This is the follow-up to my RBC InvestEase review blog post that goes in-depth about RBC’s new robo-advisor. In that post, I shared pretty much all the ins and outs of RBC InvestEase, including what all five of their portfolios are.

For this post and accompanying video, I wanted to actually walk you through the RBC InvestEase investor questionnaire, and show you what the dashboard looks like once you’ve invested your money.

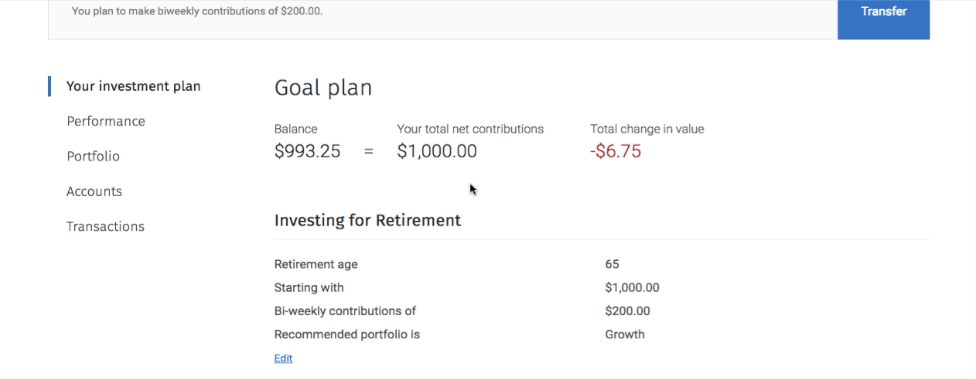

You may be wondering, how would I know what the dashboard looks like? Well, because I’m putting my money where my mouth is and have invested $1,000 of my own money in RBC InvestEase. Since I’ve literally just invested my money, I will definitely be doing a follow-up to show you my portfolio’s performance over a longer stretch of time (I’ll probably wait six months to a year), so make sure to subscribe to my email list and YouTube channel to stay in the loop of this!

Related Content

- RBC InvestEase Review: Low-Fee Investing

- The Best Time to Redeem Your RBC Rewards

- How You Can Save Automatically with RBC

- This Is What Happens When We Invest in Our Country’s Youth

RBC InvestEase Tutorial

Investor Questionnaire

I thought it would be helpful to go through RBC InvestEase’s entire investor questionnaire, because you may have never done one before. Maybe this is your first time and you’d like someone to walk you through it who has done it before. And I’m your gal! I’m a money nerd remember, and that means I’ve pretty much tested out every investor questionnaire by each robo-advisor in Canada just for fun. Yes…FUN!

So, let’s go through all 10 steps of the questionnaire.

If you want to go through the questionnaire yourself, click here.

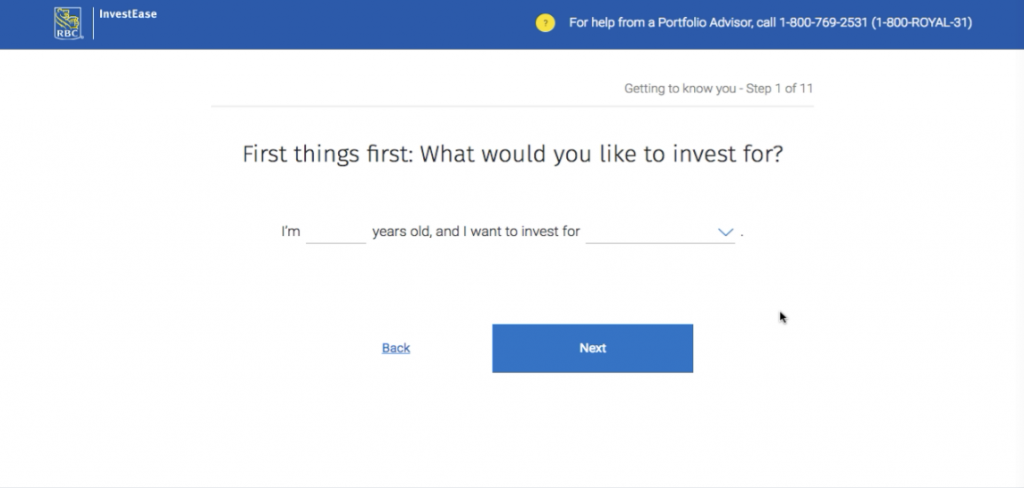

Step 1

Step 1 is fairly straightforward. Just type in your current age and the reason you want to invest (in other words, what financial goal are you investing to achieve).

For me, I’m 32 and am investing for my retirement.

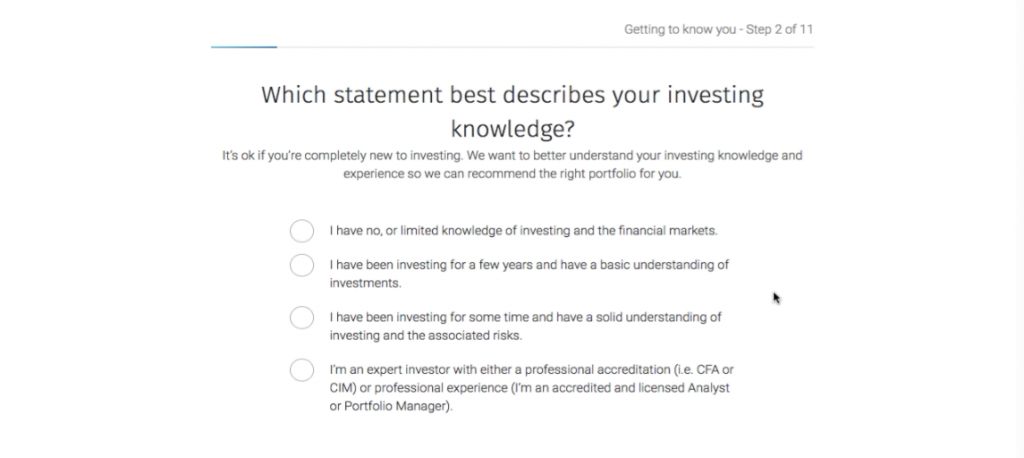

Step 2

Next, you’re asked what statement about your investing knowledge best describes you. This is to help determine if you’re at a beginner level (meaning you are just starting to learn the basics), or if you’re very comfortable with investing terminology and have a good understanding of how investing works.

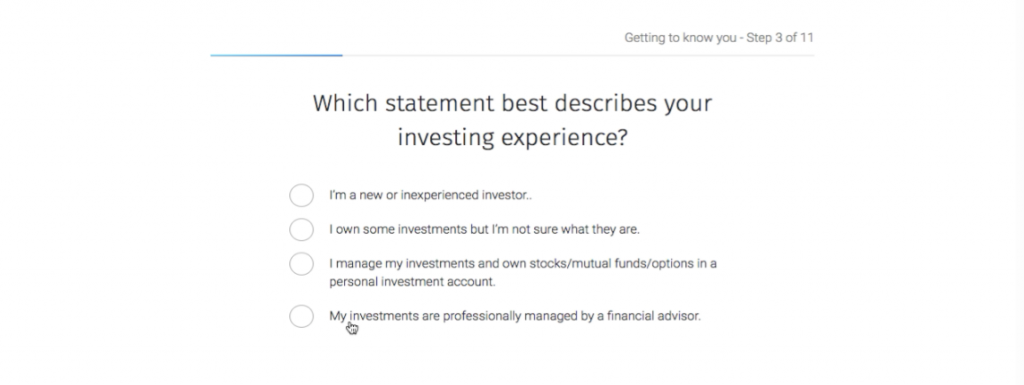

Step 3

Then, you’re asked about your investing experience (or lack thereof). This is to gauge if you’re a newbie investor, have some experience, or are at an advanced level of investing.

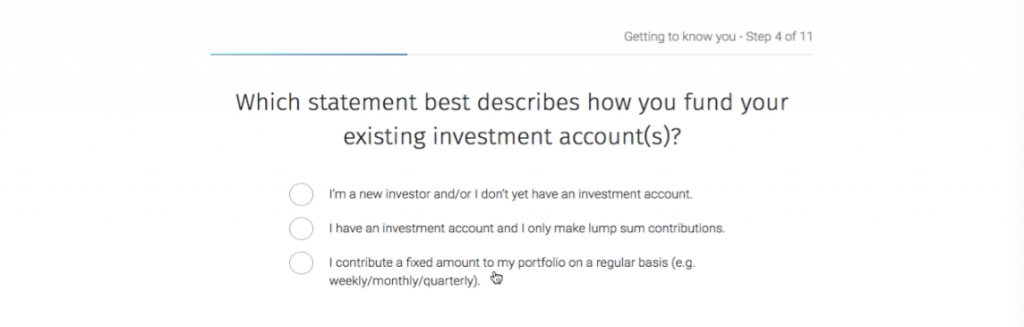

Step 4

Step 4 is to help determine whether you like to make regular or lump sum contributions to your investments (or if don’t do either yet).

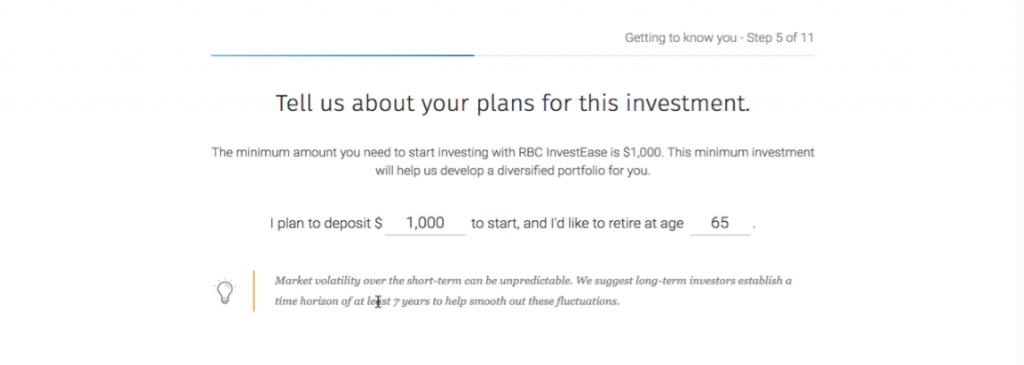

Step 5

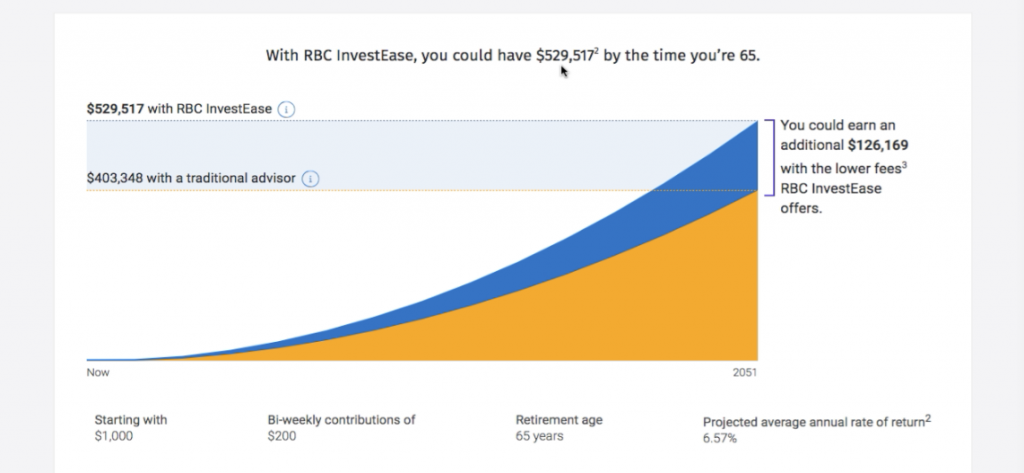

Now comes the fun stuff! Step 5 is to find out how much you’d like to start investing with (your initial deposit), and at what point you’d like to reach your goal. Since my goal is retirement, it asked me when I plan on retiring. I love the idea of retiring early, but that’s not really a big goal of mine. My dream has always been to have a career that gives me schedule flexibility and is something I’m passionate about. Well, I’m living that dream, so I don’t plan on officially retiring until I’m 65.

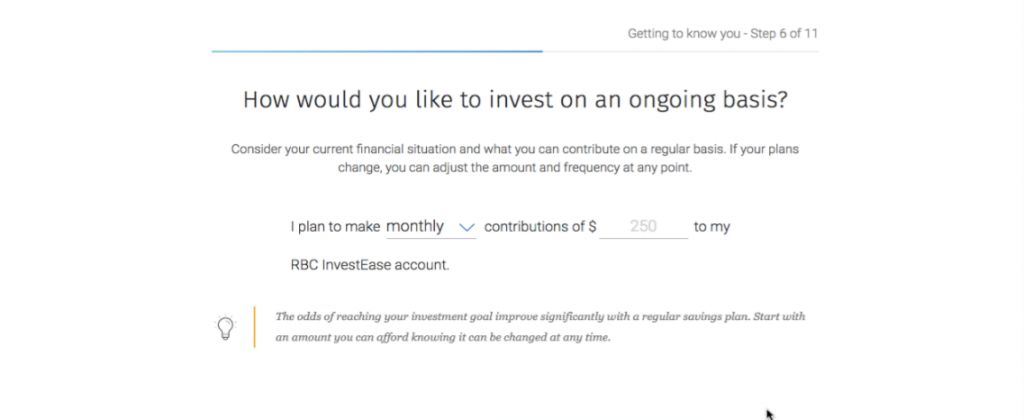

Step 6

Next, you’re asked how you’d like to make regular contributions.

I chose bi-weekly because I’ve always done it that way. I pay my mortgage bi-weekly, and in the past when I worked for different companies, I was always paid bi-weekly. Out of pure habit, I chose bi-weekly, but there’s the added benefit of making 26 contributions instead of 24 (which is semi-monthly). Those extra two contributions per year can have a big impact, but you’ll hardly notice the money coming out of your bank account.

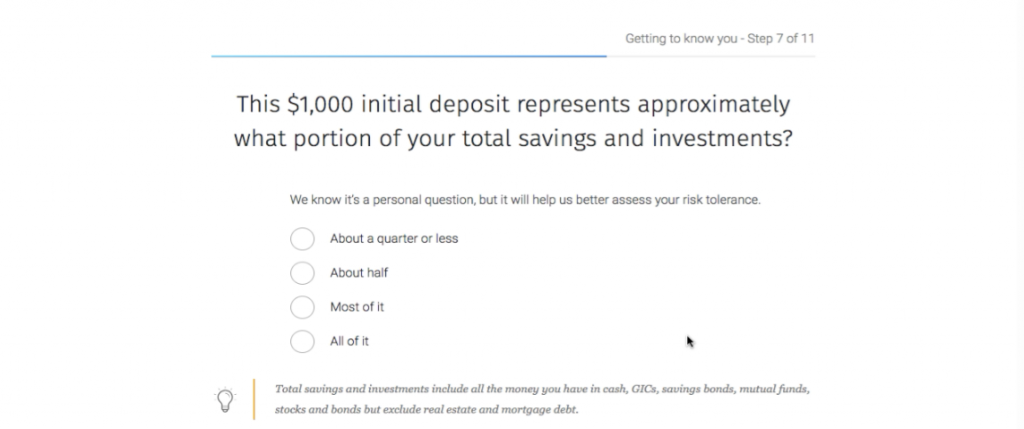

Step 7

Step 7 is about finding out how much you’ve got! You noted down your initial deposit (for me, I chose $1,000), and now you need to reveal what portion of that deposit makes up your total savings and investments. I chose a quarter or less since it’s only a small percentage of my current assets.

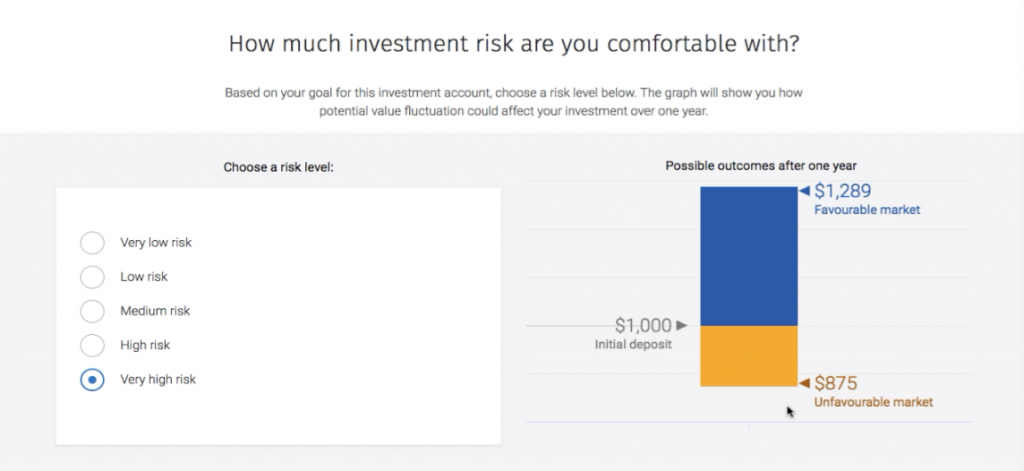

Step 8

I’m just gonna say it, this part you might get stuck on. It’s a really hard question to answer, so make sure you take your time and really give an honest answer. You don’t want to choose that you’re comfortable with “Very High Risk” when your gut is saying “Medium Risk” is more your speed. For me, I ended up choosing “High Risk”.

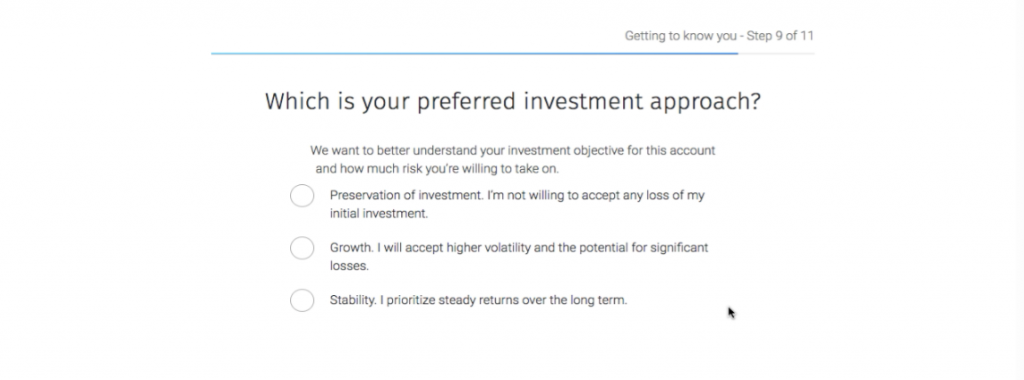

Step 9

This is another tricky question you should take your time answering. It’s to help gauge how risk tolerant or risk averse you really are.

There’s a great quote to describe risk tolerance: “the amount of psychological pain you’re willing to suffer from your investments.” I know that sounds harsh, but that’s exactly what it is. How much can you stomach when you see the value of your investments going up and down?

I chose “Growth” because although I don’t like seeing the ups and downs, I also have been investing for a while and am comfortable taking risks with my investments.

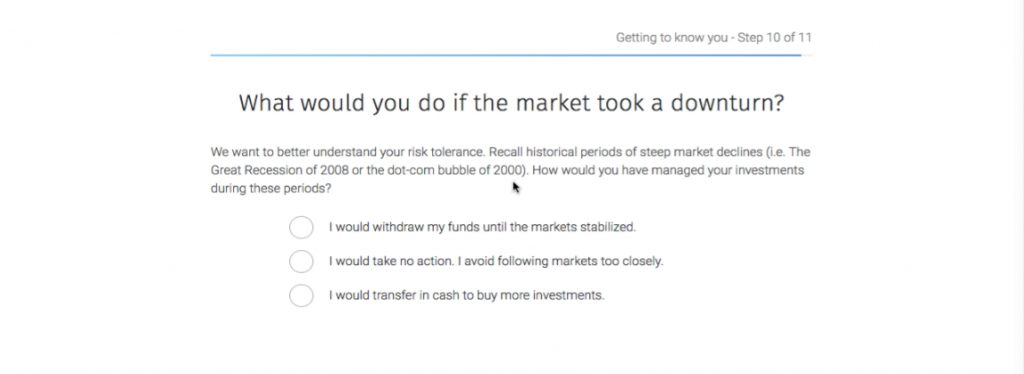

Step 10

Step 10

The last question before finding out what portfolio is right for you has once again everything to do with your risk tolerance. It’s such an important factor in determining what you should invest in, it’s pretty obvious why you’re asked several questions about the same thing.

I love this question because it brings up two very important events: the Great Recession of 2008 and the Dot-Com bubble of 2000. I was a kid when the Dot-Com bubble burst so I only remember hearing a bit about it from my parents, but I was just finishing university when the Great Recession happened. I remember vividly hearing my parents talk about how some of their friends lost their entire retirement savings because of the crash. Well, now that I understand more about how these things work, they would have only lost money if they sold everything at the bottom. If they didn’t touch anything and waited for things to rebound, they would have recovered.

For this question, I actually answered that during a market crash I would do nothing. I know logically it makes sense to buy more investments since they are essentially at a discounted price, but I know myself. I would be panicking like the rest of the country, so I feel like the best I could do is take no action.

Step 11

Step 11

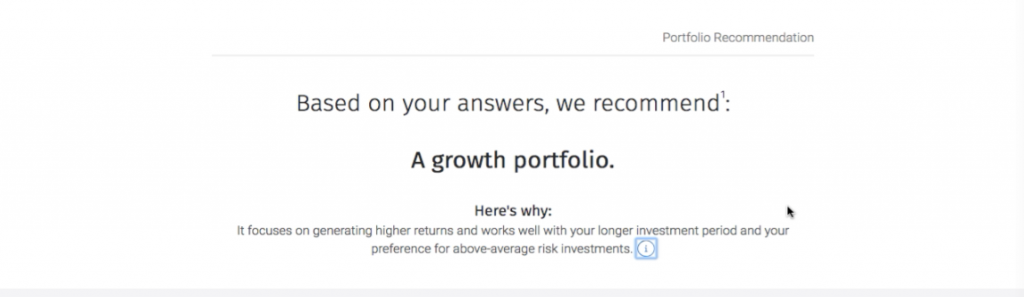

And voilà! With all 10 questions answered, you will have a specific portfolio chosen that is the best fit for you. I was actually at an event recently where one of the investment professionals spoke about how these portfolios were developed, and he explained that a ton of research, data, and skilled minds came up with the five portfolios RBC InvestEase offers.

So just in case, you’re wondering if they just put something together quickly, that is not the case at all. A lot of thought went into these. And if you have more questions like that, make sure to note them down to ask when you speak with a RBC InvestEase investment professional yourself.

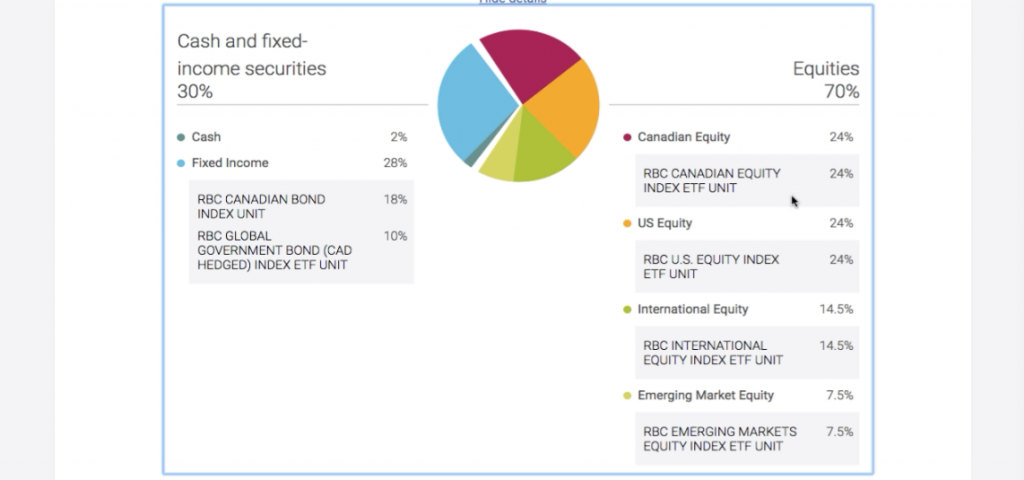

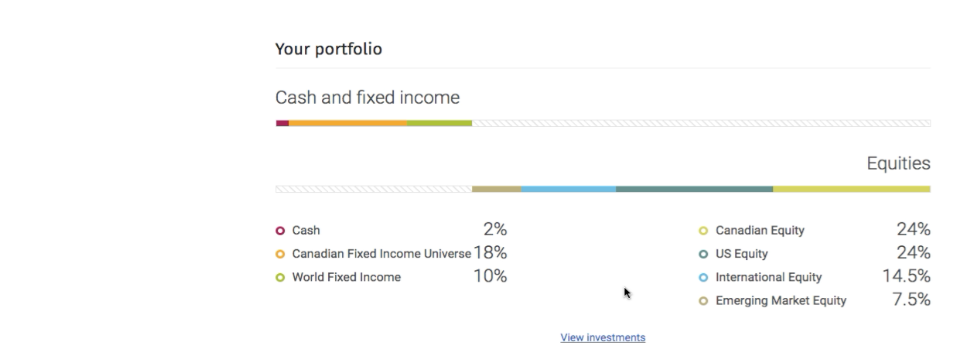

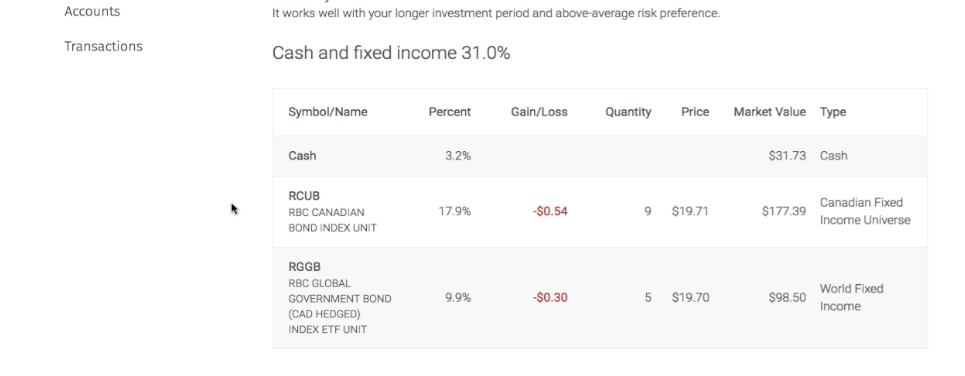

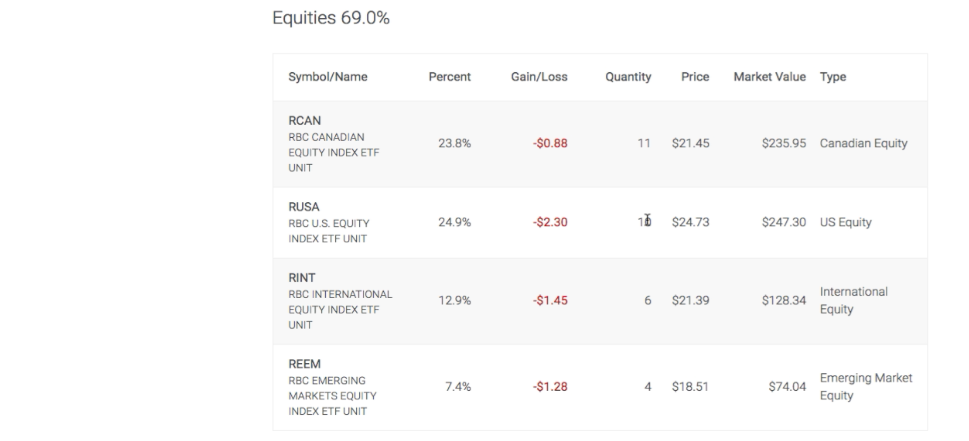

Because of all the answers I gave, I was given the “Growth Portfolio.” I was really pleased with this, because, for my current retirement investments, I am already doing a 70/30 split for equities and fixed income. They got me right on the money!

The last steps after getting my results in were to click the “Get Started” button, book a phone appointment with a RBC InvestEase investment professional, then deposit $1,000 into my account.

Inside the Dashboard

Once your money gets deposited into your RBC InvestEase account, the ETFs in your portfolio are bought for you, and you’re pretty much done. You can set and forget really.

You can of course update your regular contributions, or make lump sum contributions if you like. And you can also switch your portfolio if your goals or life circumstances have changed and you feel your current portfolio no longer fits your needs.

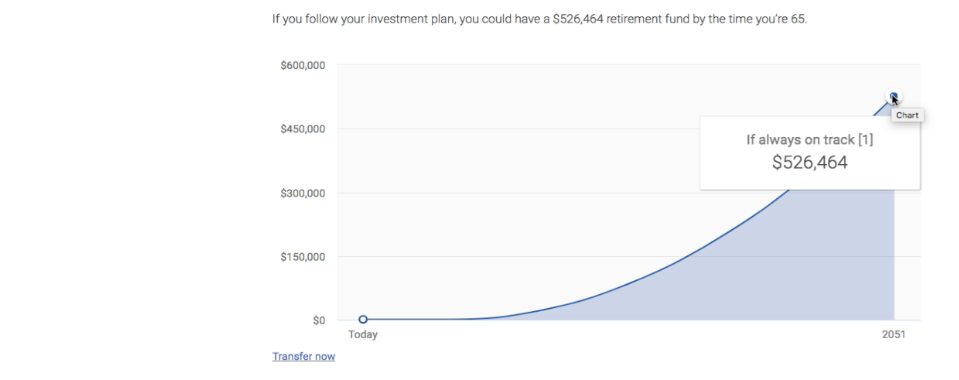

But in general, your portfolio automatically rebalances for you, so you really could just check it a few times of the year if you like. For me, since I track my net worth every month, I check it once monthly. But that’s it. I don’t want to check it more than that because I know I might get worried or emotional if I see my portfolio’s value take a dip…as shown below. The key thing to remember is to not panic. The value of your investments will go up and down. That’s normal. The worst thing you could do is cash out when things are taking a dip. Just stay the course.

For me, since I don’t need this money until I’m 65, I’m fine. And as I get older and my time horizon shrinks, I’ll update my portfolio to something more conservative so I won’t be invested in things that are as risky as right now.

Final Thoughts

I think the questionnaire in total took me about 8 minutes to go through. It may take you less time or longer. It really depends on how well you know some of the data questions (i.e. what’s your total income or what’s the sum total of your assets), but the questionnaire itself is very simple and straightforward.

As I mentioned, I am going to do a follow-up post in 6-12 months to see where I’m at. Until then, if you’d like to take the questionnaire yourself or you’re ready to jump in and start investing, don’t wait too long. In the world of investing, the sooner you start, the better you’ll be. Remember, the best day to start was yesterday, the second best day is today!

+ show Comments

- Hide Comments

add a comment