If you’ve been active in the personal finance world for as long as I have, then Vanguard is a name you’re very familiar with. That being said, it’s still more well-known in the U.S. than in Canada, considering it was founded in Pennsylvania in 1975, but Vanguard Canada didn’t set up shop in Canada until 2011 when it launched six ETFs on the TSX.

If you’ve been active in the personal finance world for as long as I have, then Vanguard is a name you’re very familiar with. That being said, it’s still more well-known in the U.S. than in Canada, considering it was founded in Pennsylvania in 1975, but Vanguard Canada didn’t set up shop in Canada until 2011 when it launched six ETFs on the TSX.

Since then, Vanguard has become the third-largest ETF provider in Canada, offering 36 different ETFs. Not only that, they’ve recently launched 4 low-cost and actively-managed mutual funds. And when I say low-cost, I mean the lowest in the country with management fees no higher than 0.50%. That’s pretty incredible considering most mutual funds have management fees at least double or triple that.

To give you an idea of the scale of Vanguard, they manage CDN $16 billion in assets within its 36 Canadian ETFs, and Canadians hold over CDN $28 billion in Vanguard investments, including both Canadian and U.S. funds.

Now, the reason I’m super excited to be writing about Vanguard for this post is because, honestly, it is one of the most highly recommended investment product providers within my circle. And my circle is comprised of well-known and award-winning personal finance experts, bloggers, podcasters and authors.

I’m also a Vanguard investor myself, currently holding the following ETFs in my RRSP and TFSA (if you’re curious):

- Vanguard Total Stock Market ETF (VTI)

- Vanguard US Total Market Index ETF (VUS)

- Vanguard Canadian Aggregate ETF (VAB)

- Vanguard S&P 500 Index ETF (VFV)

So, to share more about what Vanguard is all about, what their mission is, what they offer, and why they might be something you want to look more into, get ready for a super in-depth post clocking 2,000+ words!

A Brief History of Vanguard

Although Vanguard was founded in 1975 by John C. Bogle, the idea of launching the first index mutual fund was sparked all the way back in 1949. Bogle was a student at Princeton University and needed to find a topic for his thesis. Upon reading an article about mutual funds in Fortune magazine, he was inspired to research the mutual fund industry.

He then crafted a thesis around the idea that the mutual fund industry’s growth could be augmented by lower sales loads and management fees, being more clear and honest with clients about investment objectives, and not alluding that actively-managed mutual funds could consistently outperform market averages.

Just to reiterate these three points from John C. Bogle’s student thesis, he suggested that mutual funds should be:

- Low-cost

- Clear and simple to understand

- Track market indexes

The reason I want to emphasize these 3 key points is that now, in 2018, these are the main reasons why so many investors are ditching their high-cost actively-managed mutual funds in favour of low-cost index mutual funds and index-based ETFs.

Heck, once I became more educated about the investing industry and my options, that’s exactly what I did. I realized I was paying 2.5% on mutual funds that weren’t even earning 5% annual returns, and promptly switched to low-cost ETFs (and have been extremely happy ever since).

Getting back to my story about Vanguard’s inception, operations for Vanguard commenced in 1975 with the goal of being nothing like mutual fund management companies at the time. Instead…

It would operate on an at-cost basis, the better to put the shareholder in the driver’s seat (rather than reposing in the back seat, with the management company driving the car for a fee). Such a structure would enable Vanguard to deliver extremely low costs to shareholders.

Although Vanguard was a small company at the start (with only 3 staff members comprising of John C. Bogle, James S. Riepe, and Jan M. Twardowski), they all shared a big vision — to run a fund company in the best interests of investors and give them the best chance for investment success. That, and also launching the first unmanaged, low-cost index fund.

No other company wanted to do it since it meant fewer profits for them, so Vanguard had a big opportunity in front of them, which they jumped at to eventually change the mutual fund industry forever.

For more on the history of Vanguard, check out this article written by John C. Bogle himself.

Common Sense Investing

Even if you weren’t familiar with Vanguard before reading this post, you may have still recognized the name, John C. Bogle. That’s because he’s the author of the classic investing book that’s on almost every must-read list — The Little Book of Common Sense Investing.

If you haven’t read his book yet, I highly suggest you put it at the top of your reading list right now. It’s a great overview of what passive investing is all about and why you should strive to keep your investing costs low since that has a big impact on your returns over the long term.

Keep Your Fees Low

The book talks a lot about fees. Fees have been getting a lot more attention in Canada lately, which is about time since for years investors were blind to the fact that they were giving up a big chunk of their profits to their portfolio managers. I remember having a conversation not too long ago with a friend about fees (I’d done a podcast interview that day about them, so it was fresh in my mind), and she had no idea she was even paying fees!

In case you don’t know what kind of fees are typically charged, here are some percentages you can expect to see in Canada today:

Actively-managed mutual funds: 1 – 1.5% (plus 1% for financial advice)

Index mutual funds (a.k.a. index funds): 0.35 – 1.07%

Exchange-traded funds (a.k.a. ETFs): 0.08 – 0.75% (plus 0.40% – 0.50% for management)

To give you a better idea of what this means for you, let’s pretend you invested $10,000 in each, and you earned 8% after one year with each investment.

With actively-managed mutual funds, you would profit $550 after 2.5% ($250) in fees.

With index mutual funds, you would profit $693 after 1.07% ($107) in fees.

With ETFs, you would profit $730 after 0.70% ($70) in fees.

The difference isn’t that mind-blowing between all three (although I’m a firm believer that every dollar counts). But, if we were to increase that initial investment to $100,000 it would be a different story. You see, when your portfolio has grown to this level (which it will over time), this is where fees can have a huge impact on your profits.

With actively-managed mutual funds, you would profit $5,500 after 2.5% ($2,500) in fees.

With index mutual funds, you would profit $6,930 after 1.07% ($1,070) in fees.

With ETFs, you would profit $7,300 after 0.70% ($700) in fees.

Which investor would you like to be? The one who paid $2,500 in fees, or the one who pocketed an extra $2,000 by paying only $500 in fees? Not a hard choice, is it?

Understand Index Funds vs. Mutual Funds vs. ETFs

Since I’ve been talking a lot about index funds, mutual funds, and ETFs, I do want to clarify the difference between all three.

What used to always confuse me when I was younger was how people used different terms for the same thing.

For instance, mutual funds. When people refer to mutual funds, what they actually mean are actively-managed mutual funds. With index funds, the proper term is actually index mutual funds. Index funds are in fact a type of mutual fund, just not actively managed. Exchange-traded funds (or ETFs as most people call them) work similarly to mutual funds, but they are not mutual funds.

Confusing right?

Let’s break this down even further. Here are some easy definitions you can memorize for the future.

Actively-managed mutual funds:

“Collection of investments, such as stocks, bonds and other funds owned by a group of investors and managed by a professional money manager.” – GetSmarterAboutMoney.ca

These funds are actively-managed with the intent to beat market averages.

Index mutual funds (a.k.a. index funds):

“An index fund is a type of mutual fund with a portfolio constructed to match or track the components of a market index, such as the S&P 500.” – Investopedia.com

These funds aren’t actively managed to keep fees low and to mimic market averages.

Exchange-traded funds (a.k.a. ETFs):

“ETFs are securities that closely resemble index funds but can be bought and sold during the day just like common stocks… offer the convenience of a stock along with the diversification of a mutual fund.” – InvestingAnswers.com

The majority of these funds are not actively managed, to keep fees low and to mimic market averages. That being said, some ETFs are actively managed or “rules-based” and do have high fees. Make sure you do your due diligence before choosing to invest in a particular ETF.

Know Your Risk Tolerance & Asset Allocation

The risk was a big issue of mine when I was in my 20s. For whatever reason, I associated investing with risk. Well actually, I had a pretty solid reason. When I was just starting to learn about investing and money management, I was graduating from university…in 2009. It was the height of the recession and all I saw in the paper and from family friends was that everyone lost their life savings.

This terrified me. I didn’t have that much money to invest, so I’ll be damned if I invest what I have just to lose it all!

Luckily, I did still start investing in my mid-20s despite my fear, but I certainly didn’t do it the right way. I didn’t do my research, I didn’t know my personal risk tolerance, and I had no idea what asset allocation meant.

Now that I’m much older and wiser, I’m glad I started investing as early as I did, but I’m on a mission to prevent other 20-somethings from investing blind.

Luckily, Vanguard Canada offers some great free resources, including their Investor Questionnaire.

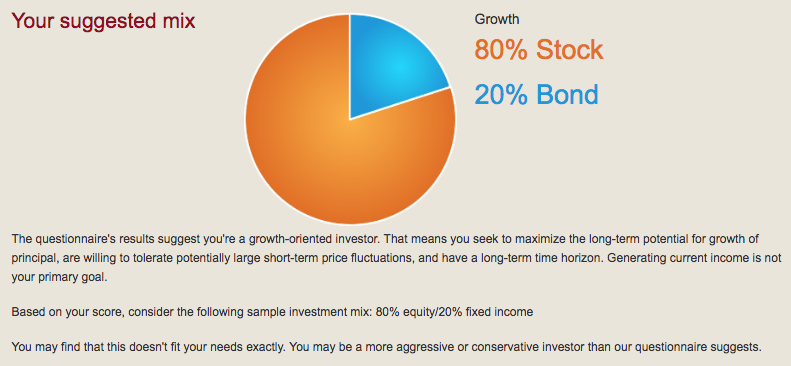

I just retook the quiz and this is the risk tolerance and asset allocation suggestion it gave me:

Even though I used to be pretty risk averse when I was younger, it honestly was because I wasn’t educated enough about investing. Now that I’m much more educated and confident about investing, I’m more open to taking risks if it means a greater chance of larger returns.

I also now understand that it’s when you’re young that you should be taking more risks with your investments because you have the least amount to lose, but plenty of time to bounce back after market dips.

Vanguard Canada Introduces Mutual Funds

I know I’ve been going on and on about Vanguard and how it started the first index mutual fund and is well-known for its ETFs in Canada, but they are actually getting into the actively-managed mutual fund game in Canada now too. But there’s a catch. The funds are low-cost and match up with their history.

This may come as a surprise to you, but it really shouldn’t. You see, before Vanguard launched the first index mutual fund, they offered 11 different actively-managed mutual funds in the U.S.

Still, if Vanguard is known for its ETFs in Canada, why go the actively-managed mutual fund route?

Because even though the Canadian ETF industry is in the billions, the Canadian actively-managed mutual fund industry is in the trillions. $1.5 trillion to be specific. The hard facts are, that although young investors are quickly adopting low-cost index-based ETFs through brokerages or robo-advisors, most investors still choose to invest in mutual funds.

It would be crazy as a business to ignore those numbers. So, Vanguard decided to get into the mutual fund business in Canada, but change it for the better too.

As I mentioned at the top of this post, most mutual funds come with a hefty price tag. They all aim to beat the market (instead of track it), but it’s almost impossible for them to succeed because those fees eat up so much of the profits. Vanguard wants to allow investors to have the choice to try and beat the market, and actually achieve that goal by offering lower fees.

Hopefully, this will trigger other investment product companies to lower their fees too.

How to Get Started Investing with Vanguard Canada

So, here’s the funny thing about Vanguard Canada. In Canada, you can’t directly invest with them online and they don’t offer index mutual funds. If you live in the U.S., you can invest with Vanguard directly online (learn more here), and they do offer index mutual funds.

Everything’s always a bit different for us Canadian folks.

What they do offer in Canada are their 36 ETFs, and now their 4 actively-managed mutual funds. If you want to add Vanguard funds in your portfolio, here are the ways to do it in Canada.

Robo-Advisors

This is how I currently invest in Vanguard funds. Right now, I have my RRSP with one robo-advisor and my TFSA with another, and both portfolios include the Vanguard funds I mentioned at the beginning of this post.

If you’ve been thinking about switching your investments to a robo-advisor and want to make sure you have Vanguard ETFs as part of your portfolio, luckily all robo-advisors are extremely transparent. When doing your research and weighing the pros and cons of each robo-advisor, make sure to take a good look at all of the funds they offer before making your choice.

Self-Directed Brokerage

If you would rather save money on fees (robo-advisors have higher fees), and don’t need the automation that robo-advisors provide, then using a self-directed brokerage is your best bet.

This is what it means to be a true DIY investor. You figure out your ideal asset allocation, make a list of funds you wish to purchase to fulfill that ratio, then buy them through a self-directed brokerage like Questrade, Virtual Brokers, QTrade, TD Direct Investing or BMO Investor Line.

Investment Advisor

If you want to just hand off your investments to a professional, that is something you can do as well (though it will cost you). Typically, these types of advisors only manage portfolios for high-net-worth individuals. Vanguard Canada suggests that if you want to go down this route, look for an advisor through the Investment Industry Regulatory Organization of Canada (IIROC).

IIROC also has a great list of questions you should ask prospective advisors before deciding to work with one.

Do you invest with Vanguard (if you’re American) or Vanguard Canada (if you’re Canadian)? I’d love to know your thoughts and experiences in the comments!

Wow Jessica, Congratulations. This is a well-researched article. I did one similar a few months ago, but mine was about 500 words. Yours is way more complete.

Keep it going. 🙂

Thanks Alain!

I’m just starting to educate myself about finances and I found this super helpful. Unfortunately, last year our financial planner set us up with actively managed funds and the MER is greater than 2%.

I’m looking into coming up with a new solution moving forward so this post was great.

That’s the story of SOOO many people. Especially if you go to a bank or financial institution for advice. They’re main objective is to sell their company’s investment products. I’m actually coming out with an online investing course in the new few weeks you may want to check out! Will share more news about it soon!

Hey Jess I am also a big fan of index fund ETFs. They make up the bulk of my portfolio, too (Australian Investor here)

Amazing! I’m so curious about investing in Australia. Any resources you could point me to as I sometimes get asked by readers/listeners?

Really appreciated your thoughts on Vanguard investments.

Thanks!