend on yourself just for fun (i.e. 15%), then save the rest.

Great article!

Thanks so much!

Love those tips, super-helpful! I’ve heard of “pay yourself first” and to be honest never understood what it really meant. It makes complete sense, I need to set this up ASAP!

Hey Jessica! Just wanted to say I really enjoy your content and you are truly an inspiration in the personal finance blogging space. Regarding this post, LOVE the first two points about paying yourself first and saving more money. Keep up the great work!

Thanks so much Jeff!

Your tips are simple yet useful. I love reading your content. Please recommend me how do I control my shopping addiction. This is the most where I end up spending most of my money. I read a number of blogs but not getting a feasible solution.

I’d say a good idea could be to work with a fee-only planner, financial counsellor, or money coach. This may be a good step if you’re looking help creating a budget, setting spending boundaries, and looking for some accountability.

Thanks for sharing such useful information on saving money.

Thanks for the comment, happy I could be helpful!