I’m going to be completely honest with you. For most of my adult life, I’ve had some type of insurance without truly knowing how I was insured. Whether it was tenant insurance, car insurance or home insurance, I’ve always made sure I was insured. But, the number of times I fully read and understood my insurance policies would add up to a big fat ZERO!

I’m going to be completely honest with you. For most of my adult life, I’ve had some type of insurance without truly knowing how I was insured. Whether it was tenant insurance, car insurance or home insurance, I’ve always made sure I was insured. But, the number of times I fully read and understood my insurance policies would add up to a big fat ZERO!

I’m shaking my head as I’m writing this because I know so much better now. But back then, I just figured everything was pretty much boilerplate and I’d probably never need to make a claim anyway. Plus, wasn’t the fact that I had insurance the really important part?

Wrong! There’s no way to truly know if you’re properly insured if you don’t know what’s going on in your particular policy. You see, all insurance policies are different, and there’s a very good chance that you may think you’re covered for something, but you’re not.

1 in 3 Canadians Haven’t Read their Insurance Policies

I guess there is some comfort in knowing that I wasn’t alone. According to a new survey by Sonnet Insurance, 1 in 3 Canadians hasn’t read their home and auto insurance policies either. That number is pretty crazy when you think about it. 1 in 3 Canadians is paying thousands of dollars each year on insurance, without really knowing what they’re getting for their money!

Unfortunately, I know that statistic is true first-hand. One of the things I do when working with my financial counseling clients is going through all the ways they are protecting themselves through insurance. I kid you not, about 90% of my clients are completely stumped when I send them my protection worksheet to fill out. They think they’re insured through their employer, or they remember getting some insurance a few years ago, but almost all of them have no clue what kind of insurance policies they have.

Don’t Be a Statistic, Take Action!

To remedy this, we go through every type of insurance available, item-by-item, to see if they need it and if they do how are they currently protected. Because at the end of the day, that’s what insurance is. It’s just a way to protect yourself from financial loss. Insurance is a good thing! It can be a financial lifesaver if you do it right! But it can be a huge disaster (not to mention a waste of money) if you go into it blindly.

If you want to stop being a statistic and do something about it, here are some helpful steps you can take to make sure you’re properly protected with your home and auto insurance.

Does Your Home Insurance Cover You For…

Identity Theft

You may have not even known this was a thing, but it should be! Most of the time identity theft is automatically included in your home insurance policy, but sometimes it’s not. You’re going to want to make sure it is because it could save you if your identity is stolen, you have to pay legal fees, or you have to pay for expenses such as replacing legal documents like your driver’s license and passport.

Overland Water and Floods

Haven’t heard of overland water coverage before? You’re not alone! 33% of people Sonnet surveyed said they either don’t understand the term or have never heard it before. But here’s why it’s something you’re going to want. Overland flood coverage protects you from loss due to damage from freshwater flooding (such as water from lakes, rivers, rainstorms, or melting snow and ice).

Remember those Toronto floods in August? Well, I sure do, and I have friends who were directly affected by it. With overland water coverage, they would have been protected from all the damage that was done.

Sewer Backups

This is usually something you have to add on to your insurance policy, but it’ll be worth it! Sewer backup coverage will protect you in the case of financial loss or damages caused by flooding due to a sewer system backup. I know, totally gross, but if it happens to you, my guess is you don’t want to be literally sitting in…you know.

Does Your Auto Insurance Include…

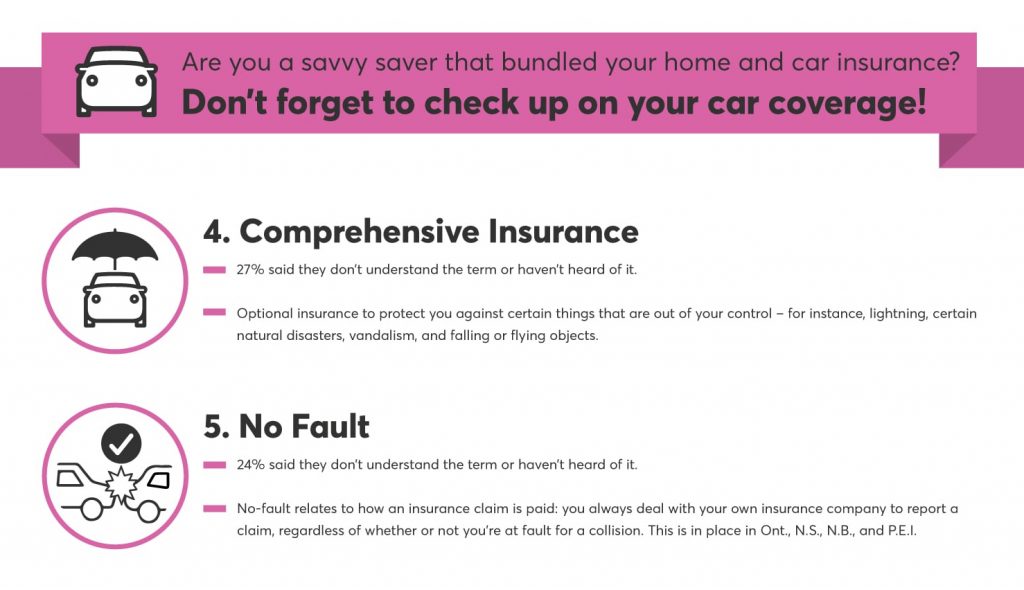

Comprehensive Insurance

This is an optional type of coverage you can add on to your policy, but in my opinion, it’s a no-brainer. Comprehensive Insurance protects you against certain things out of your control, such as lightning, certain natural disasters, vandalism, and falling or flying objects.

No-Fault Insurance

Depending on where you live, this may not be applicable to you, but if you live in Ontario, Quebec, Nova Scotia, New Brunswick, and Prince Edward Island, listen up. If you live in one of these provinces, then you will have no-fault insurance as part of your car insurance. You’ll want to keep reading as this is one of the most misunderstood terms!

No fault insurance doesn’t mean that no matter what you do, you’re not at fault for an accident. This type of insurance is actually about collecting payment for insurance claims. For instance, if you get into an accident you would report a claim to your own insurance company, regardless of whether or not you’re at fault for the collision.

This system is a way to provide faster claims settlements and reduce the costs associated with taking legal action against the at-fault third party. Nevertheless, it’s important to know about this in case you are ever in a situation where you have to make a claim.

Visit Sonnet’s website to learn how auto insurance differs between provinces.

Did You Get the Best Price on Your Insurance?

Last but not least, and this is something I also ask all of my financial counseling clients, did you get the best price on your insurance? Because most of the time the answer I get is “Probably not.” I know it’s another annoying step to take, but doing your research and comparing quotes could literally save you hundreds if not thousands of dollars in premiums.

As a personal example, when my husband and I bought our home two years ago, it all went very fast. I’m talking we looked at our townhouse, put in an offer that day, and it was accepted the next day. Because everything happened so quickly, the last thing on our minds was insurance. So, we ended up just getting home insurance with our auto insurance provider.

We didn’t shop around, we didn’t even think about it. Then, I started learning more about insurance and realized how big of a mistake we made. So, I contacted a few insurance brokers to send me some quotes for a bundled home and auto insurance policy, and I also checked out Sonnet to get a quote from them too.

Well, Sonnet ended up being the winner and by switching to them my husband and I saved about $1,000 per year! It pays to shop around, I’m telling you!

So, don’t make excuses or just keep renewing your current policy without shopping around. Put it in your calendar to contact an insurance broker to get some quotes, and try out Sonnet to compare what they can offer. They’ll literally give you a quote in minutes, so what have you got to lose?

And you don’t have to wait until your insurance term is up. You can switch anytime, and the penalty you may have to pay for leaving your current provider early may be minuscule compared to how much you could save by switching to a different provider.

It’s really important to know what your insurance covers. Thanks for the article!