Do you know what one of the most common questions I get asked is when I’m doing a financial literacy workshop?

Do you know what one of the most common questions I get asked is when I’m doing a financial literacy workshop?

“What are your thoughts on buying and selling cryptocurrency?”

My answer is usually something like this: “Go ahead if you don’t mind gambling with your money.”

Because at the end of the day, that’s pretty much what buying and selling cryptocurrency is like at the moment. I wanted to use the word “invest” when describing cryptocurrency trading just then, but after discussing cryptocurrency at length with the Canadian Securities Administrators, I honestly don’t know if “invest” is an accurate term to use.

You see, cryptocurrency is very new, it’s unregulated, shrouded in mystery, and extremely volatile. Adding all those things up, it has more similarities to betting on horses than buying common stocks.

Nonetheless, a lot of what you’ll find in the media, on blogs, and in forums about cryptocurrency is focused on how people have gotten rich off buying and selling cryptocurrency, and why you should think about buying now before missing your chance.

If there’s one thing I hate, it’s anything that perpetuates the idea that it’s easy to get rich quickly. Sure, some people have done it, but those people are the exception, not the rule.

So, for this post, I’m going to dive deep into the most important things you need to know about buying and selling cryptocurrency in Canada, and why you should proceed with caution (if you proceed at all).

When Did Cryptocurrency Start?

You may be surprised to know this, but cryptocurrency is less than a decade old. The first type of cryptocurrency, Bitcoin, only surfaced in 2009.

Who started it is still a mystery though. Currently, the myth is that Bitcoin was invented by an unknown person or group of people who use the name Satoshi Nakamoto. Even today, the creator(s) of Bitcoin is still unconfirmed.

For a full year, Bitcoin just existed. It wasn’t traded until 2010 when someone traded 10,000 bitcoins for 2 pizzas, as shared by Forbes. I bet that person is kicking themselves now because currently, 10,000 bitcoins is worth $90,830,322.42 Canadian dollars. Yikes!

Since then, other types of cryptocurrencies have been created. We’re all probably most familiar with the following 10 types of cryptocurrencies outside of Bitcoin, but there are actually 1,900 different types listed on CoinMarketCap.

- Litecoin (LTC)

- Ethereum (ETH)

- Zcash (ZEC)

- Dash (DASH)

- Ripple (XRP)

- Monero (XMR)

- Bitcoin Cash (BCH)

- NEO (NEO)

- Cardano (ADA)

- EOS (EOS)

What Is Cryptocurrency?

In case you’re still unclear what cryptocurrency is, it’s basically a digital asset that uses cryptography (the act of writing or solving codes) for security. Right now, it’s “not issued by any central authority, rendering it theoretically immune to government interference or manipulation” (Investopedia). For some people, that’s the biggest allure of cryptocurrency. For others, that’s a reason to stay far, far away from it.

Is Cryptocurrency a Type of Currency?

This is definitely up for debate, but the Bank of Canada would say no, cryptocurrency isn’t a type of currency. A better term would be a crypto asset or digital asset.

The reason for this is that typically currencies are widely accepted, and are issued and regulated by a government. Even though Bitcoin is the most popular form of cryptocurrency, it’s still not widely accepted throughout Canada or the world as a form of currency. And as mentioned above, it’s not issued or regulated by any government or any centralized organization.

The counter to this argument would be that shouldn’t something that you buy, sell or use to purchase goods or services be considered a type of currency?

For instance, the following retailers do accept Bitcoin as payment:

It’s not a long list, but it is possible to use bitcoins to buy a flight or donate funds to Wikipedia.

Still, in reality, using bitcoins as if they were Canadian dollars isn’t easy. I have first-hand knowledge of this since I participated in the Money 20/20 Race last October. I luckily only had to get myself from Toronto to Las Vegas (with a number of stops and challenges along the way) by using my chip and pin credit card. But the winner of the race, Amelie Arras, had the hard task of doing the race using only bitcoins.

That being said, although she did win (which was amazing!), she was able to do so not because it was easy to pay for things with bitcoins. She was able to travel and survive the race because she traded her bitcoins with members of the Bitcoin community in exchange for them to buy her flights, food, or accommodations. If we’re going to get technical, she was able to trade it, but not use it to buy goods and services. That’s very different than using it the same way we use dollars.

Is Cryptocurrency Backed by a Bank or Authority?

Cryptocurrency isn’t issued or regulated by any type of bank or government, which is why it’s not backed or insured like Canadian currency is.

Canadian currency that is deposited into a Canadian financial institution is insured by the Canada Deposit Insurance Corporation (CDIC) up to a maximum of $100,000 per financial institution. That means if the bank you use goes bankrupt, and you have $1,000 in a chequing account and $10,000 in a savings account, your $11,000 will remain safe. You’ll get a payout by CDIC.

Unsurprisingly, there’s no similar insurance for cryptocurrency, which is why it’s considered to be very risky.

Is Cryptocurrency a Type of Investment?

Depending on who you ask, you could get a “Yes” or “No” answer. For me personally, I would lean more towards a “No” just because it’s so new, it’s unregulated, it’s extremely volatile, and there aren’t as many rules in place compared to other investment types.

For instance, for traditional trading of stocks, bonds, ETFs and derivatives, there are exchanges with rules and hours of operation. With cryptocurrency, there are virtually no rules and exchanges operate 24 hours per day.

Now, if you wanted to go back to the basic definition of investing, which is buying an asset in the hopes that it increases in value to earn you a profit, some would argue that cryptocurrency would fit the bill. But still, it’s important to take note that the cryptocurrency markets are not transparent and the trading platforms you must use to buy and sell cryptocurrency aren’t regulated either.

Is Cryptocurrency Safe?

In my opinion, cryptocurrency is one of the most volatile and risky assets you can buy today.

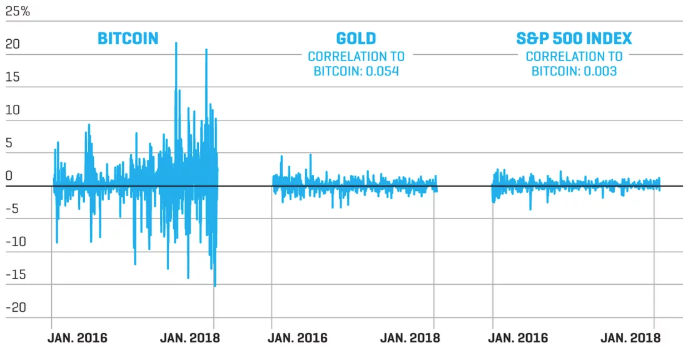

Let’s first talk about volatility. Let’s compare the daily volatility of Bitcoin to gold and the S&P 500 Index from 2016 to 2018. Here’s a chart that shows just how volatile, and thus risky, Bitcoin is to gold and the S&P 500 index found on Fortune.com.

.

.

If that doesn’t make you feel a bit anxious, it should! I don’t think I’d be able to handle the constant ups and downs of Bitcoin without feeling nervous about my money.

But that’s not the only reason cryptocurrency, in general, isn’t considered a safe asset to buy. There is also a high susceptibility to cybersecurity threats and hacks. For some examples, the defunct exchange Mt. Gox was robbed of $500 million in Bitcoin in 2014, Bitfinex was robbed of $72 million in Bitcoin in 2016, and a number of Coinbase customers were robbed in 2017 (Fortune).

Final Thoughts on Buying and Selling Cryptocurrency

Is cryptocurrency something you should stay away from at all costs, or is it worth the risk for a huge reward? This may sound like a cop-out, but it just depends. Cryptocurrency is still so new, mysterious, and unpredictable. People have had major losses when buying and selling cryptocurrency, and people have become millionaires.

At the end of the day, it really depends on your goals and your risk tolerance. If you don’t have the stomach for something with such high volatility and would rather buy assets that are more secure, then cryptocurrency is not for you.

For those of you who have an exceptionally high tolerance for risk, and are comfortable with the idea that you could potentially lose all the money you put into cryptocurrency, then go ahead and try it out.

If you’re not really sure how you feel about cryptocurrency but are worried that if you don’t buy know you’ll be kicking yourself later, there are plenty of other things you can invest in to gain significant returns that may still be a better fit for you.

The important thing to remember is that before buying any type of cryptocurrency, make sure you know what you’re getting yourself into and understand the consequences.

For more information about securities regulation and investing, make sure to check out the Canadian Securities Administrators’ website.

I find cryptocurrency fascinating, confusing and a bit scary. In a perfect world, I would venture into unknown waters – but something always holds me back. hahaha. Thanks so much for the article.

Thanks for reading, glad you liked it!

Bitcoin has indeed lead the way. There are better payment methods now, mostly contracting offers new features. However, there is no guarantee that Bitcoin’s value will continue to skyrocket, or for any other cryptocurrencies for that matter, but there are ways to leverage these kind of currencies and create exponential growth whether the value goes up or down. Either way, investing in any of these could make you a millionaire (how I wish!)– or lose you a fortune – so it is best advised to make decisions extremely carefully.

Absolutely. It’s so new and unpredictable, you really need to have a high risk tolerance in my opinion if you’re thinking of buying cryptocurrency as an investment, and also not make it a bit part of your portfolio. Thanks for the comment!

Something to be conscious of: there’s a lot of “pumping and dumping” going on. Some holders of crypto hype up a particular crypto currency then quickly sell once they’ve made a profit – essentially there’s a lot of manipulation going on so be careful out there folks

Absolutely. Same thing goes for some stocks out there too, but definitely something people need to think about with crypto as well. Thanks for the comment!

Thanks for this informative guide about cryptocurrency.

Really helpful.

I’m so glad you think so! Thanks for reading!