I honestly didn’t think I would be able to write this post. Because I honestly didn’t think I would pass the Canadian Securities Course (CSC®) my first try. But here we are and thank god for it!

Let me give you some context. I’ve been in the personal finance world for almost a decade now, starting out as a hobby personal finance blogger in 2011. That hobby blog evolved, and 4 years ago I left my corporate job to work for myself as a content creator, speaker, money expert in the media, and financial counselor.

After I became an Accredited Financial Counsellor Canada (AFCC®) at the start of 2018, I thought I was done with formal financial education. It took me a year to get those credentials and I felt wiped out by the end of it.

Cut to 6 months later and I got a bit restless. Although I really enjoyed the AFCC program (maybe I’ll write about that in a future post), it didn’t go in-depth on topics like investing. Moreover, although I’ve been able to bring more awareness to the program with my platform, most people have still never heard the term “financial counselor” before.

You know how annoying it is when someone asks you about your credentials, you tell them, and they look at you blankly because they have no idea what an Accredited Financial Counsellor Canada is or if it’s even “legitimate”. It is by the way. It’s just not as popular a program in Canada compared to the U.S. where it originated. Typically most people who do the program pursue a career as a credit counselor for a credit counseling agency. But I digress.

The Canadian Securities Course through the Canadian Securities Institute, on the other hand, people have heard. Almost every other Canadian personal finance expert I know, not to mention journalists and financial planners, have taken it.

So to me, it was the natural next step to take. However, now that I’ve checked it off my list, I’ve set my sights even higher. I’m slowly pursuing the Certified Financial Planner (CFP®) designation. I’ve even signed up for Financial Planning 1 through the Canadian Securities Institute to continue down that path. But I’m not here to talk about the CFP or the AFCC. I want to share with you my experience and my study tips for passing the Canadian Securities Course.

How Long It Took Me to Pass the Canadian Securities Course

From cracking open Volume 1 of the CSC coursebook to passing the Volume 2 exam, it took me 3 months to complete. Would I suggest this as a reasonable timeframe for doing the Canadian Securities Course? Absolutely not! My heart starts to race just thinking of the stress and pressure I put on myself to do it so quickly.

In the course, it does provide a study planner for 3, 6, 9, and 12-month windows. To me, 3 months isn’t really enough time to let all the content truly soak in and for you to do all the interactive quizzes, watch all the videos, and take all the practice exams.

So…why on Earth did I try to do it in only 3 months? Money. That’s why. I signed up for the course in 2018. I paid to renew it in 2019. And in 2020, I had to take it otherwise be forced to pay the full fee once again (you can only renew it once). Thankfully, because of the pandemic, my course license was extended. It was set to expire in July 2020, but it was extended to the end of October. This little saving grace motivated me to get serious about studying. Still, I didn’t leave myself much time. I started studying in mid-July, and had my first exam on Sept. 23, and my second exam on Oct. 14.

Although the course provides a study planner, since I was in a time crunch, I just did my own thing. If I was smart and left myself more time, I probably would have opted for the 6-month plan. Instead, here’s what I did:

- 2 Weeks: Volume 1 has 12 chapters, so I studied a new chapter every day, which also included me watching all the accompanying videos and doing the interactive quizzes.

- 2 Weeks: Volume 2 has 13 chapters, so I studied a new chapter every day to replicate my process for Volume 1.

- 3 Weeks: I went back to Volume 1 to study since that was the first exam I booked to take. I re-read the entire textbook, highlighted sections, wrote notes and terms on flashcards, re-watched a few of the videos, then did both practice exams. I passed both practice exams, which gave me confidence that I’d pass the real exam.

- 1 Week: I needed a break from studying (and my mental health!), so I took one week off from studying.

- 3 Weeks: In the final 3 weeks, I studied Volume 2 again, which included re-reading the entire textbook, highlighting sections, and making flashcards. I only did one of the practice exams because I felt a bit burnt out from all the studying, but I passed it, and thankfully I passed the real thing too!

So yes, I read both textbooks twice! And I can honestly say I have never studied so hard for anything in my life! But I’m glad I did. Not just because I passed, but also because that information is very much ingrained in my mind now and for the future.

Don’t Cheap Out on Study Materials

One thing I was worried about was that my textbooks were a few years old since I’d signed up for the course 2 years prior. I have no idea what’s different in the updated textbooks, but if I were you, I wouldn’t try to save money by buying someone’s used textbooks. Just play it safe and get the new ones.

Moreover, there are a few different options for enrollment. I opted for the most expensive package because if you’re going to cheap out on something, maybe it shouldn’t be on study materials for an exam you hope to pass. I bought the Canadian Securities Course (CSC®) Value Pack Combo and I’m so glad I did.

I found the videos super helpful and the practice tests invaluable. But, the package also included a Financial Investment Calculations Toolkit with a calculator, Financial Statement and Ratios e-Tutorial, and Macro and Microeconomics e-Tutorial which I didn’t use at all. Also, the free calculator you get isn’t great. Instead, I bought the Texas Instruments BA-II-Plus BAII Plus Financial Calculator since I wanted a calculator I could find YouTube tutorials on how to use it. It’s also the calculator used in course videos.

I found the videos super helpful and the practice tests invaluable. But, the package also included a Financial Investment Calculations Toolkit with a calculator, Financial Statement and Ratios e-Tutorial, and Macro and Microeconomics e-Tutorial which I didn’t use at all. Also, the free calculator you get isn’t great. Instead, I bought the Texas Instruments BA-II-Plus BAII Plus Financial Calculator since I wanted a calculator I could find YouTube tutorials on how to use it. It’s also the calculator used in course videos.

What Sections You Should Focus On When Studying the CSC

The course gives you the breakdown of the exams, and they are pretty on-point for what you should focus on.

As you can see for Volume 1, 23% of the exam focuses on a fixed income. The exam made it feel like it was closer to 35%, but maybe that’s because I hate doing bond calculations. Fixed income was definitely my weak point, so I spent more time studying those sections. And yes, you do unfortunately have to memorize mathematical formulas. They don’t provide them for you. So make some flashcards and memorize them.

For me, my strong points were the Canadian Marketplace and, to my surprise, Derivatives. As you study and take the practice exams, you’ll find your strong and weak points too. What fun!

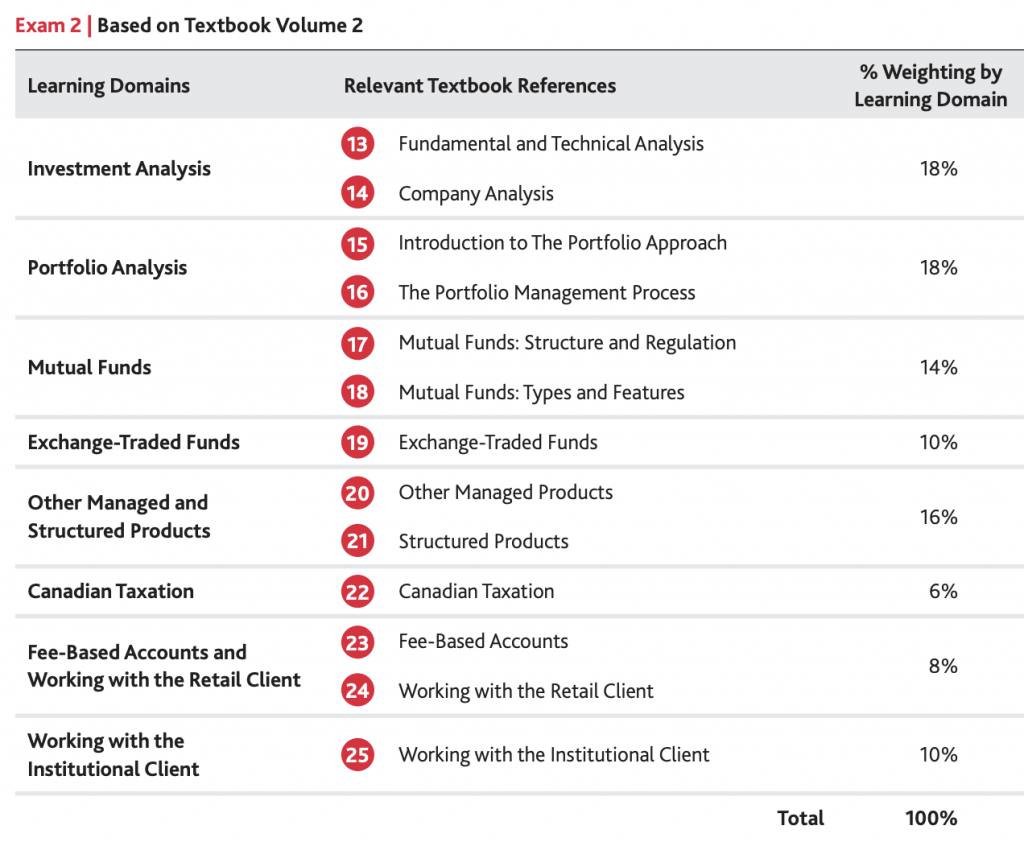

For Volume 2, overall I found the study material easier to digest and generally more interesting. But if you were to look at my test marks, you would have no idea! No joke, I marked 1% higher on the Volume 2 exam compared to Volume 1.

For Volume 2, overall I found the study material easier to digest and generally more interesting. But if you were to look at my test marks, you would have no idea! No joke, I marked 1% higher on the Volume 2 exam compared to Volume 1.

Although fixed income was the big focus of Volume 1, with Volume 2 I didn’t really feel like one section took over. Looking at the exam section weightings, Investment Analysis and Portfolio Analysis are the heaviest weighted, but when taking the exam it really feels like it. I personally struggled with Investment Analysis. Although I enjoyed the content, I found it difficult to memorize, but it could have been because of study fatigue or a number of other factors.

What the Exam Is Like During Covid

I never thought I would take an in-person exam during a pandemic, but now I can say I’ve done two! I thought it was weird that the Canadian Securities Institute didn’t offer the CSC exams online using a virtual proctor. That was the setup for my financial counseling exams and I really appreciated the convenience of being able to do the exam from home.

I’m not sure if that’s something the CSI is working on for the future, but hopefully, they are, considering how long you now have to wait to find an open slot to book your exam (the backlog is insane!). I booked both my September and October exams in late July, and they were the last slots available. I also recently looked to see when was the soonest I could book my exam for Financial Planning 1, but it’s booked solid for the rest of 2020.

For my exams, I opted for computer-based exams instead of paper-based. I prefer doing exams on a computer, plus the big benefit is once you finish you find out instantly if you passed or failed. You just have to wait a day or two to find out the exact percentage you got. But keep in mind it does cost $75 to do the computer-based exam, whereas paper-based is free.

In terms of what to expect at the exam centre, I mean, we are in a pandemic. But the CSI gives you clear instructions on safety protocols, and here’s what that looks like:

- You must have a mask on the entire time upon entering the exam room and taking the exam.

- Your temperature will be checked before being allowed to enter the exam room.

- You must bring your own pencils, eraser, non-programmable calculators, and government-issued photo identification. If you do not have any of the above, you will not be permitted to write your exam. If you’re doing a computer-based exam, you are allowed to use a pen, but for paper-based exams, you must have pencils.

- You must take off the cover of your calculator for the exam, as some covers have programming instructions on them that are not allowed.

- You must arrive at the exam centre 30 minutes in advance of your exam. If you arrive earlier, you’ll be turned away because they cannot offer a waiting area.

- Upon entering the building where the exam centre is located, follow signage, social distancing protocols, and instructions that the exam proctor will provide.

- Washroom breaks and food are not permitted during the exam. You can however use the bathroom before and after the exam with permission.

One thing I also didn’t realize before taking the first exam is you’re allowed to bring flashcards, your phone, and textbooks with you into the exam centre before the exam. So you are allowed to do some extra studying before taking the exam. You’ll just be told to put all of your belongings away into your assigned cupboard near the entrance 5-10 minutes before the exam starts.

Also, the exam proctors can’t really help you. Unless you have a technical problem, they don’t allow you to ask any questions specifically related to the exam. Lastly, not everyone in the exam room will be doing the same exam. Some people may be taking the CSC, Wealth Management Essentials, or other exams offered by the CSI.

What I will say is I thought the CSI did a very good job in terms of safety protocols. I felt safe the entire time. There was clear social distancing and overall it was very efficiently run.

Why You May Want to Take the Canadian Securities Course

I want to end this post off with explaining why you may want to take the Canadian Securities Course. Initially, my goal was simply to pass the CSC and move on with my life. And somehow only a few days after passing, I enrolled in yet another course with the intention of now completing the CFP exam in a few years.

Is the Canadian Securities Course worth taking just on its own? In my opinion, yes. Because I think knowledge is always worth it. That being said, the CSI does offer the CSC at a lower price point called Canadian Securities Course (CSC®) for Investors. Although it’s half the price, it doesn’t include the exam or the certification after passing. So if you just want the textbooks to learn on your own, that is an option. But what’s the fun of studying without the motivation of an exam or the reward of a certificate? But that’s really up to you.

If you want to take the CSC to further your career, here are some of the different paths you can take.

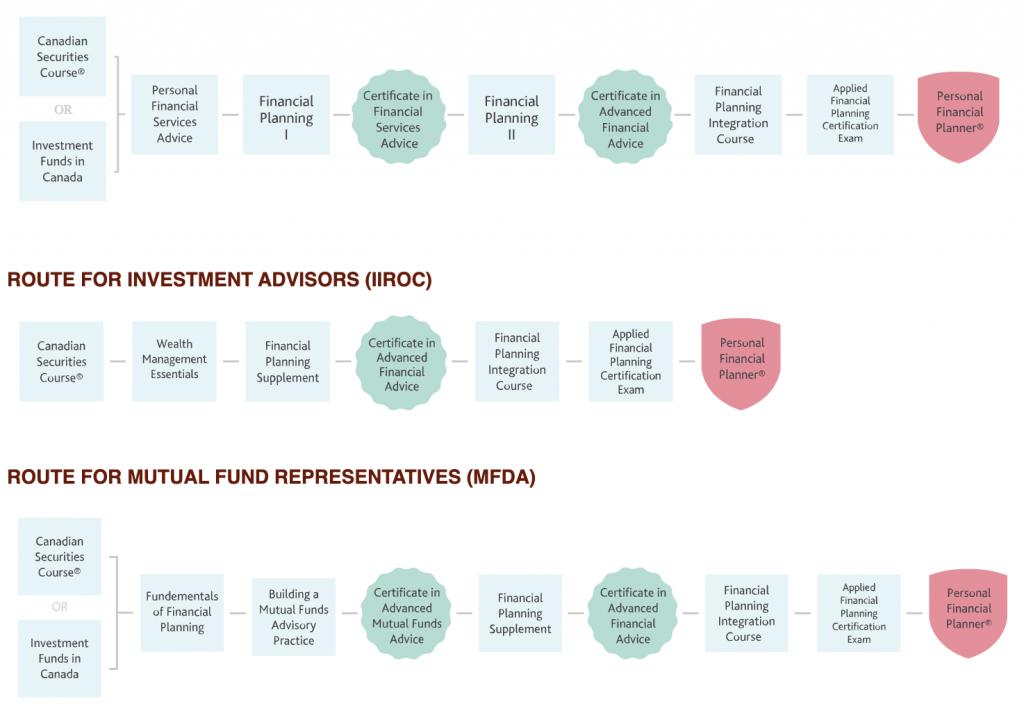

Personal Financial Planner (PFP®)

You could become a Personal Financial Planner (PFP®). Not to be confused with the Certified Financial Planner (CFP®) designation, the PFP is a designation that many people pursue working as financial advisors at financial institutions. Honestly, outside of the financial industry bubble, most people have never heard of the PFP. That’s not to say that it’s bad or not worth getting, but I would suggest doing some research to see if it makes sense for your personal career path.

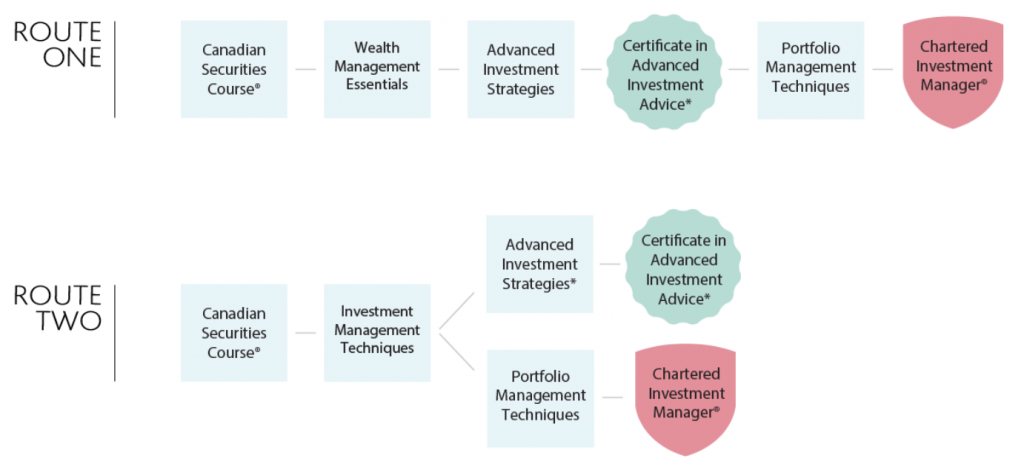

Chartered Investment Manager (CIM®)

If you want to become a Portfolio Manager, Advising Representative, Associate Advising Representative or to be able to conduct discretionary portfolio management services for clients with an IIROC member firm, this might be a designation you want to pursue after passing the Canadian Securities course.

MTI® Estate and Trust Professional

If you aspire to manage estates and trusts with affluent clients, the Canadian Securities Course could lead you to earn the MTI® Estate and Trust Professional designation.

Certified Financial Planner (CFP®)

And lastly, there’s the route I plan on taking, the Certified Financial Planner (CFP®) designation. Although there are different paths to becoming a CFP, such as through Advocis, since I already did the CSC it only makes sense to continue taking courses through the CSI instead of another institution.

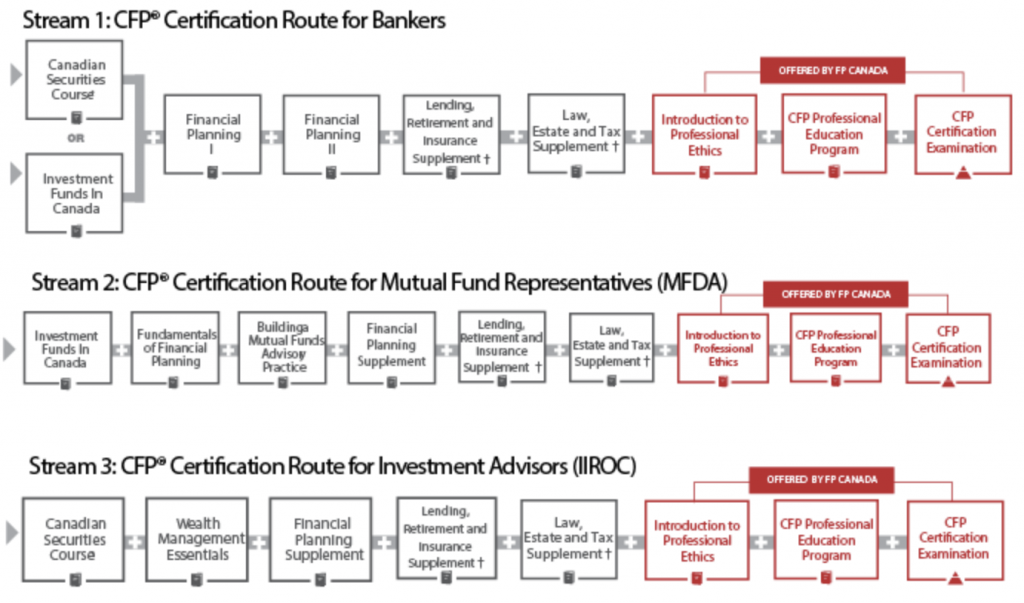

I’m going to be taking Stream 1, and as you can see, I’ve got 6 courses to take before I can take the CFP exam. My estimate is that it will take me two years to get exam-ready, so wish me luck!

Final Thoughts

One thing I found helpful was going on forums like Reddit to see what other people’s experiences were like. Well, sometimes I found people’s responses helpful. What I didn’t find helpful was anyone saying that the exam was easy or it’s a beginner course. Sure, it’s a foundational course to achieve a certain designation or credential, but calling it a beginner course makes it sound like the learning material and exams are easy.

It’s not. Far from it. On the CSI website, you’ll see that it estimates that it will take you between 135-200 hours of study time depending on your background and level of comprehension. That is definitely accurate. Although I’m quite experienced when it comes to personal finance and didn’t have to much trouble with comprehension, I estimate that I spent at least 200 hours studying. And the reason for that is because there is just so much content to understand and memorize. No one can just breeze through the textbooks and expect to pass (unless you have a photographic memory or have done similar courses before).

If you want to pass, I would suggest giving yourself at least 6 months to study. I would also suggest focusing on Volume 1, then taking the exam, then cracking open Volume 2 to study. Don’t try to do both simultaneously. If I could do anything differently, it would have been to focus on one volume at a time.

Also, because I was considering doing this but am glad I didn’t, I personally don’t think it’s necessary to spend any extra money by buying practice exams or study notes from other organizations. You’ll be just fine with the resources provided directly from the CSI. But also, do what you need to do to pass! This was just my experience and worked for me.

Got any questions for me? Let me know in the comments, I’ll be happy to answer!

Hey Jessica, thanks for this! Would you recommend someone try taking this if they are terrible at math — like, failed gr. 11 math and never took it again, bad? I’m a financial journalist but don’t have much confidence that I could handle equations. I know there’s the investor option but, like you said, doesn’t come with a certificate.

Oh definitely! I stopped taking math after grade 11, so the equations in the course aren’t that complex. They are fairly basic formulas like (A-B/Bx100). I’d say the biggest challenge is just mental. When you think you’re “bad at math” for so long, you have zero confidence when it comes to memorizing formulas. But just watch some of the videos, I also watched some YouTube tutorials, then practice with your calculator, and you’ll be able to memorize in no time. As a reference, I didn’t start memorizing the bond equations for Vol. 1 til two days before the exam and it was fine. So don’t let that be the reason you don’t do it! If this gal who has a fine arts degree can pass the CSC, you can too!

Thanks! I appreciate the insight! Hopefully I can start next month!

That’s one of the silver linings of this pandemic. Since we’re all stuck at home, there’s never been a better time to hunker down and study. Good luck!

Why dint you look at taking up ific against csc, as with both you can take up CFP. Cost wise ific is cheaper as well.Any particular differentiating factor between csc and ific??

I signed up to take the CSC before I made the decision to pursue the CFP. Also, not sure what you mean by taking IFIC against CSC? The Investment Funds Institute of Canada doesn’t offer a CFP program. Advocis is typically the other program/path people take against going through the Canadian Securities Institute. Or you can do it through a college of CIFP (The Canadian Institute of Financial Planning). https://www.fpcanada.ca/students-and-candidates/education-requirements/core-advanced-curriculum-providers

Hey Jessica,Thanks for the reply , I meant csi themselves offer Ific course . As per the career path chart listed in their website People who pursue that also can take the cfp path (correct me if I am wrong) , Wanted to know what the key difference between the Canadian securites course and investment funds in Canada course offered by csi .Your views and advice on the same would greatly help.Thank you

Oh I see, I thought you meant the IFIC organization, not the Investment Funds in Canada (IFC) course. Typically, the people who take the IFC want to become mutual fund dealers. As you’ll see in the description of the course page (https://www.csi.ca/student/en_ca/courses/csi/ifc.xhtml), the course’s focus is heavy on mutual funds. It even says at the bottom of the page to consider taking the CSC as an alternative path because it’s more comprehensive. But for me, the big deterrent from taking the IFC instead of the CSC is it limits you. For instance, if you want to become a Chartered Investment Manager (CIM) or MTI Estate and Trust Professional, you require the CSC.

Thanks Jessica, your inputs were valuable

Hi Jessica,

I completed my CSC this year as well and I’m now about to write the Conducts and Practices Handbook, can you explain why your next course of action isn’t the CPH?

Because I have no plans to become a licensed investment advisor, I’m instead working towards becoming a CFP.

Hello Jessica, it’s really nice that you detailed posted all the information about CSI and I am really thankful for it (: I am a fresh graduated diploma and I am interested in Finance industry, so I am considering about CSI, any recommendation or suggestion for a freshman like me? Thank you again (: Hope to see your response

Hi Amy, all I can share is my experience studying and passing the exam, not with entering the finance industry workforce. I’ve never worked in the traditional financial industry, have always been self-employed. But my suggestion would be to connect with people who have roles you aspire to get and ask about their path. Good luck!

Hi Jessica,

From your experience, how similar would you say Exam 1 was in relation to the Practice exams (in terms of difficulty. I completed both practice exams, with a result of 80% on both, and write my actual exam tomorrow. Was hoping you can help me get a better idea on what to expect.

Thanks

The real exams I found to be more difficult, though it could also be due to the setting (the exam centre, especially during Covid, was more high stress than doing it on my laptop in my living room). I did much better on the practice exams than the real thing, but you should be fine scoring that high on the practice exams. Remember, the goal is to pass. Anything above that is just gravy. Good luck, you’ll do great!

Appreciate the quick reply Jessica and thank you for the insight.

Jessica, congrats on your passing the CSC and good luck with your career path. I finished my Volume 1 exam in October and my Volume 2 exam is slated for end of Jan in Mississauga. I totally agree with your assessment on Practise Exams/ Chapter Quiz vs the Exam questions. If I remember correctly there was only a few (less than 5, if that) Practise Exam questions came up in the actual Exam. They actually had a couple questions from Volume 2 thrown in in the Volume 1 Exam. One that I can remember was on the “Buy Side” which was in Volume 2 !!

Question for you Jessica, can I expect more of the same; ie Practise/Chapter exams vs the actual Volume 2 Exam?

Thanks in advance.

Best regards

Dan

Congrats on passing Vol. 1! I feel like when I went through the exams, I didn’t really notice too much if any replication of the questions from the practice exams (then again, I wasn’t really focused on that I was so focused on just passing haha!). But yes, expect more of the same. There may only be a few similar questions, but otherwise it’s really a completely different exam. Personally, I enjoyed Vol. 2 more than Vol. 1, plus having the confidence going into the exam knowing you passed Vol. 1 also helps when taking the Vol. 2 exam.

Hey Jessica , thanks for providing your experience with the CSC exam. I’m pretty much on the same path as you as far as finishing In 3 months . I’ve passed volume 1 already in Dec and planning to take the exam for volume 2 at the end of January 2021 . I agree not ideal but so far so good but lots of studying lol .

I had a quick question concerning your next steps in your learning for the CFP designation . Why did you Choose steam 1 vs stream 3? Is there a big difference ? I

I chose stream 1 for the CFP because I was genuinely looking forward to taking both Financial Planning 1 and 2 courses. And so far, I’m not disappointed!

Thanks for your reply and glad you’re enjoying the courses.

hi Jessica , happy new year. thanks for your sharing . I think it was very useful. I am ready to apply for the csc because I want to work in bank.

Glad you found it helpful!

Ive enrolled in CSI course and bought the combo pack!!! Videos??? Where??? And are there practice exams available in package or do you have to pay extra???

You’ll be able to find all materials when you log into the Student Login on the CSI website, then click on “Access Online Courses”.

Hey Jessica – thanks for taking the time to blog. Just wrote the first test and passed. You’ll be pleased to know that the exam is now done remotely! Onward to volume 2!

Yes I heard, that’s great news!

Thank you so much for the valuable input. I want to know whether taking the Canadian securities course from a college will help to have better chances and pass this certification?

If it’s instructor-led then it may be easier than self-paced with the textbooks. I personally prefer self-paced so I can do it in my own time (I’ve always hated lectures).

Hey Jessica, Thanks for the helpful insights about the exam. I am scheduled to write exam 2 in a couple of weeks. The only thing which is bothering me is the Investment Analysis section where I just don’t know any method to remember all those ratios. Any inputs on this would help. Hope I am able to clear it. TIA

From what I remember, that wasn’t a big section of the exam. But since you still have some time to study, if there are any areas you feel are your week points, make sure to go through the exercises again and just keep going through those sections until you feel it makes more sense.

Hey Jessica,

I’m in the process of studying for the CSC 2 exam and was curious how many calculation based questions there would be. Do you recall roughly?

Not a lot from what I remember especially compared to exam 1. I spent a lot of time memorizing formulas for Vol. 1 and not much time for Vol. 2. It’s more about concepts than calculations I found.

I studies for almost 7 months gave exam 2twice dnt clear, really felt many questions were out of syllabus

Not sure if I understand. You studied for 7 months, didn’t pass, and you felt like most of the questions were not related or outside of the course content? If so, sorry to hear about your struggle but I’d have to disagree. Best of luck on trying the exams again and don’t give up!

Hey Girl,

i really appreciate coming across your blog as i’ve been trying to seek some help in terms of a guide on how to study more efficiently. My exam 2 is in the beginning of the first week of April and I’m currently working 9-5 which sometimes end ups going to 6-7. How would you recommend to studying efficiently for a dry material course like this? A friend mentioned she would read it 3x (first to briefly read, second to highlight and third to summarize). I’m struggling to read it simply haha. Looking forward to your help!

Ya I read both textbooks twice. Once to just absorb the info, the second to highlight and make flashcards, and I’d highly recommend that. If I were you, I’d make a clear schedule to study and stick to it. This exam is no joke!

Hello Jessica,

Thank you for making this blog. It is really informative. I would like to ask one question: I am not finance student or have any mathematics background, would it would be hard for me to take the course. Would you recommend any basics that i should study before taking the course?

I look forward to hearing from you. Thank you

If you have zero investing or finance background, it might be worth it to read some finance books beforehand and listen to some podcasts just to get familiar with it all. I’ve got a list on my recommendations page to check out.

Hi Jessica,

I tried on IFIC exam and I failed on my first attempt which I know I used the wrong method to study.So I am planning to write exam on next month that I saw IFIC Check 2019, a kind of study material which helpful in the exam.Cost $150.Do I have to buy that one or use the different method to study and get the pass mark? I am so down and confused.Please let me know any suggestion which I can improve ?Thank you

So the IFIC course (Investment Funds in Canada) is a different course than the Canadian Securities Course so I can’t really speak on that since I haven’t taken it. If you’re asking whether it’s worth it to buy the IFIC Online, interactive version for the course, I did for the CSC and found it very helpful for studying.

Hello Jessica,

I have couple of questions. Do we have to enroll for the csc course in order to give the exam? As i got material from my friend so i am thinking to study on my own without enrolling and just give a exam. My second question is if we fail volume one or vol 2, do have to give both exams again?

I really enjoy the recommeded podcasts as well. Thank you

Yes you have to register for the course in order to take the exam. If you fail one of the exams, you just need to retake that exam. You don’t have to retake both if you passed one since they are completely separate exams.

Hi Jessica, which institution you Can recommend I Can enrol With The course.. I Did My Canadian incestment finds course With IFSE . However, they Dont have CSC course.

Any recommendation ?

By The way, Thank you So much for sharing Your Experience

You can only do the Canadian Securities Course through the Canadian Securities Institute.

Thank you for the information, are you aware if all this info is applicable for someone planning on working in Quebec?

Great question! I think everything’s a bit different for Quebec residents so your best bet is to contact the CSI directly. However, I did find this page with info on the Financial Planning Program for Quebec that may be helpful https://www.csi.ca/student/en_ca/designations/flpqc_info.xhtml

Thanks Jessica!!! The CSC exam can at first glance seem daunting. The materials are thick with small font, and the language can seem deep and convoluted. The best way to study is to separate the actual learning objectives by chapter, from the extra and unrequired examples and repeated points.

Hello Jessica. Thank you for this informative post. Can I register for CSC and study for it if I am receiving my EI benefits?

That shouldn’t be a problem as explained here https://www.canada.ca/en/employment-social-development/programs/ei/ei-list/courses-training.html#OwnInitiative But always best to check with them too https://www.canada.ca/en/contact.html

Hi Jessica! I’m new in Canada and I’ve been working as chef. Back in my country I studied for some time business administration but I didn’t complete the program. I do want to take my professional career in a different path and I’m doing research about entry level positions for financial institutions and I read about having CSC certification. Is it necessary to have a bachelor in order to succeed in this field? By reading about your career, I know you haven’t worked for financial institutions, however, do you have any advice you can share to get an entry level job in a financial institution?

Thank you!

I can’t really help unfortunately, but I’d definitely suggest reaching out to people in the field or who have roles you aspire to in order to learn more about what paths they took to get there.

Thank you for taking the time to reply 🙂

Happy to!

Hey Leonardo! I am not Jessica haha but have worked for financial institutions since I graduated from my bachelors degree in commerce. It is not necessary to succeed in the Canadian industry however it can certtainly help your chances at starting in more of a mid-level job with a financial institution. I would reccommend taking the CSC as it will certainly give you a talking point/stand out on your resume. As well, although it may not be your dream I would start in the bank as a teller/customer service as then you have your foot in the door and you can then start working your way up! Hope that helps, best of luck – enjoy the ride!

Hi,

Does the CSC exam 1 only come from volume 1 and exam 2 test you on all the content in volume 2 alone. Guess I’m wondering if i have to read volume 1 & 2 to take the exam one? or just volume 1

That’s correct. Exam one is based on Vol. 1. Exam two is based on Vol. 2. So very well you can only read Vol. 1 and take the first exam (this may be easier and less confusing), then read Vol. 2 and take exam two.

Hey Jessica,

My name is Marco and I’m building a career path leading towards the CFP designation. I was Googling ways to study for the CSC exam and how other people have gone about it when I stumbled across this article. The AFCC designation really interested me, could you please tell me about your experience working as a Financial Counsellor? I’ve been finding it difficult to find work options with the designation.

If you’re working towards being a CPF and want to work for a financial planning firm or financial institution, definitely do the CFP. The AFCC I liked, however, it’s not as recognized and most people that get that designation do so to work as a credit counsellor for a credit counselling agency. I’m one of the few who became an independent practitioner. And even after finishing the program, I’ve decided to pursue the CFP as well. That being said, let’s say you wanted to do some money coaching independently and wanted some credentials beforehand, the AFCC might be a good option since the CFP may take you years to achieve. I did the AFCC in 1 year, but you could possibly do it quicker.

Thank-you for the reply Jessica. Another question I had for you was aside from claiming the CSC for tax purposes on your T2202 and the training credit, are there any other grants or scholarships us Canadians are eligible for? I know U.S. residents who are becoming CFPs have access to many scholarships but I couldn’t find any info for Canadians. Thanks 🙂

Not that I know of off the bat. The CSI may itself provide scholarships but I’m not sure if there are any scholarships to pay for courses through the CSI. I think typically what people do is they get their employer to pay for the courses for them.

Hey Jessica! Thank you so much for taking time to write this blog (and for answering the follow up questions too), I have really been informed and encouraged. I have a law degree from overseas and moved to Canada last year and breaking in has been tough. I plan to write the CSC to broaden my options for a job that I like. I was worried about my mathematical skills as I have not done anything math (well except calculating my own money, lol) in more than a decade but I see you replied to a similar questions (tell me again that I don’t need to know all the math but just be willing to try). I will challenge myself on this and will report back with my success story. Thank you again for writing this!

If I can pass with only Grade 11 math, you can definitely pass having gone through a law degree (that’s no joke!). Good luck on your exams!

Hi Jessica, thank you! This was very informative! I am limited for time and very nervous and will be writting my firsr exam soon! Do they ask similar questions on the exam as they do in the learning map, quizes etc. that CSI provides online? And also I have a very very silly question to ask! They provide the % weighted by each section. There are 100 questions, did you feel that they asked the same number of questions as percentage? For example, 15 questions or similar (give or take) for the canadian marketplace? 13 questions for the economy section etc.

Thanks again for sharing your experience!!

Similar in format yes, but don’t expect any questions from the practice tests to be on the actual exams (there were none that were identical). As for the weighting for each section, yes it did seem accurate to what they said the weightings would be.

Hi Jessica,

Your blog has been very helpful in terms of your experience and opinion about the whole course. I appreciate such thorough review. I have been taking it slow and only have a few hours a day to complete the CSC since i work 8:30-5 on weekdays and rush hour eats up my night as well.. I completed my first exam in April and would like to know if you’ve heard from others the weightage that you experienced may be similar for more recent exams that were taken by your peers? Lets say during 2021-early 2022? Since you mentioned that it was heavily focused on Investment Analysis from how you felt.

Also, one last thing.. I recently graduate from a university and took the time to work as an admin assistant while studying for my CSC. I worked as a teller during my school years but would like to know if once I attain the certificate, will employers perceive me to be more qualified to work as a Financial Advisor Associate from CIBC? I was told by a department manager that it mostly requires admin work and working closely to assist FSRs.

Thank you.

I’m not sure if the weightings have changed but your best bet is to see what the exam weightings are here (it’ll at least give you an idea on what to focus on more): https://www.csi.ca/student/en_ca/courses/csi/csc_info.xhtml. In terms of your other question, I wish I could help but I’ve never worked in financial services in the traditional sense (never worked for financial institutions) so have no experience with that type of corporate ladder. With that said, I have heard from people who do that having the CSC on your resume can help. This career map may also be helpful: https://www.csi.ca/student/en_ca/careermap/index.xhtml

Hello Jessica,

Lovely read, and quite informative. My background is in real estate, as I have been a broker for twelve years albeit on and off… But I was wondering how much of real estate is interconnected with this as I thought of maybe mixing a bit of my knowledge and experience and the financial planning courses, and if any of the branches offer something a bit more inline with real estate.

That being said, I am looking to completely reorient my career and I have been pondering about the finance industry for a better part of a decade.

Thank you for your blog, once again. I will be following this from now on. 🙂

Speaking specifically about the CSC, there’s not much real estate involved besides a few mentions of REITs. Similarly with the FP1 and FP2 courses, there are some sections on mortgages, but not much.

🙂 Fantastic. Thank you for your answers. I will be looking for the CSC programs for next year at the CSI here, in Montreal.

Best of luck on passing the CSC exams!

Phenomenal post! Extremely insightful and helps tremendously with my preparation. Thanks Jessica!

Thank you!

Hi Jessica

Congratulations on passing your CSC! Thanks for this great blog post, it is really helpful.

Did you attend the webinars? How often do those happen and were they helpful? Were the webinars recorded so you could refer to them later if you wanted?

Were the CSC Videos good and how do they compare to the webinars?

Thank you!

Hi Sabina! When I was studying for the CSC, they hadn’t yet offered those webinars though I’m sure they’re very beneficial. For me, I simply studied using the textbooks (making my own note cards and highlighting important parts), then going through all the resources provided in the CSC student portal like quizzes and exercises and any videos that were included in there. The videos as I remember them were just screehshares typically just explaining formulas.

That is really helpful to know Jessica. Thanks for the quick response!

You’re welcome!

Hello. Im so glad i ran into your blog. I have been in banking and have been wanting to do my CSC for the longest time. Since you wrote this a while back, do you see the benefits of it so far? From what fellow collegues say. IFC is better and cheaper. what do you suggest? Thanks for the breakdowns btw

Depends on what you want to do with it. For me, it’s one of the courses I needed to fulfill my educational requirements to take the CFP exam by going through the CSI. But if you don’t plan on going that route, IFC may be all you need if you want to continue in banking.

Hi Jessica, hope you’re doing well.

I did have a question about taking the CSC. I just enrolled in the course and have begun reading through the first few chapters. I was wondering, the sections in the textbooks “Learning objectives” and “Summary” are what is on the main focal points on each exam? Meaning how much of the exams are weighted on just those sections alone?

Not trying to cut corners, just making sure I also give a strong focus to those or treat them the same as all the other text in between them.

Looking forward to hearing from you and thank you for being a positive influence on myself making my decision easier to take the course.

Thanks

It’s hard to say since now it’s been a few years since I took the exam, plus they change up the exam questions and weightings often to keep things fresh. But I’d guess those objects and summaries are in there for a reason haha. But I did find the weightings of each section’s focus on the exam they have listed on the website were pretty accurate. I’d say doing the exercises and practice exams though were incredibly helpful when preparing for the exam.

Thank you for your quick response Jessica. Much appreciated!

Happy to help and good luck on the exam!

Hey Jessica,

I failed my first attempt at exam one. I felt that the practice exams where nothing like the actual exam. Now I’m just stressed on how to learn 12 chapters ASAP so I can move on. I’m also working full-time which doesn’t help.

Where you working full-time at the time when you did the CSC? Have any suggestions on what I should do to pass this exam? lol

It’s ok that you failed, a lot of people do, it’s a really tough exam so don’t let that deter you from trying again. And yes, I was working full-time because I run my own business, so I’m always working while studying. Just take a beat, don’t focus on “passing” but instead focus on truly absorbing all the information. You can also contact the CSI to see if there are any exam prep tools you haven’t used. I remember them having some webinars before but I can’t find them, so you may be able to ask if they still offer them to students to help.