You may remember in the spring of 2019, I did a blog post and video on TD Direct Investing’s new WebBroker feature called GoalAssist. Well, a lot has changed since then!

Now, if you log into WebBroker, you’ll see that the same feature has a new name — Goals. Why do you ask? Because TD Direct Investing just launched a new mobile app-based service, and you guessed it, they’re calling it TD GoalAssist™.

So, what is this new app all about? How does it compare to WebBroker, the main trading platform offered through TD Direct Investing? And how does it compare to other trading apps in Canada?

Well, I’m about to tell you. When Goals first launched with WebBroker in April 2019, it was to help DIY investors set up and track their investment goals with their different portfolios. Although I’m still a big fan of the feature, I did have some ideas to make it even better than I expressed to the TD team early on.

Little did I know, they were already several steps ahead of me.

What Is TD GoalAssist™?

On October 27, 2020, TD Direct Investing launched a new mobile app-based service called TD GoalAssist as a way to help Canadians set financial goals (as they can through the Goals feature in WebBroker), invest for their futures, and most significantly, save on fees.

One of the big perks of TD GoalAssist is that there are no account balance minimums, no maintenance or inactivity fees, and you can make commission-free trades on all TD ETFs. In other words, if you used the app and only traded TD ETFs, you would pay zero fees (aside from the MERs embedded in the ETFs themselves).

This app is the first of its kind in Canada and is available to download on iOs and Android.

Can I Trade Stocks on the App?

But honestly, it’s very simple. It’s a trading app that allows you to buy any stock listed on all major North American stock exchanges or TD ETFs.

I should point out that although there are no commission fees for TD ETF trades, that doesn’t apply to stock trades. If you want to trade stocks, there is still the same $9.99 commission fee just like with WebBroker.

What ETFs Are Available to Trade on the App?

I should also make clear that although you can trade any stock from the major exchanges, the only ETFs available to trade on the app are TD ETFs. If you want access to more, a TD Direct Investing WebBroker account might be a better option. But the large suite of TD ETFs still enables a wide range of investment strategies, especially if you mix them with your favourite stocks. And it’s hard to argue with commission-free trades. For a look at the different ETFs they offer, check out their TD ETF page.

How Is TD GoalAssist Different Than TD Direct Investing’s Goals?

That being said, the biggest difference between TD Direct Investing’s WebBroker platform and the new TD GoalAssist app is that TD GoalAssist includes the same Goals feature, but also provides a guided experience helping you to create a portfolio to match your investment goal.

You see, when you’re in the TD GoalAssist app, you determine your investment goal and risk tolerance. You then have the option of either creating your own portfolio of TD ETFs or stocks or selecting a TD ETF portfolio that most aligns with your investment goal and risk tolerance using a TD One-Click ETF Portfolio.

What Is a TD One-Click ETF Portfolio?

In case you’re not familiar with TD One-Click ETF Portfolios, these types of ETFs are often called asset allocation ETFs or all-in-one ETFs and most of the major ETF providers offer them too (they’re more common than you think!).

Think of them as an ETF comprised of ETFs that automatically rebalances itself to a particular asset allocation to stay aligned to a particular risk rating.

Let’s look at an example, shall we?

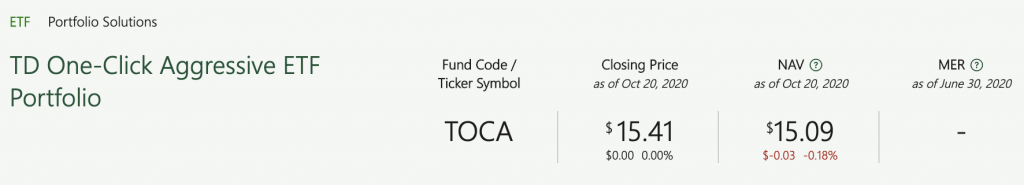

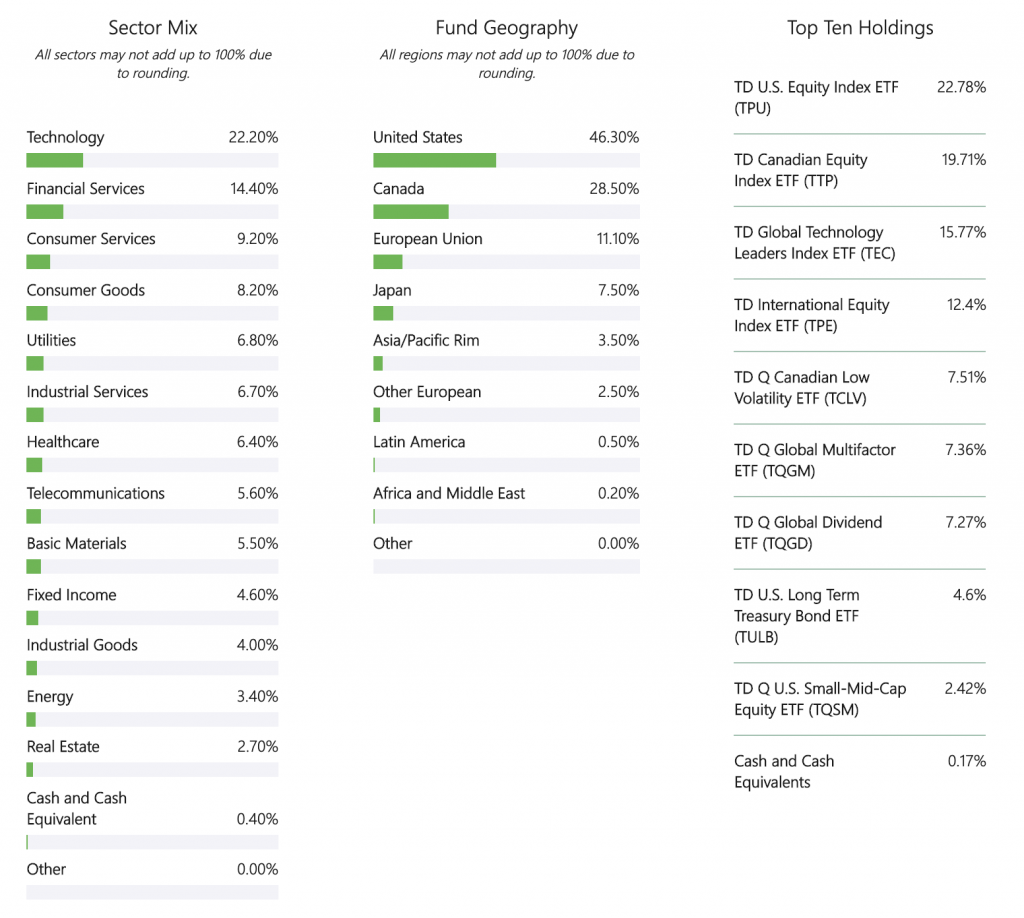

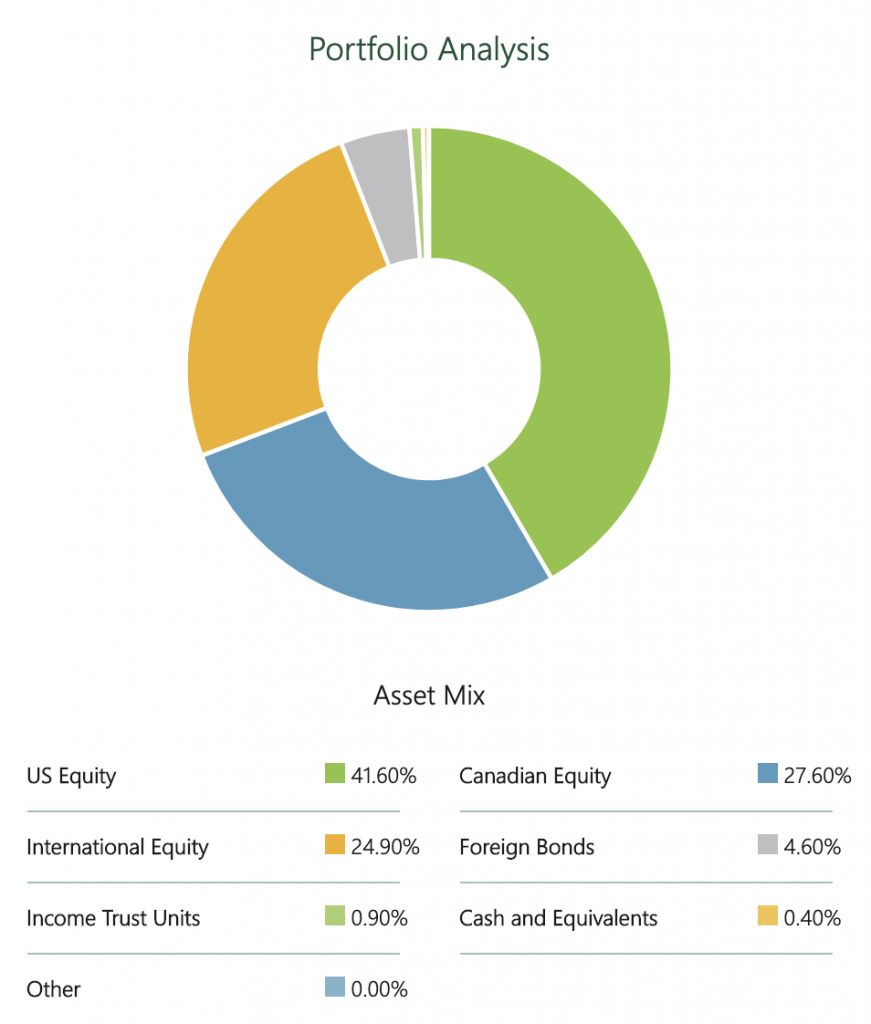

Take TD One-Click Aggressive ETF Portfolio (TOCA) as our example.

It is an ETF, but inside it are other ETFs, which you can see in the Top Ten Holdings section.

Figure 1: This image reflects the holdings when it was taken on Oct. 23, 2020 – note that holdings are subject to change

By putting all of those ETFs together, it is designed to create a diversified portfolio of equities and fixed income with exposure to different markets.

And the beauty of it is that if you’re happy with the asset allocation and its risk rating, you don’t have to rebalance it. A team of professionals at TD Asset Management Inc., Canada’s largest money manager in pension assets, does that for you.

Wait, Is This a Robo-Advisor?

TD GoalAssist is an electronic self-directed investment service. So even though there’s robo here, there’s no advisor. TD GoalAssist doesn’t offer investment advice, product recommendations, or monitor the suitability of your investments. Instead, it gives you simplified resources to help you make decisions for yourself about your investments.

Doing it yourself means that you call all the shots and can avoid the management fee (typically 0.50%) that robo advisors charge in addition to the MERs of the ETFs in your portfolio (typically between 0.10-0.30%). If you were to invest with TD GoalAssist, you would only be paying the $9.99 commission fee on stock trades and the MERs of TD ETFs. For example, if holding only a TD One-Click ETF Portfolio, you would only pay the ETF’s MER which is 0.25% since TD ETF trades are free.

This is all to say that if you want the convenience of a robo-advisor but want to save on fees (because who doesn’t love more money in their pocket?), TD GoalAssist may be a good solution for you.

What Account Types Are Available?

When setting up your TD GoalAssist account, you can open cash, RRSP and TFSA accounts in Canadian dollars.

What Kind of Support Is Provided?

Since this service is still part of TD Direct Investing, which is a self-directed online brokerage, they cannot provide investment advice. This is the same for any other discount brokerage. Similar to WebBroker, TD GoalAssist provides support to its users and Investment Representatives are available to answer questions.

Moreover, there is a dedicated “Learn” section within the app that features a library of short, highly visual educational videos to help you build your foundation investing knowledge and to guide you through the app so you can better understand how it all works.

Final Thoughts

To me, TD GoalAssist is a great solution for anyone who wants to dive into passive investing but is looking for something in between a robo-advisor and a regular discount brokerage platform.

Robo-advisors are great, but they do charge a management fee on top of your portfolio’s MER, which can add up over time. Building and managing your own portfolio is a great way to have flexibility with your investments and save on fees, but it’s also a lot of responsibility and does include some time commitment to be successful at it.

The best of both worlds may just be in the form of TD GoalAssist.

If you want to trade stocks, consider whether you’ll get more value from this app than having a TD Direct Investing WebBroker account. WebBroker charges the same amount for stock trades and has a wider selection of investments and services available.

But TD Direct Investing WebBroker accounts can have a maintenance fee which usually bites accounts with less than $15,000 in them. So if you only have a little to invest at the moment, you might find that the streamlined investment selection offered through TD GoalAssist is still a fair trade-off to avoiding a maintenance fee.

To explore more about TD GoalAssist and find out how you can start investing towards your goals, click here.

The flaw in it all is that you are compelled to purchase TD funds only, good and bad. With Tangerine, not so. I have investments with TD and Tangerine

Yes that’s definitely something to consider. You are limited to TD ETFs in the app, but if you were planning on investing in them anyway, using the app could save you money in fees. But Tangerine isn’t really an equal comparison since they offer a very different product. They aren’t a discount brokerage for starters, and their portfolios are built with index mutual funds, not index ETFs. And because of that, their fees are higher because mutual funds are more expensive products than ETFs. You’re looking at paying 1.07% with a Tangerine portfolio compared to 0.25% for the TD One-Click ETF Portfolio.

I already have RRSP , TFSA and a non- registered account at TDDI . The one feature of TD Goal Assist which is of interest to me is the ability to buy and sell TD ETF’s commission free.

Is the only way to do so is to go through the entire procedure of opening up new duplicate accounts , funding them , and then being able to buy commission free ETFs only on the app based Goal Assist accounts ?

If so , is this not redundant ?

And if not, if I am misunderstanding , how can I simply buy commission free TD ETFs through my already existing TDDI accounts ?

Thank you

Yes, that’s correct William. TD DI’s WebBroker and TD DI’s GoalAssist app are completely separate and don’t talk to each other. So if you want to invest in TD ETFs through the app, it would mean opening up a new account in GoalAssist, funding it, then buying the ETFs. As someone who also invests using WebBroker, I also wish there was a way I could simply move my TFSA that lives in WebBroker over to GoalAssist in a seamless way, but that’s currently not how it’s set up. Hope that clarifies things.

Yes, that does clarify things.

It clarifies that TD is prepared to offer incentives to target new investors with smaller amounts to invest – clearly a good thing.

What is not so good is that TD is not prepared to extend the same benefit to an existing client – say, one with a seven figure account.

Strikes me that this should not be difficult to treat existing WebBroker clients and new Goal Assist clients the same , and that the decision not to do so is a choice and not due to any any actual barriers preventing it.

Also hard for me to see the risk /reward here for TD in alienating ( and potentially losing ) the existing client.

No ?

I agree with this comment. Before opening a Goal Assist Account I went to my WeBBroker account and tested whether I would get the same perk of no commission When buying units of a TD OneClick ETF. Not so. As a “valued” investor I am hit with the $9.99 commission that a newbie to TD investor would not have to pay. Doesn’t sound like good customer loyalty and retention.

Hi Jessica

Do you have any more info on the TD one click etf’s? Right ups or podcasts?

I current have a TD balanced growth mutual(apprx 20K) l that I would like to switch. This could be an option or I have been researching the e-series as well Vanguards etf’s.

Thanks,

Chad

I would definitely suggest looking into investing in a portfolio of ETFs instead of mutual funds because they offer the same diversification with way lower fees (saving you a ton of money in the long-term). For asset allocation ETFs, there are the TD ones, then Vanguard, iShares, BMO, and Horizons also have them. You can check out the different MERs and portfolios they offer to compare, then make a decision that works with your investing goals. The bonus if you’re using TD GoalAssist, TD ETF trades are free. For other ETFs, unless you’re using Questrade, there’s a commission for trades.

I understand the management fee of the all in ETF TD offers, however, are the fees layered? Are you still charged the underlying fees of the basket of ETFS. Example, does TEC (an ETF of TD in the basket of the all in account) charge a fee of 0.20% and then the overall all in ETF charge another fee of 0.25%???

Thanks

The MER of the asset allocation ETF is all you pay. It includes management and the MERs of the underlying ETFs.

is there a fee for transferring my existing TFSA and RRSP from my regular TD account to TD GOAL ASSIST?

I don’t think sp, but to double-check I’d suggest contacting TD GoalAssist’s support team.

i buy mostly U.S. ETFs and Stocks. So this app is of no use to me. Will they have a U.S. account any time soon?