How much do you need to retire in Canada? This is a common question I get from financial counseling clients and readers/listeners and for good reason! There is an abundance of content out there on why you should start investing early for retirement, how to optimize your TFSA and RRSP for retirement, and why it’s important to keep your investment fees low as they’ll eat into your returns. What there isn’t as much clarity on is how much money you will actually need to have a comfortable retirement. You may have heard numbers like $1 million or $2 million thrown around, but what do those numbers mean? And are they enough?

How much do you need to retire in Canada? This is a common question I get from financial counseling clients and readers/listeners and for good reason! There is an abundance of content out there on why you should start investing early for retirement, how to optimize your TFSA and RRSP for retirement, and why it’s important to keep your investment fees low as they’ll eat into your returns. What there isn’t as much clarity on is how much money you will actually need to have a comfortable retirement. You may have heard numbers like $1 million or $2 million thrown around, but what do those numbers mean? And are they enough?

Well, in today’s post I’m going to break down how you can calculate how much you will need for retirement. It’s not rocket science and it’s something you should know, even if retirement is still decades into the future.

$1 Million Dollars Might Not Be Enough to Retire On — Especially If You’re A Millennial

For as long as I’ve been reading investing books (let’s say a decade), $1 million has always been cited as the average amount of money someone will need to live a relatively comfortable retirement. Well, a lot has changed in the past 10 years and factoring in inflation, $1 million may not be enough if you plan on living in an expensive Canadian city like Vancouver or Toronto. Also – if you’re a millennial – you won’t be retiring for a while and you’ll need to factor in perhaps 30 more years of inflation before you retire — plus another 30 or so years of inflation AFTER you retire.

I know what you’re thinking. You’re thinking that $1 million already sounds impossible to save up, so how on Earth are you supposed to save more than that for retirement? Is there even a point in trying to save up that amount when you’ve got bills and debts to deal with?

Yes, there is! If you’re 30, I know $1 million sounds like a scary number, and $1.5 or $2 million sound even scarier, but I think we need to move away from that big number for a second to fully understand how to get there.

You Won’t Need 100% of Your Current Income to Live Off of in Retirement

Depending on your age and where you’re at in life, you may still be carrying student debt, you probably aren’t (although you might be) earning at the top of your salary bracket yet, and you may have some big expenses to deal with like a mortgage or starting a family. I get it, there’s a lot to deal with in life. It can feel difficult to include retirement savings in your budget when you already feel strapped for cash.

Well, that’s actually one of the amazing things about retirement — your life in retirement will probably be less expensive than it is right now. Hopefully, you’ll be debt-free when you retire. This should actually be a big goal of yours because you’ll significantly reduce your cost of living in retirement if you no longer have any debts.

Assuming you are debt-free, that means no more consumer debt or mortgage to have to worry about. You also won’t have to squirrel away money for savings since you’ll already have your future income saved up to spend. Lastly, you’ll be done with the big expenses. No more mortgage and your family will be moved out and financially independent from you. All you’ll have to make sure you can afford is your day-to-day expenses, gifts for loved ones, clothing, health expenses, travel, and taxes.

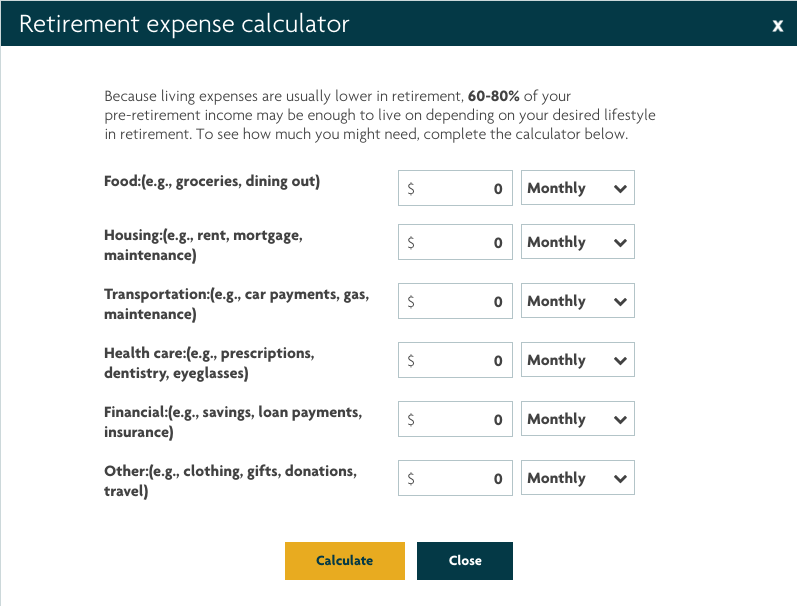

To get a clear idea of what kind of expenses you may have in retirement, check out Sun Life’s Retirement Calculator which includes this section on calculating your expenses.

As it mentions, you may actually only need 60-80% of your current income to live on. This makes a lot of sense since you’ll have far fewer expenses in your retirement years. Then again, you can aim to have 100% of today’s income for retirement if you want to have a very cushy retirement, but in general, it’s not necessary. Actually, based on a 2016 Retirement Now Report by Sun Life “Canadian retirees are living on an average 62% of the income they earned prior to leaving the workforce.”

Your Retirement Income Will Be Supplemented by CPP & OAS

One thing many people often forget about is that although you are responsible for funding most of your retirement, you will get some help thanks to the Canada Pension Plan and Old Age Security. And yes, the Canada Pension Plan will be around by the time you retire. Just check out my podcast episode with a representative of the Canada Pension Plan Investment Board stating that CPP will be around for at least the next 80 years.

How the Canada Pension Plan works is you can apply to receive your CPP payments when you turn 65, however, you can receive reduced payments any time after 60 and before 65, or you can defer payments from age 65 til you hit 70, with a payment increase of 0.7% for every month you wait after 65 (up to age 70). How much you will receive will depend on how much and for how long you’ve contributed to CPP, and at what age you decide to start taking payments. As a reference, according to the Government of Canada website, for October 2018 the average payout was $664.41/month, and the 2019 maximum payout was $1,154.58.

Old Age Security differs from the Canada Pension Plan in that it’s not a pension you’ve contributed to during your working life. Instead, it is funded from the revenues of the Government of Canada. The amount you get paid once you reach 65 is dependent on how long you’ve lived in Canada after the age of 18. The longer you’ve lived in Canada, the higher the payout.

The maximum payout for OAS is $601.45/month as calculated for January-March 2019 unless you qualify for the supplement. In order to qualify for the maximum, you must have resided in Canada for at least 40 years after turning 18, and continuously for the 10 years immediately before the approval of your OAS pension.

That being said, there is the Old Age Security pension recovery tax to factor in, also referred to as the OAS clawback. That means that if your net income in retirement exceeds a certain threshold, you’ll need to pay back the Old Age Security payouts you received. For 2018, the threshold is $75,910 to a maximum of $122,843. How the clawback is calculated is you must pay 15% of any amount above the threshold up to the maximum. If your income equals or exceeds $122,843, you have to repay all the OAS payments you received. So, if your net income was $85,000, it would look like this.

$85,000 – $75,910 = $9,090

$9,090 x 15% = $1,363.50 (amount you must pay back)

Calculate How Much You Need Tomorrow to Start Saving Today

So, we’ve covered that $1 million probably won’t be enough to retire on by the time millennials like you are ready to retire. We also know that the best place to start your retirement calculations is by determining what annual income you’d like to live on in retirement. Then, we’ve gone over how CPP and OAS are there to help supplement your personal savings.

With all this knowledge, you’re now ready to punch in your current savings numbers to find out what number you should aim to have saved up for retirement.

One easy way to do this is to try out Sun Life’s Retirement Savings Calculator. It already includes an assumed amount for CPP and OAS, so you just need to type in how much you’ve got saved so far and what annual income you hope to have for retirement.

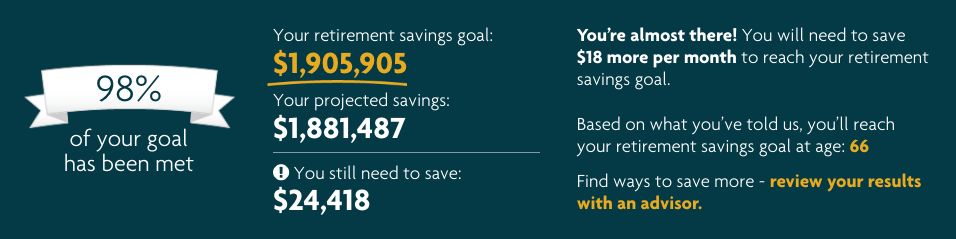

For myself, I typed in that I’d like to have a retirement income of $56,000 in today’s dollars before taxes. Well, apparently that means my retirement savings goal should be $1,905,905. As a side note, while a $1.9 million retirement savings goal may sound excessive today, keep in mind that in my scenario I’m looking far into the future and as such, the $1.9 million takes into consideration the anticipated impact of inflation for the time between now and my retirement, and inflation plus the cost of living while I’m retired. For someone who is much closer to retirement, this number could be significantly less.

Currently, I’ve got $100,000 saved up in my retirement fund and I’m contributing $1,000 towards that fund every month. Still, the calculator says that’s not quite enough to meet my goal. However, if I just add another $18/month to my current contributions, I should be able to hit my target of $1.9 million by the time I reach 65, according to the assumptions built into the calculator.

This is actually a great reminder that if you increase your current contributions by just a few dollars, over several decades it could have a huge impact! For me, an $18 extra added to my current contributions will turn into $24,418 by the time I’m 65! I guess I’d better adjust my contributions pronto!

How much do you need to retire in Canada? Try out the retirement calculator and share your retirement goal number in the comments!

+ show Comments

- Hide Comments

add a comment