Nod your head “Yes” if someone’s ever told you that you’d better keep some cash unbanked (like hidden in a wall or in a safe) because if your bank goes bankrupt, you’ll lose everything.

I’ve certainly heard this many times throughout the years, and sadly usually from people older than me who should know better. Here’s the thing, there are a ton of banking myths out there, and I want to debunk them right now so you can be better informed.

And the first myth, and just downright bad piece of advice, that I want to debunk is that it’s a good idea to keep large amounts of cash on hand in your house. And if you’re wondering who actually does this, people really do! I remember an old co-worker told me her dad had stacks of cash in his walls because he didn’t trust the banks. The thing is, a lot can go wrong if you do this instead of keeping your cash safe in a chequing or savings account.

- It could be stolen

- It could be destroyed in a fire, earthquake or flood

- You may forget where you put it or forget the combination to your safe

- You may forget you even hid it in the first place

- It may get damaged or disintegrate over the years

Moreover, you don’t need to worry about your bank going bankrupt because that’s why the Canada Deposit Insurance Corporation (CDIC) exists! You see, CDIC Deposit Insurance protects Canadians and their money for free and automatically if you bank with a CDIC member financial institution.

In other words, there’s nothing to freak out about. But to help squash those fears and help you understand how CDIC Deposit Insurance works, here are some key things you need to know.

1. Why CDIC Was Created

CDIC was created as an independent Crown corporation in 1967 as a call to action by Parliament after previous years of turmoil within the financial industry. What triggered CDIC’s creation was the failure of two financial companies one after the other. First, there was the foreclosure of the Atlantic Acceptance Corporation in 1965, then there was the failure of Prudential Finance in 1966.

During this time of crisis, the government realized it needed to step in and do something. So, CDIC was created to protect eligible deposits in member financial institutions in the case of a failure. In 2011, CDIC became Canada’s resolution authority, which means they have tools to support the resolution of all banks, big and small.

To learn more about the history of CDIC (which is actually pretty interesting), check out this free e-book — From Next Best to World Class: The People and Events That Have Shaped the Canada Deposit Insurance Corporation 1967-2017 by C. Ian Kyer.

2. Why People Still Think You Can Lose Money at Your Bank

Even though CDIC exists to protect us and our savings, you may still be wondering why people think you can still lose your savings if your bank goes under.

Before CDIC, if a bank failed, you were at risk of losing your money. This was a reality your grandparents may have experienced, then passed down that knowledge to your parents, then to you. For example, let’s talk about one of the biggest bank failures in Canadian history — the Home Bank of Canada collapse of 1923.

Remember that classic scene in It’s a Wonderful Life when there’s a bank run on Bailey Brothers’ Building and Loan, and George is forced to use his honeymoon money to keep it solvent? Well, that same hysteria happened in 1923 when the Home Bank of Canada shut its doors to customers all over the country due to financial mismanagement, bad investments and not being able to pay off its debts. In short, the bank collapsed and more than 60,000 customers lost all their savings held with them. For the full story on this, check out this historical recounting on Torontoist.

That bank failure was almost 100 years ago, but there have been many bank failures since then. Since 1970, there have been 43 bank failures, including:

- Fidelity Trust Company – 1983

- Western Capital Trust Company – 1985

- Bank of Credit and Commerce Canada – 1991

- Security Home Mortgage Corporation – 1996

For a full list of bank failures in Canada, visit this page on CDIC’s website.

But, since CDIC was created in 1967, guess how much money customers lost from their banks after they collapsed? Not a penny. You read that right. Since CDIC’s inception, they’ve protected more than 2 million people holding $26 billion in insured deposits at these failed institutions. Not one person lost a single dollar under CDIC Deposit Insurance.

3. How CDIC Works

So, how does CDIC work, and what important exceptions are there to be aware of?

Your Bank Needs to Be a Member

As I mentioned earlier, CDIC Deposit Insurance is free and automatic for you as a bank customer. But, your financial institution must be a member of CDIC for you to be protected. You see, CDIC Deposit Insurance is free for you, but not for your bank or federal credit union. All federally-regulated deposit-taking institutions are required to be members, and they need to pay for that insurance. But in the end, it’s in their best interest.

All you have to do to ensure you’re protected by CDIC Deposit Insurance is to check that your bank with a member of CDIC. An easy way to do this is to check the footer of your Financial Institution’s website.

Example:

Another way to do it, especially if you’re looking at opening up an account at a new bank, is to check this list of CDIC members. If you don’t see your financial institution on the list, then you won’t be protected by CDIC Deposit Insurance.

CDIC Deposit Insurance Does Not Cover Investments

Lost some money in your investment portfolio because you held stock in a company that went bust? Well, that’s part of the risk of investing in stocks and not something CDIC can help you with.

CDIC was meant to protect your cash or term-deposit savings, not your investments. To be clear, here’s what CDIC Deposit Insurance protects and doesn’t protect.

What Is Covered

- Savings accounts

- Chequing accounts

- Term deposits (like GICs) with terms of 5 years or less

- Term deposits (like GICs) with terms of 5 years or greater New as of April 2020

- Debentures issued to evidence deposits by CDIC member institutions (other than banks)

- Money orders and bank drafts issued by CDIC members

- Cheques certified by CDIC members

- Foreign currency deposits (like U.S. dollars) New as of April 2020

What Is Not Covered

- Mutual funds (including money market funds), stocks and bonds

- Digital and cryptocurrencies

- Treasury bills and bankers’ acceptances

- Principal protected notes that are traded

- Debentures issued by banks, governments or corporations

- Deposits with receipts payable to bearer (rather than to a named person)

- Deposits held at financial institutions that are not CDIC members

- Travelers’ cheques New as of April 2020

4. How to Maximize Your CDIC Coverage

Even though I mentioned that since CDIC came to be, not one person has lost a dollar from a member institution under their protection in a bank failure, that doesn’t mean all of your money is protected. There are limits around how much money they can protect. This is important to know because it may help you determine your personal banking strategy (i.e. not holding all of your cash at just one bank).

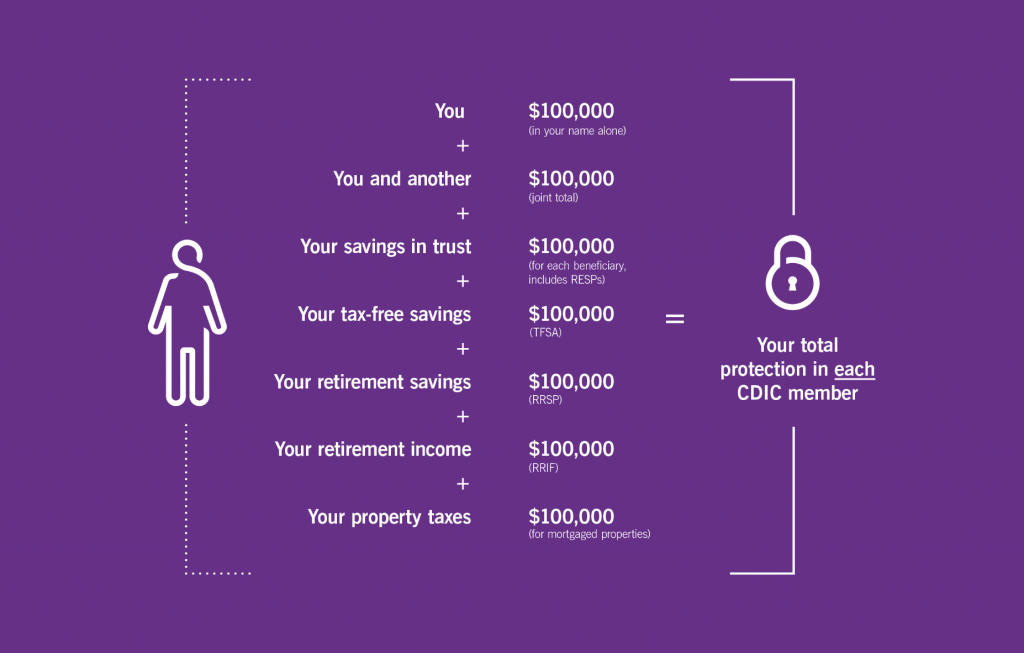

CDIC insures eligible deposits at its member institutions up to a maximum of $100,000 (principal and interest combined) per depositor per insured category per institution.

First things first, let’s break down the 7 different categories:

- Deposits held in one name

- Deposits held in more than one name

- Deposits held in an RRSP

- Deposits held in an RRIF

- Deposits held in a TFSA

- Deposits held in a trust

- Deposits held for paying taxes on mortgaged properties

Now that we know the different categories, it’s important to know that CDIC protects your deposits up to $100,000 in each category at the same institution. Except for trusts, they are insured for up to $100,000 per beneficiary.

Here’s an example to help you visualize coverage.

So, if you had the following at a single financial institution:

- $100,000 in deposits under your name (i.e. a chequing account and 3 savings accounts)

- $100,000 in deposits under you and your partner’s name (i.e. joint chequing and joint savings accounts)

- $100,000 in a trust in which you’re the beneficiary (i.e. an RESP)

- $100,000 in retirement savings (i.e. cash and GICs in an RRSP)

- $100,000 in retirement income (i.e. cash and GICs in an RRIF)

- $100,000 in deposits held in a mortgage property tax accounts

All of those deposits would be covered. That’s $600,000 protected by CDIC. That being said, since you’ve maxed out those particular categories, it would be wise to put any additional deposits you’d like covered at another financial institution.

5. Calculate Your Coverage with the CDIC Deposit Insurance Estimator

With this information in mind, it can get a bit confusing trying to calculate how much you are actually covered by CDIC deposit insurance.

Instead of trying to do it manually and assume your calculations are correct, I’d suggest using CDIC’s Deposit Insurance Estimator. It will show you what you are and aren’t covered within minutes.

+ show Comments

- Hide Comments

add a comment