A few weeks ago, I was lucky enough to have been invited to co-moderate a roundtable discussion alongside Desjardins CEO Guy Cormier for “A Greener Dollar”, a special event that was part of the Globe Series in Vancouver. In total, there were about 15 of us who got together at a coffee shop to spend an hour discussing sustainable finance, what we wanted to see in terms of progress, and what we were all doing right now as investors.

I was really excited about this event because besides myself and Guy who work in the financial sphere, all the roundtable participants worked exclusively in the sustainability space. I was curious what their thoughts on investing and finance were and how the conversation would go, so I was thrilled that we had a super engaging conversation (that took us way over our 1-hour time slot!). Let me share with you some of the things we discussed.

Can You Be a Responsible Investor When You’re Struggling Financially?

How we kicked things off was I asked everyone if they would like to share how they were currently investing their money. A few shared that they were investing in mutual funds at the bank. Others shared that they had opened discount brokerage accounts and were experimenting with self-directed investing, and a few others said they were investing with a robo-advisor.

No matter how everyone was investing, two things were very clear: everyone wanted to make a positive impact with their investing dollars, and a good percentage of participants were concerned about jumping in because they were either struggling with other financial obligations (ie. student debt, unstable work, variable income), a lack of financial confidence, or both.

Let’s talk about some of those financial obligations because I honestly hear about them all the time and they can be a big deterrent for potential investors. In my view, there is a step-by-step process one should take before investing.

First, set up a fully funded Emergency Fund (just a high-interest savings account) that has at least 3 to 6 months’ worth of living expenses in it. This is so if there’s a financial emergency, or you get laid off or are working contract jobs, you’ve got cash in the bank to stay afloat.

Once that’s done, if you have debt, like a student loan or credit card debt, make a debt repayment plan. Determine what debt strategy you want to take, set due dates for all of those debts so you know when they will be paid off by, then include those regular debt payments into your budget so paying them off becomes a habit.

I would also suggest, especially when you’re just starting out and not earning a consistent or sizeable income, have a backup! That can look like a weekend job or starting a side hustle. From personal experience, if I didn’t work as an on-call teleprompter operator for the news for 3 years on top of my day job, or start a blog that helped me earn some revenue from Google ads and sponsorships, I wouldn’t have been able to overcome some of my financial struggles as easily or quickly.

Then, once you’ve done all of the above, save up at least $1,000 so you can start investing in a responsible way. But, how do you actually go about investing in responsible funds and how do you know you’re even doing it the right way?

Can You Be a Responsible Investor When You’re Not Confident About Investing?

Financial confidence, especially when it comes to investing, is something I am all too familiar with. Not only have I personally dealt with this throughout my 20s, but I’ve talked with so many others at my workshops, inside my online investing course, or as financial counseling clients, who’ve experienced the same thing. Financial confidence just means you have the knowledge and experience to confidently make wise financial decisions for yourself. Without that confidence, well, you might become paralyzed with fear and not do anything. And not doing anything is one of the worst things you can do.

So, in order to feel good and confident about investing, you need to arm yourself with…knowledge and experience. Confidence isn’t something you’re born with, it’s something you develop based on the accumulation of information, facts, and practice. Even if you’re not ready to invest or don’t have the money to start, you can start educating yourself and open up a practice account with a discount brokerage to get a feel for how it all works.

Moreover, when you’re educating yourself, you can start researching what your options are in terms of responsible investing. What banks or robo-advisors offer responsible funds, or what funds can you buy yourself in a discount brokerage account?

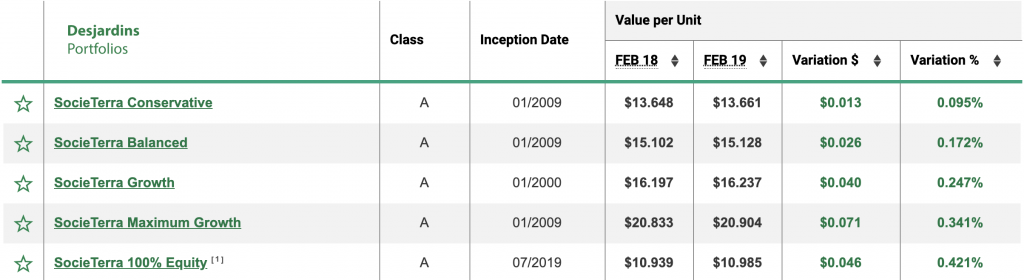

Since this was a Desjardins event, Guy shared how Desjardins has been offering their SocieTerra mutual funds for 25 years. Here’s a look at their responsible mutual fund offerings as a reference:

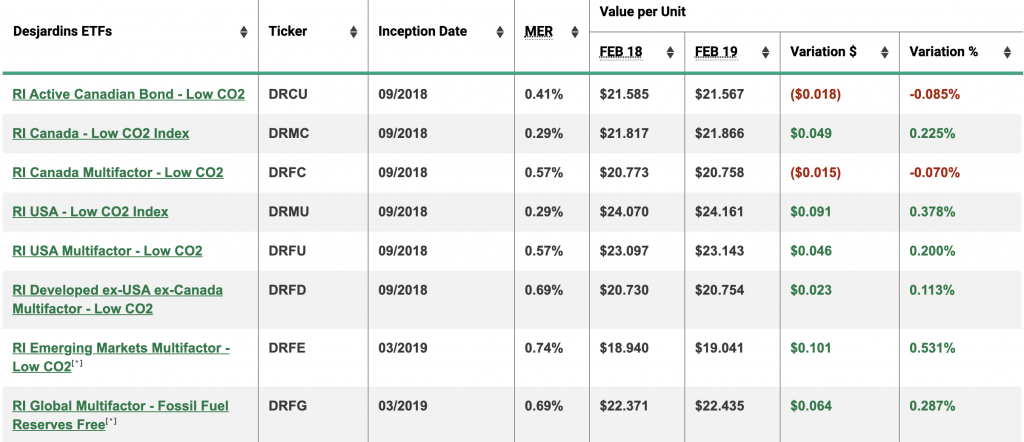

But they also offer responsible ETFs, which offer lower fees that still follow the same ESG criteria of their mutual funds.

But even if you are currently investing, but still aren’t sure you’re doing it right, you can change paths or strategies at any point. Personally, I’ve invested in almost every possible way there when I was learning how to invest and what was the right path for me.

I started out investing in index mutual funds, then switched to actively-managed mutual funds, then eventually decided to do a hybrid of robo-advisor investing and self-directed investing. I of course made some mistakes, and those mistakes cost me money in the form of lost returns, but the good thing is you can learn from those mistakes and change course at any time.

The key thing to remember is it’s better to be invested in the market than not at all.

Key Takeaways

We discussed a ton of different things at this event, but I want to share some of the key takeaways I felt were the most memorable and impactful.

1. Not All Responsible Funds Are the Same

Since the idea of responsible, sustainable, or green funds is still relatively new, that means that not all responsible funds are built the same. Some may include fossil fuels for example. Why is this? Because although these funds seek to implement ESG criteria (meaning they seek to invest in companies that are responsible environmentally, socially, and in governance), some fund companies have different interpretations or definitions of what ESG means to them.

Moreover, some fund companies may want to include things like fossil fuels into the mix because they want to have a seat on the board of that company as a way of having some authority on the decisions the company makes. With that said, before choosing to invest in a responsible fund, make sure you’re fully aware of what companies are in there.

2. Investing Responsibly Doesn’t Mean Giving Up High Returns

During the roundtable, Guy shared how investing in responsible funds or companies does not mean you’re sacrificing investment returns. Actually, you may end up with better returns because you are investing in companies that are progressive, forward-thinking, and most likely will be major players in the future as the economy shifts to answer to the current global crisis we’re dealing with. So don’t let the fear of earning lower returns scare you from investing in responsible funds.

Remember, you have a huge impact with your investing dollars, so make sure you’re investing in something you can feel good about.

3. Investing in Niches Can Be Risky Without Diversification

There was also some discussion about wanting to see more niche funds, such as funds that only invest in local companies or funds that invest exclusively in wind power. Although there’s nothing inherently wrong with wanting to invest in local companies or wind power, it’s important to remember that as part of a smart investment strategy, you need to be diversified. You may be putting your portfolio at risk if you invest in just a few companies, industries or sectors, so it’s important to remember that if you want to invest in some niches, make sure you’re also diversifying by investing in other more broad funds.

Final Thoughts

This was such an inspirational and exciting event to be a part of. I look forward to having more conversations and creating more content on responsible investing. And I hope that not too far into the future, responsible investing will just be known as investing. So if there’s one thing I want to leave you with it’s that with everything going on in the world right now, you do have a voice. And one way you can use your voice is by being intentional in what companies you choose to support with your investing dollars.

You should get Tim Nash (The Sustainable Economist/Good Investing) on your podcast to talk about responsible investment. He’s super knowledgeable.

I have. You can find the episode here:

https://jessicamoorhouse.com/ep-129-sustainable-investor-tim-nash/