Ever wonder how exactly you should invest if you’re a millennial? Because let’s be honest, investing as a millennial is way different than investing like our parents’ generation.

Now, we all know that investing is an important element of personal finance on top of budgeting, saving, and paying down debt, but for some reason, it’s also usually the last thing we Millennials try to tackle.

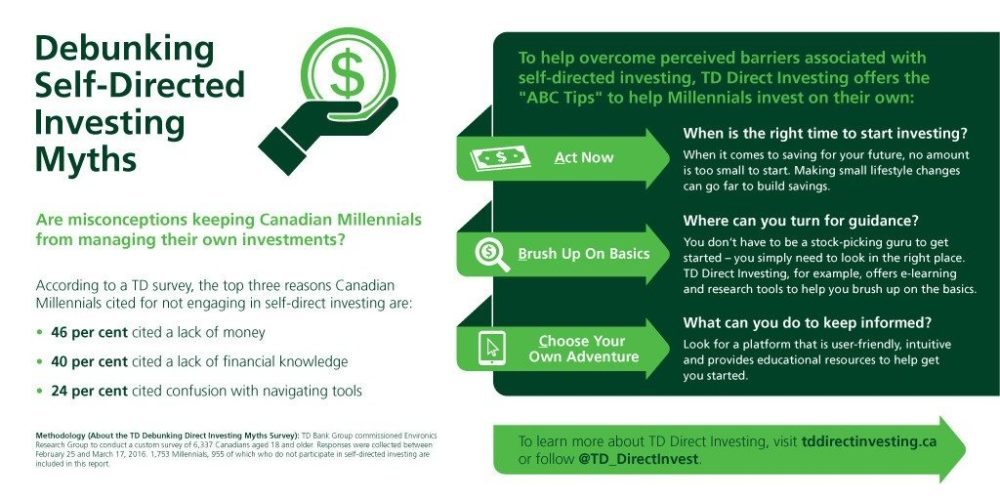

Afraid of or Clueless About Investing? You’re Not Alone

Investing, especially when you’re very new to it, can seem intimidating. You don’t want to do it wrong for fear of losing your hard-earned money, but whenever you talk to people about it, it doesn’t seem like anyone really knows anything about it. They’ll throw around terms like ETFs or GICs, but when you ask them specifically what any of those mean or when is a good time to start investing, it’s hard to get a clear answer.

If you’re nodding your head right now, I feel you! I went through the exact same thing in my early 20s. It was incredibly frustrating wanting to invest, but not having a clear roadmap on how to go about it.

TD did a survey recently and unsurprisingly found that 36% of Millennials don’t know if it’s the right time to invest and 37% don’t invest at all. So clearly there is a huge number of Millennials out there who are either afraid of the risk factor that comes with investing, or they just don’t know how to start — so they don’t.

How I Would Suggest You Invest If You’re a Millennial

It’s simple — investing in Index Funds and Exchange-Traded Funds (ETFs) is the way to go if you’re a Millennial. GICs and mutual funds just don’t offer the returns they once did, and their fees are notoriously high. Going the self-directed route is also a good way to go, especially since there are so many ways to do this now, like through TD’s Direct Investing WebBroker™. Options like these help you cut down on costs, leaving you with more money in the end.

This is fairly common knowledge within the personal finance blogging community. That’s why I was so shocked to learn that many Millennials don’t consider self-directed investing an option because they don’t think they have enough money to do it, they don’t feel knowledgeable enough about it, or they just find it confusing.

Here’s the thing, it’s really not. As I mentioned earlier, there are so many different platforms out there to make it simple for you. For example, TD noticed that there was a need to simplify self-directed investing, so they created the TD Direct Investing WebBroker™. They’ve integrated tools to help you navigate the platform intuitively, focused on making the user experience a priority, and basically just make it easier for investors like you to reach your financial goals without having to constantly worry about how your investments are doing.

And This Is What You Should Do Right After Reading this Post

The key takeaway from this post is that investing shouldn’t be complex or scary. And if someone, whether a friend, colleague, or advisor tells you otherwise, ignores them or runs away! Brush up on the ins and outs of Index Funds and ETFs (I highly suggest listening to my podcast episodes with Barry Choi and John Robertson for starters) and then choose a platform that will help you invest in these products.

And if you’re still not sure if right now is the right time to start investing… it is. Yes, because interest rates are low right now, you may not make that elusive 8-10% all the finance books talk about. But it’s important to remember that the sooner you start saving and investing for your future, the better off you’ll be.

And if you’re still not convinced, consider these investing ABC’s from Calvin MacInnis, S.V.P. of TD Direct Investing:

Act Now

No amount is too small when it comes to saving for your future. You just need to start, no matter how much money you can afford to contribute. The earlier you contribute, the bigger the impact those small sums will grow into down the road.

Brush Up On the Basics

You don’t have to be a math whiz to understand personal finance. It’s very basic stuff when you break it down. The important thing is to regularly brush up on the basics by reading books and blogs, watching educational videos, and listening to helpful podcasts to keep informed.

Choose Your Own Adventure

Never forget that you’re in control of your financial future. Don’t be afraid to try out self-directed investing because it seems confusing. It’s come a long way over the years and there are a number of platforms out there that are user-friendly, intuitive, and include helpful resources to guide you through it.

What are your thoughts on how to invest if you’re a millennial? Share in the comments.

I think it is great for folks to start investing as young as possible. I feel like there is an honest learning curve, and it’s better to make little mistakes while there is time to fix it and the numbers are smaller. The first time we invested in a IRA, we accidentally bought a CD as the investment!

Great article! Completely agree, it’s all about just making a small start and building you way up. Being in my mid-20’s I only started investing last year but once I started it was a whole lot easier to keep going. Education is definitely key!