This episode is sponsored by LowestRates.ca, where you can find the lowest rates in Canada for your mortgage, auto insurance, life insurance, and more…just like that. Make sure to check out their awesome blog, especially their Young Money series.

It’s sadly the final week of season 3 of the More Money Podcast, and this episode is my last guest interview for the season. After this week I’ll be taking some much-needed time off, then I’ll be back with more awesome episodes for season 4 starting Wednesday, Jan. 11.

Since it is the last week of season 3, I’ve saved one of my best interviews for last. I’ve been a huge fan and supporter of LowestRates.ca for well over a year now, but this was the first chance I got to interview the start-up’s CEO Justin Thouin.

I even went to the LowestRates.ca offices and brought all my podcasting gear just so I could get to the bottom of why he’s so passionate about educating people about the importance of comparison shopping.

It may be common sense to most of us, but the truth is most of us don’t actually try to find the best rates on the important stuff.

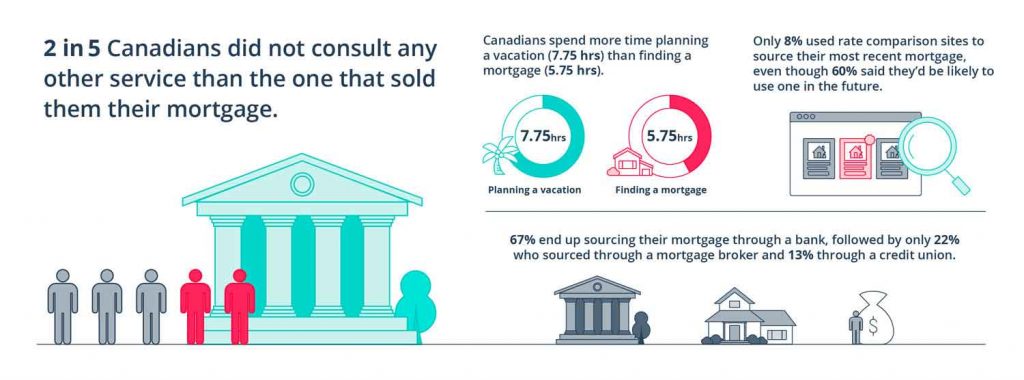

Sure, we’ll spend hours trying to find the best deal on a vacation package, but as LowestRates.ca’s survey shows, most Canadians don’t spend the same time and effort when it comes to finding the best rate for their mortgage. This is insane because a vacation will cost you maybe $1,500 whereas a mortgage is closer to $500,000! Come on people!

In this episode, we also chat about Justin’s journey from the corporate world to launching his own company and taking a big risk to pursue something he believed in. This is a sentiment I can definitely relate to, but I’ll leave more details on that until season 4.

That Survey I Mentioned

LowestRates.ca conducted a very interesting survey this year to show how few Canadians comparison shop for their mortgage, even though there are so many free resources out there to make it easy! You’ll never get the best deal if you don’t do your research first!

And if we’re talking mortgages, finding a lower rate than the one your bank initially offers you could save you thousands of dollars in the long run.

SURVEY: Are Canadians Making Embarrassing Financial Decisions?

LowestRates.ca’s Most Helpful Blog Posts

- What’s the best credit card? We recommend cards to four different Canadians

- How I stopped budgeting and learned to love the tracker

- Millennials are more loyal to banks than any other generation, according to survey

- Why 2017 will be the best year ever to sign up for a rewards credit card

Follow LowestRates.ca on Social

- Follow LowestRates.ca on Twitter

- Like LowestRates.ca on Facebook

- Connect with LowestRates.ca on LinkedIn

+ show Comments

- Hide Comments

add a comment