Capital gains taxes just went up for a portion of Canadians thanks to the new rules that just took affect today. And lots of Canadians are not happy about this because effectively, it’s a wealth tax by a different name. Plus who likes paying more taxes? No one!

Nevertheless, I’ve been seeing a lot of misinformation out there about this new capital gains tax rules, so in the post, I want to clarify some things, share what you need to know and how these capital gains changes could affect youl

No One is Paying a 67% Tax

One thing I’ve seen a lot online is people thinking that they now have to pay a 67% tax rate on their capital gains moving forward. This is false and literally makes no sense since we don’t pay tax on 100% of our capital gains (which I’ll share more about in a bit), but also because the highest combined federal and provincial marginal tax rate someone can have, as of 2024, is 54.80% (this is the top rate for someone in Newfoundland and Labrador). In other words, no one is paying a 67% tax!

We also have a progressive tax system in Canada, which means we pay different percentages of tax on different levels of income. So, even if you were at that top tax rate, the overall amount of tax you would have to pay would be much lower. This is what’s called your average tax rate. I won’t go into more detail about this since I do actually have a video that explores this more in-depth called Income Taxes in Canada, so make sure to watch that after this.

Another reason people are up in arms about this is they think it will affect them and their tax bill next year, when in fact, this change is projected to only affect 40,000 Canadians with incomes that average $1,411,000. That’s only 0.13% of the population. For the other 99.87% of the population, this change will have zero impact. And if you have a corporation like I do, this change is expected to only affect 12.6% of corporations since 87.4% of corporations don’t earn any capital gains. So, I just wanted to put that into perspective for you.

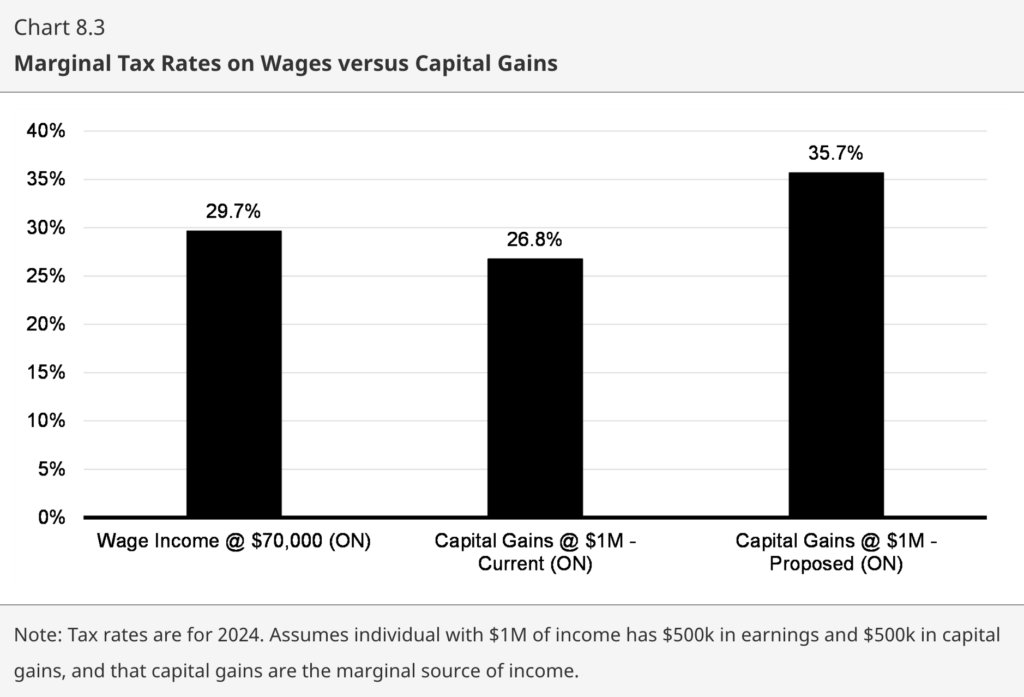

And lastly, it’s important to understand the purpose behind this change, which is to make things more equitable for the middle class and to get those who hold most of the wealth in this country to pay a fairer share. For example, with the old capital gains rules, it was possible for someone earning a $70,000/year salary to have a higher marginal tax rate than a wealthy individual with 1 million dollars of income from capital gains. With the new rules, now that wealthy individual will be at a higher marginal tax rate than the person earning $70,000.

How Capital Gains Taxes Work

Let’s start by talking about how capital gains are taxed in Canada.

As a refresher, a capital gain is simply the result of you selling a security or property, such as stocks, bonds, ETFs, mutual funds, real estate, precious metals, antiques, even a business, for a profit. If you earn a profit, you’ve got to pay tax on it. However, the good news is you don’t have to pay tax on all of it.

You see, currently, you only have to pay tax on ½, or 50%, of your capital gain. This is what’s known as the capital gains inclusion rate.

Let’s say you bought $10,000 worth of stocks. 10 years later you sell those stocks for $35,000.

$35,000 – $10,000 = $25,000 (capital gain)

$25,000 is your capital gain. That’s how much profit you earned from buying low and then selling high.

But now you need to pay your share of taxes on that profit, so you’d take that gain and halve it to end up with $12,500. That’s the amount you’d actually pay tax on.

$25,000 x 50% = $12,500 (taxable portion)

Pretty great, right? Especially considering you have to pay tax on 100% of your employment or self-employment income or interest you earn from savings accounts, GICs, and bonds. That’s why investors love capital gains, they have very favourable tax treatment.

What’s Changing with Capital Gains Taxes

So, what’s changing with all this? Well, as of June 25, 2024, if you earn a capital gain over $250,000, then the capital gains inclusion rate increases to ⅔, or 66.7%. So that means if you earn a capital gain of $250,001, the $250,000 will have the 50% inclusion rate and the $1 over the threshold will have the 66.7% inclusion rate. Not only that, this threshold only applies to individuals like you and me.

If a capital gain is realized inside a trust or a corporation, guess what? There’s no threshold. All capital gains inside trusts or corporations will be subject to the increased 66.7% inclusion rate. So that means for someone like me who has a corporation for my business, if I were to invest any money inside my corporation and earn a capital gain, that gain would have a higher inclusion rate compared to a capital gain I earned as an individual, unless I surpass that $250,000 threshold.

For example, let’s say you invested $100,000 in some stocks and 10 years later it grew to $500,000. If you were to sell it, you’d realize a capital gain of $400,000, here’s what that would look like.

$500,000 – $100,000 = $400,000

$250,000 x 50% = $125,000 (first taxable portion)

$150,000 x 66.7% = $100,050 (second taxable portion)

Total taxable amount = $225,050

$225,050 x 53.53% (top marginal tax rate for Ontario) = $120,469.27 (taxes owed)

That doesn’t look like that big of a deal, but here’s what it would look like under the old rules…

$500,000 – $100,000 = $400,000

$400,000 x 50% = $200,000 (taxable portion)

$200,000 x 53.53% (top marginal tax rate for Ontario) = $107,060

So, under the new rules, not only is an extra $25,050 taxable, but you’d also end up paying $13,409.27 extra in taxes.

Another way of framing this is under the old rules, you’d never exceed a marginal tax rate of 26.77% on your capital gain. That’s because 53.53% halved is 26.77%. Under the new rules, the top marginal tax rate on capital gains increases to 35.7%.

But what if this capital gain occurred inside a corporation? Assuming your corporation is based in Ontario, your tax rate would be 50.17% (this is the combined federal and provincial corporate tax rate for investment income for Ontario).

Here’s what that would look like.

$500,000 – $100,000 = $400,000

$400,000 x 66.7% = $266,800 (taxable portion)

$266,800 x 50.17% (corporate tax rate for investment income in Ontario) = $133,853.56 (taxes owed)

Now let’s compare it to the old rules.

$500,000 – $100,000 = $400,000

$400,000 x 50% = $200,000 (taxable portion)

$200,000 x 50.17% (corporate tax rate for investment income in Ontario) = $100,340 (taxes owed)

So, under the new rules, not only is an extra $66,800 taxable, but you’d also end up paying $33,513.56 extra in taxes.

Although I’ve been showing you simple examples using marginal tax rates, I found this really great capital gains calculator that factors in other forms of income and thus your average tax rate to give you a more realistic idea of how much tax you’d actually end up paying under the old and new rules, so make sure to check it out.

Who Will Be Affected By this Capital Gains Tax Increase?

Now, you may be thinking, “Ya, this won’t affect me. I don’t have a trust or corporation, or I don’t have an investment portfolio big enough to earn a 6-figure capital gain.”

Well, remember, stocks or other investments aren’t the only way you can earn a capital gain as an individual. One other common way to earn a capital gain is with real estate.

So the good thing is, if you ever sell the home that you live in, you won’t have to pay a capital gain because of the principal residence exemption. This exemption eliminates any capital gain on principal residences. So if you bought a home in 2004 for $150,000 and now it’s worth $800,000 and you want to sell it, you won’t have to pay a penny in taxes on its $650,000 profit.

The same cannot be said for secondary properties. For any property that isn’t your principal residence, it’s considered your secondary property. This could look like a cottage or rental property you own. If you ever sell your secondary property, you do have to pay capital gains tax and if your capital gain is over $250,000, the increased inclusion rate will apply to the portion over that threshold.

Another example could be if you wish to gift a secondary property to someone. Let’s say you own a cottage and want to gift it to your children. Even though it’s a gift, it’s still treated as if you’re selling the property at its fair market value before handing it over to its new owners. So, if you bought a cottage for $100,000 in 2001 and now it’s worth $900,000, and you want to gift it to your daughters, you’ll have to pay tax on its $800,000 capital gain first. This is really important to understand beforehand because you don’t want to be in a situation where you can’t afford to pay the taxes.

How to Reduce Your Capital Gains Taxes

To wrap things up, let’s discuss what you can do to legally avoid this higher inclusion rate or at least reduce your capital gains taxes owed.

Use Your Registered Accounts

Well first, instead of housing your investment portfolio in an unregistered (or taxable) account in which you would have to pay tax on any capital gains, you could instead house them inside your registered accounts like your TFSA (there are no taxes on capital gains inside a TFSA), your FHSA if you’re eligible for one (if you buy a home with the funds inside your FHSA, you can make withdrawals tax-free), or your RRSP (you can defer paying tax on the funds inside it until you make a withdrawal and ideally are in a lower tax bracket).

Offset Your Capital Gains with Capital Losses

Another strategy is to make use of any capital losses. If you buy a security or property, then sell it for less than you paid for it, you can deduct that capital loss from your capital gain. The best part is you can carry forward capital losses indefinitely. So many savvy taxpayers hold onto capital losses until they wish to sell some of their investment portfolio or a secondary property and know they’ll realize a hefty capital gain. Just remember, with these new inclusion rate rules, this may also affect your calculation when deducting your capital losses.

Time Your Capital Gains

Timing is another important thing to consider. If you expect to realize a big capital gain, you may want to wait until you are in a lower tax bracket. This could happen if you switch jobs to one with a lower salary, are self-employed and your income is lower than projected, or you only work for a portion of the year and thus will earn less income because of it.

Similarly, if it’s investments you want to sell for a profit, consider selling only a portion of them each year so any capital gains remain under that threshold, instead of selling them all at once to realize a big capital gain that will go over the threshold.

Claim a Capital Gains Reserve

In the same vein, you may also be able to claim a capital gains reserve if you sell a property but are paid for it over a stretch of time no longer than 5 years (the year of the sale plus the proceeding 4 years). For example, let’s say you bought a condo with the intention of eventually selling it to your adult son. If you wanted to try to remain under that inclusion rate threshold, you could set it up so your son pays you for the condo in yearly installments over the course of 5 years. With that said, there are some specific rules with this, so make sure to look more into it or talk to tax professional before doing anything.

Donate Your Shares to Charity

Another thing you could do if you’re feeling generous is to donate shares of stocks or ETFs, mutual funds, segregated funds, or federal or provincial government bonds to a registered charity. When you do this, not only will you not have to pay any capital gains tax, but you’ll also get a tax credit for your charitable donation as well.

Lifetime Capital Gains Exemption

And lastly, if you’re going to realize a capital gain because you’re selling your business or farming or fishing property, don’t forget about the lifetime capital gains exemption. This exemption can help eliminate some or all capital gains taxes you may owe when selling your business.

In addition, there’s the new Canada Entrepreneurs’ Incentive (CEI) that will reduce the inclusion rate to 33.3% on capital gains up to $2 million on the sale of your business, though this is only applicable to businesses in certain industries like construction, tech and manufacturing, so not all businesses are eligible for this.

+ show Comments

- Hide Comments

add a comment