Robo-advisors are becoming more and more popular in Canada, with more options than ever popping up. This is good news for investors, because it’s a sign that more investment companies are realizing the importance of offering investment products with lower fees.

The latest robo-advisor to open its doors is from one of the big banks in Canada — RBC InvestEase. News of RBC InvestEase’s pending launch came out in November 2017, and the pilot program started in January 2018. Since then, RBC InvestEase has been adding many new features and opened it up in multiple provinces.

RBC InvestEase is essentially RBC’s answer to all the independent robo-advisors out there. The great thing about RBC coming out with its own robo-advisor is how convenient it will be for current and new RBC customers. Now, you can continue banking with RBC and have your low-fee investments all in one place. For customers who don’t bank with RBC, they can easily transfer money from other banks to RBC InvestEase and start investing.

To learn more about RBC InvestEase, below are some of the most popular questions answered to help you decide whether it’s where you want to invest your money.

Related Content

- Responsible Investing: RBC InvestEase Offers New RI Portfolios

- How to Invest Using RBC InvestEase with Video Tutorial

- The Best Time to Redeem Your RBC Rewards

- How You Can Save Automatically with RBC

What ETFs Are in their Portfolios?

This shouldn’t come as a surprise, but RBC InvestEase uses ETFs from RBC Global Asset Management to build their portfolios.

You see, almost all other robo-advisors offer ETFs from various ETF providers like Vanguard, RBC and Blackrock. This is because independent robo-advisors are simply digital investment platforms, not asset management firms. What I mean by that is although they sell ETFs, they don’t manage or control the assets in those ETFs. It’s the asset management firms (the ETF providers) that do that.

Since RBC InvestEase is part of the RBC family, it only makes sense they would use ETFs that RBC owns and manages.

Here’s a full list of the ETFs they offer:

- (RCSB) RBC Canadian Short Term Bond Index ETF

- (RCUB) RBC Canadian Bond Index ETF

- (RGGB) RBC Global Government Bond (CAD Hedged) Index ETF

- (RCAN) RBC Canadian Equity Index ETF

- (RUSA) RBC US Equity Index ETF

- (RINT) RBC International Equity Index ETF

- (REEM) RBC Emerging Market Equity Index ETF

What Portfolios Do They Offer?

RBC InvestEase offers 5 different risk profiles for investors with different risk tolerances, time horizons, and financial goals.

RBC InvestEase doesn’t display its portfolios on its website, so the only way to find out what portfolios they offer is by doing their investor questionnaire over and over to get different results.

And that’s exactly what I did, so here are all the portfolios below!

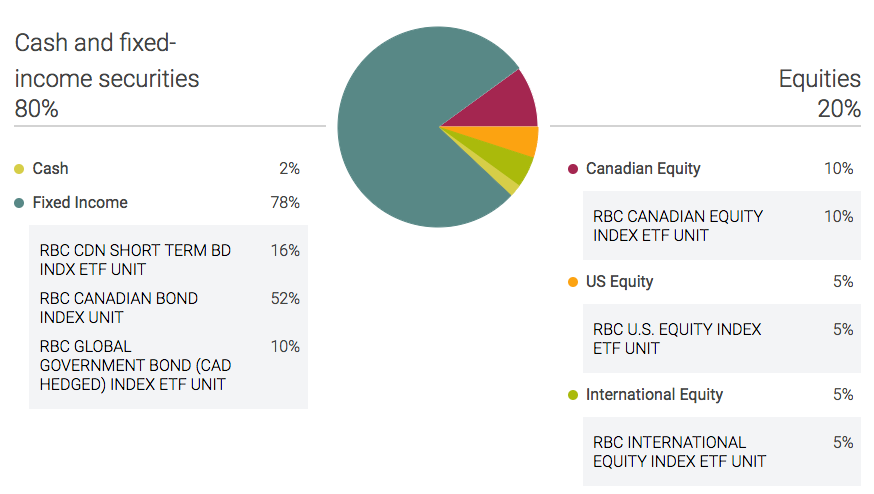

Very Conservative Portfolio (80% Fixed Income | 20% Equities)

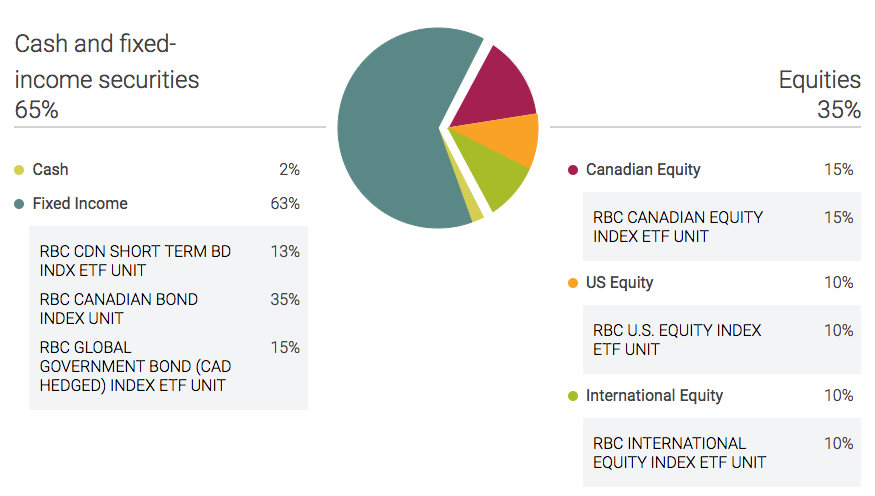

Conservative Portfolio (65% Fixed Income | 35% Equities)

Conservative Portfolio (65% Fixed Income | 35% Equities)

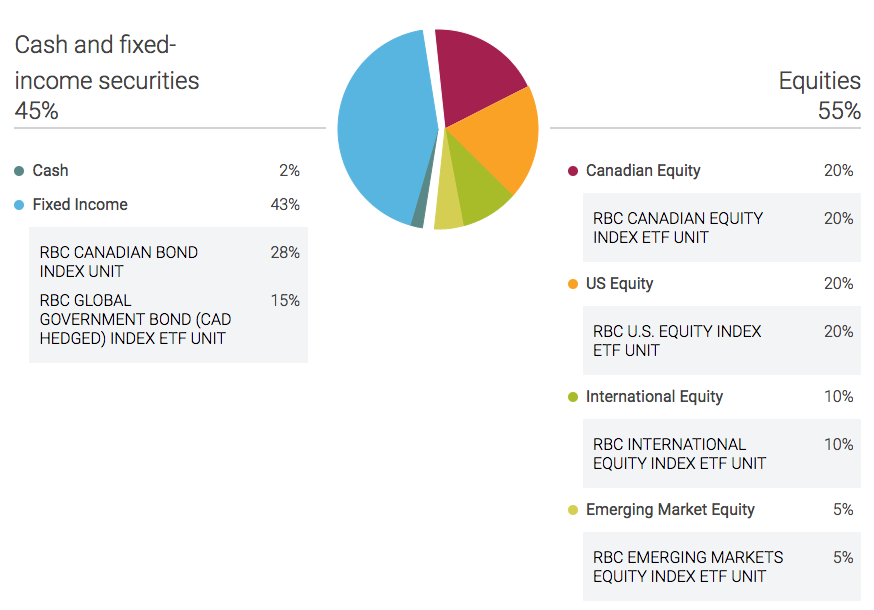

Balanced Portfolio (45% Fixed Income | 55% Equities)

Balanced Portfolio (45% Fixed Income | 55% Equities)

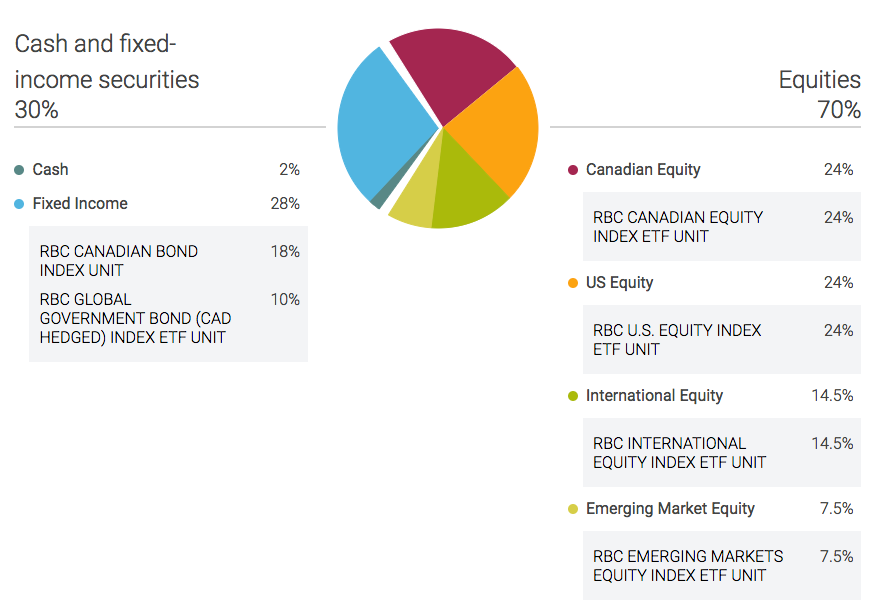

Growth Portfolio (30% Fixed Income | 70% Equities)

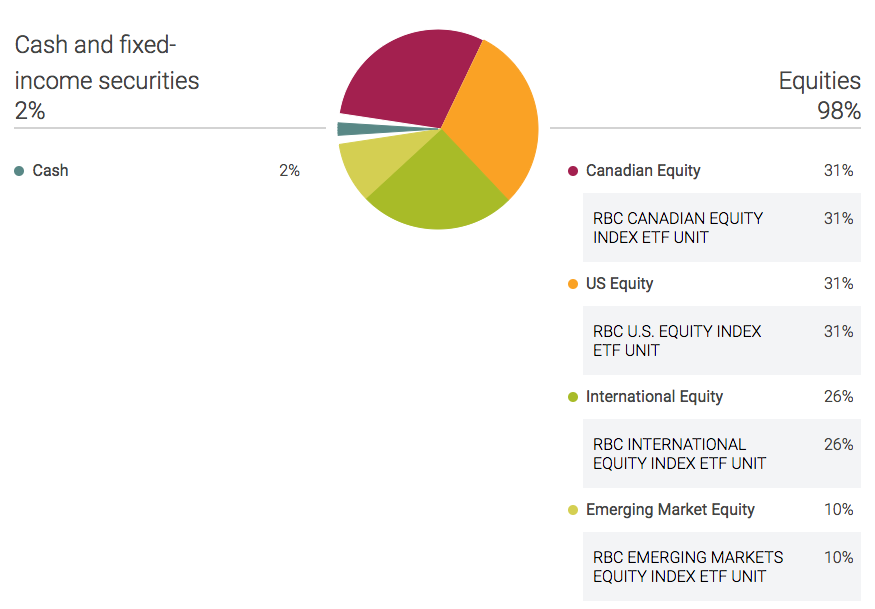

Aggressive Growth Portfolio (2% Fixed Income | 98% Equities)

Aggressive Growth Portfolio (2% Fixed Income | 98% Equities)

What Are the Fees?

What Are the Fees?

Fees are so important. Remember, the lower the fees, the more money in your pocket! RBC InvestEase’s fees are actually quite comparable to the fees charged by other robo-advisors at a 0.50% management fee, plus ETF MERs which range from 0.10%-0.17%.

If you’re not super clear what that 0.50% management fee is for, it takes care of any trades that take place, the cost of a portfolio manager rebalancing your portfolio for you, and phone and email access to an investment professional to answer any questions, and a yearly portfolio review with a portfolio manager.

What Accounts Can I Open with RBC InvestEase?

Currently, you can open up a Tax-Free Savings Account (TFSA), a Registered Retirement Savings Plan (RRSP), or a non-registered investment account.

They are working on making more account types available, such as the Locked-In Retirement Account (LIRA), Restricted Locked-in Registered Retirement Savings Plan (RLSP), Registered Retirement Income Fund (RRIF), Registered Education Savings Plan (RESP), and joint accounts.

How Much Do I Have to Invest to Start?

Like most other robo-advisors, RBC InvestEase does have a minimum initial deposit amount of $1,000. It requires this deposit in order to put you in a well-diversified portfolio. But, after that initial deposit, there are no minimums or limits on future contributions. It’s up to you how much you want to add to the pile.

When Does My Portfolio Get Rebalanced?

One of the benefits of using a robo-advisor like RBC InvestEase is that you don’t have to worry about rebalancing your portfolio. What I mean by that is if you start with a portfolio that has a 70/30 split of equities and fixed income, you don’t have to worry about buying or selling assets throughout the year to maintain that asset mix.

In case you’re wondering how your portfolio is rebalanced, it’s up to the discretion of the portfolio manager. But, in general, they review your portfolio daily and may rebalance your portfolio if necessary after 120 days. Or, if a significant economic event occurs, they’ll review your portfolio to see if they need to make any trades. Luckily, trades are included in your 0.50% management fee, so you don’t have to worry about any extra costs when they rebalance your portfolio.

How Do I Start Investing with RBC InvestEase?

Currently, RBC InvestEase is still in its pilot phase. That means that it’s currently only available in Alberta, Saskatchewan, and Ontario. There are however plans to launch it nationally very soon.

If you do live in one of the provinces listed above, right now is actually a great time to open an account and start investing with RBC InvestEase. Why? Because if you sign up now, you won’t have to pay their 0.50% management fee on your investments until Oct. 31, 2019. You’ll only pay the ETF MER (charged by the ETF provider) which is between 0.10%-0.17%.

If you’re looking for some action steps, here’s how to get started:

- Visit RBCInvestEase.com and click on the button that reads Get Started.

- Answer the questions in its investor questionnaire to find out what portfolio best fits your risk tolerance, time horizon, and financial goals.

- If you’re happy with the portfolio is suggests, you can open an account online.

- You’ll then receive an email confirming you’ve opened an account and will be prompted to set up a quick call with a Portfolio Advisor to confirm your investment plan and answer any questions.

- After your call, you’ll receive access to your account and can start depositing money into your portfolio online.

Got More Questions?

For other questions you may have, check out the RBC InvestEase FAQs section on their website.

+ show Comments

- Hide Comments

add a comment