Want to learn how to improve your credit score in Canada? Good! Because you 100% can do it yourself and it’s not hard (though it may not be easy). Here’s a helpful and free Credit Best Practices Guide you can download to help you improve your credit score today!

Want to learn how to improve your credit score in Canada? Good! Because you 100% can do it yourself and it’s not hard (though it may not be easy). Here’s a helpful and free Credit Best Practices Guide you can download to help you improve your credit score today!

Why You May Think Credit Scores Aren’t Important

When I first started my personal finance journey over 7 years ago, one piece of advice I found a lot of “money gurus” shared was that it wasn’t important to know your credit score. Instead, what was more important was to check your credit report. To be fair, that’s not bad advice per se. Your credit report is important to check at least once annually (I’ll dive into that a bit more shortly). Still, I found it odd that they were essentially saying “Don’t worry about that, it’s not important” when in actual fact knowing your credit scores and understanding how they work is important!

How I discovered this was through my financial counseling training. Most Accredited Financial Counselling Canada® designees go through the program to specifically become credit counselors for non-profits. I’m probably one of the few designees who simply wished to get my credentials to become an independent fee-only financial counselor. In any case, although the program goes through all aspects of financial planning, credit and debt are heavily focused on. To give you a taste, one of the books we were required to read was Credit for Canadians: Fix Your Own Credit Report, Protect Yourself from Identity Theft by Mike Morley (super exciting reading, let me tell you!).

So, going back to why these “money gurus” shared in their books or TV shows that credit scores aren’t important. I don’t really know why they shared this misguided advice, I can only speculate. One theory is that they don’t trust the credit bureaus. They may feel it’s all a big racket in which these bureaus getting paid by consumers to find out their credit scores, and also getting paid by creditors (financial institutions and credit/loan companies) as all creditors have to be a member of at least one credit bureau. Or maybe they believe the credit bureaus are in cahoots with lenders in a big scheme to get more consumers to borrow, pushing more consumers into debt which obviously isn’t good.

I’m not here to defend the credit bureaus. All I want to do is explain how the system works. And the system works by you getting scored by these credit bureaus based on past credit behaviour, which will determine if you will be approved for credit, how much credit you’ll be approved for, and what kind of interest rate you’ll be offered.

These Are the Credit Bureaus in Canada

In Canada, there are two credit bureaus: Equifax Canada and TransUnion Canada.

You may have thought there was a third, but that’s only in the United States. In the U.S., there are three credit bureaus: Equifax, TransUnion, and Experian.

What a “FICO Score” Means

Both Equifax Canada and TransUnion Canada use a credit scoring system called a FICO score. In case you’re curious, that acronym comes from Fair Isaacs Company which developed the scoring system. This scoring system helps to predict the likelihood of a consumer paying their bills or debts on time.

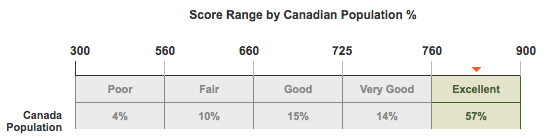

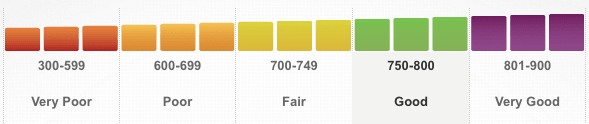

It scores consumers by giving them a number between 300 and 900. As you may already know, the higher the number the better! If you have a low number, it’s basically telling lenders that they don’t have much confidence in you paying your bills or debts on time.

Here’s Equifax’s credit score range by Canadian population percentage that’s pretty interesting.

And here’s TransUnion’s credit score range.

You may be wondering, what do they base these scores on? It’s an important thing to answer since it could help you identify why your credit scores aren’t as high as you assumed they’d be. As outlined in Credit for Canadians, “Credit scoring involves assigning a value, usually points, to different factors that will be used to predict the likelihood of you paying your loan back as agreed.” And the loan can mean any type of credit, such as a line of credit, credit card, mortgage, car loan, etc.

So, how do these bureaus assign points? They don’t reveal all the details, however, we do know that some factors are more heavily weighted.

Here’s a quick breakdown:

- 35% – Late payments, bankruptcies, collections and judgments

- 30% – Current debts

- 15% – Age of accounts

- 10% – Type of credit (credit cards, mortgage, bank loan)

- 10% – Applications for new credit or credit inquiries

As you can see, paying your debts on time and how much current debt you have accounts for 65%! That means those are the two most important things you need to be mindful of when thinking of how to improve your credit scores. In other words, always pay your bills and debts on time, and make a plan to pay off all your debts as soon as possible.

Why Credit Scores Are Important

Unless you never plan on getting a credit card, getting a mortgage or car loan, or using any type of credit in your life, credit scores are important. You need to know how creditworthy or responsible you look to lenders because they ultimately decide whether or not to approve you for credit, how much credit you’ll be approved for, and what interest rate you’ll get.

A common example is getting a mortgage. Almost all homeowners require a mortgage to afford a home. When applying for a mortgage, you want to make sure you’ll be approved for the amount you need to buy a home and get a low-interest rate. If you have high credit scores, it is very likely you’ll be approved for the amount you need and get a low-interest rate. If you don’t have high credit scores, you may only be approved for a fraction of what you were hoping for and be given a high-interest rate.

Why You May Have Different Credit Scores at Each Bureau

This is a common question I get: “Why is my score 650 at Equifax and 700 at TransUnion?” The simple answer is that they are different bureaus and thus are given different information from lenders. You see, lenders in Canada only have to be a member at one of the bureaus, not both.

For example, Lending Company A may only report information about you to Equifax, and Lending Company B may only report information about you to TransUnion. Equifax and TransUnion do not share information, which is why you need to check your scores at both bureaus. I know, it’s annoying but that’s just how the current system is set up.

What Credit Reports Are All About

Your credit report is where all the credit information about you lives. The credit score is just a number to help lenders determine whether you are creditworthy or not, but the details about you are in the credit report. That’s why you need to check your credit reports from both bureaus at least once per year to see what’s on your report and verify that all the information being reported about you is accurate.

If there is inaccurate information on either of your reports, it could inadvertently lower your credit scores. So make sure all the information is correct. But if you see a mistake or something that isn’t up-to-date, first contact the lender to dispute it and get them to fix the reporting error to the bureau. If that doesn’t work, contact the bureau directly.

You can request your free credit reports from both bureaus via these links:

How to Check Your Credit Scores

Now, to find out what your current credit scores are, there are a few ways you can do it. You can do it on the free way or the paid way.

Some people speculate that the free credit scores aren’t as accurate as going directly to the bureaus, but at a conference, I went to last year a rep from TransUnion said that shouldn’t be the case. These partner companies get the scoring data directly from the bureaus, so the scoring numbers should be identical.

That being said, I’ve heard many people say they’ve tested them all out and they don’t match. I’m not sure why, maybe these companies are lagging behind in getting their scoring numbers. In any case, I usually tell my clients to test out the free ones if they like, but in my opinion, it’s easiest to just pay for a one-month subscription for both Equifax and TransUnion, then cancel those subscriptions before they renew (and yes, this is what I do personally as well). This way you get your most accurate score within minutes plus it includes your credit report and suggestions on how to improve your scores too.

Free Credit Scores

- Ratehub (for Equifax score)

- Borrowell Free Credit Score (for Equifax score)

- Capital One Canada (for Transunion score)

- Credit Karma Free Credit Score (for TransUnion score)

Paid Credit Scores ($19.95/month)

Tips on How to Improve Your Credit Score

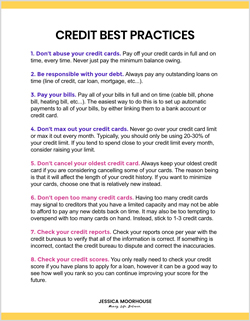

Once you find out your credit scores, you may want to take immediate action to improve them. Make sure to download the free Credit Best Practices guide for a checklist on how to start improving your scores today!

Got any questions about how to improve your credit score in Canada? Share them in the comments, I’m happy to answer!

+ show Comments

- Hide Comments

add a comment