If you’ve listened to my podcast this fall, then you’ve heard me share some details about CoPower Green Bonds already. Honestly, they’re a company I’m so thrilled to partner with because I truly believe in what they are doing.

CoPower is a young company (founded in 2013) with a big focus on sustainable investing. I’ve talked a lot about investing on the blog and podcast, but I’ve actually only had one guest on to talk about sustainable investing (episode 129 with Tim Nash). I’m hoping to talk about it more down the road because in my opinion investing and sustainability should go hand in hand!

What Is Sustainable Investing?

Sustainable investing is a trend that is gaining traction rapidly, especially among young investors who want to build their wealth, be true to their values and do good in the world through their investing dollars.

You see, as important as it is to start investing young, have a diversified portfolio, and keep fees low, there’s another important element to investing that often gets overlooked — being mindful of what companies you’re actually investing in.

For instance, do you know what specific companies are in your investment portfolio? More importantly, do they align with your personal values or do they fall into the category of “sinful investments“?

As an example, it’s no secret that I’m a big fan of index investing. A common ETF in many index portfolios is iShares Core MSCI All Country World ex Canada Index ETF (XAW). It’s a massive ETF with aggregate underlying holdings in 8,678 companies.

Most people probably wouldn’t do the extra legwork of looking at that long list of holdings and researching every company, but you may not need to find out some of the not-so-great companies in there.

All I did was find this Business Insider article, The 15 Worst Companies for the Planet, and did a quick comparison to the XAW ETF. I thought I might find a few of the companies from the article in the ETF, but I was shocked to find that 13 of 15 companies were in there!

- Archer Daniels Midland

- AES

- PPL Corp.

- Duke Energy Corp.

- FirstEnergy Corp.

- Southern

- Bunge Ltd.

- American Electric Power

- Ameren Corp.

- Consol Energy Corp.

- ConAgra Brands Inc.

- NRG Energy

- Peabody Energy Corp.

And that’s not even mentioning all the cigarette and pharmaceutical companies I found in the ETF too.

How to Practice Sustainable Investing

If this has opened your eyes and has you second-guessing what you’re currently investing in, don’t freak out. There are so many great sustainable investing products out there, and despite what you might think, investing sustainably doesn’t mean you’ll have to give up higher returns.

One good place to start your research is the Responsible Investment Association website. It has a whole marketplace of investment products and companies, including CoPower.

Then, once you have an idea of what kind of products you want to invest in, make sure they fit into your overall investment portfolio.

What Are CoPower Green Bonds?

If you’re looking to add some more sustainable investments to the “alternatives” part of your portfolio, you may want to check out CoPower Green Bonds.

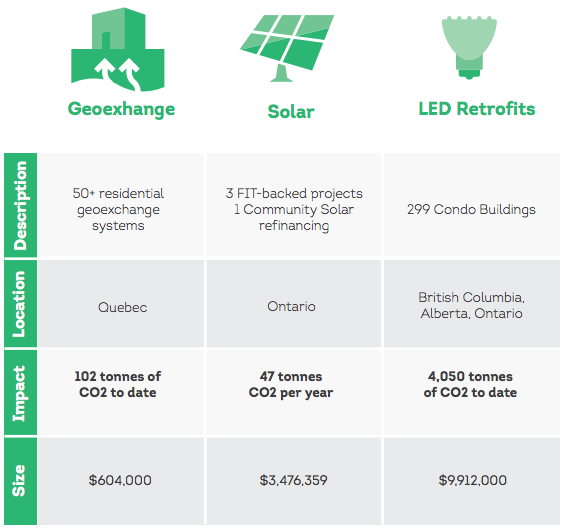

As you can guess from the name, CoPower offers bonds to investors to finance small-to-mid-sized clean energy and energy efficiency projects, an area that they believe is being underserved by mainstream finance.

In other words, you lend CoPower money, they use that money to fund sustainable energy projects, then they pay you back with interest.

Here’s a look at some of the projects they are funding in 2018.

What Are the Returns on CoPower Green Bonds?

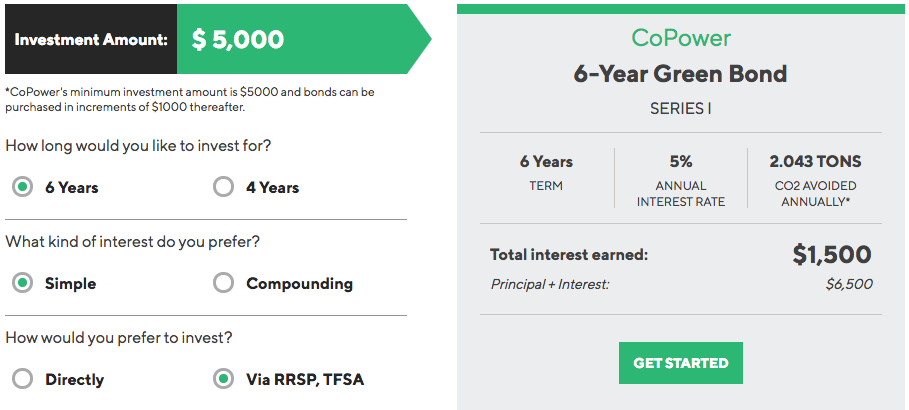

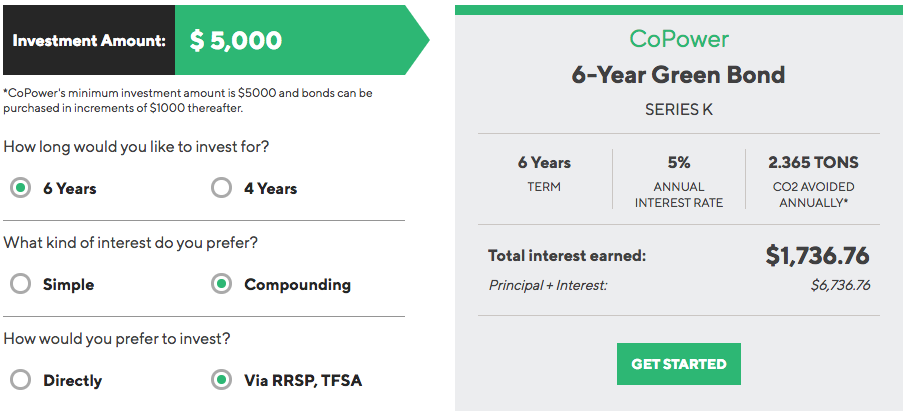

Currently, there are two types of bonds you can purchase:

- 4-year bond, 4% annual interest rate

- 6-year bond, 5% annual interest rate

Obviously, you’ll earn a higher percentage if you buy the longer-term bond, but it depends on what your particular needs are. For example, will you need cash sooner for a large purchase? You also start earning interest as soon as your bonds are issued.

Moreover, you can choose a simple interest or compounding interest for your bond returns.

Simple Interest

If you choose a simple interest, you’ll receive quarterly interest payments deposited directly into your investment account (principal will be repaid at maturity).

Compounding Interest

If you choose compounding interest, your quarterly interest payments will be re-invested, earning you interest on all interest accrued as well as your principal. That being said, you won’t receive your interest or principal back until your bonds mature. Still, you’ll earn more money on your money if you choose to compound.

What’s the Minimum Deposit?

The minimum amount you can invest is currently $5,000, but after that, you can buy more bonds in $1,000 increments. There are also maximums depending on your investment situation and you can find those on CoPower’s FAQ.

That being said, the best way to determine how much you want to invest is by looking at your asset mix. If you need $5,000 in “alternatives” in order to balance your portfolio to your ideal asset mix, then that may be the amount of CoPower Green Bonds you wish to purchase. As I’ve said before, you don’t want to hold too much in any one product so you’ll want to take that into account too.

Can You Hold CoPower Green Bonds in Registered Accounts?

Yes, you can! You can hold CoPower Green Bonds in an unregistered account, or a TFSA, RRSP, RESP or RRIF. You can either open a registered account at Olympia Trust or Questrade to do so.

That being said, it’s important to check if there are any extra administrative fees that may apply when opening up a registered account for these bonds. For instance, Questrade will charge you a $75 administrative fee, and possibly other fees (inactivity fees) if you don’t hold a certain amount in your Questrade account. It’s best to speak to someone at the brokerage to know exactly what fees you’ll be billed beforehand.

As far as tax time is concerned, you’ll then receive a T5 Statement of Investment Income like your other investments.

How Can You Buy CoPower Green Bonds?

You can buy them directly through CoPower, or if you want to put your bonds in a registered account, you can go through Olympia Trust or Questrade.

Can You Sell Your CoPower Green Bonds?

What if you buy CoPower Green Bonds, but don’t want them anymore? Well, unlike most other bonds that you can buy and sell freely on the bond market, you can’t sell your Green Bonds. Since they are private investments and are not traded on any public exchange, you must hold them until maturity once you buy them. So, make sure you’re sure before diving in!

Is Investing in CoPower Green Bonds Safe?

This is probably the most common question I’ve heard and have found online — is it safe? Let’s be clear, all investment products have some sort of risk associated with them. Whether it’s a market risk or inflation risk, nothing is immune to risk, not even cash.

That goes for bonds too. No bond issuer, including CoPower, can 100% guarantee that you’ll receive the promised returns or your principal back. The only type of investment that is guaranteed is Guaranteed Investments Certificates (GICs).

Going back to the question of whether investing in CoPower Green Bonds is safe, there are risks. One example could be technical problems with the underlying projects that could lead to a late payment or default on a loan. CoPower provides lots of information on their site and in their offering memorandum about other risks and how they work to mitigate them for investors.

In this case, for example, they often require project owners to establish debt-service reserve funds and part of their process involves ensuring that warranties and insurance are in place when relevant. It’s nice to see that they report that to date no loans have defaulted and all interest payments have been made on time, from borrowers to CoPower and from CoPower to investors.

A few more important points are that the loans underlying the bonds are secured by the project assets. CoPower is also careful to invest in clean energy and energy efficiency projects that they believe are “high quality”. They used established technologies that they call “boring, nothing experimental” and to date, all the projects have been in Canada (although in the future they could be in the U.S. too). Projects have strong contracts in place and are typically already operational and selling clean energy or saving energy, although they may involve projects in the construction or installation phase when risks are understood.

CoPower is there to help investors understand the bonds and their associated risks. During the investment process, investors are provided with the offering memorandum which contains all the details, and investors are advised to review it. In addition, one of the steps in the investment process is to know your client and call a CoPower representative to make sure it’s a suitable investment.

Final Thoughts

As I’ve increased my investing knowledge a million times over since I started my podcast almost 4 years ago, the trend of sustainable investing is something I’m becoming more and more excited about.

We often talk about how we can use our dollars for positive impact, by boycotting certain stores or not buying certain products, but we need to do the same thing with our investments. Actually, that would probably have a bigger impact!

If you don’t know what specific companies you’re investing in, take some time to find out. If you don’t feel good about the companies you’re investing in, do something about it! Research what sustainable investments are available, and check out CoPower Green Bonds to see if they make sense for you.

+ show Comments

- Hide Comments

add a comment