It all started when my husband asked me, “Is there a way I can accept payments from clients without being charged crazy high fees?” He’d been using Paypal for a number of years to invoice his international clients for his music engineering business, but he was getting fed up with the amount of money he was losing from the astronomical fees and inflated foreign exchange rates.

As someone who has always hated high fees and has spent years educating people on the benefits of no-fee banks and low-fee investments, I started doing some digging to find a solution. That’s how I stumbled upon Wise, a universal account Canadians can use to send, spend or receive money internationally without the considerable mark-ups and hidden fees charged by banks. Needless to say, my husband now uses Wise to save money on fees and get paid from clients promptly, no matter where they are in the world, and it’s been a game changer for his business.

However, Wise isn’t just useful if you have a small business. What I’ve also discovered is it can be a handy tool for your personal finances too. Let me show you exactly how Wise works so you can better understand how it can help you save more money in your business, your day-to-day life, or both!

How to Send Money Abroad with the Lowest Fees

Did you know that according to Wise’ 2022 Remittance Report, $7.2B (USD) of remittances outflowed in 2021? What these numbers show is the massive volume of people who are not only sending money internationally but are likely being gouged by costly fees and bad exchange rates, reducing the amount their loved ones will ultimately receive.

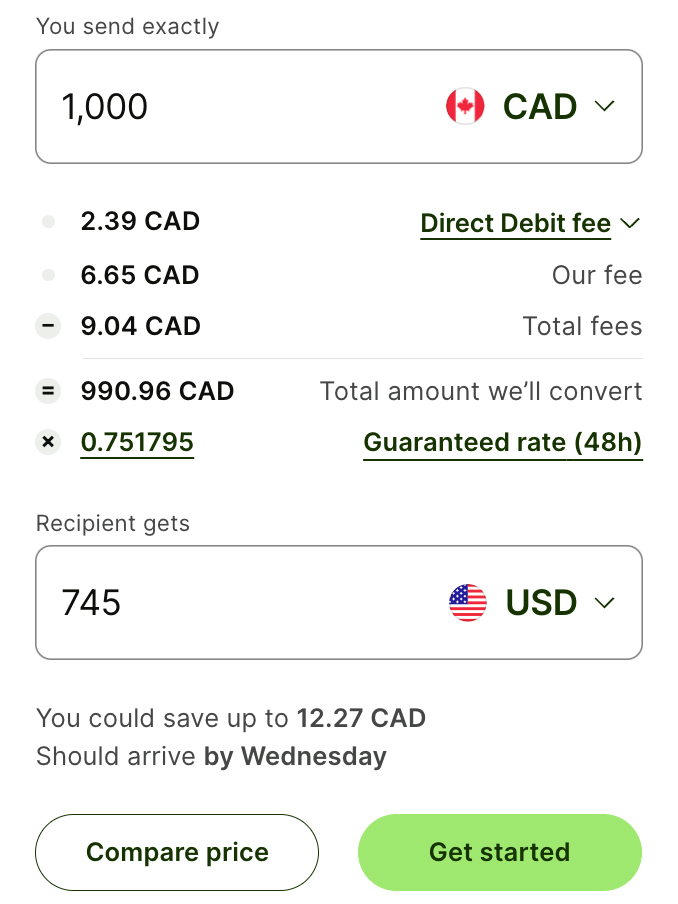

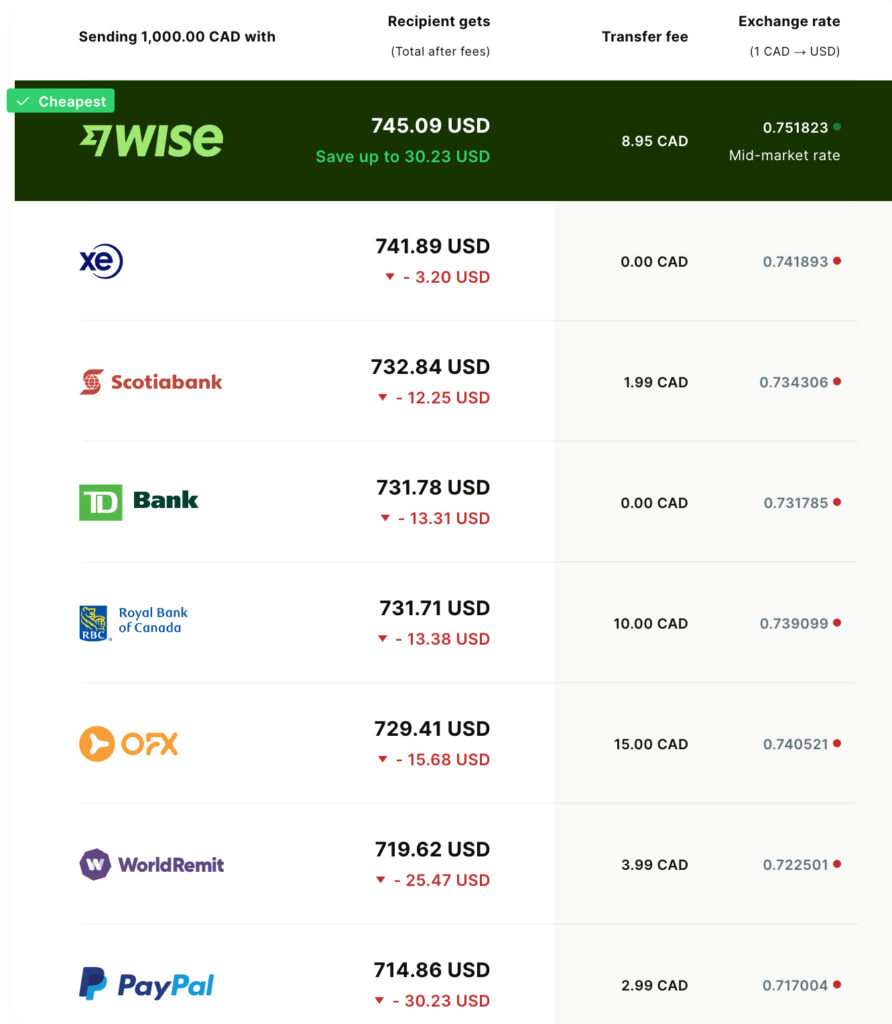

Wise is focused on transparency and offers low, clearly stated fees and the mid-market exchange rate (the “realest” and fairest exchange rate), so nothing is hidden from you during a transaction. When compared with their competitors, the numbers speak for themselves.

For example, let’s say you wanted to send $1,000 CAD to your family in the U.S. Here’s what this would look like using Wise (screenshots taken on June 13, 2023).

As you can see, you save the most amount of money when using Wise compared to its competitors.

Wise also makes it incredibly easy to receive money internationally. Its new Interac e-Transfer® Auto Deposit feature enables Canadians to have a new and more convenient way to receive money in a Canadian Wise Account. In collaboration with Peoples Trust Company, part of Peoples Group, personal account customers can now activate their CAD Wise balance to receive money via Interac®.

How to Travel Internationally in the Right Currency

Sending money abroad for the lowest cost is super important, but what if you were the one going abroad? Typically travellers convert their Canadian dollars into local currency or use their Canadian credit cards, without realizing the hidden fees they’re paying or the unfavourable exchange rate they’re getting. So, how can you keep more of your money to spend on making your vacation the best one yet instead of wasting it on fees? The Wise card can help!

The Wise card can also be connected to Google or Apple Pay to make it even easier to pay for things when travelling. It’s easy to use, all you have to do is deposit funds into your Wise account and then you can either pay for things just like a regular debit card or withdraw cash from an international ATM.

Not only will this help you avoid high credit card foreign transaction fees, but you have the option of loading your account with Canadian dollars which will be automatically converted into the local currency for the lowest fees available. If you already have some local currency, like the euros your Nonna sent you for your birthday, you can deposit those into your account and spend them with no currency conversion necessary.

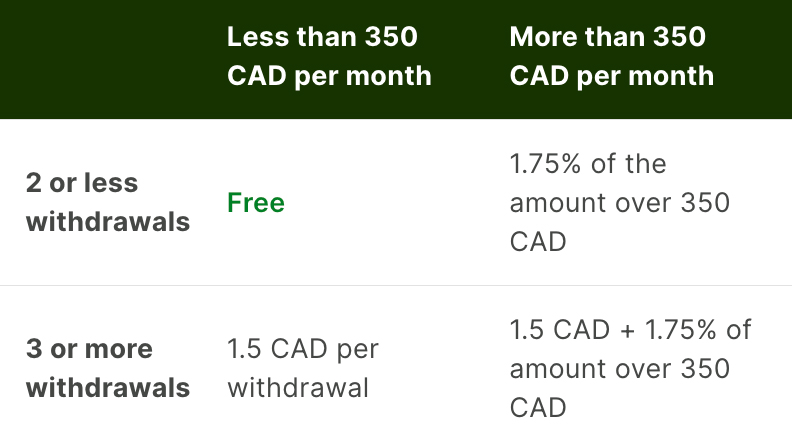

You can also use your Wise card to withdraw up to $350 CAD from an international ATM fee-free each month and then a minimal withdrawal fee after that.

In other words, when my husband and I finally go on the Italian getaway we’re planning for next year, I’ll be using my Wise card for most of my purchases instead of using my credit card or getting euros from my bank.

Beware of Dynamic Currency Conversion

You know when you get the option to choose your home currency (i.e. CAD) or the local currency (i.e. EUR) when trying to withdraw money at an international ATM or pay for a meal at a restaurant on vacation with your debit or credit card? You may not think there’s much of a difference and because it can be hard to do the mental math, you may just default to choosing your home currency. This is what’s called Dynamic Currency Conversion (DCC) and let me tell you it’s costing you more than you realize.

You see, when you choose your home currency, you’re allowing the ATM or payment terminal to choose the exchange rate, which won’t be the mid-market rate but will include an embedded foreign conversion fee which can be as high as 6-12%. What should you do instead? Next time you see the option, make sure to choose the local currency option. And better yet to avoid any foreign transaction fees from your home bank, use your Wise card and either use money you’ve already converted to local currency or use your home currency and Wise will automatically convert your money for you at the mid-market rate. Just another way to save money while you’re spending money abroad.

How to Save Money with Wise in Your Small Business

And lastly, what made me first discover the platform, Wise Business can be incredibly helpful for your small business when serving international customers or clients. With functionalities like accounts with multi-user access, approval workflows, an account debit card and expense cards for employees, and integrations with accounting software like Quickbooks or Xero, Wise Business could be the international business account you’ve been looking for. And 300,000 businesses that already use it would agree. Wise Business also lets you pay up to 1,000 people with one click, keep your international money all in one place, move money between currencies in seconds, and save on currency conversion fees when paying for expenses in foreign currency.

Is It Safe?

Because I always get this question, plus I wanted to know if my money was safe, let’s talk about how Wise protects your money. Although Wise is not CDIC insured (because it isn’t a bank), they are still regulated and follow strict rules by being registered with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a Money Service Business (MSB) as well as having an MSB license with the Authorité des Marchés Financiers (AMF).

Not only that, Wise keeps your money separate from the company’s finances and it doesn’t lend your money out like a bank does. When it holds your money and the money of all of its customers, it holds that money in cash with reputable banks or invests it in secured investments like stable short-term government bonds that are only at risk of defaulting if that government goes belly up (which is highly unlikely).

How to Get Started

Ready to try it out yourself? It’s free to make an account and will only take you a few minutes to set up. Visit wise.com/ca to get started.

Wow, this article was incredibly helpful! I’ve always needed help finding the most cost-effective way to convert currencies, especially when traveling abroad. The information about Wise Canada is eye-opening. I had yet to learn that they offer such competitive rates and low fees. I’ll be looking into using their services for my next trip. Thank you for sharing this valuable information!

Hey there, I have been using Wise for the last 3 months. User interface is easy and you really can save a lot. Futhermore, they applied nice security options, including 2 factor authentification with fingerprint options. Both Web portal and mobile app work as a charm! Thank you Jessica for sharing this with us.

Thanks for sharing your experience!